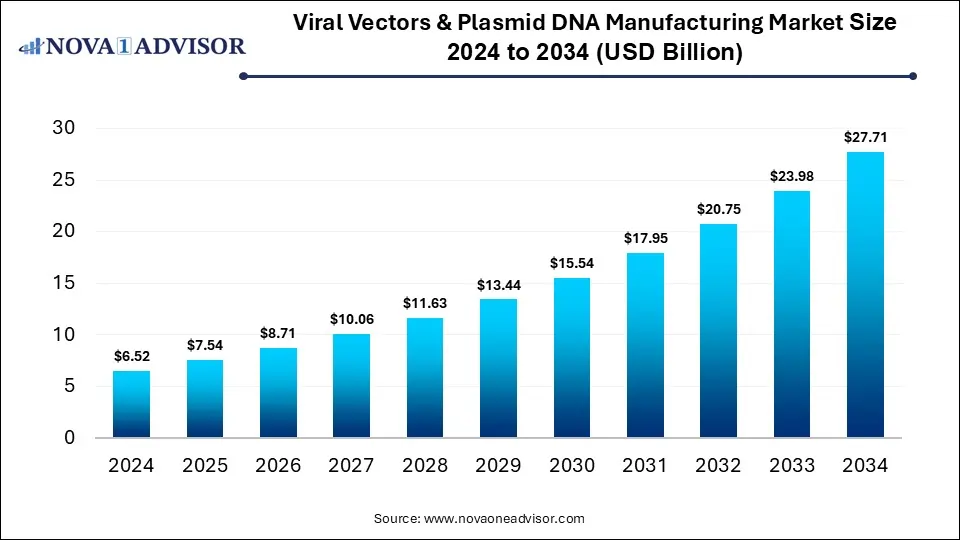

Viral Vector & Plasmid DNA Manufacturing Market to Surpass USD 27.71 Billion by 2034

According to Nova One Advisor, the global viral vector & plasmid DNA manufacturing size is calculated at USD 7.54 billion in 2025 and is expected to surpass around USD 27.71 billion by 2034, growing at a compound annual growth rate (CAGR) of 15.57% over the forecast period 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global viral vector & plasmid DNA manufacturing market size is calculated at USD 6.52 billion in 2024, grows to USD 7.54 billion in 2025, and is projected to reach around USD 27.71 billion by 2034, growing at a CAGR of 15.57% during the forecast period 2025 to 2034. The market is growing due to the rising demand for gene and cell therapies, vaccines, and advanced biologics. Increasing R&D investments and approvals for gene-based treatments are further accelerating market expansion.

Key Takeaways

- North America dominated the viral vector & plasmid DNA manufacturing market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By vector type, the adeno-associated virus (AVV) segment led the market with the largest revenue share in 2024.

- By vector type, the lentivirus segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By workflow, the downstream processing segment held the largest market share in 2024.

- By workflow, the upward processing segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the vaccinology segment held the highest market share in 2024.

- By application, the cell therapy segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By disease, the cancer segment dominated the market in 2024.

- By disease, the genetic disorders segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the research institutes segment led the market with the revenue shares in 2024.

- By end user, the pharmaceutical and biopharmaceutical companies segment is expected to grow at the fastest CAGR in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/9206

What is Viral Vector & Plasmid DNA Manufacturing?

Viral vector & plasmid DNA manufacturing involves producing genetic materials used to deliver therapeutic genes or vaccines, enabling the development of gene therapies, vaccines, and other advanced biologics. The viral vector & plasmid DNA manufacturing market is growing rapidly due to the increasing demand for gene and cell therapies, DNA-based vaccines, and advanced biologics. Rising investments in biotechnology research, expanding clinical trials for genetic disorders and cancer, and advancements in large-scale production technologies are driving market growth. Additionally, the growing number of regulatory approvals for gene therapy products and collaborations between biotech and plasma companies are further boosting the market’s expansion.

What are the Key Growth Drivers of the Viral Vector & Plasmid DNA Manufacturing Market?

The major drivers of the market include rising demand for gene and cell therapies, increasing R&D investments in biotechnology, and advancements in manufacturing technologies. Growing approvals for gene-based treatments, expanding use in vaccines, and strategic collaborations between pharmaceutical and biotech companies are also fueling market growth. Additionally, supportive government funding and favorable regulatory initiatives are encouraging innovation and accelerating product approvals.

