Textile Chemicals Market Size to Worth USD 50.84 Billion by 2034

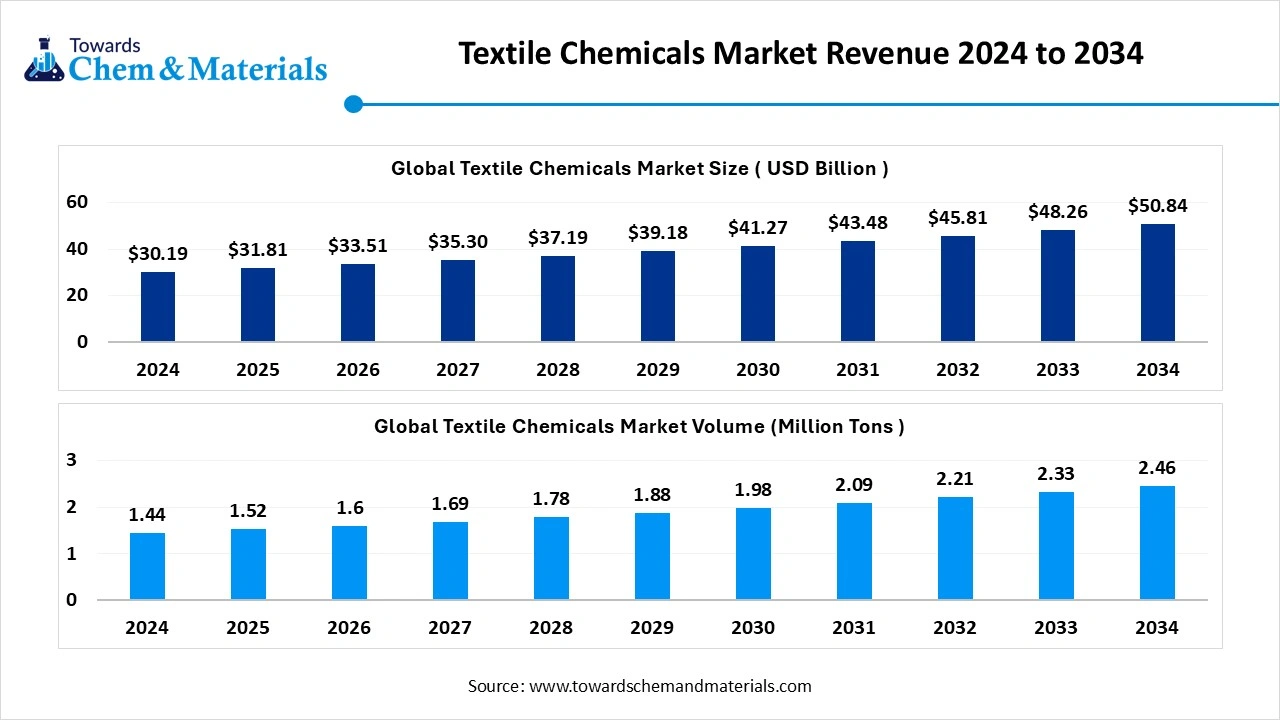

According to Towards Chemical and Materials, the global textile chemicals market size is calculated at USD 31.81 billion in 2025 and is expected to be worth around USD 50.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period 2025 to 2034.

