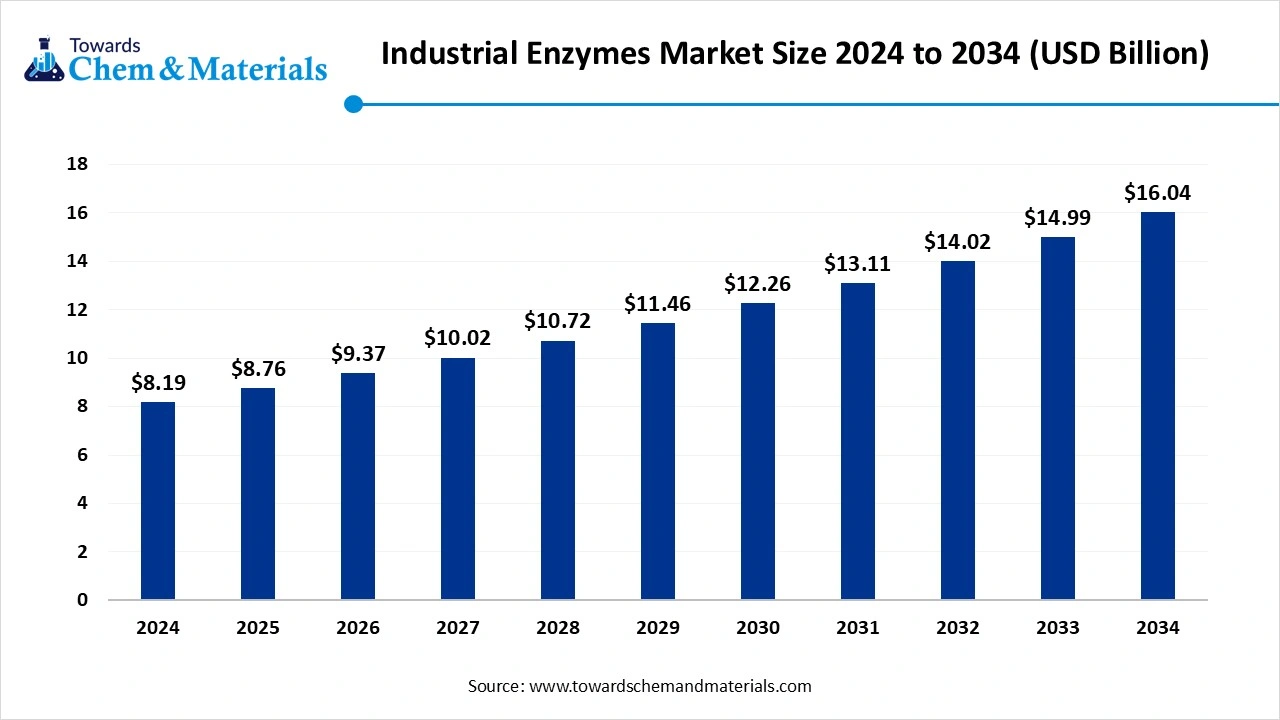

Industrial Enzymes Market Size to Surpass USD 16.04 Bn by 2034

According to Towards Chemical and Materials, the global industrial enzymes market size is calculated at USD 8.76 billion in 2025 and is expected to surpass around USD 16.04 billion by 2034, growing at a CAGR of 6.95% from 2025 to 2034.

