Food Packaging Industry Outlook, Growth Drivers, Sustainable Packaging Trends, and Domino’s Role in Advancing Innovation and Digital Solutions

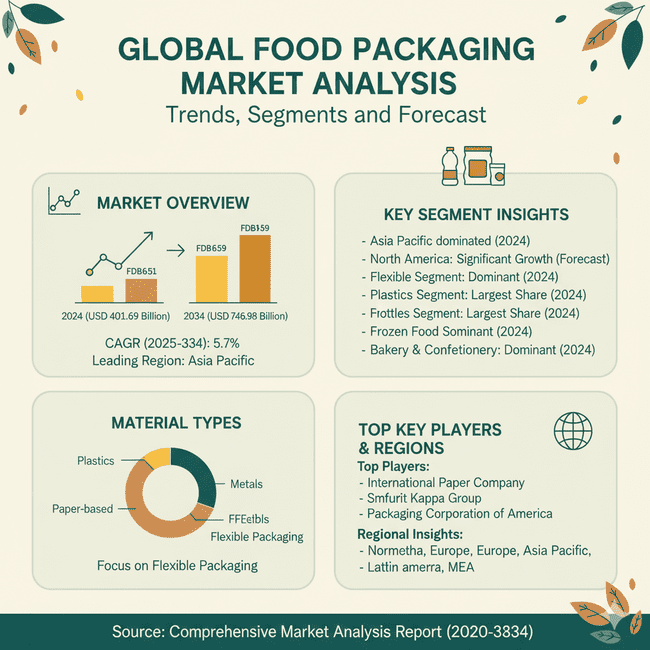

The global food packaging market is expected to grow from USD 427.40 billion in 2025 to USD 746.98 billion by 2034 (CAGR 5.7%), driven by trends in flexible and plastic packaging, frozen food, and sustainability. Asia Pacific leads, with North America showing significant growth. Major players include Tetra Pak, Amcor, and Berry Global. The frozen food packaging market is projected to reach USD 79.59 billion by 2034. Domino’s leads the global pizza market, with nearly 20,000 stores, and a strong digital ordering presence.

Ottawa, Nov. 05, 2025 (GLOBE NEWSWIRE) — The global food packaging industry is expanding rapidly, projected to grow from USD 427.40 billion in 2025 to USD 746.98 billion by 2034 (CAGR 5.7%), led by Asia Pacific. Key trends include dominance of flexible and plastic packaging, strong growth in frozen and fresh food packaging, and innovation in sustainable, smart, and convenient solutions. The frozen food packaging market will reach USD 79.59 billion by 2034, while plastic packaging and fresh food packaging will hit USD 97.13 billion and USD 132.08 billion, respectively. Food storage containers and corrugated packaging also show steady gains, driven by e-commerce and restaurant demand. Major players include Tetra Pak, Amcor, Berry Global, Sealed Air, Ball Corporation, and Mondi.

In the pizza segment, Domino’s leads globally with nearly 20,000 stores in 83 countries, USD 4.48 billion revenue (2023), and 60% digital orders, reflecting the fast-growing global pizza and frozen food markets driven by convenience, sustainability, and automation.

The global food packaging market is set to grow from USD 427.40 billion in 2025 to USD 746.98 billion by 2034, with a CAGR of 5.7%. This report offers comprehensive data on market segments, regional analysis, and the competitive landscape, including key players like Tetra Pak, Amcor, and Ball Corporation. It covers the global market’s material types, including plastics, paper-based materials, and metals, with a focus on flexible packaging. Regional insights from North America, Europe, Asia Pacific, Latin America, and MEA are also included.

Major Key Insights of the Food Packaging Market

- Asia Pacific dominated the food packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By type, the flexible segment registered its dominance over the global food packaging market in 2024.

- By material, the plastics segment dominated the market with the largest share in 2024.

- By packaging type, the bottles segment registered its dominance over the global food packaging market in 2024.

- By food type, the frozen food segment dominated the food packaging market in 2024.

- By application, the bakery & confectionery segment dominated the food packaging market in 2024.