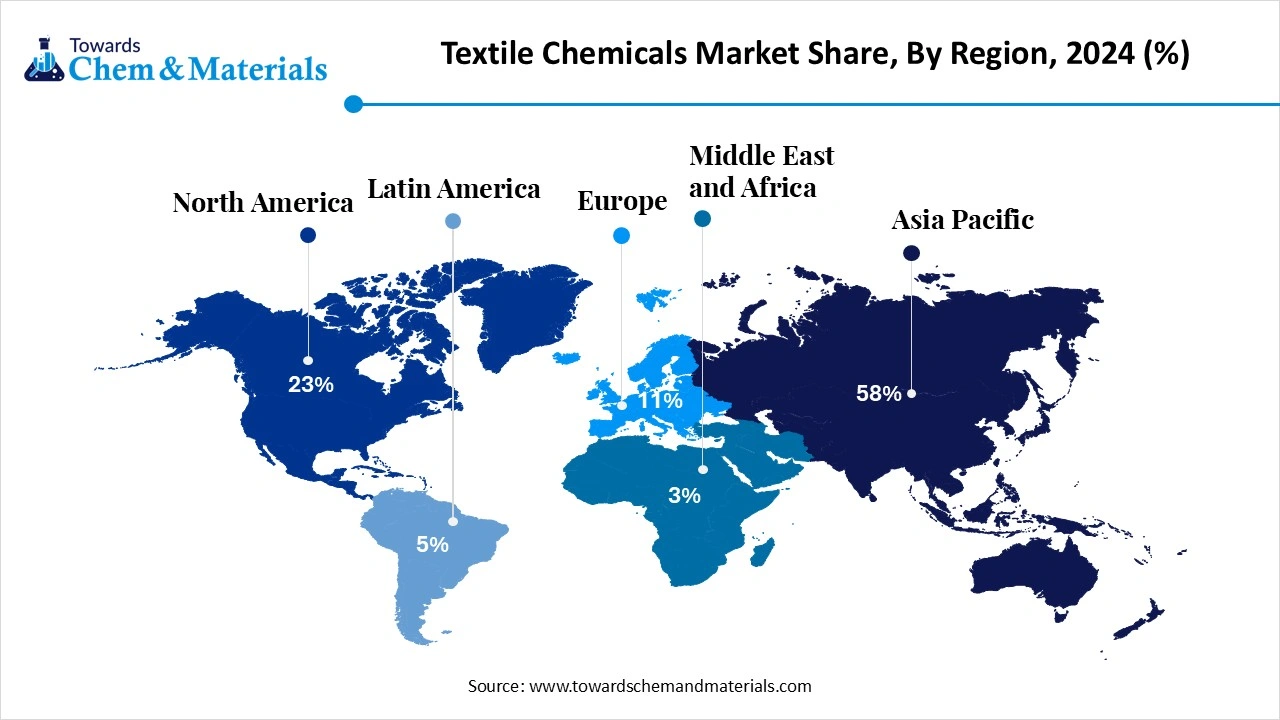

Ottawa, Nov. 13, 2025 (GLOBE NEWSWIRE) — The global textile chemicals market size was valued at USD 30.19 billion in 2024 and is anticipated to reach around USD 50.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35 % over the forecast period from 2025 to 2034. Asia Pacific dominated the textile chemicals market with a market share of 58% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

According to Towards Chemical and Materials, the global textile chemicals market stands at 1.52 million tons in 2025 and is forecast to reach 2.46 million tons by 2034, growing at a CAGR of 5.49% from 2025 to 2034.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5840

What are Textile Chemicals?

The textile chemicals market is being driven by the increasing demand for sustainable and high-performance textiles across the apparel, home furnishing, and technical textile sectors. Textile chemicals are specialty chemical formulations used at various stages of textile manufacturing, ranging from pre-treatment and dyeing to finishing and coating, to impart specific properties and enhance fabric performance. These chemicals play a crucial role in improving the texture, color, strength, durability, and functionality of textiles used in apparel, home furnishings, automotive interiors, and industrial applications.

Sustainability has become a defining trend shaping the market. Manufacturers are focusing on developing bio-based, non-toxic, and water-efficient chemical solutions to comply with stringent environmental regulations such as REACH and the ZDHC (Zero Discharge of Hazardous Chemicals) initiative.

Textile Chemicals Market Report Highlights

- Asia Pacific dominated the textile chemicals market, accounting for a 58% revenue share in 2024.

- The China textile chemicals industry dominated the APAC region with a revenue share of 67.12% in 2024.

- By process, the coating process dominated the market with a 72.11% revenue share in 2024.

- By process, the protection segment under the coating category is expected to register a robust CAGR of 4.92% during the review period.

- By Product, the coating & sizing chemicals segment dominated the textile chemicals market, accounting for a revenue share of 51.17% in 2024.