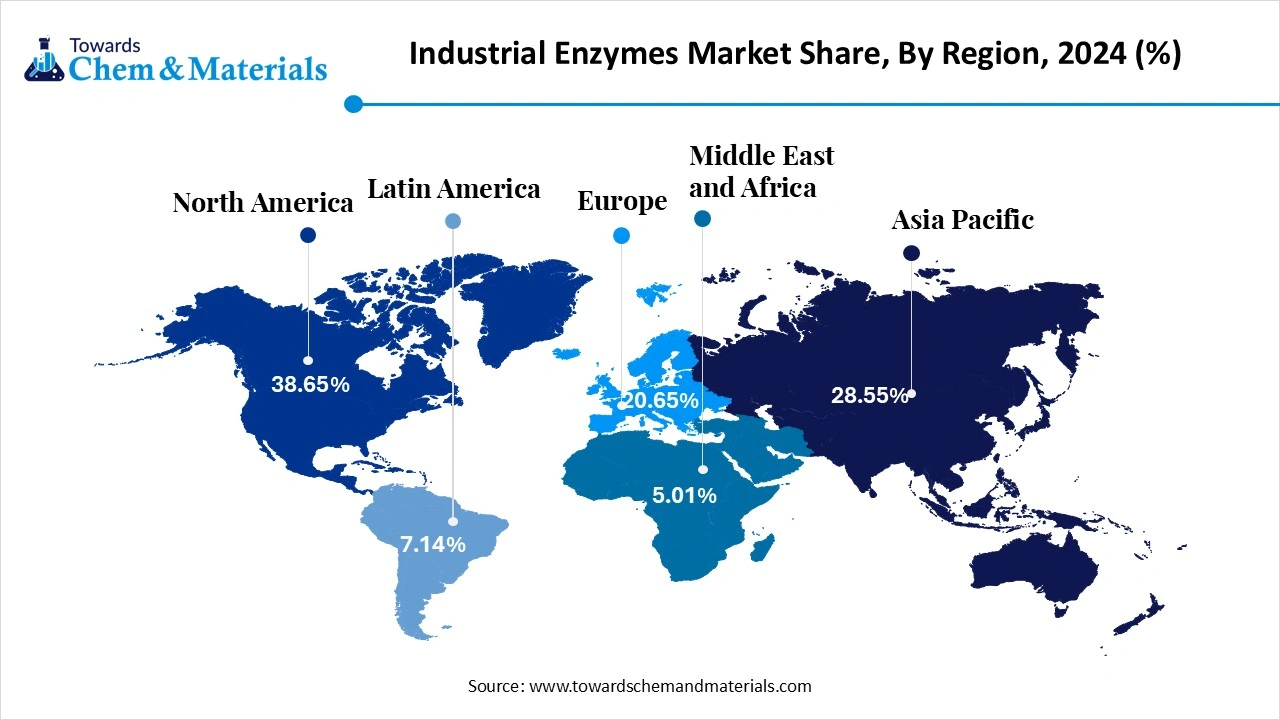

Ottawa, Nov. 10, 2025 (GLOBE NEWSWIRE) — The global industrial enzymes market size was valued at USD 8.19 billion in 2024 and is anticipated to reach around USD 16.04 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.95% over the forecast period from 2025 to 2034. North America dominated the industrial enzymes market with a market share of 38.65 % in 2024. The growth of the industrial enzymes market is primarily driven by increasing demand across several key sectors, including food & beverages, textiles, pharmaceuticals, and biofuels. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5577

What are Industrial Enzymes?

The global industrial enzymes market is expanding rapidly, driven by growing demand for sustainable and efficient manufacturing processes across multiple industries. These enzymes are widely used in sectors such as food & beverages, animal feed, detergents, biofuels, textiles, and pharmaceuticals, providing cost-effective and eco-friendly alternatives to traditional chemical processes. Advances in biotechnology and enzyme engineering are enhancing enzyme stability, specificity, and production efficiency, further fueling market growth.

Regional markets like North America, Europe, and Asia-Pacific are witnessing significant adoption due to increasing industrialization and supportive government policies promoting green technologies. Key market players are focusing on strategic collaborations, mergers, and acquisitions to strengthen production capacities and global distribution networks.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Industrial Enzymes Market Report Highlights

- The U.S. industrial enzymes market size is estimated at USD 2.37 billion in 2025, and is expected to reach USD 4.66 billion by 2034, at a CAGR of 7.70% during the forecast period 2025-2034

- North America dominated the industrial enzymes market and accounted for the largest revenue share of 38.65% in 2024.

- By product, the carbohydrase segment accounted for the largest revenue share of 49.34% in 2024.

- By application, The food and beverage segment held the largest revenue share of 22.65% in 2024.