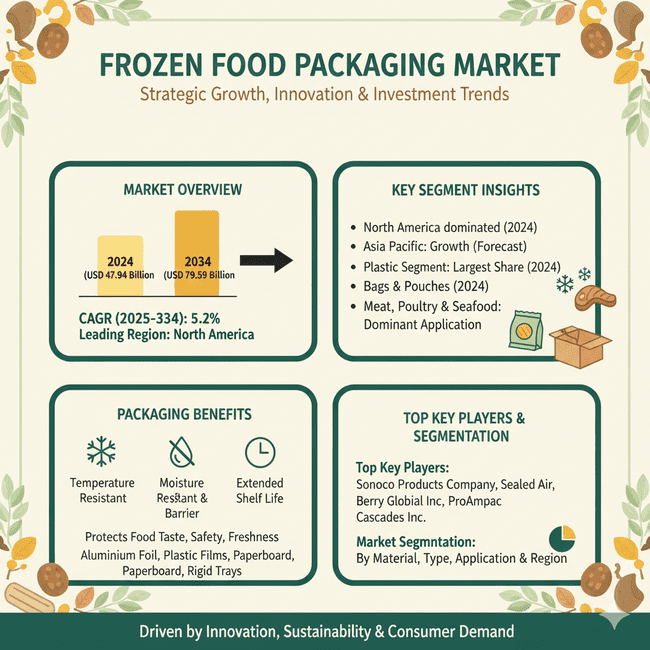

Frozen Food Packaging Market Strategic Growth, Innovation & Investment Trends

The frozen food packaging market reached USD 47.94 billion in 2024 and is projected to hit USD 79.59 billion by 2034, expanding at a CAGR of 5.2%. The report provides comprehensive segmentation by material (plastic, paperboard, metal), type (bags & pouches, trays, films, boxes), and application (meat, dairy, bakery, fruits & vegetables). It covers detailed regional data across North America, Europe, Asia Pacific, Latin America, and MEA, highlighting North America’s 2024 dominance and Asia Pacific’s fastest growth trajectory. The report includes an in-depth competitive landscape featuring Sonoco, Sealed Air, Berry Global, Amcor, and ProAmpac, along with value chain and trade flow analysis, import–export statistics, and supplier/manufacturer data across key regions.

Major Key Insights of the Frozen Food Packaging Market:

- North America dominated the frozen food packaging market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By material, the plastic segment dominated the market with the largest share in 2024.

- By type, the bags & pouches segment registered its dominance over the global frozen food packaging market in 2024.

- By application, the meat, poultry & seafood segment dominated the frozen food packaging market in 2024.

Frozen Food Packaging Market: Protects Food Taste

The specialized packaging materials and designs that protect food products stored at sub-zero temperatures (-18 degree Celsius) is known as frozen food packaging. It ensures food safety, freshness, extended shelf life by preventing moisture loss, freezer burn, and contamination. The frozen food packaging is temperature resistant, moisture resistant and vapour barrier. Different types of material utilized for manufacturing frozen food packaging have been mentioned here as follows: aluminium foil, plastic films, paperboard & cardboard, vacuum, and clamshell containers and rigid trays.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2024 | USD 47.94 Billion | |

| Projected Market Size in 2034 | USD 79.59 Billion | |

| CAGR (2025 – 2034) | 5.2 | % |

| Leading Region | North America | |

| Market Segmentation | By Material, By Type, By Application and By Region | |

| Top Key Players | Sonoco Products Company, Sealed Air, Berry Global Inc., ProAmpac, Cascades Inc. | |

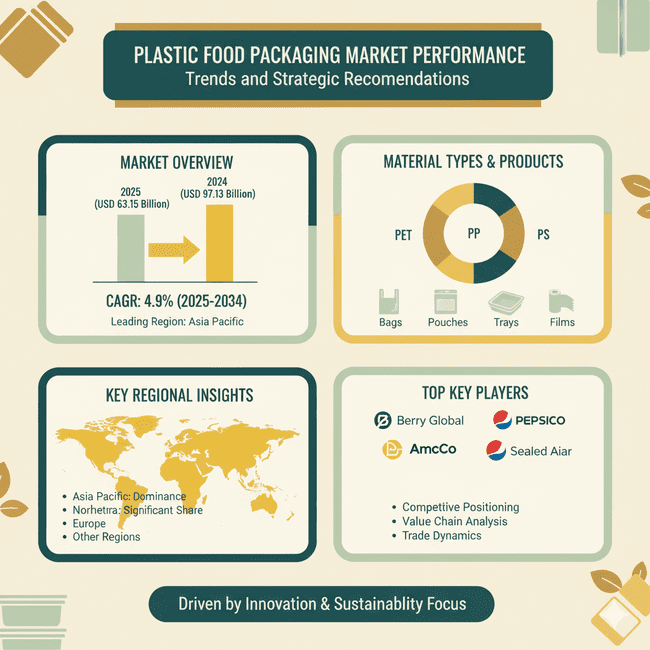

Plastic Food Packaging Market Performance, Trends and Strategic Recommendations

The plastic food packaging market is projected to grow from USD 63.15 billion in 2025 to USD 97.13 billion by 2034, achieving a CAGR of 4.9% during the forecast period. This market includes critical data on material types like PET, PE, PP, and PS, and product categories such as bags, pouches, trays, and films. Regionally, the market is driven by dominance in the Asia-Pacific (APAC) region, accounting for a significant share, followed by North America, Europe, and other regions. This report also provides a comprehensive analysis of leading companies like Berry Global, Amcor, PepsiCo, and Sealed Air, with a focus on their competitive positioning, value chain, trade data, and market dynamics.