- For Instance, In March 2023, Touchlight received a UK government grant under the £277 million Life Sciences Innovative Manufacturing Fund to advance its £14 million enzymatic DNA manufacturing scale-up. The funding will help expand its Hampton facility, add new equipment, and boost production capacity to support clients in late-stage development and commercialization.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9206

Viral Vector and Plasmid DNA Manufacturing Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 7.54 billion |

| Revenue forecast in 2034 | USD 27.71 billion |

| Growth rate | CAGR of 15.57% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2018 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Vector Type, Application, Workflow, End-User, Disease, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

| Customization scope | Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

What are the Major trends in the Viral Vector & Plasmid DNA Manufacturing Market in 2024?

- In June 2024, Charles River Laboratories International, Inc. partnered with the Gates Institute at the University of Colorado Anschutz Medical Campus to establish a lentiviral vector CDMO. This collaboration aims to enhance GMP-grade lentiviral vector production, supporting the development of advanced cell and gene therapies for treating blood cancers.

- In April 2024, MassBiologics secured USD 5 million in funding from the Massachusetts Life Sciences Center (MLSC) to establish a viral vector manufacturing facility. The investment will support the company’s efforts to advance the development and large-scale production of viral vectors crucial for gene therapy applications.

What is the Emerging Challenge in the Viral Vector & Plasmid DNA Manufacturing Market?

The emerging challenge in the market is the high cost of large-scale production. Maintaining product quality, consistency, and regulatory compliance adds further difficulty. Additionally, limited manufacturing capacity, supply chain constraints for raw materials, and skilled workforce shortages hinder scalability, making it challenging for companies to meet the growing demand for gene and cell therapy products.

Segmental Insights

By Vector Type Insights

What made the Adeno-associated Virus (AVV) Segment Dominant in the Market in 2024?

The adeno-associated virus (AVV) segment accounted for the largest revenue share in 2024, owing to its proven safety, low immunogenicity, and strong efficiency in gene delivery. Its increasing use in developing gene therapies for rare and inherited diseases, along with growing regulatory approvals and clinical success of AVV-based treatments, has further strengthened its position as the leading segment in the market.

- For Instance, In March 2024, Polyplus, part of the Sartorius group, introduced the RepCap plasmid pPLUS® AAV-RC2 to enhance AAV2 production. This launch supports the company’s goal of strengthening its role as a leading supplier of raw materials for AAV manufacturing in gene and cell therapy.

The lentivirus segment is expected to record the fastest CAGR during the forecast period due to its strong ability to integrate genetic material into both dividing and non-dividing cells, making it highly suitable for stable and long-term gene expression. Its growing adoption in CAR-T cell therapies, cancer treatment, and genetic disorder research, along with continuous advancements, are key factors driving the segment’s rapid growth.

By Workflow Insights

How did Downstream Processing Segment Dominate the Viral Vector & Plasmid DNA Manufacturing Market in 2024?

The downstream processing segment held the largest market share in 2024 due to its critical role in ensuring the purity, safety, and quality of viral vectors and plasmid DNA used in gene and cell therapies. The growing demand for efficient purification techniques, coupled with advancements in chromatography and filtration technologies, has strengthened this segment. Additionally, the need to meet stringent regulatory standards and maintain high product yield further boosted the dominance of downstream processing in the market.

The upstream processing segment is projected to grow at the fastest CAGR during the forecast period due to increasing demand for scalable and efficient production systems for viral vector and plasmid DNA. Advancements in cell culture technologies, adoption of single-use bioreactors, and optimization of transfection methods are driving this growth. Additionally, investments in process development are further accelerating to enhance productivity and reduce costs is further accelerating the expansion of the upstream processing segment.

By Application Insights

Why the Vaccinology Segment Dominated the Viral Vector & Plasmid DNA Manufacturing Market in 2024?

The vaccinology segment held the largest market share in 2024 due to the increasing adoption of viral vectors and plasmid DNA in vaccine development, particularly for infectious and emerging diseases. The success of gene-based vaccines, such as mRNA and viral vaccines, has driven demand for advanced manufacturing solutions. Additionally, rising government initiatives and investments in vaccine research and production further strengthened the growth of the market.