- By product, the finishing agents’ segment is anticipated to register the fastest CAGR of 4.91% from 2025 to 2034.

- By Application, the apparel segment dominated the textile chemicals market, accounting for a revenue share of 44.11% in 2024.

- By product, the home furnishing segment registered a steady CAGR of 3.92% during the forecast period.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Different Chemicals Are Used During the Making of Textiles, The Basic List of Processes Is as Below:

- Scouring and washing of yarn and fibers: The yarn is scoured and washed using detergents or enzymes to be clean and ready for the textile manufacturing process.

- Bleaching: In the bleaching process, two types of chemical processes are used. Peroxide stabilizers and peroxide killers are used during the bleaching process to either bleach the fabric or neutralize the amount of peroxide in the fabric.

- Mercerising: Concentrated caustic soda is applied to the yarn when it’s under tension, especially for cotton fabric, so later, the fabric becomes more friendly to dyes and chemical treatment going forward.

- Dyeing: There are various dyes used to color the fabric/material, such as indigo dyes, vat dyes, sulfur-based dyes, direct dyes, natural dyes, etc. After dyeing, further processes are required in order to improve the color brightness of the fabric, disperse the dyes, and improve dye penetration in the fabric, these processes are leveling agents, soaping agents, and vat leveling agents.

- Printing: Various chemicals such as pearl binders, puff binders, and other binders are used in printing to make it accurate and clearly visible on the clothes.

- Finishing: Chemicals are used during the finishing process for various purposes such as anti-shrinking, fire-retardant, softness, anti-yellowing over time, and many more.

- Washing: Certain chemicals are used during the washing process either wet wash or dry

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5840

Textile Chemicals Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 31.81 Billion |

| Revenue forecast in 2033 | USD 50.84 Billion |

| Growth rate | CAGR of 5.35% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2018 – 2023 |

| Forecast period | 2025 – 2033 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

| Segments covered | Process, product, application, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; Turkey; Italy; UK; France; Russia; Spain; Poland; China; India; Japan; South Korea; Vietnam; Indonesia; Saudi Arabia; South Africa; Morocco; Tunisia; UAE; Kenya; Brazil; Argentina |

| Key companies profiled | AB Enzymes; Archroma; BASF SE; BioTex Malaysia; Dow; Ethox Chemicals, LLC; Evonik Industries AG; Fibro Chem, LLC; German Chemicals Ltd.; Govi N.V.; Huntsman International LLC; Kemira Oyj; Kiri Industries Ltd.; LANXESS; OMNOVA Solutions Inc.; Omya United Chemicals; Organic Dyes and Pigments; Resil Chemicals Pvt. Ltd.; Solvay S.A.; The Lubrizol Corporation |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Read More News : Textile Market Size to Surpass USD 2.01 Trillion by 2034

- wash, it removes dirt, dust, waste, and any harmful materials from the textile.

Major Applications of the Textile Chemicals:

- Fiber Processing/Pre-treatment: Chemicals like scouring and bleaching agents are used to clean raw fibers and fabrics by removing natural impurities such as waxes, oils, and dirt, ensuring they are prepared for subsequent processes.

- Dyeing and Printing: Dyes and a range of auxiliaries are applied to impart vibrant, long-lasting colors and patterns to fabrics, while ensuring even penetration, colorfastness, and sharpness of design.

- Finishing: Finishing agents are used to enhance the aesthetic appeal and tactile properties of fabrics, such as adding softness, wrinkle resistance, or special effects like a specific luster or drape.

- Imparting Functional Properties (Technical Textiles): Specialty chemicals provide fabrics with specific performance characteristics, including water repellency, flame retardancy, UV protection, or antimicrobial features for use in technical and performance textiles.

- Sizing and Coating: Sizing agents are applied to yarns before weaving to improve their strength and reduce breakage, while coating chemicals add functional layers for specific industrial applications like in geotextiles or medical textiles.

What are the Key Trends of the Textile Chemicals Market?

- Shift Towards Sustainability: Driven by stringent environmental regulations and consumer demand, the industry is increasingly adopting eco-friendly, bio-based, and non-toxic chemicals, such as enzyme-based pre-treatments and organic dyes, to reduce water pollution and energy consumption.