Report Highlights: Important Revelations

- Asia Pacific’s pioneering role in innovating plastic food packaging.

- Influence of plastic food packaging on everyday life in North America.

- Advancements in pet packaging for the food and beverage sector.

- Vital contribution of plastic bags and pouches to food packaging.

- Plastic food packaging’s significance in the bakery and confectionery sectors.

- Enhancing consumer satisfaction through smart plastic packaging.

Fresh Food Packaging Market Insights, Forecast and Competitive Strategies

The fresh food packaging market is valued at USD 95 billion in 2024 and is expected to reach USD 132.08 billion by 2034, growing at a CAGR of 3.35% from 2025 to 2034. This steady expansion is driven by increasing demand for sustainable and efficient packaging solutions worldwide. The market is observed to grow due to the rising demand for convenience food items availability and to extend the shelf-life period of the food by premium packaging.

Fresh Food Packaging Market Trends

- Changing Preferences: Customers’ continuously changing preferences due to their busy lifestyles and eating habits have boosted the market’s growth rapidly.

- Technological Advancement: Due to advancements in packaging technology, several details can be attached to the packaging to let customers know about the food they consume.

- Sustainability: Growing production of sustainable packaging has boosted the market significantly.

- Customer Demand: The rising demand for convenient packaging of fresh food along with safety to maintain its quality has grown the market.

Key Metrics and Overview

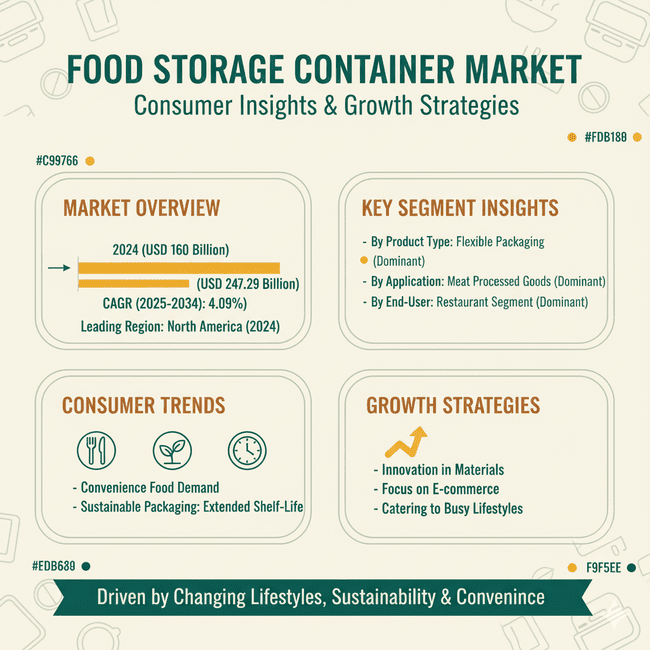

Food Storage Container Market Consumer Insights & Growth Strategies

The food storage container market was estimated at USD 160 billion in 2024, grew to USD 167.36 billion in 2025, and is projected to reach around USD 247.29 billion by 2034.

Key Takeaways

- North America led the food storage container market with the highest share in 2024.

- By product type, the flexible packaging segment dominated the food storage container market.

- By application type, the meat processed goods segment dominated the market share in 2024.

- By end-user type, the restaurant segment dominated the market share 2024.

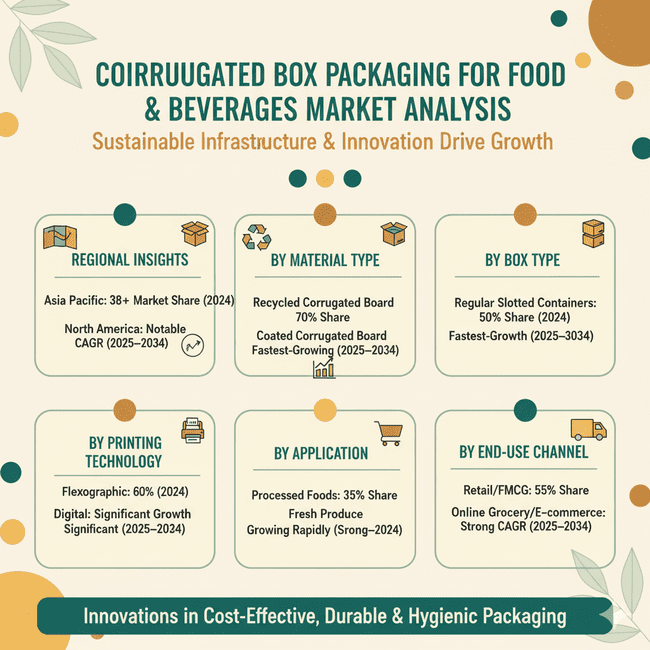

Corrugated Box Packaging for Food & Beverages Market Size and Regional Production Analysis

The corrugated box packaging for food & beverages market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The rising demand for cost-effective, durable, and hygienic packaging has influenced the development of the single-use plastic packaging market. Continuous innovation in this sector to fulfil the shifting demand of the consumers has influenced the growth of this market. Due to the presence of major market players and investors, this industry is dominating in the Asia Pacific region.