- For Instance, In March 2024, during its sixth Vaccines Day event, Moderna, Inc. shared key updates highlighting the progress and expansion of its mRNA vaccine pipeline. The announcements included new clinical data, along with financial, manufacturing, and commercial developments across its respiratory, latent, and other vaccine programs.

The cell therapy segment is expected to grow at the fastest CAGR during the forecast period due to the rising adoption of gene-modified cell therapies like CAR-T and stem cell treatments for cancer and genetic disorders. Increasing clinical trials, regulatory approvals, and investments in cell-based research are driving growth. Moreover, advancements in viral vector and plasmid DNA technologies that enable efficient gene delivery are further accelerating the expansion of the market.

By Disease Insights

What Made the Cancer Segment Dominant in the Viral Vector & Plasmid DNA Manufacturing Market in 2024?

The cancer segment dominated the market in 2024 due to the rising use of gene and cell therapies, such as CAR-T and oncolytic viral therapies, for cancer treatment. Increasing cancer prevalence, coupled with strong R&D investments and growing regulatory approvals for gene-based oncology products, further supported this dominance. Additionally, advancements in viral vector technology have enhanced targeted delivery, improving the effectiveness of cancer therapeutics and driving market growth.

The genetic disorder segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for gene therapies that target inherited diseases such as hemophilia, cystic fibrosis, and muscular dystrophy. Advancements in viral vector and plasmid DNA technologies enable precise gene delivery and long-term therapeutic effects. Additionally, rising investments, expanding clinical trials, and supportive regulatory framework are accelerating for genetic disorders.

By End User Insights

How did Research Institutes Segment Dominate the Viral Vector & Plasmid DNA Manufacturing Market in 2024?

The research institute segment led the market in 2024 due to the increasing focus on gene and cell therapy research and the rising number of academic collaborations with biotech and pharmaceutical companies. Significant funding support from government and private organizations, along with expanding R&D activities for developing advanced therapies and vaccines, also contributed to this dominance. Research institutes play a crucial role in innovation, driving early-stage development and technological advancements.

The pharmaceutical and biopharmaceutical company segment is expected to grow at the fastest CAGR during the forecast period due to the increasing adoption of viral vector and plasmid DNA technologies in drug development and gene therapy manufacturing. Rising investments in advanced biologics, growing partnerships with CDMOs, and expanding pipelines for gene and cell therapies are driving this growth. Additionally, advancements in large-scale production and regulatory approvals are further boosting the segment’s expansion.

By Regional Analysis

How is North America contributing to the Expansion of the Viral Vector & Plasmid DNA Manufacturing Market?

North America dominated the market in 2024 due to strong investments in gene and cell therapy research, advanced biomanufacturing infrastructure, and the presence of leading biotechnology and pharmaceutical companies. Supportive regulatory frameworks, increased FDA approvals for gene-based therapies, and growing adoption of personalized medicine further strengthened the region’s leadership. Additionally, significant funding for R&D and expanding clinical trials contributed to North America’s major market share.

How is Asia-Pacific Accelerating the Viral Vector & Plasmid DNA Manufacturing Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period due to rising investments in biotechnology and gene therapy research, expanding biomanufacturing capabilities, and increasing government support for advanced healthcare innovations. The growing presence of contract manufacturing organizations (CMOs), improving healthcare infrastructure, and a surge in clinical trials for genetic and rare diseases are further driving market expansion across countries like China, Japan, and India.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9206

Viral Vector & Plasmid DNA Manufacturing Market Value Chain Analysis

1. Research & Development (R&D)

This initial stage involves identifying therapeutic targets, developing vector/plasmid designs, and conducting preclinical studies. It includes design optimization, vector selection (viral or non-viral), and in vitro/in vivo testing for efficacy and safety.

Key Players:

Sangamo Therapeutics, CRISPR Therapeutics, Editas Medicine, Intellia Therapeutics

2. Raw Material Supply

This stage involves the sourcing of high-quality raw materials such as enzymes, cell culture media, plasmid backbones, and reagents critical for plasmid propagation and vector production. The quality and consistency of these materials directly impact the success and scalability of downstream manufacturing.

