The Digital Remittance Market is set for sustained growth as increased migration, expanding fintech solutions, and widespread smartphone use accelerate the shift toward faster and more affordable digital money transfers.

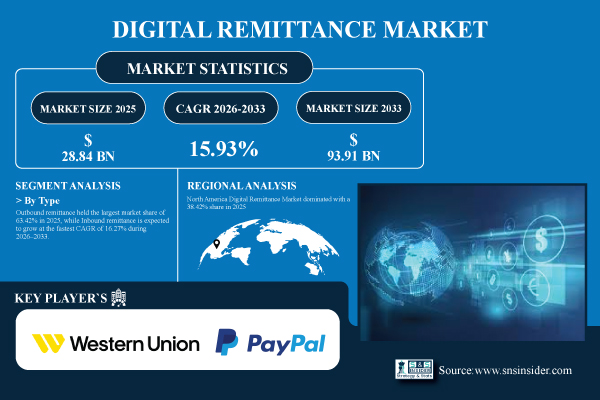

Austin, Nov. 19, 2025 (GLOBE NEWSWIRE) — The Digital Remittance Market size is valued at USD 28.84 Billion in 2025E and is projected to reach USD 93.91 Billion by 2033, growing at a CAGR of 15.93% during the forecast period 2026–2033.

Faster, more affordable digital money transfers are being fueled by rising cross-border migration, quick fintech adoption, and growing smartphone usage. These factors are anticipated to greatly accelerate industry expansion in the upcoming years.

Download PDF Sample of Digital Remittance Market @ https://www.snsinsider.com/sample-request/8847

The U.S. Digital Remittance Market is projected to grow from USD 8.28 Billion in 2025E to USD 25.28 Billion by 2033, at a CAGR of 15.01%.

Fintech adoption, smartphone-based transfers, growing cross-border payment innovations in major cities and immigrant-dense areas, and rising migrant remittances are the main drivers of growth.

Segmentation Analysis:

By Type, Outbound Remittance Held the Largest Market Share of 63.42% in 2025; Inbound Remittance is Expected to Grow at the Fastest CAGR of 16.27% during 2026–2033

Outbound Remittance segment dominated the market in 2025 as millions of migrant workers continued sending money to their home countries through digital channels. Inbound Remittance is the fastest growing segment, benefiting from rising digital wallet adoption and faster processing times.

By Channel, Online Segment Dominated with a 71.56% Share in 2025 and is Projected to Expand at the Fastest CAGR of 17.48%

Online segment dominated the market in 2025 as consumers increasingly preferred mobile apps and web-based services over traditional cash transfers. Online is also the fastest growing segment, supported by AI-driven verification and blockchain integration improving speed and security.

By Application, Personal Remittance Accounted for the Highest Market Share of 68.39% in 2025; Business Remittance is Anticipated to Record the Fastest CAGR of 16.91% during 2026–2033

Personal segment dominated the market in 2025, driven by growing cross-border worker migration and family-based financial support. Ease of use, instant transfers and reach made personal payments the primary driver of volume. Business is the fastest growing segment, aided by the rise of e-commerce and SME cross-border trade.

By Mode of Transfer, Bank Transfer Held the Largest Share of 54.83% in 2025; Mobile banking is Expected to Grow at the Fastest CAGR of 18.36% during 2026–2033

Bank Transfers segment dominated the market in 2025 due to their reliability, security, and strong integration with payment systems. Banking is the fastest growing segment, accelerated by fintech expansion, smartphone penetration, and ease of app-based transfers.

If You Need Any Customization on Digital Remittance Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8847

Regional Insights:

The North America Digital Remittance Market dominated with a 38.42% share in 2025, driven by robust fintech adoption and high digital literacy. The region’s strong banking infrastructure, coupled with growing demand for fast, low-cost cross-border transfers, is propelling digital remittance use.

The Asia Pacific Digital Remittance Market is the fastest-growing region, projected to expand at a CAGR of 17.74% from 2026 to 2033. Growth is fueled by rising migrant worker populations, increasing smartphone penetration, and expanding fintech ecosystems in countries including India, China, the Philippines, and Indonesia.

Key Players:

- Western Union Holdings, Inc.

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- MoneyGram International, Inc.

- Wise plc (formerly TransferWise)

- Zepz (incorporating WorldRemit, Sendwave)

- Remitly Global, Inc.

- Azimo Limited

- TransferGo Ltd.

- NIUM, Inc. (Instarem)

- TNG FinTech Group

- Digital Wallet Corporation

- Coins.ph

- OrbitRemit

- Smiles

- Flywire Corporation

- SingX

- FlyRemit

- Intermex Group, Inc.

- Small World Financial Services

Digital Remittance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 28.84 Billion |

| Market Size by 2033 | USD 93.91 Billion |

| CAGR | CAGR of 15.93% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Inbound Remittance, Outbound Remittance) • By Channel (Online, Offline) • By Application (Personal, Business) • By Mode of Transfer (Bank Transfer, Money Transfer Operators, Mobile Banking, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

Recent Developments:

- In May 2025, Western Union launched WU Digital Connect, a next-generation remittance platform integrating blockchain-based tracking and instant payout options, enhancing transaction transparency, speed, and customer experience across major remittance corridors.

- In August 2025, PayPal introduced PayPal Global Remit, a new digital remittance app offering low-cost international money transfers with real-time exchange rate visibility and AI-driven fraud protection for users in over 80 countries, strengthening its footprint in the cross-border payment ecosystem.

Buy Full Research Report on Digital Remittance Market 2026-2033 @ https://www.snsinsider.com/checkout/8847

Exclusive Sections of the Report (The USPs):

- User Experience & Service Quality Metrics – helps you evaluate customer satisfaction, platform convenience, and accessibility performance across diverse digital remittance channels.

- Innovation & Partnership Index – helps you track the pace of technological advancement and collaboration between fintechs, banks, and regulators driving service modernization.

- Consumer Behavior & Accessibility Insights – helps you understand digital adoption trends, mobile-first usage patterns, and retention dynamics across remittance users.

- Security & Compliance Performance – helps you assess the robustness of AML/KYC frameworks, authentication methods, and fraud detection systems ensuring transaction integrity.

- AI & Automation Adoption Rate – helps you identify how artificial intelligence and automated tools enhance verification, customer support, and compliance efficiency.

- Market Connectivity & Open Banking Penetration – helps you analyze how open banking APIs and integrated payment ecosystems improve cross-border transaction speed and transparency.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.