Key Takeaways

- Regional Insights:

- Asia Pacific held over 38% market share in 2024

- North America to grow at a notable CAGR (2025–2034)

- By Material Type:

- Recycled corrugated board: Largest share (70%) in 2024

- Coated corrugated board: Fastest-growing segment (2025–2034)

- By Box Type:

- Regular slotted containers: 50% market share in 2024

- Die-cut boxes: Strong growth projected (2025–2034)

- By Printing Technology:

- Flexographic: 60% market share in 2024

- Digital: Significant growth expected (2025–2034)

- By Application:

- Processed foods: Largest share (35%) in 2024

- Fresh produce: Growing rapidly (2025–2034)

- By End-Use Channel:

- Retail/FMCG: 55% share in 2024

- Online grocery/e-commerce: Expanding at a strong CAGR (2025–2034)

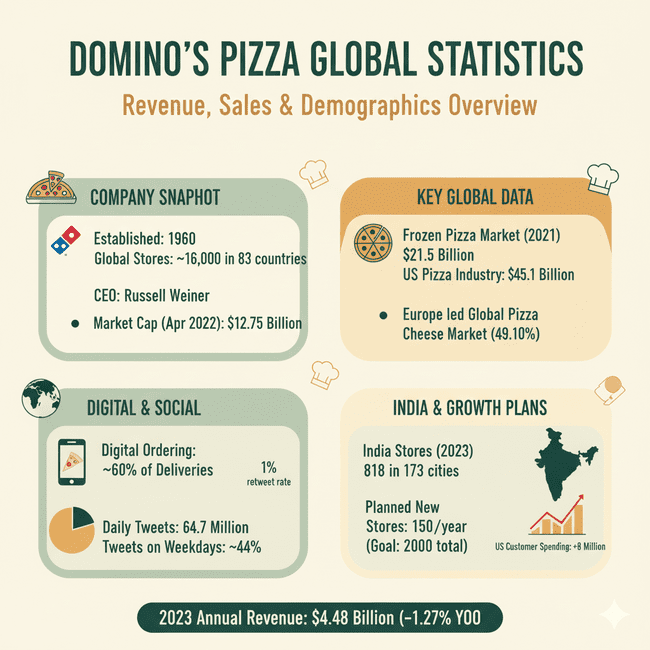

Domino’s Pizza Statistics: Revenue, Sales, and Demographics Overview

Domino’s Pizza is one of the world’s most recognized and successful pizza restaurant chains. Founded in 1960 in the United States by Russell Weiner, Domino’s has grown into a global fast-food powerhouse known for its delicious pizzas, efficient delivery system, and innovative use of technology. The company is owned by the master franchisor Domino’s Pizza Inc., and it operates across 83 countries and 5,701 cities worldwide with a network of approximately 16,000 stores.

Global Presence and Operations

Domino’s dominance in the pizza industry is reflected in its widespread global reach and operational scale:

- The brand operates around 16,000 stores globally, spanning 83 countries.

- It has a presence in 5,701 cities across the world.

- India alone hosts 818 Domino’s stores spread over 173 cities, making it one of the brand’s most important international markets.

- Domino’s employs approximately 14,400 people worldwide.

Product Range and Menu Innovation

Although pizza remains at the heart of Domino’s business, the company has continually evolved its menu to cater to changing consumer tastes.

- The menu includes traditional, specialty, and customizable pizzas, available in a range of crusts and toppings.

- Beyond pizza, Domino’s now offers pasta, oven-baked sandwiches, burgers, bread bowls, and other side dishes.

- The brand frequently updates its menu to stay relevant with global flavor preferences and food trends.

Business and Market Highlights

Domino’s success is supported by strong market positioning and a large share in the global food delivery market:

- The global pizza industry in the United States alone is valued at USD 45.1 billion.

- 13% of the U.S. population consumes pizza on weekdays, showing high domestic demand.

- Customer spending on pizza in the U.S. has grown by about 8 million in recent years.

- The digital ordering system now contributes to around 60% of all Domino’s food deliveries, emphasizing the brand’s technological advancement in online platforms and mobile apps.