Key Players:

Thermo Fisher Scientific, Merck KGaA, Cytiva, Danaher Corporation

3. Process Development & Optimization

At this stage, scalable and GMP-compliant manufacturing processes are developed for producing viral vectors or plasmids. This includes upstream (cell culture, transfection) and downstream (harvesting, purification) process optimization to ensure yield, purity, and batch-to-batch consistency.

Key Players:

Lonza, Catalent, Oxford Biomedica, WuXi Advanced Therapies

4. Manufacturing (GMP Production)

This is the core of the value chain, where large-scale production is carried out under Good Manufacturing Practices (GMP). It involves bioreactor-based vector production, purification, and formulation for clinical or commercial supply.

Key Players:

FUJIFILM Diosynth Biotechnologies, Aldevron, Thermo Fisher Scientific, Charles River Laboratories

5. Quality Control & Regulatory Compliance

This stage ensures that vectors and plasmids meet stringent regulatory standards for purity, potency, safety, and identity. QC testing includes sterility, endotoxin levels, vector genome integrity, and compliance with regulatory guidelines like FDA and EMA.

Key Players:

Eurofins Scientific, Charles River Laboratories, SGS, BioReliance (MilliporeSigma)

6. Distribution & End-Use Applications

Finally, the manufactured products are distributed to biopharma companies, hospitals, and research institutions for use in gene therapy, vaccine development, and clinical trials. Timely delivery, cold chain logistics, and global reach are critical at this stage.

Key Players:

Pfizer, Novartis, Gilead Sciences (Kite Pharma), bluebird bio, Moderna

Key Players Operating in the Viral Vector & Plasmid DNA Manufacturing Market

- Thermo Fisher Scientific

Thermo Fisher is a leading global supplier of plasmid DNA, viral vectors, and GMP-compliant manufacturing services. It offers end-to-end solutions, from raw materials to commercial-scale production, supporting gene therapy developers worldwide.

- Lonza

A major contract development and manufacturing organization (CDMO), Lonza provides comprehensive services for viral vector production including process development, GMP manufacturing, and quality testing. The company supports both early-phase and commercial therapies.

- Catalent

Catalent offers specialized expertise in viral vector manufacturing through its gene therapy division. Its facilities provide GMP-grade adeno-associated virus (AAV), lentivirus, and plasmid DNA manufacturing, with scalable production capacity.

- Aldevron (a Danaher company)

Aldevron is a global leader in the production of research-grade, GMP-grade, and clinical-grade plasmid DNA. It is known for supporting early-stage biotech and major pharma companies with scalable DNA manufacturing.

- Oxford Biomedica

A pioneer in lentiviral vector manufacturing, Oxford Biomedica partners with major gene therapy companies to deliver clinical and commercial-scale vector supply. It has extensive GMP-compliant facilities and long-standing expertise.

- FUJIFILM Diosynth Biotechnologies

It offers end-to-end viral vector and plasmid DNA manufacturing services, including process development and GMP production. The company is expanding its global capacity to meet rising demand in gene therapy.

- Charles River Laboratories

The company specializes in testing, QC, and analytical services for viral vectors and plasmid DNA. It plays a critical role in ensuring regulatory compliance and product safety throughout the development lifecycle.

- Wuxi Advanced Therapies (WuXi AppTec)

It provides comprehensive CDMO services for gene therapy, including viral vector production, plasmid DNA manufacturing, and analytical testing. WuXi supports global clients with modular manufacturing platforms.

- Vigene Biosciences (now part of Charles River)

The company engages in producing AAV, adenovirus, and lentivirus vectors at research, preclinical, and GMP scales. It supports gene therapy developers with high-throughput and flexible manufacturing options.

- Bluebird Bio

A key player in gene therapy, Bluebird Bio manufactures its own viral vectors for clinical and commercial use. It is vertically integrated to control quality and supply chain in-house.

Recent Developments in the Viral Vector & Plasmid DNA Manufacturing Market

- In July 2024, Kaneka Eurogentec, an FDA-approved CDMO specializing in cGMP biopharmaceuticals, successfully produced one kilogram of plasmid DNA in a single fermentation batch for a major drug developer. This achievement marks a significant milestone, showcasing exceptional production efficiency and scalability in plasmid DNA manufacturing.

