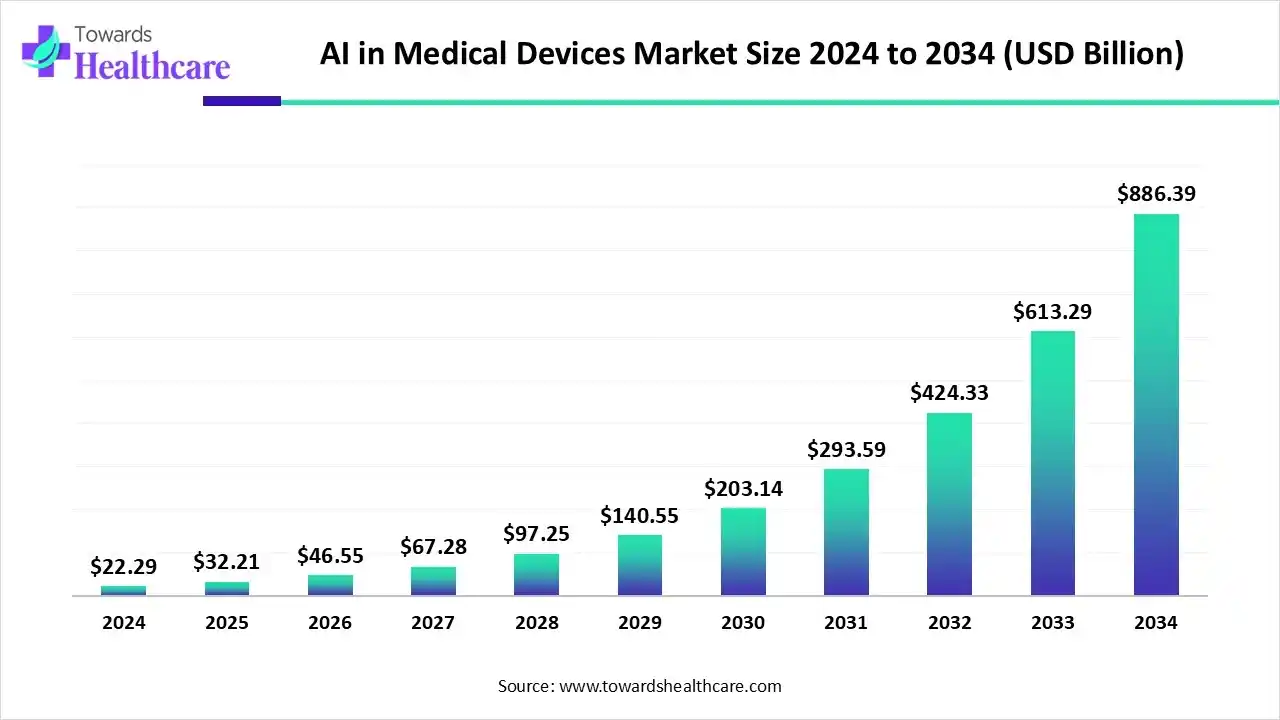

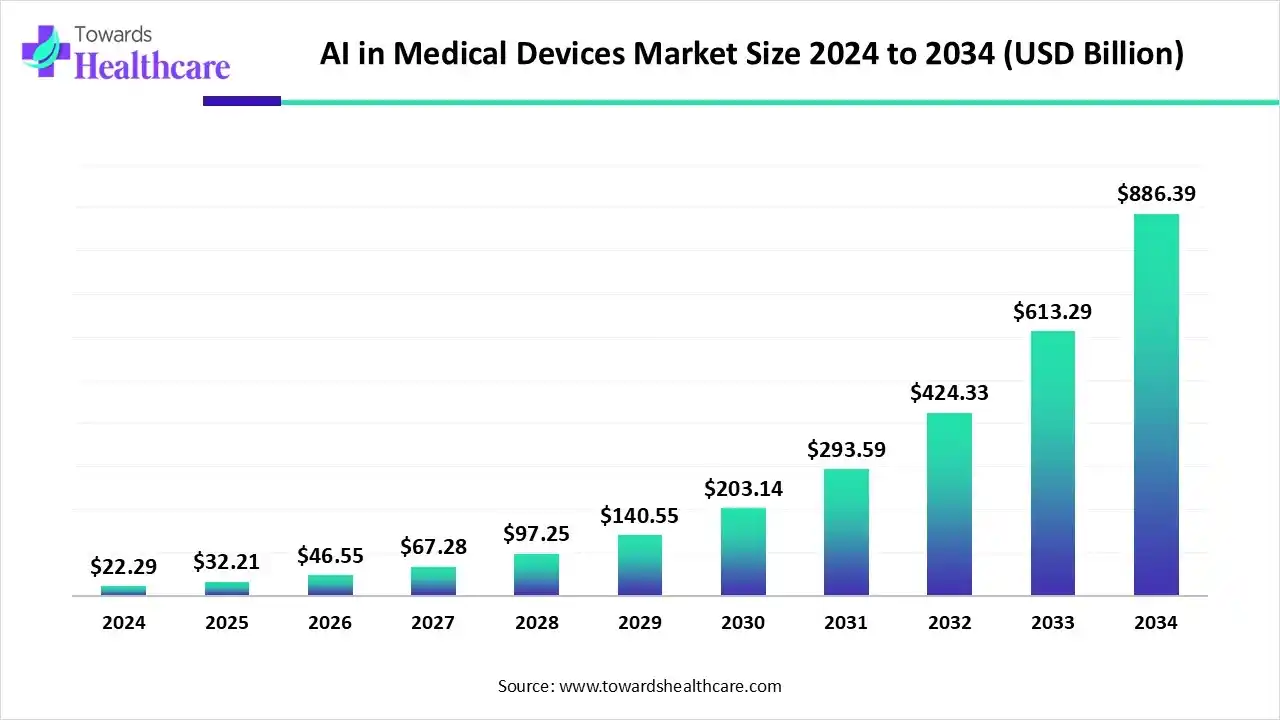

The global AI in medical devices market size is calculated at USD 32.21 billion in 2025 and is expected to reach around USD 886.39 billion by 2034, growing at a CAGR of 44.53% for the forecasted period.

Ottawa, Nov. 18, 2025 (GLOBE NEWSWIRE) — The global AI in medical devices market size was valued at USD 22.29 billion in 2024 and is predicted to hit around USD 886.39 billion by 2034, rising at a 44.53% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6259

Key Takeaways

- AI in medical devices market to crossed USD 22.29 billion by 2024.

- Market projected at USD 886.39 billion by 2034.

- CAGR of 44.53% expected in between 2025 to 2034.

- North America registered dominance in the market in 2024.

- Asia Pacific is expected to be the fastest-growing region during 2025-2034.

- By component, the software segment dominated the global market in 2024.

- By component, the services segment is expected to grow rapidly in the predicted timeframe.

- By technology, the machine learning (ML) segment led the AI in medical devices market in 2024.

- By technology, the deep learning segment is expected to be the fastest-growing during 2025-2034.

- By device type, the diagnostic devices segment registered dominance in the market in 2024.

- By device type, the wearable devices segment is expected to grow rapidly in the studied years.

- By application, the medical imaging & diagnostics segment dominated the market in 2024.

- By application, the clinical decision support systems (CDSS) segment is expected to grow at a rapid CAGR in the upcoming years.

- By functionality, the detection & diagnosis segment accounted for the major revenue share of the market in 2024.

- By functionality, the prediction & risk stratification segment is expected to witness rapid expansion during 2025-2034.

Raising R&D Investments: How Does the Market Bloom?