Global Market Share and Expansion Plans

Domino’s continues to expand its international footprint with ambitious growth strategies:

- The company aims to open 150 new stores annually, with a long-term vision of reaching 2,000 stores globally.

- Europe currently holds the largest share (49.10%) of the global pizza cheese market, followed by North America (37.05%) — both key regions for Domino’s growth and supply chain operations.

- Outside the U.S., Domino’s operates approximately 5,000 stores worldwide, serving millions of customers daily.

Financial and Corporate Statistics

Domino’s financial performance highlights its global strength and resilience in a competitive market:

- In 2023, Domino’s reported annual revenue of USD 4.48 billion, representing a slight decline of -1.27% compared to the previous year.

- As of April 2022, Domino’s had a market capitalization of approximately USD 12.75 billion, reflecting its strong valuation in the fast-food and quick-service restaurant (QSR) industry.

Innovation and Intellectual Property

Domino’s commitment to innovation extends to its technology, product development, and operational systems:

- The brand holds 23 patents globally, with 16 of them uncontested.

- Of these, 56% of the patents are still active, covering innovations in delivery systems, kitchen operations, and digital ordering technology.

Digital Engagement and Social Media Presence

Domino’s has established itself as one of the most digitally active food brands in the world, particularly on social media:

- The company generates nearly 64.7 million tweets daily, showcasing its massive social reach and brand engagement.

- Roughly 1% of Domino’s tweets are retweeted by followers, reflecting strong audience interaction.

- Around 44% of Domino’s total tweets are posted on weekdays, aligning with its customer engagement and marketing campaigns.

Customer Behavior and Preferences

- Saturday night is considered the most popular time for pizza consumption, often associated with social gatherings and family meals.

- The convenience and comfort of pizza have made it one of the most beloved weekend foods across multiple age groups and regions.

Global Pizza Market Context

- The global frozen pizza market was valued at USD 21.5 billion in 2021, indicating continued growth in both fresh and ready-to-cook pizza segments.

- Domino’s, as one of the leading players, contributes significantly to this global market expansion through its international operations and innovative product offerings.

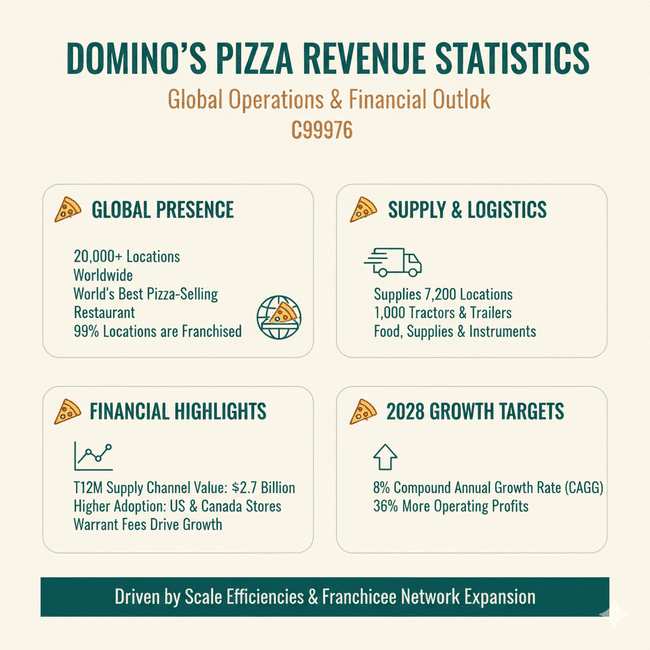

Domino’s Pizza Revenue Statistics and Growth Outlook

Domino’s Pizza continues to dominate the global pizza industry as one of the most successful and widespread restaurant chains in the world. With an extensive global footprint and a strong franchise-driven business model, Domino’s has built a highly efficient operational network that fuels its consistent financial growth and expansion.

Global Reach and Market Leadership

With nearly 20,000 store locations worldwide, Domino’s Pizza holds the title of the world’s largest pizza-selling restaurant chain. The brand’s global scale and operational excellence have cemented its leadership position across multiple regions, particularly in North America, Europe, and Asia-Pacific.

Domino’s business model heavily relies on franchising:

- The company owns just about 1% of its total 20,000 locations.

- The remaining 99% of stores are operated by franchisees, reflecting Domino’s strategic focus on empowering local operators while maintaining global consistency in quality and service.

Revenue and Supply Chain Performance

According to recent company filings:

- Domino’s generated approximately USD 2.7 billion in 12-month supply chain value, underscoring the efficiency of its vertically integrated system.

- The company operates a large-scale logistics and distribution infrastructure, supplying ingredients and equipment to thousands of stores worldwide.

