Robo Advisory Market Size to Surpass USD 71.19 Billion by 2032; Rising at 30.43% CAGR | SNS Insider

Robo Advisory Market growth is driven by rising demand for automated, low-cost investment solutions, AI-driven portfolio management, digital banking expansion, and increasing financial literacy.

Austin, Nov. 11, 2025 (GLOBE NEWSWIRE) — Robo Advisory Market Size & Growth Insights:

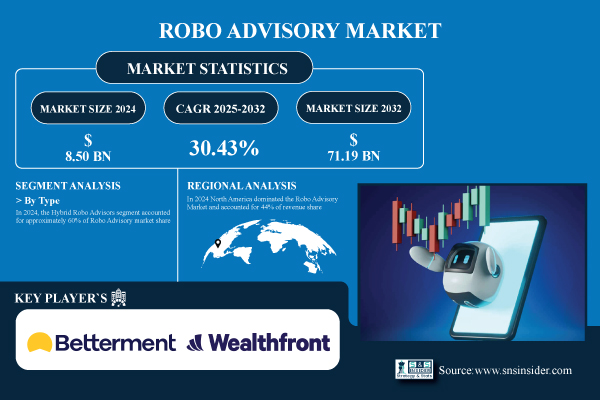

According to the SNS Insider,“The Robo Advisory Market Size was valued at USD 8.50 Billion in 2024 and is projected to reach USD 71.19 Billion by 2032, growing at a CAGR of 30.43% during 2025-2032.”

The size of the Robo Advisory Market is expected to expand at a CAGR of 27.28% from 2025 to 2032, reaching USD 17.59 billion. The majority of research indicates that the growing desire for affordable and personalized wealth management solutions, the widespread use of AI-powered investing platforms, and the expansion of retail and high-net-worth investors are the main factors propelling the growth of the robo advisory market.

Growing Number of Strategic Collaborations and Innovation Augment Market Growth Globally

Partnerships such as these enable the smooth integration of digital investment solutions, goal-based planning, and next-generation AI-powered portfolio management, increasing the scalability and efficiency of platforms. More technological sophistication opens the door for adoption by high-net-worth and retail investors by lowering barriers to entry and boosting user trust. Additionally, the development of new business models and marketing alliances enables Robo Advisory providers to provide tailored wealth management services in an economical and efficient manner. Therefore, the market is growing as a result of all of these causes together, which also helps the wealth management industry’s overall digital transition by making Robo consulting platforms an effective alternative to traditional financial consulting services.

Get a Sample Report of Robo Advisory Market Forecast @ https://www.snsinsider.com/sample-request/8255

Leading Market Players with their Product Listed in this Report are:

- Betterment LLC

- Fincite GmbH

- Wealthfront Corporation

- The Vanguard Group Inc.

- The Charles Schwab Corporation

- Ellevest Inc.

- Ginmon Vermögensverwaltung GmbH

- Wealthify Limited

- SoFi Technologies Inc.

- SigFig Wealth Management LLC

- Personal Capital Corporation

- Acorns Grow Incorporated

- Fidelity Investments

- UBS Group AG

- Allianz SE

- JP Morgan Chase & Co.

- Morgan Stanley Wealth Management

- Interactive Brokers LLC

- M1 Finance

- Qplum Technologies

Robo Advisory Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 8.50 Billion |

| Market Size by 2032 | USD 71.19 Billion |

| CAGR | CAGR of 30.43% From 2025 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type(Pure Robo Advisors AND Hybrid Robo Advisors) • By Provider(Fintech Robo Advisors, Banks, Traditional Wealth Managers and Others) • By Service Type(Direct Plan-based/Goal-based and Comprehensive Wealth Advisory) • By End User(Retail Investor and High Net Worth Individuals) |

Purchase Single User PDF of Robo Advisory Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8255

Key Industry Segmentation

By Type

In 2024, the Hybrid Robo Advisors segment accounted for approximately 60% of Robo Advisory market share, as a hybrid model includes human advisory in addition to AI-driven strategy, and portfolio execution. The Pure Robo Advisors segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 31.87%, due to the growing acceptance of automated investment solutions, including, fully automated, AI based, economical personalized portfolio management system.

By Provider

In 2024, the Fintech Robo Advisors segment accounted for approximately 41% of Robo Advisory market share, due to technology disruptive innovation driven competitive advantage based on user-centric digital platforms. The Banks segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 32.74%. The segment is propelling as traditional banks are increasingly integrating AI-driven robo-advisory solutions into their offerings to enhance customer experience, improve portfolio management, and provide personalized investment guidance.

By Service Type

In 2024, the Direct Plan-based/Goal-based segment accounted for approximately 60% of Robo Advisory market share, reflecting strong demand for personalized, goal-oriented investment solutions. The Comprehensive Wealth Advisory segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 31.87%, due to increasing demand for fully integrated wealth management solution that provides automated investing with human advisor customizing innovative investment strategies across wealth asset classes.

By End-User

In 2024, the High Net Worth Individuals segment accounted for approximately 65% of Robo Advisory market share, reflecting strong adoption among affluent investors seeking personalized, technology-driven portfolio management. The Retail Investor segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 32.06%. Rising digital adoption, increasing financial literacy, and demand for low-cost, automated investment solutions are driving this expansion.

Regional Insights:

North America held a 44% revenue share and dominated the Robo Advisory Market in 2024. The region’s strong digital adoption rates, the development of its technological infrastructure, and the abundance of knowledge on AI-powered investing platforms have all contributed to its current position as a leader.

Asia Pacific is expected to witness the fastest growth in the Robo Advisory Market over 2025-2032, with a projected CAGR of 32.47%. Rapid digitalization, a surge in innovative solutions traction coupled with rising cognizance for AI-powered investment Platforms is contributing to the market growth.

Do you have any specific queries or need any customized research on Robo Advisory Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/8255

Recent News:

- In Sept 2024, Vanguard reduced the minimum investment for its Digital Advisor robo-advisory platform from USD 3,000 to just USD 100. This move aims to attract more retail investors by providing accessible, low-cost automated investment solutions and expanding adoption of digital wealth management services.

Exclusive Sections of the Robo Advisory Market Report (The USPs):

- PRICING & COST STRUCTURE ANALYSIS – helps you assess how fee models (Robo-only vs. Hybrid) and cost components such as algorithm development and platform maintenance influence overall profitability and competitiveness in the Robo Advisory market.

- OPERATIONAL & PERFORMANCE METRICS – helps you evaluate platform efficiency through metrics like average portfolio returns, risk-adjusted performance (Sharpe Ratio, Alpha), and onboarding time — enabling performance benchmarking against traditional advisory services.

- TECHNOLOGY & DIGITAL INFRASTRUCTURE METRICS – helps you identify the degree of digital maturity across the industry, covering AI/ML integration for portfolio optimization, cloud adoption rates, cybersecurity compliance, and automation in client servicing.

- REGULATORY & COMPLIANCE METRICS – helps you understand how adherence to financial regulations (SEC, FCA, MiFID II) and frequency of audits or compliance violations impact market credibility and operational risk exposure.

- REGIONAL PRICING VARIATIONS & FORECASTED FEE TRENDS – helps you track how pricing structures differ across major markets and anticipate fee adjustments driven by technological advancements and growing competition.

- CYBERSECURITY & DATA RELIABILITY BENCHMARKS – helps you gauge platform reliability through system uptime percentages, data breach incidents, and compliance rates — crucial for assessing customer trust and risk management standards.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.