The middle office outsourcing market is expanding steadily as financial institutions seek greater agility and compliance through outsourced solutions amid increasing operational complexity and pressure to optimize costs.

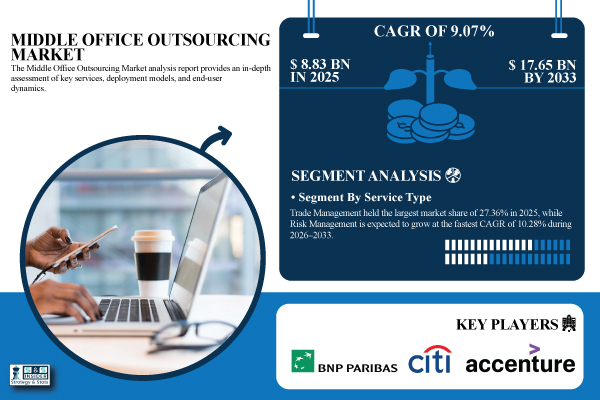

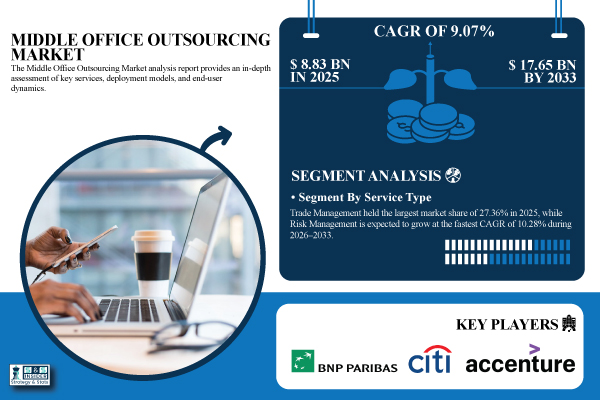

Austin, Nov. 19, 2025 (GLOBE NEWSWIRE) — The Middle Office Outsourcing Market size is valued at USD 8.83 Billion in 2025E and is projected to reach USD 17.65 Billion by 2033, growing at a CAGR of 9.07% during the forecast period (2026–2033).

Financial institutions are adopting outsourcing solutions to improve operational agility and compliance as a result of the growing complexity of financial operations and the need for cost effectiveness.

Download PDF Sample of Middle Office Outsourcing Market @ https://www.snsinsider.com/sample-request/8854

The U.S. Middle Office Outsourcing Market is projected to grow from USD 2.68 Billion in 2025E to USD 5.08 Billion by 2033, at a CAGR of 8.37%.

Growth is driven by expanding financial services digitization, rising adoption of AI-based automation, and increasing regulatory compliance demands among leading asset management and investment firms.

Segmentation Analysis:

By Service Type, Trade Management Held the Largest Market Share of 27.36% in 2025; Risk Management is Expected to Grow at the Fastest CAGR of 10.28%

Trade Management segment dominated the market due to its critical role in automating trade capture, confirmation, and settlement across complex asset classes. Risk Management is the fastest growing segment, fueled by rising regulatory pressures and market volatility.

By Deployment Type, On-Premise Segment Dominated with a 46.78% Share in 2025; Cloud-Based Deployment is Projected to Expand at the Fastest CAGR of 11.34%

On-Premise segment dominated the market as large financial firms prioritize control, data sovereignty, and compliance over operational flexibility. Cloud-Based are the fastest growing segment as institutions seek scalability and lower IT costs. With increasing adoption of hybrid and SaaS-based middle office platforms, over 58% of new outsourcing deals in 2025 incorporated at least one cloud-based component.

By Enterprise Size, Large Enterprises Accounted for the Highest Market Share of 62.41% in 2025; Small & Medium Enterprises is Anticipated to Record the Fastest CAGR of 10.86% through 2026–2033

Large Enterprises segment dominated the market owing to their vast investment portfolios, operations and demand for high-volume data processing and reconciliation capabilities. Small & Medium Enterprises (SMEs) are the fastest growing segment, driven by the affordability of modular outsourcing services.