- Domino’s manages a fleet of 1,000 tractors and trailers that support delivery of food products, supplies, and restaurant equipment to both company-owned and franchised locations.

This extensive supply network allows Domino’s to serve around 7,200 stores directly, ensuring consistent quality and timely distribution. The company’s centralized approach has led to efficiencies through scale, optimizing costs and boosting margins across its operations.

Regional Performance and Market Penetration

Domino’s has recorded strong adoption and brand loyalty in the United States and Canada, where its online ordering systems, mobile app integrations, and loyalty programs have significantly contributed to sales growth. These markets continue to serve as key revenue generators for the company’s overall global performance.

Growth Strategy and Financial Outlook

Looking ahead, Domino’s is positioned for sustained financial growth over the next several years:

- Management leadership has set a target to achieve at least an 8% compound annual growth rate (CAGR) in revenue by 2028.

- The company also expects its operating profits to increase by 36% by 2028 compared to previous levels.

- As Domino’s expands its store network globally, it anticipates higher-margin fee growth from warrants and royalty revenues tied to new franchise additions.

This combination of expanding scale, efficient supply chain operations, and a proven franchise model positions Domino’s for long-term profitability and shareholder value creation.

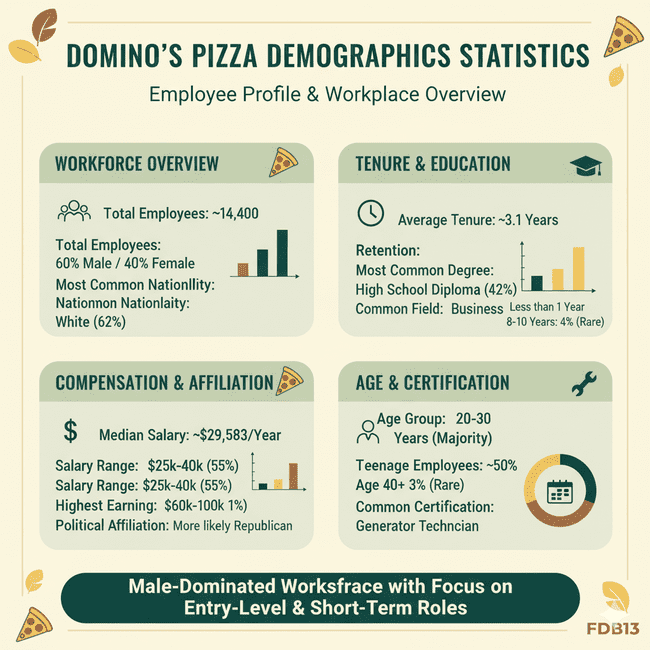

Domino’s Pizza Demographics Statistics and Workforce Overview

Domino’s Pizza, one of the world’s most successful quick-service restaurant (QSR) chains, employs a large and diverse workforce that plays a key role in maintaining its global dominance. The company’s employee demographics reflect its broad operational presence, workforce diversity, and dynamic employment culture.

Workforce Overview

As of the most recent data, Domino’s Pizza employs approximately 14,400 people worldwide across its company-owned and franchised locations. This large workforce supports the brand’s extensive restaurant network and supply chain operations.

Gender Composition

Domino’s workforce exhibits a noticeable gender distribution:

- 60% of Domino’s employees are male, while 40% are female, indicating that the company remains male-dominated in its overall employment structure.

- Women continue to play a significant role in managerial, customer service, and store-level operations, while a larger proportion of delivery and kitchen staff are male.

Ethnicity and Nationality

In terms of ethnicity:

- The most common race among Domino’s employees is White, representing about 62% of the workforce.

- Other ethnic groups are also represented, though in smaller proportions, highlighting a degree of diversity across regions where Domino’s operates.

The majority of Domino’s workforce in the United States holds American nationality, with the White ethnic group being the predominant demographic segment.

Education Level

Domino’s employs individuals from various educational backgrounds, with a large proportion entering through entry-level positions.

- The most common qualification among Domino’s employees is a high school diploma, held by around 42% of workers.

- Many employees pursue higher education or technical certifications while working part-time, illustrating Domino’s appeal to students and early-career individuals.

The most common academic major among Domino’s employees is business, aligning with the brand’s operational focus on sales, management, and entrepreneurship.

Age Distribution

Domino’s workforce is characterized by its youthful composition:

- The majority of employees are between 20 and 30 years old.

- Roughly half of Domino’s employees are teenagers, balancing part-time jobs alongside their studies.

- Only about 3% of employees fall into the 40+ age group, indicating that Domino’s workforce skews young.

This youthful demographic is largely due to the nature of the fast-food industry, which attracts students and early-career professionals seeking flexible job opportunities.