The global AI in medical devices market has been widely adopting various AI algorithms and machine learning for data analysis, bolstering diagnostic tools, and optimising treatment accuracy. This is mainly impacted by a rise in significant investments in AI R&D, encouraging government initiatives, and accelerated adoption in radiology and cardiology. Nowadays, the leading companies are fostering FDA-approved devices, specifically in radiology and cardiology, and the unification of advanced technologies, such as deep learning and natural language processing.

Quick Facts Table

| Table | Scope | |

| Market Size in 2025 | USD 32.21 Billion | |

| Projected Market Size in 2034 | USD 886.39 Billion | |

| CAGR (2025 – 2034) | 44.53 | % |

| Leading Region | North America | |

| Market Segmentation | By Component, By Technology, By Device Type, By Application, By Functionality, By Region | |

| Top Key Players | Fujifilm Holdings Corporation, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings, Inc., Samsung Medison, IBM Watson Health, Intel Corporation, NVIDIA Corporation, Aidoc, Butterfly Network, Inc. | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Prominent Drivers in the AI in Medical Devices Market?

Along with increased demand for tailored medicine, AI further supports in minimizing the workload on healthcare professionals, especially radiologists, by facilitating quicker and more precise image analysis and decision support. As well as the market is fueled by an expanding wearable sensors is boosting the adoption of AI-enabled medical devices for persistent, remote patient care.

What are the Transforming Drifts in the AI in Medical Devices Market?

- In November 2025, the Korean government planned to invest 940 billion won in AI and robotics medical device R&D.

- In September 2025, Philips, a health technology company, planned to invest more than $150 million in manufacturing and research and development across the United States.

What is the Developing Limitation in the AI in Medical Devices Market?

One of the crucial challenges in the market is the rising need for greater expenditure and lengthy timelines for rigorous testing and robust data validation, which further creates a barrier to faster innovation and market arrival. Sometimes, a company may face hurdles in the data quality and its accessibility, as they are segregated in diverse systems.

Regional Analysis

How did North America Dominate the Market in 2024?

In 2024, North America held the biggest revenue share of the market. The emergence of a vital catalyst in the regional expansion is the presence of suitable U.S. government funding for AI in biomedical research through programs such as Bridge2AI. The latest developments include Apple’s atrial fibrillation history feature for the Apple Watch, AI-assisted surgical robotics that boost accuracy, and Medtronic’s Sugar.

For instance,

- In October 2025, the UK and US regulators collaborated on medical technologies and AI.

- In September 2025, Reveal HealthTech closed its $7.2 million Series A funding round to escalate the AI-powered healthcare revolution.

What Made the Asia Pacific Grow Significantly in the Market in 2024?

During the prospective period, the Asia Pacific is anticipated to expand rapidly in the AI in medical devices market. The regional market is mainly driven by the rising demand for intelligent and interconnected healthcare approaches, extensive government initiatives and investments in healthcare infrastructure. This is further spurred by a rise in innovative alliances, such as in July 2025, Jaslok Hospital & Research Centre partnered with AnginaX AI, and unveiled Maharashtra’s foremost AI-enabled heart disease prevention model.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Latest Initiatives in the AI in Medical Devices Market: 2024-2025

| Canadian Government | In 2025, signed a $560 million deal with Siemens Healthineers to revolutionize imaging equipment across the province of Alberta. |

| Indian Government | In June 2025, it announced ₹330 crore in funding to develop an AI in Healthcare Centre of Excellence by IIT Delhi and AIIMS Delhi. |

| In October 2024, | The FDA authorized over 1,000 AI-driven medical devices, with a substantial rise in approvals in 2023 and 2024, most of them in radiology and cardiology. |

Segmental Insights

By component analysis

Which Component Led the AI in Medical Devices Market in 2024?

The software segment was dominant with the largest share of the market in 2024. The segment mainly comprises AI-enhanced tools for medical imaging analysis for escalating disease detection, platforms that support tailored treatment strategies, and systems that automate administrative tasks. Recently, Microsoft has designed software called Dragon Copilot that assists in listening to and automatically developing notes from clinical consultations, lowering administrative burden.