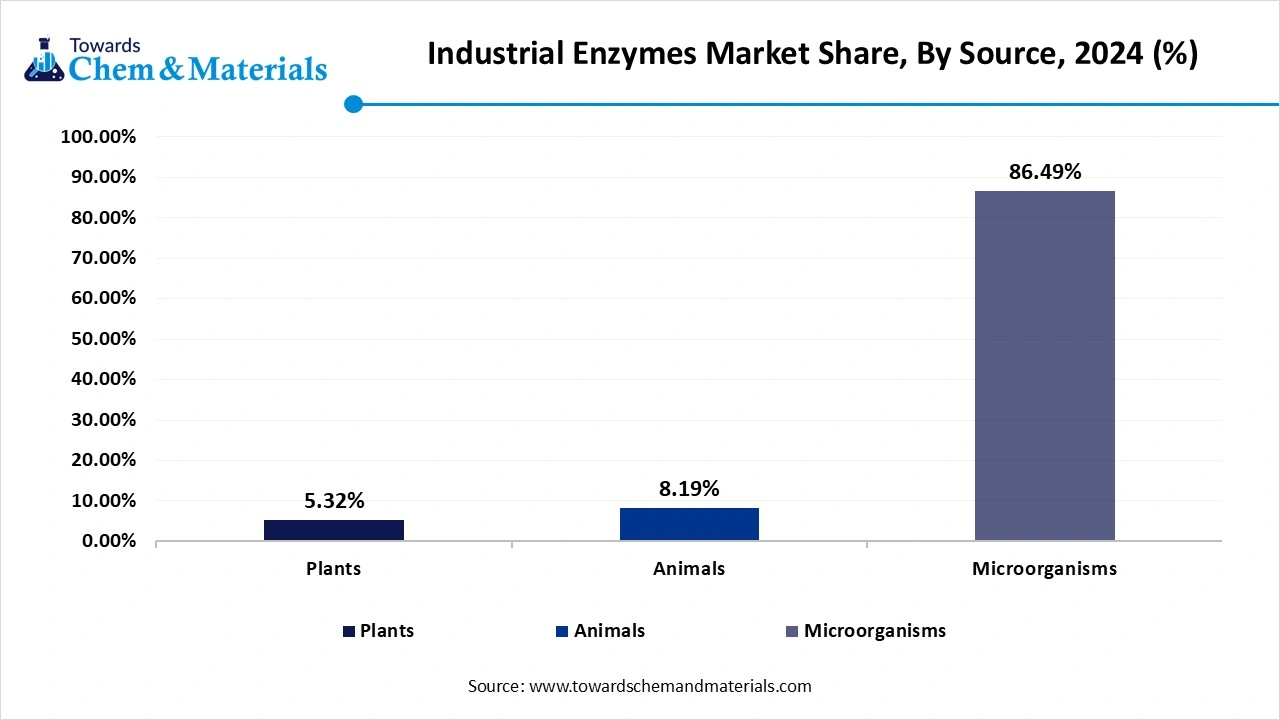

- By source, The microorganisms segment accounted for the largest revenue share of around 86.49% in 2024.

What are the main benefits of using industrial enzymes?

Improved efficiency: Enzymes can catalyze reactions much faster than chemical methods, which can help to improve the efficiency of industrial processes. This can lead to a reduction in production time and costs, as well as an increase in the yield of the final product.

Increased specificity: Enzymes are highly specific in the substrates they catalyze, meaning that they can target specific molecules or groups of molecules, rather than affecting a wide range of compounds. This can result in a higher purity of the final product and less waste.

Reduced environmental impact: Enzymes are biodegradable and can be derived from renewable resources, which can help to reduce the environmental impact of industrial processes. They also often operate at milder conditions than chemical catalysts, reducing the production of greenhouse gas emissions.

Cost-effectiveness: Enzymes are often cheaper to use than traditional chemical catalysts, since they can be produced on a large scale and can be used multiple times before they need to be replaced.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5577

Industrial Enzymes Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 8.76 Billion |

| Revenue forecast in 2034 | USD 16.04 Billion |

| Growth rate | CAGR of 6.95% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 – 2025 |

| Forecast period | 2025 – 2034 |

| Segments covered | Product, source, application, region |

| Regional scope | North America; Europe; Asia Pacific; Middle East & Africa; Latin America |

| Key companies profiled | Novozymes; BASF SE; DuPont Danisco; DSM; NOVUS INTERNATIONAL; Associated British Foods Plc; Amano; Enzyme Inc.; Chr. Hansen Holding A/S; Advanced Enzyme Technologies; Lesaffre; Adisseo Enzyme Development Corporation (EDC) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Types of Industrial Enzymes and Their Applications

1. Carbohydrate-Active Enzymes:

In the food industry, starch is a key ingredient in products like bread, bakery items, and many processed foods. It comes from plants like corn, potatoes, and wheat, and it plays an essential role as a thickener, water binder, and fat substitute. Starch is made up of two main components—amylose and amylopectin—both of which are types of glucose units. To improve the functionality of starch, it is often modified through enzymes or chemicals. Key enzyme-driven processes include the creation of cyclodextrins (a type of starch derivative) and the breakdown of starch into simpler sugars for syrup production. These starch-based products are found in a wide variety of foods such as soft drinks, ice cream, baby food, and canned fruit. In the brewing and baking industries, enzymes like alpha-amylases help process starch and produce syrups or alcohol. These enzymes are often naturally present in raw food materials, or they can be sourced from plants or microorganisms.