- In June 2024, GenScript Biotech Corporation launched its GenScript FLASH Gene service, a rapid sequence-to-plasmid (S2P) platform designed to deliver gene constructs with exceptional speed, quality, and cost efficiency. This innovation highlights the company’s continued leadership in synthetic biology and commitment to advancing high-quality gene synthesis solutions.

More Insights in Nova One Advisor:

- Enzymatic DNA Synthesis Market – The global enzymatic DNA synthesis market size was valued at USD 296.35 million in 2024 and is anticipated to reach around USD 3,159.16 million by 2034, growing at a CAGR of 26.7% from 2025 to 2034.

- Pharmacogenomics Market – The global pharmacogenomics market was valued at USD 18.35 billion in 2024 and is projected to hit around USD 44.2 billion by 2034, growing at a CAGR of 9.19% during the forecast period 2025 to 2034.

- U.S. Plasmid DNA Manufacturing Market – The U.S. plasmid DNA manufacturing market size was valued at USD 1,046.85 million in 2024 and is projected to surpass around USD 7,195.49 million by 2034, registering a CAGR of 21.26% over the forecast period of 2025 to 2034.

- Targeted DNA RNA Sequencing Market – The global targeted DNA RNA sequencing market size was valued at USD 12.55 billion in 2024 and is anticipated to reach around USD 73.91 billion by 2034, growing at a CAGR of 19.4% from 2025 to 2034.

- Human DNA Vaccines Market – The global human DNA vaccines market size is calculated at USD 345.85 million in 2024, grow to USD 370.65 million in 2025, and is projected to reach around USD 691.23 million by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

- DNA & Gene Chip Market – The DNA and gene chip market size was exhibited at USD 11.55 billion in 2024 and is projected to hit around USD 37.51 billion by 2034, growing at a CAGR of 12.5% during the forecast period 2025 to 2034.

- U.S. DNA Manufacturing Market – The U.S. DNA manufacturing market size is calculated at USD 2.75 billion in 2024, grows to USD 3.25 billion in 2025, and is projected to reach around USD 14.75 billion by 2034, growing at a CAGR of 18.29% from 2025 to 2034.

- DNA Methylation Market – The DNA methylation market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 6.26 billion by 2034, growing at a CAGR of 13.6% during the forecast period 2024 to 2034.

- DNA Nanotechnology Market – The DNA nanotechnology market size was exhibited at USD 4.75 billion in 2024 and is projected to hit around USD 29.19 billion by 2034, growing at a CAGR of 19.91% during the forecast period 2025 to 2034.

- DNA-encoded Library Market – The DNA-encoded Library Market size was exhibited at USD 759.25 million in 2024 and is projected to hit around USD 2717.49 million by 2034, growing at a CAGR of 13.6% during the forecast period 2025 to 2034.

- DNA Sequencing Market – The DNA sequencing market size was exhibited at USD 14.95 billion in 2024 and is projected to hit around USD 106.20 billion by 2034, growing at a CAGR of 21.66% during the forecast period 2024 to 2034.

- Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market – The Asia Pacific viral vector and plasmid DNA manufacturing market size was exhibited at USD 1.90 billion in 2023 and is projected to hit around USD 13.88 billion by 2033, growing at a CAGR of 22.0% during the forecast period 2024 to 2033.

- U.S. Viral Vector And Plasmid DNA Manufacturing Market – The U.S. viral vector and plasmid DNA manufacturing market size was valued at USD 2.45 billion in 2023 and is expected to be worth around USD 15.30 billion by 2033, with a registered CAGR of 20.1% during forecast period 2024 to 2033.

- U.S. Plasmid DNA Contract Manufacturing Market – The U.S. plasmid DNA contract manufacturing market size was valued at USD 165.19 million in 2023 and is projected to surpass around USD 964.69 million by 2033, registering a CAGR of 19.3% over the forecast period of 2024 to 2033.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the viral vectors & plasmid DNA manufacturing market.

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

- Others

By Application

- Gene Therapy

- Antisense &RNAi

- Cell Therapy

- Vaccinology

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Disease

- Genetic Disorders

- Cancer

- Infectious Diseases

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9206

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.