- Growing Demand for Technical Textiles: There is a rapid increase in demand for technical textiles used in automotive, medical, and construction industries, which require specialized chemical treatments (e.g., flame retardants, antimicrobial agents, UV stabilizers) to impart specific, high-performance properties.

- Focus on Multifunctional Finishes: Manufacturers are developing chemicals that provide multiple benefits in a single application, such as finishes that offer softness, water repellency, and wrinkle resistance simultaneously, meeting the consumer preference for convenient, durable, and high-quality fabrics.

- Adoption of Digitalization and Smart Manufacturing: The integration of Industry 4.0 technologies like AI-integrated dosing systems, automation, and data analytics is optimizing chemical application processes, leading to enhanced efficiency, reduced waste, and greater consistency in production.

- Transition to a Circular Economy: The market is seeing a growing focus on recycling and reusing textiles and the chemicals within them, with companies investing in technologies that can recover virgin-quality materials from textile waste and close the production loop.

AI Revolutionizing the Textile Chemicals Industry: Driving Innovation, Efficiency, and Sustainability

Artificial Intelligence (AI) is playing a transformative role in the textile chemicals industry by optimizing production processes, accelerating product development, and promoting sustainability across the value chain. One of its most impactful applications lies in predictive analytics, where AI models analyze vast datasets, from chemical compositions to textile performance metrics, to forecast outcomes and improve product quality.

This enables manufacturers to design innovative chemical formulations with enhanced dye affinity, colorfastness, and fabric softness, while minimizing resource waste. Machine learning algorithms can identify optimal combinations of chemicals to achieve specific textile properties, such as wrinkle resistance, water repellency, or flame retardancy, with reduced environmental impact.

Market Opportunity

Rising Demand for Sustainability and High-performance Chemicals.

The growing consumer and regulatory focus on sustainability presents a major opportunity in the textile chemicals market. Manufacturers are increasingly investing in eco-friendly dyes, bio-based finishes, and waterless processing technologies to meet stringent environmental standards. This shift towards green chemistry not only reduces the ecological footprint but also opens new avenues for innovation and premium product differentiation across global textile value chains.

Additionally, leading apparel brands are partnering with chemical producers to develop circular textile solutions and biodegradable coatings. The increasing adoption of sustainable textile chemicals in regions such as Europe and Asia-Pacific further accelerates market expansion. Furthermore, leading apparel and home textile brands are forming strategic collaborations with chemical suppliers to create sustainable product lines that align with global circular economy goals.

Limitations & Challenges

- Environmental Regulations: Strict global regulations on chemical usage and discharge necessitate expensive compliance measures and significant R&D investment in sustainable alternatives.

- Raw Material Volatility: Fluctuating prices and potential disruptions in the supply of petrochemical-based raw materials directly impact production costs, profit margins, and supply chain stability.

Immediate Delivery Available | Buy This Premium Research Report (https://www.towardschemandmaterials.com/checkout/5840

Textile Chemicals Market Segmentation Insights

Process Type Insights

How Coating Segment Dominates the Textile Chemicals Market?

The coating segment dominated the market in 2024, due to it provides specialized and high-value functional properties to fabrics that are difficult to achieve through other methods. These essential properties, including water resistance, flame retardancy, UV protection, and antimicrobial features, are crucial for the rapidly growing technical textiles sector, which encompasses applications in automotive, medical, and protective clothing industries.

The treatment of finished products segment is growing fastest in the market, due to increasing consumer demand for value-added fabrics with enhanced properties such as softness, wrinkle resistance, color retention, and antimicrobial features. While the coating segment currently holds the largest overall market share, the significant growth rate of the finishing agents segment highlights the industry’s focus on innovative and sustainable post-treatment solutions to meet evolving consumer preferences for both aesthetics and enhanced functionality.

Product Type Insights

How the Coating and Sizing Segment Dominates the Textile Chemicals Market?