Employment Duration and Retention

Employee retention at Domino’s varies, reflecting the high turnover rates typical of the quick-service industry:

- The average Domino’s employee stays with the company for approximately 3.1 years.

- 34% of employees remain with Domino’s for more than one year.

- The majority of workers are employed for less than a year, often as temporary or part-time staff.

- Long-term retention is relatively rare — only 4% of employees stay with Domino’s for 8 to 10 years.

Despite this, the company continues to invest in employee development and advancement opportunities across both its corporate and franchise networks.

Salary and Income Range

Domino’s offers a range of salaries depending on position, experience, and role:

- The median annual income for a Domino’s employee is around USD 29,583.

- The majority (55%) of workers earn between USD 25,000 and USD 40,000 per year.

- Only about 1% of employees fall within the USD 60,000 to USD 100,000 salary range, typically representing higher managerial or technical positions.

Global Pizza Consumption Statistics and Market Insights

Pizza remains one of the most universally loved foods across the globe — cherished for its convenience, variety, and flavor. From local pizzerias to global chains, the pizza industry continues to expand at an impressive pace, reflecting strong consumer demand and cultural significance in many countries.

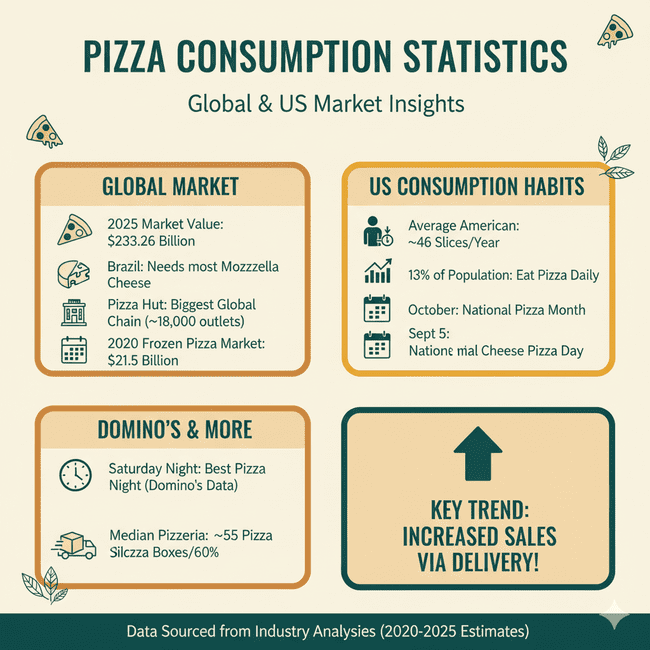

Global Market Overview

The global pizza market is on track for steady growth over the coming years:

- By 2025, the market is projected to reach an estimated value of USD 233.26 billion, highlighting pizza’s enduring global appeal and strong demand across both developed and emerging economies.

- Within this expanding market, frozen pizza has become a key growth segment. In 2020, the worldwide frozen pizza market was valued at approximately USD 21.5 billion, driven by convenience trends and growing at-home dining preferences.

Country Insights and Global Leaders

Different countries contribute uniquely to the global pizza landscape:

- Brazil stands out for its enormous cheese demand — its pizza industry requires the highest amount of mozzarella cheese of any country in the world.

- In terms of scale, Pizza Hut holds the title as the largest pizza chain globally, operating nearly 18,000 outlets worldwide.

- The United States remains a core market for pizza consumption, both in volume and cultural significance.

Pizza Culture in the United States

Pizza has become deeply rooted in American culture and everyday life:

- Around 13% of Americans eat pizza every single day, making it one of the most consumed fast foods in the nation.

- The average American eats approximately 46 slices of pizza each year, underscoring its popularity across all age groups.

- Saturday night is widely recognized as the most popular time to enjoy pizza, especially for family gatherings, parties, and weekend takeouts — a trend also confirmed by Domino’s Pizza statistics.

- A median pizzeria in the U.S. uses about 55 pizza boxes daily, reflecting consistent, high-volume demand.

- Pizza delivery significantly boosts business performance, with delivery orders increasing overall sales by up to 60%.

Pizza-Themed Celebrations

Pizza’s iconic status is celebrated through national events in the United States:

- National Cheese Pizza Day is celebrated every September 5th, honoring one of the most beloved pizza varieties.

- The entire month of October is recognized as National Pizza Month, during which pizzerias nationwide offer promotions and special menus to celebrate the country’s favorite comfort food.