2. Cellulases:

Cellulases are important in the textile industry, especially for the processing and finishing of materials made from cellulose (like cotton and hemp). These enzymes help improve the quality of fabrics by breaking down cellulose fibers. In particular, they’re used in the denim industry to create a faded or worn look on jeans without the need for pumice stones, in a process called bio-stoning. Cellulases also play a role in the cleaning and care of fabrics by brightening faded clothes and reducing lint. Additionally, they are used in biopolishing to enhance the appearance of textiles like cotton, hemp, and rayon, making the fabric softer and shinier.

3. Peptidases (Proteases):

Proteases are enzymes that break down proteins, and they are widely used across various industries. In the beer and alcohol industry, proteases help clear up haze in beer by breaking down proteins that cause cloudiness. In baking, proteases help break down gluten in dough, making it easier to work with and improving the texture of bread. For example, bromelain, a protease from pineapples, is often used to speed up dough relaxation and prevent shrinkage in baked goods. In the leather industry, proteases are used in a process called “bating,” which softens leather and makes it more flexible by breaking down proteins. However, the enzymatic action is carefully controlled to avoid damaging the leather.

4. Lipases:

Lipases are enzymes that break down lipids (fats) and are used in a variety of industrial applications. These enzymes are highly versatile and can work with different types of fatty substances, including oils and fats from plants and animals. In the detergent industry, lipases help break down greasy stains on clothes. Lipases are also important in organic chemistry, where they are used in reactions like esterification and transesterification, particularly in the production of biodiesel and other chemicals. Their ability to work in organic solvents and their selectivity make them valuable in many industrial processes.

5. Nucleic Acid Enzymes:

DNA polymerases are enzymes that help replicate DNA and are crucial in genetic research and diagnostics. In medical diagnostics, DNA polymerases are used in PCR (Polymerase Chain Reaction) technology, which amplifies small amounts of DNA to make them detectable. PCR is essential in identifying the presence of pathogens, such as viruses and bacteria, in patients. For instance, it’s used to detect infections like tuberculosis, HIV, and viral hepatitis. PCR is also used in genetic testing to identify gene mutations that could lead to inherited diseases like cystic fibrosis or cancer. By amplifying specific genes, PCR helps doctors assess genetic risks in patients and their families.

6. Oxidoreductases:

Oxidoreductases are enzymes involved in redox reactions, where one molecule is oxidized and another is reduced. In the food industry, these enzymes are used for their antibacterial properties. For example, glucose oxidase (GOx) generates hydrogen peroxide (H2O2), which can kill bacteria. In textile manufacturing, catalase (a type of oxidoreductase) is used to break down excess hydrogen peroxide after bleaching processes. This reduces water usage, helps minimize chemical waste, and makes the dyeing process more efficient.

Key Sustainability Trends in the Industrial Enzymes Industry

AI Revolutionizing the Industrial Enzymes Industry

Artificial intelligence (AI) is significantly transforming the industrial enzymes industry by enabling faster and more precise enzyme discovery and design. Machine learning algorithms can predict enzyme structures, functions, and stability, reducing the time and cost of research and development. AI-driven process optimization allows manufacturers to enhance enzyme production efficiency, improve yields, and lower operational costs. Predictive analytics helps in customizing enzyme formulations for specific industrial applications, increasing effectiveness and product performance. Additionally, AI facilitates quality control and real-time monitoring in manufacturing, ensuring consistent product standards.

What are the Key Trends of the Industrial Enzymes Market?

Market Opportunity

Rising Demand for Sustainable and Eco-Friendly Solutions

A major opportunity in the industrial enzymes market is the increasing demand for sustainable and environmentally friendly manufacturing processes. Industries such as food & beverages, detergents, textiles, and biofuels are seeking bio-based alternatives to reduce chemical usage and carbon footprint.