The coating and sizing segment dominated the market in 2024, due to their critical role for imparting high-value, specialized functional properties to fabrics that cannot be achieved through other conventional treatments. Sizing chemicals are essential in the pre-treatment stage to enhance yarn strength and durability during weaving, while coatings provide vital characteristics like waterproofing and flame retardancy, crucial for the technical textiles sector. Consequently, the ability of these applications to provide durable, performance-oriented features in high-growth industries ensures the segment maintains the largest market share and revenue contribution.

The finishing agent segments are expected to grow at the fastest rate in the market, due to increasing consumer demand for value-added fabrics with enhanced properties such as permanent press, advanced softness, wrinkle resistance, and antimicrobial features. Manufacturers are heavily investing in sustainable and low-impact finishing solutions, such as bio-based softening agents and water-repellent finishes free from harmful PFAS chemicals, to meet both regulatory requirements and consumer preferences.

Application Insights

How the Apparel Segment Dominates the Textile Chemicals Market?

The apparel segment dominated the market in 2024, due to the immense volume of clothing produced globally, driven by a large and growing population, rising disposable incomes, and the rapid pace of fast fashion trends. Apparel manufacturing requires a vast array of chemical treatments at nearly every stage of production, from pre-treatment and dyeing to various finishing processes that impart desired properties such as softness and wrinkle resistance. This high-volume, chemically intensive production cycle, particularly prevalent in large manufacturing hubs.

The technical textiles segment is growing-fastest in the market, due to the increasing demand for high-performance materials with specialized functionalities like durability, flame resistance, and UV protection across diverse end-use industries, including automotive, healthcare, construction, and defense. The technical textiles segment is expanding at a faster rate, highlighting a significant shift in market dynamics towards performance-oriented and functional textile applications.

Regional Insights

Asia-Pacific Textile Chemicals Market: The Epicenter of Sustainable Innovation and Industrial Expansion

