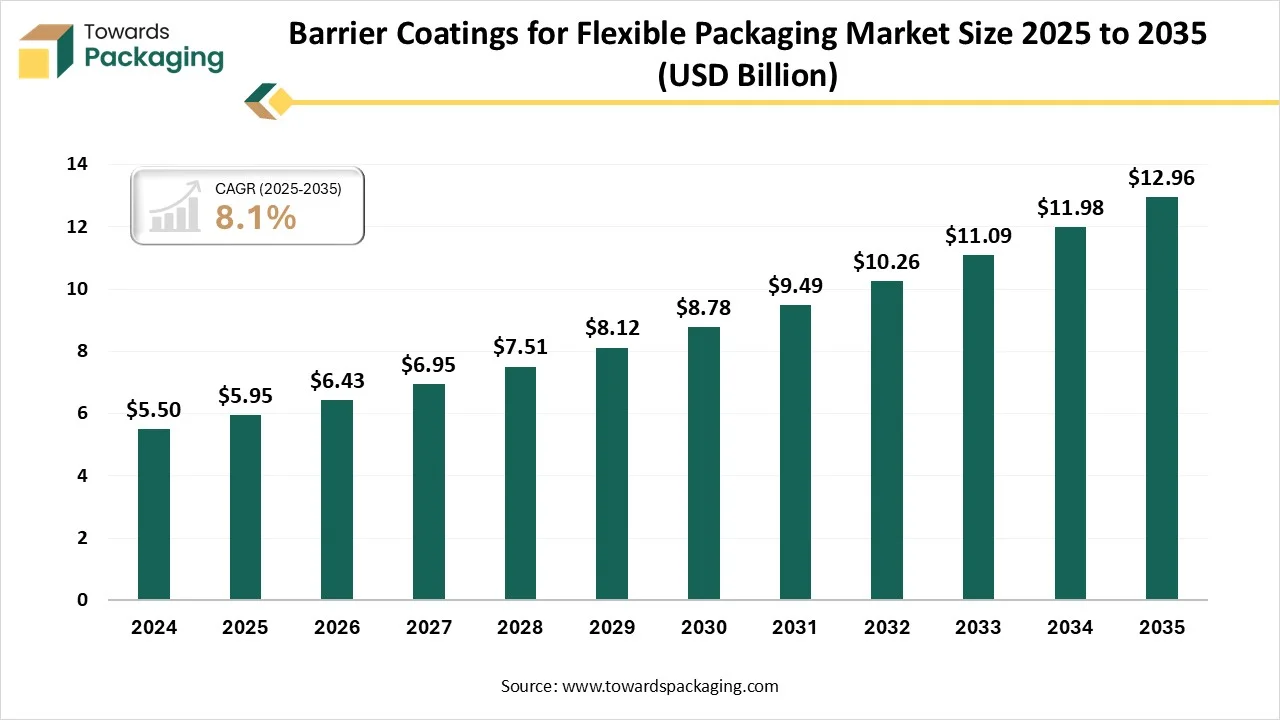

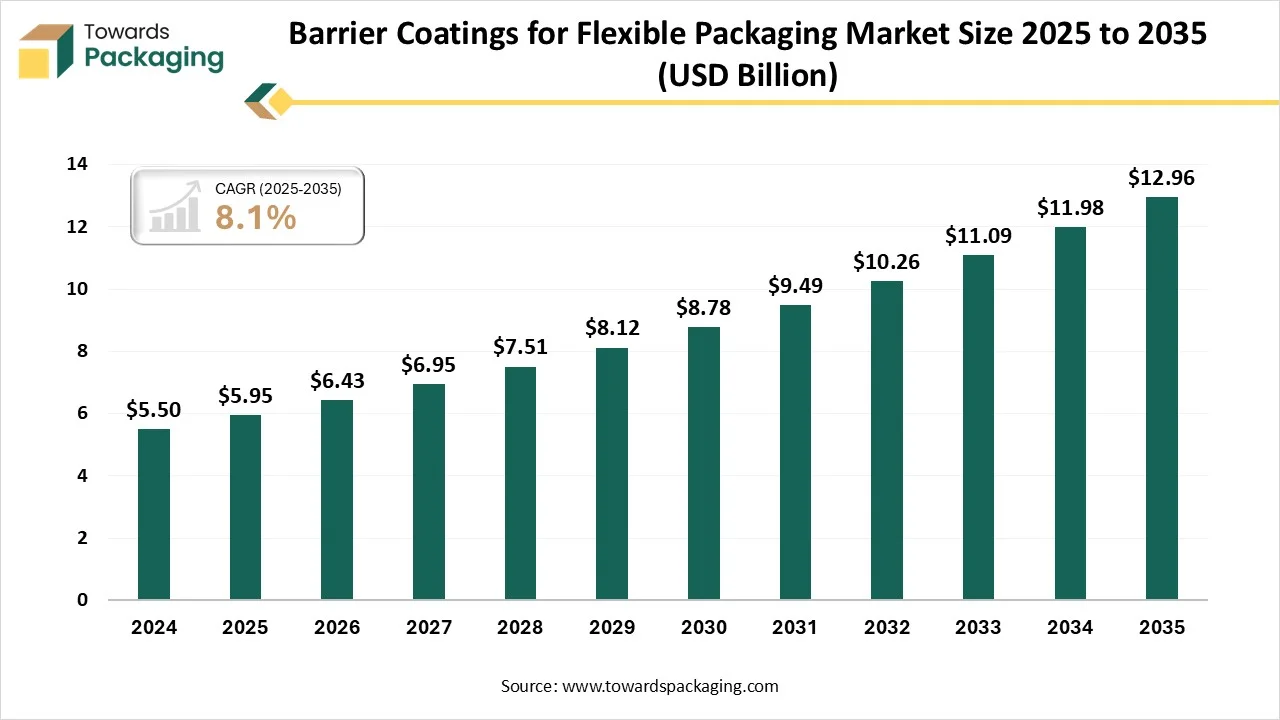

According to projections from Towards Packaging, the global barrier coatings for flexible packaging market is set to increase from USD 6.43 billion in 2026 to nearly USD 12.96 billion by 2034, reflecting a CAGR of 8.1% during 2026 to 2035.

Ottawa, Jan. 21, 2026 (GLOBE NEWSWIRE) — The global barrier coatings for flexible packaging market reported a value of USD 5.95 billion in 2025, and according to estimates, it will reach USD 12.96 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising demand for extended shelf life and sustainable packaging solutions.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Takeaways

- By region, the Asia Pacific dominated the global barrier coatings for flexible packaging market by holding the highest market share in 2025.

- By region, Europe is expected to grow at a notable rate from 2026 to 2035.

- By coating type, the polymer-based coatings segment dominated the market share in 2025.

- By coating type, the biopolymer and water-based coatings segment is expected to grow at the fastest rate between 2026 and 2035.

- By substrate material, the plastic films segment held the largest market share in 2025.

- By substrate material, the paper & bio-based films segment is projected to grow the fastest between 2026 and 2035.

- By application, the food and beverage segment dominated the market share in 2025.

- By application, the pharmaceuticals and healthcare packaging segment is projected to grow at the fastest rate between 2026 and 2035.