On the other hand, the services segment is estimated to register the fastest growth in the coming era. AI is increasingly offering consulting, maintenance and support, training, and integration services. Eventual developments are encompassing the Eko Health created an AI-assisted digital stethoscope (by collaborating with Imperial College London), which helps in detecting heart failure, valve disease, and irregular rhythms in just 15 seconds. Whereas, the emerging surgical devices are Intuitive Surgical’s da Vinci 5 and Johnson & Johnson’s OTTAVA, which are acquiring regulatory clearances and entering clinical trials.

By technology analysis

Why did the Machine Learning (ML) Segment Dominate the Market in 2024?

In 2024, the machine learning (ML) segment registered dominance in the AI in medical devices market. A substantial benefit is that leveraging AI/ML technologies is combating the lack of healthcare professionals and boosting automations in tasks like image analysis and coupled with faster diagnosis and treatment strategy. The era is broadly using the IDx-DR system for diabetic retinopathy screening, real-time monitoring through wearables, and guided ultrasound devices.

Moreover, the deep learning segment will expand fastest in the studied years. They are assisting overall market expansion through their integration in medical imaging analysis, predictive analytics, robotic surgery, and personalized monitoring wearables.

- In July 2025, Cardiosense acquired FDA clearance for CardioTag, a wearable sensor which has applies deep learning to track heart function by simultaneously capturing ECG, PPG, and SCG signals.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By device type analysis

Which Device Type Dominated the AI in Medical Devices Market in 2024?

The diagnostic devices segment held a dominant share of the market in 2024. A prominent driver is the accelerating cases of cancer, cardiovascular diseases, and neurological disorders that are increasingly demanding early and accurate detection for robust treatment planning. In 2025, the FDA approved LensHooke X3 PRO and X12 PRO Semen Quality Analyzer, which are AI-driven lab devices that further automate the analysis of semen quality for diagnostic uses.

However, the wearable devices segment is predicted to witness rapid growth. Currently, the globe is emphasizing preventive and home-based healthcare, and persistent technological breakthroughs in sensors, connectivity, and data analytics. Emerging solutions are exploring AI-driven predictive health monitoring in smartwatches and rings, real-time language translation in earbuds, and sophisticated AR/VR applications for industrial and entertainment purposes.

By application analysis

Why did the Medical Imaging & Diagnostics Segment Lead the Market in 2024?

In 2024, the medical imaging & diagnostics segment accounted for the dominating share of the AI in medical devices market. AI-enabled solutions facilitate minimal diagnostic errors and improved speed of image analysis and diagnosis, and ultimately give more streamlined workflows for clinicians. Recently developed iCAD ProFound Breast Suite are employed for breast cancer detection and customized risk assessment.

Whereas the clinical decision support systems (CDSS) segment will grow rapidly. The broader use of AI algorithms is implemented in the prediction of sepsis and cardiovascular risk, diagnostic aids for diabetic retinopathy and particular skin cancers, and treatment optimization tools. Significant efforts, like Brilliant Doctor, which has utilized machine learning for dermatological diagnoses, and QRthytm used AI for identifying optimal rhythm management strategies for atrial fibrillation.

By functionality analysis

What Made the Detection & Diagnosis Segment Dominant in the Market in 2024?

The detection & diagnosis segment led the AI in medical devices market in 2024. Specific application of AI algorithms leverages rigorous tools in the study of genomic data to estimate hereditary concerns, and the use of natural language processing to extract insights from clinical notes. Such as the UK’s NHS has executed AI-enabled chatbots for initial diagnosis and triage, supporting the simplification of healthcare operations.

On the other hand, the prediction & risk stratification segment is anticipated to expand at a rapid CAGR. The segmental expansion will be propelled due to a rise in the availability of large healthcare datasets and advancements in computing power for establishing and training advanced AI models. Day by day, researchers are focusing on XAI techniques (like SHapley Additive exPlanations – SHAP) to assist clinicians in understanding how an algorithm arrived at a specific prediction.