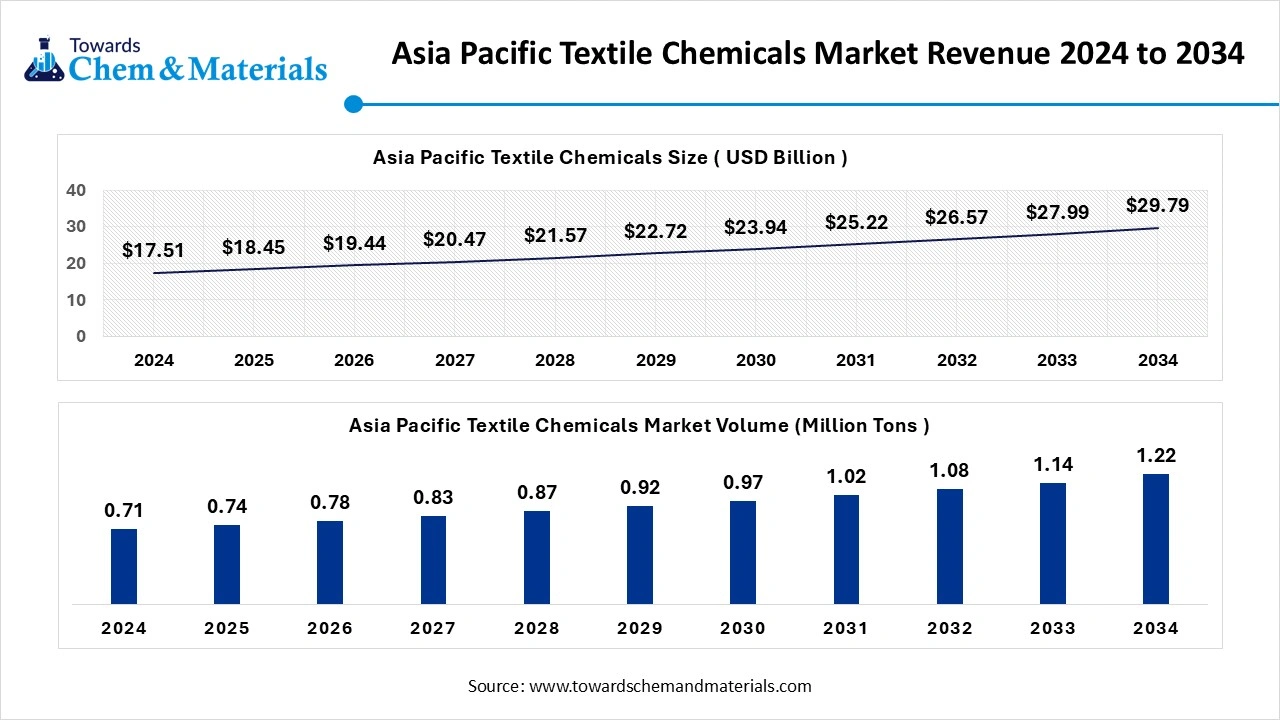

The Asia Pacific textile chemicals market volume is approximately 0.74 million tons in 2025 and is forecast to reach 1.22 million tons by 2034, growing at a CAGR of 5.56% from 2025 to 2034.

The Asia Pacific textile chemicals market size was valued at USD 17.51 billion in 2024 and is expected to reach USD 29.79 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.The Asia Pacific dominated the textile chemicals market in 2024.

The Asia-Pacific region continues to dominate the global textile chemicals market, driven by its strong manufacturing base, rapid industrialization, and rising domestic demand for textiles. A major transformation shaping the industry is the accelerated shift towards sustainable and eco-friendly textiles. Witt key players, like REACH, ZDHC, and GOT, are manufacturing bio-based dyes, water-efficient pre-treatment agents, and non-toxic findings. Additionally, the expanding demand for technical and functional textiles, the Global leader in sustainable textile chemistry and digital transformation. The Asia-Pacific textile chemicals market is set for continued expansion, supported by environmental initiatives, digital innovation, and strong global trade momentum, positioning the region at the heart of the future.

China Textile Chemicals Market Trends

China’s market is driven by robust domestic consumption and strong export demand, yet it is undergoing a major transformation shaped by sustainability goals, stringent environmental regulations, and rapid industrialization. Chinese manufacturers are heavily investing in green chemistry innovation, including biodegradable finishes, waterless dyeing technologies, enzyme-based pre-treatment agents, and recyclable coating, and cleaner production policies. The market is evolving from a traditional, volume-driven model to technologies, combine environmental regulations. Global leader in advanced textile chemical manufacturing, setting new standards for efficiency, performance, and eco-conscious textile production worldwide.

North America Textile Chemicals Industry: Driving Innovation Through Sustainability and Advanced Manufacturing

The North America textile chemicals market is witnessing steady and strategic growth, driven by increasing demand for high-performance, functional, cross multiple applications to enhance fabric quality and durability. A major driver shaping the market is the rising emphasis on sustainability and eco-friendly textile chemicals, bio-based dyes, low-VOC and non-toxic finishing agents, enzyme-based pre-treatment chemicals, and water-efficient solutions to reduce environmental impacts. Technological advancements are playing a crucial role in transforming the North American textile chemicals market. The adoption of AI-driven process optimization, IoT-enabled production systems, and digital monitoring tools further contributes to this growth.

U.S. Textile Chemicals Market Trends

The U.S. market is one of the largest and most advanced globally, driven by strong domestic textile production, high-quality apparel manufacturing, and significant exports. Technological innovation is also a critical factor shaping this growth. The market is increasingly influenced by demand from various industries, including healthcare, automotive, and industrial applications. The market is witnessing strategic collaborations between chemical manufacturers, textile producers, and global fashion brands.

Europe Textile Chemicals Market Trends

The Europe textile chemicals industry is well-established, backed by a long history of textile manufacturing and chemical innovation. The region emphasizes research and development to create advanced chemicals that improve fabric performance, durability, and multifunctionality. Innovations in dyeing technologies, nanotechnology applications, and sustainable chemical solutions are key drivers of market growth, reflecting Europe’s focus on efficiency, quality, and environmental compliance.