Enzymes provide energy-efficient, biodegradable, and non-toxic solutions that meet these sustainability goals. This trend also encourages innovation in enzyme engineering and process optimization, driving long-term growth in the market. Additionally, supportive government policies and incentives for green technologies are further boosting enzyme adoption.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5577

Industrial Enzymes Market Segmentation Insights

Product Insights

Which Product Leads the Industrial Enzymes Market?

The carbohydrase segment dominated the market with the highest largest share in 2024, due to their widespread applications across multiple industries such as food & beverages, biofuels, and animal feed. These enzymes efficiently break down complex carbohydrates into simpler sugars, enhancing product quality, yield, and digestibility. The growing demand for bioethanol and other renewable energy sources has further boosted carbohydrase usage in biofuel production.

The proteases segment is expected to grow fastest over the forecast period, due to their versatile applications across industries such as detergents, food & beverages, leather, and pharmaceuticals. These enzymes efficiently break down proteins, enhancing product quality, functionality, and process efficiency. In the detergent industry, proteases improve stain removal and cleaning performance under various conditions, driving widespread adoption.

Application Insights

Which Application Segment Leads the Industrial Enzymes Market?

In 2024, the food and beverage segment led the market, due to the growing demand for high-quality, safe, and nutritious products. Enzymes are extensively used in baking, dairy, brewing, and juice processing to improve flavor, texture, shelf life, and production efficiency. Rising consumer preference for natural, clean-label, and additive-free products has further increased enzyme adoption in this sector.

The animal feed segment is growing fastest in the market, due to rising demand for high-efficiency feed formulations that enhance animal growth and nutrient absorption. Enzymes such as phytases, proteases, and carbohydrases are widely used to improve feed digestibility and reduce waste, lowering production costs for livestock and poultry. Increasing global meat and dairy consumption has driven the need for more productive and sustainable feed solutions.

Source Insights

What Made the Microorganisms Lead the Industrial Enzymes Market in 2024?

The microorganisms segment led the market, due to their versatility and efficiency in enzyme production. They offer high yields and faster growth rates compared to plant- or animal-based sources, making large-scale production more cost-effective. Microbial enzymes can be easily engineered and optimized for specific industrial applications, enhancing performance and stability under diverse conditions.

The plant-based enzymes segment is expected to lead the market over the forecast period, driven by their natural origin and widespread acceptance in food, beverage, and nutraceutical industries. They are preferred for applications requiring non-animal, vegetarian, or clean-label solutions, aligning with consumer demand for healthier and more sustainable products. These enzymes often exhibit high specificity and activity under mild processing conditions, making them ideal for delicate industrial processes.