Global Pizza Sales Statistics and Market Trends

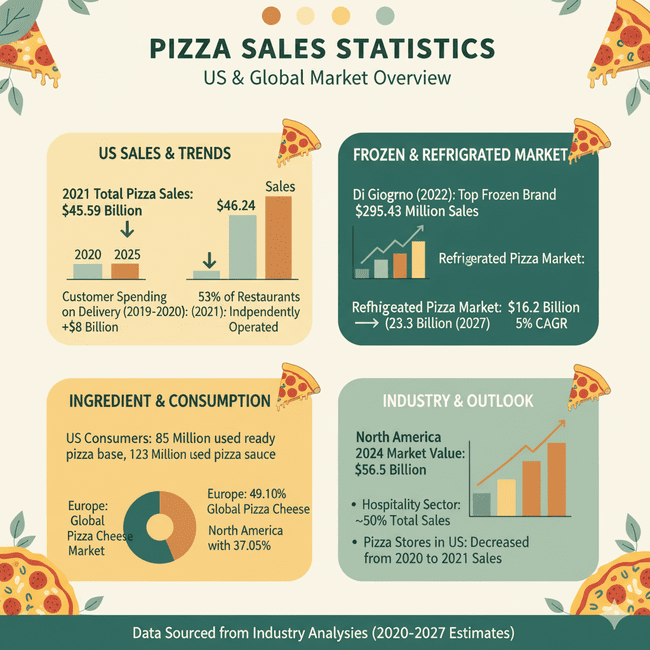

The pizza industry continues to be one of the strongest-performing segments within the global food and quick-service restaurant (QSR) market. Despite fluctuations in restaurant operations and consumer habits, pizza sales have remained resilient due to strong demand, home delivery growth, and the expanding frozen and refrigerated pizza categories.

Top Pizza Brands and Market Leaders

- In 2022, DiGiorno was ranked as the top frozen pizza company, recording USD 295.43 million in sales.

- The brand’s consistent performance underscores the increasing popularity of frozen and ready-to-bake pizzas among global consumers.

- Pizza Hut, Domino’s, and Little Caesars also continue to dominate global chain restaurant sales, while smaller, local pizzerias retain strong regional influence.

Consumer Usage and Preferences

Pizza remains a household staple across the United States:

- Nearly 85 million Americans used ready-made pizza bases, while around 123 million used pizza sauces, illustrating the growing trend of preparing pizzas at home.

- Between 2019 and 2020, pizza delivery spending in the United States rose by approximately USD 8 billion, reflecting the rapid shift toward delivery and takeaway models during and after the pandemic.

- Saturday nights remain the most popular time for pizza consumption, often associated with social gatherings and weekend dining.

Regional Market Performance

The pizza industry maintains a strong presence across all major regions, with notable dominance in Europe and North America:

- Europe holds the largest share of the global pizza cheese market, accounting for 49.10%, followed by North America.

- The North American pizza market is projected to reach a market value of USD 56.5 billion in 2024, reaffirming the region’s leadership in both consumption and production.

Frozen and Refrigerated Pizza Market

The convenience-driven frozen and refrigerated pizza segments are expanding rapidly:

- The refrigerated pizza market was valued at USD 16.2 billion in 2020 and is expected to grow to USD 23.3 billion by 2027, registering a CAGR of 5%.

- Cafés, hotels, and restaurants are among the largest commercial buyers of frozen pizza, helping to sustain strong annual growth in this market segment.

Sales Trends and Industry Performance

Despite overall resilience, the pizza industry has faced moderate shifts in recent years:

- In 2021, total pizza sales in the United States reached USD 45.59 billion, a slight decline from USD 46.24 billion in 2020.

- During this period, the number of pizza outlets in the U.S. declined, reflecting consolidation among restaurant chains and independent operators.

- Approximately 53% of all pizza restaurants in 2021 operated as independent pizzerias, while chain restaurants continued to dominate national-level sales.

- The hospitality sector — including hotels, cafés, and restaurants — accounted for nearly 50% of total pizza sales, driven by dine-in and catering services.

Market Outlook

The global pizza industry remains on a path of steady growth, supported by innovation in frozen food production, efficient delivery systems, and digital ordering platforms.

With a projected CAGR of 5% through 2027 and expanding demand across both commercial and household markets, pizza continues to secure its place as one of the world’s most consumed and profitable food products.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Sustainable Food Packaging Market Competitive Analysis

- Food and Beverage Metal Cans Market Size, Segments, Regional Data

- Europe Fresh Food Packaging Market Growth, Key Segments, and Regional Dynamic

- Fast-Food Containers Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA)

- Chitosan-Based Aerogel Food Active Packaging Market Competitive Positioning

- Europe Food Packaging Market Growth, Key Segments, and Regional Dynamic

- North America Post-Consumer Recycled Plastics Food Packaging Market Growth

- Asia Pacific Food Packaging Market Growth, Key Segments, and Regional Dynamic

- Sanitary Food and Beverage Packaging Market Size, Share, Trends, Segments

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.