The Germany textile chemicals market is expected to grow over the forecast period. Germany, in particular, stands out for its strong R&D focus across industrial sectors, including textiles and chemicals. German manufacturers lead in developing high-performance and eco-friendly textile chemicals, often pioneering new technologies and processes that set industry benchmarks. The country’s commitment to sustainability, regulatory adherence, and technological advancement continues to strengthen its position as a global leader in textile chemical innovation.

Latin America Textile Chemicals Market Trends

The textile chemicals industry in Latin America is witnessing steady growth, driven by rising domestic demand and expanding export opportunities. Key textile-producing countries such as Brazil, Mexico, and Colombia rely on a wide range of chemicals for dyeing, printing, finishing, and treating fabrics to meet both quality standards and evolving consumer preferences.

Middle East & Africa Textile Chemicals Market Trends

The textile chemicals industry in Middle East & Africa (MEA) is growing as several countries invest in industrial development and infrastructure to strengthen their textile manufacturing capabilities. Initiatives such as the establishment of textile parks and industrial zones are boosting demand for chemicals used in dyeing, finishing, and printing. For example, in May 2024, Kenya launched the Nairobi Gate Industrial Park (NGIP), a 100,000-square-meter facility dedicated to textile and apparel manufacturing and warehousing, aimed at supporting the rapid growth of the country’s cotton, textile, and apparel sectors while attracting foreign investment for large-scale projects.

Top Companies in the Textile Chemicals Market & Their Offerings:

- AB Enzymes: AB Enzymes produces a range of specialist, eco-friendly cellulase enzymes that replace harsh chemicals in denim treatment, biofinishing, and bio-polishing processes to achieve desired fabric effects and surface quality.

- Archroma: Archroma provides a broad portfolio of dyes, color solutions (like the EarthColors range), and performance-enhancing finishes (such as non-PFAS water repellents and formaldehyde-free systems) that aim for high performance and sustainability across the entire textile supply chain.

- BASF SE: BASF offers a comprehensive range of sustainable textile chemicals, including biodegradable sizing agents and enzyme-based solutions, and is a key supplier of intermediates (such as PolyTHF® for elastic fibers) for synthetic fiber production and fabric coating.

- BioTex Malaysia: BioTex Malaysia manufactures a wide range of innovative and sustainable specialty chemicals, including water and oil repellents, flame retardants, and processing auxiliaries, often using bio-based raw materials like palm oil derivatives.

- Dow: Dow provides a variety of chemical solutions to the textile industry, including performance additives and specialty materials, used in applications such as coatings, sizing, and finishing to enhance fabric properties and processing efficiency.

- Ethox Chemicals, LLC: Ethox Chemicals specializes in manufacturing specialty chemicals, including a range of surfactants and other processing aids, for use in various stages of textile wet processing like scouring, dyeing, and finishing.

- Evonik Industries AG: Evonik provides specialty chemicals for the textile industry, focusing on solutions that improve the performance, durability, and sustainability of textile products, such as ingredients for softeners, coatings, and finishing agents.

- Fibro Chem, LLC: Fibro Chem manufactures specialty chemical auxiliaries for the textile industry, offering products that aid in processes like preparation, dyeing, and finishing to achieve specific fabric properties and improve production efficiency.

- German Chemicals Ltd.: This company offers various chemical products for textile applications, focusing on providing solutions for different processing stages, likely including auxiliaries, dyes, and finishing agents.

- Govi N.V.: Govi N.V. is a supplier of a diverse range of chemical products, including auxiliaries and specialty additives designed for textile processing applications, contributing to the functionality and aesthetic qualities of fabrics.

- Huntsman International LLC: Huntsman (now mostly integrated into Archroma’s Textile Effects division) provides a wide range of dyes, chemicals, and integrated solutions for the entire textile processing chain, with a strong focus on sustainable and resource-saving technologies for coloration and finishing.