By End User, Asset Managers Held the Largest Share of 29.84% in 2025; Hedge Funds is Expected to Grow at the Fastest CAGR of 10.43% during 2026–2033

Asset Managers segment dominated the market as they handle diverse portfolios requiring precise performance reporting, compliance tracking, and reconciliation. Hedge Funds are the fastest growing segment, leveraging outsourcing to scale quickly and maintain lean operational structures.

If You Need Any Customization on Middle Office Outsourcing Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8854

Regional Insights:

The North America Middle Office Outsourcing Market dominated with a 38.67% share in 2025, attributed to its highly developed financial infrastructure and strong base of asset management and investment firms. The U.S. and Canada lead in adopting advanced automation, AI, and cloud-based outsourcing solutions.

The Asia Pacific Middle Office Outsourcing Market is the fastest-growing region, projected to expand at a CAGR of 10.72% during 2026–2033. Growth is fueled by rapid financial digitalization, expanding investment management activities, and rising adoption of cloud-based outsourcing across China, India, Japan, and Singapore.

Major Key Players:

- Accenture plc

- State Street Corporation

- JPMorgan Chase & Co.

- The Bank of New York Mellon Corporation

- Citigroup Inc.

- BNP Paribas S.A.

- Northern Trust Corporation

- SS&C Technologies Holdings, Inc.

- CACEIS Bank S.A.

- Apex Group Ltd.

- Genpact Limited

- Linedata Services S.A.

- Empaxis Data Management India Private Limited

- Indus Valley Partners

- Brown Brothers Harriman & Co.

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Tata Consultancy Services Limited

- Wipro Limited

- HSBC Holdings plc

Middle Office Outsourcing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 8.83 Billion |

| Market Size by 2033 | USD 17.65 Billion |

| CAGR | CAGR of 9.07% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Trade Management, Portfolio Performance Reporting, Risk Management, Compliance & Regulatory Support, Reconciliation, Others) • By Deployment Type (On-Premise, Cloud-Based, Hybrid) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By End User (Asset Managers, Hedge Funds, Banks, Broker-Dealers, Insurance Companies, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

Recent Developments:

- In March 2025, Accenture expanded its AI Refinery platform by launching a new AI Agent Builder that empowers business users to build and customize advanced AI agents without coding. This strengthens its leadership in enterprise automation and operational transformation.

- In September 2025, State Street introduced Enterprise Performance, powered by Opturo, a cloud-based performance calculation engine seamlessly integrated with its Alpha platform, enhancing workflow automation, real-time insights, and advanced analytics capabilities for investment managers.

Buy Full Research Report on Middle Office Outsourcing Market 2026-2033 @ https://www.snsinsider.com/checkout/8854

Exclusive Sections of the Report (The USPs):

- OPERATIONAL EFFICIENCY METRICS – helps you evaluate how outsourcing enhances trade processing speed, accuracy, and turnaround time across portfolio and risk management operations.

- RISK & COMPLIANCE MANAGEMENT INDICATORS – helps you understand how financial institutions leverage outsourcing to improve regulatory reporting, audit accuracy, and data confidentiality standards.

- TECHNOLOGICAL INTEGRATION RATE – helps you assess the adoption and impact of AI, RPA, and cloud-based automation in optimizing reconciliation, trade matching, and analytics workflows.

- VENDOR PERFORMANCE BENCHMARKS – helps you analyze vendor retention, contract renewal, and customer satisfaction levels to identify top-performing outsourcing partners.

- PARTNERSHIP & COLLABORATION INDEX – helps you track the growing collaboration between outsourcing firms and fintech or regtech players driving innovation and compliance automation.

- SERVICE QUALITY & SLA COMPLIANCE – helps you measure adherence to service level agreements and performance standards among key outsourcing vendors ensuring operational resilience.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.