Browse More Insights of Towards Healthcare:

The medical device CMO and CDMO market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global medical device CRO market size is calculated at USD 8.49 billion in 2024, grew to USD 9.25 billion in 2025, and is projected to reach around USD 19.9 billion by 2034. The market is expanding at a CAGR of 8.98% between 2025 and 2034.

The global medical device testing market size was calculated at USD 10.77 billion in 2025 and is expected to reach around USD 24.32 billion by 2034, expanding at a CAGR of 9.47% from 2025 to 2034.

The global medical device outsourcing market size is calculated at US$ 160.3 in 2024, grew to US$ 180.59 billion in 2025, and is projected to reach around US$ 507.89 billion by 2034. The market is expanding at a CAGR of 12.65% between 2025 and 2034.

The medical device gaskets & seals market was estimated at US$ 0.92 billion in 2023 and is projected to grow to US$ 1.57 billion by 2034, rising at a compound annual growth rate (CAGR) of 5% from 2024 to 2034.

The global medical device contract manufacturing market size is calculated at USD 78.61 billion in 2024, grew to USD 87.14 billion in 2025, and is projected to reach around USD 220.57 billion by 2034. The market is expanding at a CAGR of 10.86% between 2025 and 2034.

The 3D Printed medical devices market is anticipated to grow from USD 5.59 billion in 2025 to USD 24.69 billion by 2034, with a compound annual growth rate (CAGR) of 17.94% during the forecast period from 2025 to 2034, as a result of rising demand for customized 3D printed solutions.

The global Class C & Class D medical devices market size recorded US$ 55.13 billion in 2024, set to grow to US$ 69.52 billion in 2025 and projected to hit nearly US$ 559.55 billion by 2034, with a CAGR of 26.12% throughout the forecast timeline.

The global pain management devices market size is calculated at USD 7.68 billion in 2024, grew to USD 8.41 billion in 2025, and is projected to reach around USD 19.1 billion by 2034. The market is expanding at a CAGR of 9.54% between 2025 and 2034.

The global implantable medical devices market size is calculated at USD 97.17 billion in 2024, grew to USD 103.14 billion in 2025, and is projected to reach around USD 176.33 billion by 2034. The market is expanding at a CAGR of 6.14% between 2025 and 2034.

What are the Revolutionary Developments in AI in Medical Devices Market?

- In November 2025, Volta Medical officially unveiled its AF-Xplorer II system, the company’s ‘next-generation’ AI solution, which was developed to provide seamless real-time assessment of complex AF.

- In November 2025, Remidio launched Neubo 130, an AI-assisted ultra-widefield neonatal retinal imaging system.

- In October 2025, CorVent Medical introduced an AI/ML-powered CorVision SaaS platform and opened Series B Financing.

AI in Medical Devices Market Key Players List

- Fujifilm Holdings Corporation

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Samsung Medison

- IBM Watson Health

- Intel Corporation

- NVIDIA Corporation

- Aidoc

- Butterfly Network, Inc.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Technology

- Machine Learning (ML)

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others (Reinforcement Learning, Hybrid Models)

By Device Type

- Diagnostic Devices

- Wearable Devices

- Monitoring Devices

- Therapeutic Devices

- Surgical Devices

- Imaging Devices

- Other AI-enabled Devices

By Application

- Medical Imaging & Diagnostics

- Clinical Decision Support Systems (CDSS)

- Patient Monitoring & Management

- Drug Discovery & Development Support

- Virtual Assistants & Chatbots

- Personalized Medicine

- Robotic Surgery

- Administrative Workflow Optimization

- Others (Predictive Analytics, Risk Assessment)

By Functionality

- Detection & Diagnosis

- Prediction & Risk Stratification

- Image Analysis & Processing

- Patient Management & Workflow Automation

- Therapy Planning & Assistance

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6259

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.