Regional Insights

Enzyme Ascendancy: North America’s Biocatalyst Command

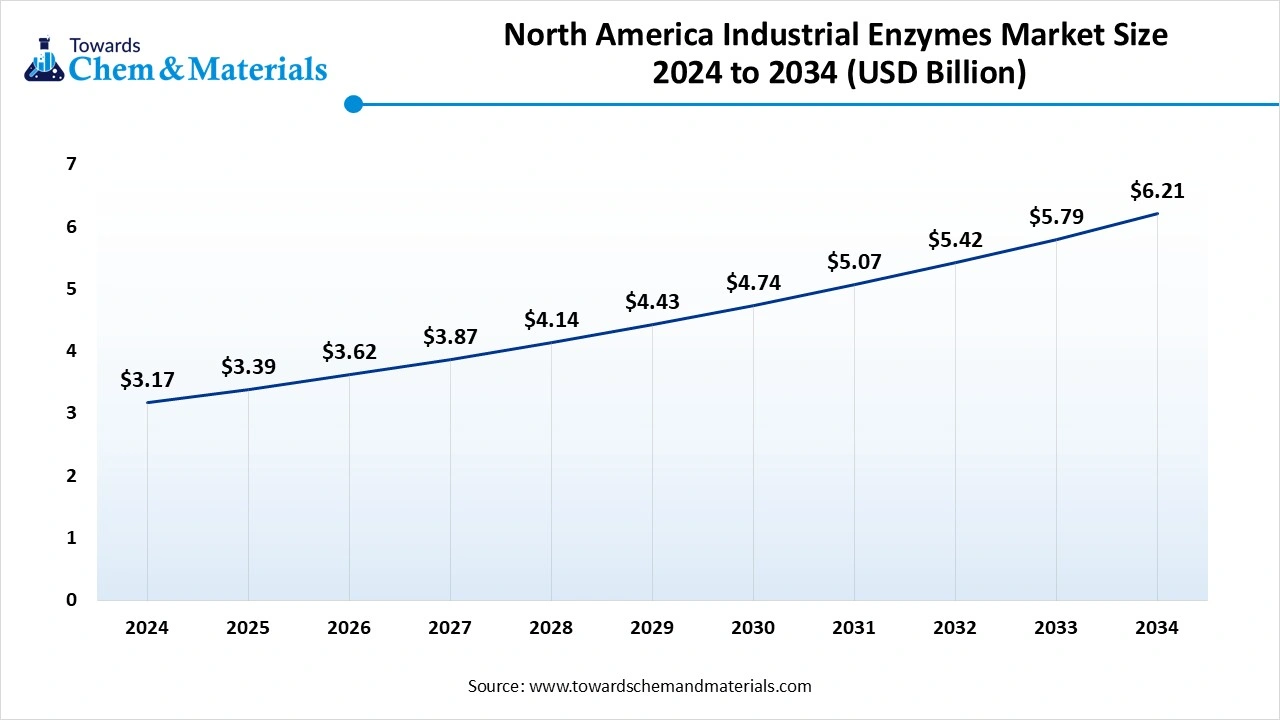

The North America industrial enzymes market size was valued at USD 3.17 billion in 2024 and is expected to be worth around USD 6.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.96% over the forecast period 2025 to 2034.

North America dominates the market due to its well-established industrial base and early adoption of biotechnology-driven solutions. The region benefits from strong research and development infrastructure, enabling innovation in enzyme engineering and novel applications. High demand from key sectors such as food & beverages, detergents, biofuels, and pharmaceuticals continues to drive market growth. Additionally, supportive government regulations and initiatives promoting sustainable manufacturing and green technologies have accelerated enzyme adoption.

U.S. Industrial Enzymes Market Trends

The U.S. market is witnessing steady growth driven by rising demand across sectors such as food & beverages, biofuels, and detergents. Innovations in enzyme engineering are enabling more efficient and sustainable processes, attracting investments from major industry players. Increasing consumer preference for eco-friendly and bio-based products is fueling the adoption of enzymes in various manufacturing processes.

Asia-Pacific’s Biocatalyst Boom: The Epicenter of Enzyme Expansion

The Asia-Pacific region is witnessing the fastest growth in the market, driven by rapid industrialization and expanding manufacturing sectors. Rising demand from food & beverages, animal feed, textiles, and biofuel industries is a major growth factor. Increasing government support for biotechnology and green manufacturing initiatives is encouraging enzyme adoption across the region. Countries like China and India are investing heavily in enzyme research, production facilities, and advanced biotechnological applications.

China Industrial Enzymes Market Trends

China’s market witnessing growth drivers include rising demand from the food & beverage, feed, detergent, and textile sectors, as manufacturers seek sustainable bio-catalytic solutions. Government policies favoring green manufacturing and industrial biotechnology, such as initiatives under China’s “14th Five-Year Plan,” are helping elevate enzyme adoption. Among enzyme types, carbohydrase’s are dominating in both revenue and growth in China, reflecting their heavy use in carbohydrate-rich food and feed applications.

Europe Industrial Enzymes Market Trends

The industrial enzymes market in Europe has experienced significant growth in recent years, owing to the surging demand for sustainable and environment-friendly solutions for various industries. Enzymes, renowned natural catalysts, have revolutionized industrial processes by enhancing their efficiency and promoting sustainability. This makes them indispensable components in numerous industries in Europe.

Germany industrial enzymes market is a mature and highly innovative segment, driven by robust demand from its well-established food & beverage, animal feed, textile, and detergent industries. A key focus is on developing highly efficient, sustainable enzyme solutions that reduce processing costs, improve product quality, and align with stringent environmental regulations and the circular economy initiatives within Germany and the EU.

Latin America Industrial Enzymes Market Trends

The industrial enzymes market in Latin America is witnessing significant growth owing to its flourishing food and beverage, textiles, and detergent industries. Countries of the region, including Brazil, Argentina, and Chile, are experiencing a rise in consumer awareness about the benefits of using enzymes, which is further fueling the growth of the market in South America.

Middle East & Africa Industrial Enzymes Market Trends

The industrial enzymes market in the Middle East & Africa is an emerging and rapidly growing segment, primarily driven by the expansion of its food & beverage, animal feed, and biofuel sectors, along with increasing awareness of enzymes’ benefits for process efficiency and sustainability. The region is seeing growing investments in industrial biotechnology, leading to a rising adoption of enzymes to optimize production costs, enhance product quality, and meet evolving environmental and consumer demands.