More Insights in Towards Chemical and Materials:

- Textile Market Size to Exceed USD 2.01 Trillion by 2034

- AI in Textile Market Size to Hit USD 68.44 Bn by 2035

- Geotextiles Market Size to Hit USD 28.90 Billion by 2035

- Bio-Based Textiles Market Size to Reach USD 54.21 Billion in 2025

- Aroma Chemicals Market Size to Surpass USD 11.63 Billion by 2035

- Water Treatment Chemicals Market Size to Reach USD 58.16 Bn by 2034

- Green Chemicals Market Size to Surpass USD 29.49 Billion by 2034

- PFAS Free Chemicals Market Volume to Reach 905.32 Kilo Tons by 2034

- Bio-Based Platform Chemicals Market Size to Hit USD 48.46 Bn by 2034

- Lithium Chemicals Market Size to Surge USD 196.28 Billion by 2034

- Electronic Materials And Chemicals Market Size to Surge USD 136.03 Bn by 2034

- AI in Chemicals Market Hits USD 28.74 Bn at 29.36% CAGR [2025-34]

- Sustainable Materials Market Size to Hit USD 1078.35 Bn by 2034

- Generative AI in Chemical Market Hits $ 4978.04 Billion By 2034

- U.S. Cosmetic Chemicals Market Size to Hit USD 4.05 Billion by 2034

- Europe Green Chemicals Market Size to Reach USD 11.23 Billion by 2034

- U.S. Green Chemicals Market Size to Reach USD 8.74 Billion by 2034

- U.S. Specialty Chemicals Market Size to Surge USD 303.05 Bn by 2034

- Europe Textile Market Size to Worth Around USD 410.94 Bn by 2034

- U.S. Textile Market Size to Surge USD 283.15 Billion by 2034

- Asia Pacific Textile Market Size to Hit USD 1,010.03 Bn by 2034

Textile Chemicals Market Top Key Companies:

- AB Enzymes

- Archroma

- BASF SE

- BioTex Malaysia

- Dow

- Ethox Chemicals, LLC

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Ltd.

- Govi N.V.

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd.

- LANXESS

- OMNOVA Solutions Inc.

- Omya United Chemicals

- Organic Dyes and Pigments

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The Lubrizol Corporation

Recent Developments

- In October 2025, Zschimmer & Schwarz’s bio-based spin finishes and wicking agent, under the LERTISAN range and as HYDROSET ECO-DRY, at the ITMA Asia exhibition in Singapore. Zschimmer & Schwarz showcased 100% bio-based spin finishes to targeted hygiene nonwovens and synthetic fabrics requires excellent moisture managements.

- In January 2024, Devan Chemicals, a provider of sustainable textile finishes, is excited to announce its upcoming participation in Heimtextil 2024. Devan invites attendees to visit their booth in Hall 11.0, booth A21, to experience firsthand the latest sustainable textile finishes they have developed.

- In April 2024, BASF SE announced its portfolio of polyamides for the textile industry. The company’s sustainable polyamide PA6 and PA6.6 product range has been certified under the Recycled Claim Standard (RCS) for textile applications. This certification allows BASF SE to market textiles produced using recycled raw materials.

- In May 2023, Dystar announced its eco-advanced indigo dyeing, which aims to reduce energy consumption by up to 30% and water usage by up to 90% during the production process.

Textile Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Textile Chemicals Market

- Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2034)

- Pretreatment

- Bleaching Agents

- Desizing Agents

- Scouring Agents

- Others

- Coating

- Anti-Piling

- Protection

- Water Proofing

- Water Repellant

- Others

- Treatment Of Finished Products

- Softening

- Stiffening

- Others

- Pretreatment

- Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2034)

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Dispersants/levelant

- Fixative

- UV absorber

- Others

- Finishing Agents

- Flame retardants

- Antimicrobial or anti-inflammatory

- Repellent and release

- Others

- Surfactants

- Detergents & Dispersing Agents

- Emulsifying Agents

- Lubricating Agents

- Wetting Agents

- Desizing Agents

- Bleaching Agents

- Scouring Agents

- Yarn Lubricants

- Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2034)

- Apparel

- Innerwear

- Outerwear

- Sportswear

- Others

- Home Furnishing

- Carpet

- Drapery

- Furniture

- Others

- Technical Textiles

- Agrotech

- Buildtech

- Geotech

- Indutech

- Medtech

- Mobiltech

- Packtech

- Protech

- Others

- Other Applications

- Apparel

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5840

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.