Top Companies in the Industrial Enzymes Market & Their Offerings:

- Chr. Hansen Holding A/S (now part of Novonesis): Specializes in enzymes and microbial solutions for food, nutrition, and agriculture, with a focus on dairy.

- Lesaffre: Provides fermentation-based industrial enzymes for applications like baking and animal feed.

- Adisseo: Offers feed enzymes, such as Rovabio® Excel, to improve nutrient digestibility in livestock.

- BASF SE: Supplies enzymes for detergent formulations (Lavergy®) and animal nutrition applications.

- Novozymes (now part of Novonesis): A former industry leader offering enzymes for a vast range of industrial uses, including biofuels, textiles, and food.

- DuPont Danisco (now IFF): Provides enzymes for the food and beverage industry, focusing on dairy, baking, and brewing applications.

- DSM (now dsm-firmenich): Offers a comprehensive portfolio of feed enzymes designed to enhance animal nutrition and feed efficiency.

- NOVUS INTERNATIONAL: Supplies feed enzyme solutions (CIBENZA®) to optimize protein digestion and improve livestock performance.

- Associated British Foods Plc: Through its subsidiary AB Enzymes, it provides enzymes for baking, plant-based foods, and detergents.

- BioProcess Algae, LLC: Focuses on developing algae production systems to produce biocompounds, including potential enzyme sources, for biofuels and animal feeds.

- Koninklijke DSM N.V (now dsm-firmenich): Offers feed enzymes to the animal nutrition and health market, aimed at improving feed efficiency

More Insights in Towards Chemical and Materials:

- Textile Market Size to Exceed USD 2.01 Trillion by 2034

- Textile Chemicals Market Size to Surge USD 50.84 Billion by 2034

- Bio-Based Textiles Market: Demand, Production, and Future Projections

- U.S. Enzymes Market Size to Reach USD 8.17 Billion by 2034

- Agricultural Enzymes Market Size to Reach USD 1,480.56 Mn by 2034

- Enzymes Market Volume Boosts 1343.40 Kilo Tons By 2034

- Phosphate Fertilizers Market Size to Hit $ 124.97 Bn by 2034

- Fertilizers Market Size to Hit USD 380.16 Billion by 2035

- Specialty Fertilizers Market Size to Hit 49.33 Million Tons by 2034

- Nitrogenous Fertilizer Market Size to Reach USD 224.55 Bn by 2034

- U.S. Nitrogenous Fertilizer Market Size to Surpass USD 26.29 Bn by 2034

- Asia Pacific Fertilizers Market Size to Reach USD 313.44 Bn by 2034

- Controlled Release Fertilizers Market Size to Reach USD 4.49 Billion by 2034

- Fertilizer Catalysts Market Size to Exceed USD 4.75 Billion by 2034

- Sulfur Fertilizer Market Size to Hit USD 8.02 Billion by 2034

- Asia Pacific Nitrogenous Fertilizer Market Size to Worth USD 157.57 Bn by 2034

- U.S. Fertilizers Market Size to Reach USD 47.28 Billion by 2034

- Geotextiles Market Size to Hit USD 28.90 Billion by 2035

- Europe Textile Market Size | Companies Analysis 2025-2034

- U.S. Textile Market Size to Surge USD 283.15 Billion by 2034

Industrial Enzymes Market Top Key Companies:

- Novozymes

- BASF SE

- DuPont Danisco

- DSM

- NOVUS INTERNATIONAL

- Associated British Foods Plc

- Amano Enzyme Inc.

- Chr. Hansen Holding A/S

- Advanced Enzyme Technologies

- Lesaffre

- Adisseo

- Enzyme Development Corporation (EDC)

Recent Developments

- In June 2025, Novonesis finalized its acquisition of DSM-Firenich’s stake in the Feed Enzymes Alliance for €1.5 billion. The agreement was accounted in February 2025 to expand Novonesis’s position across the animal BioSolutions value chain and enhance its presence in bio-based enzymes.

Industrial Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Industrial Enzymes Market

By Product

- Carbohydrase

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Plants

- Animals

- Microorganisms

By Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Nutraceutical

- Personal Care & Cosmetics

- Wastewater

- Agriculture

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5577

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.