- By distribution channel, the direct supply segment led the market share in 2024.

- By distribution channel, the online/specialty platforms segment is projected to grow the fastest between 2026 and 2035.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5922

Key Technological Shifts

- Rapid adoption of water-based and solvent-free coatings to meet sustainability and regulatory requirements.

- Increased use of biobased and compostable barrier materials as alternatives to plastic laminates.

- Advancements in nano coatings and thin film technologies to improve oxygen and moisture resistance.

- Growing integration of recyclable mono materials with compatible coatings to support circular packaging designs.

What is Going on in the Barrier Coatings for Flexible Packaging Industry?

The barrier coatings for flexible packaging market is witnessing steady growth due to the growing need for packaging options that are sustainable, lightweight, and high-performing. These coatings support recyclability objectives while improving resistance to oxygen, moisture, and grease. Market expansion is being driven by strong adoption in the pharmaceutical, food, and e-commerce sectors. Market dynamics are also being shaped by environmental regulations and technological advancements.

Private Industry Investments for Barrier Coatings for Flexible Packaging:

- Amcor PLC: Amcor is investing heavily in material science to develop recyclable and mono-material barrier films that meet global sustainability goals and enhance product safety and shelf life.

- ACTEGA GmbH: ACTEGA develops high-performance, water-based barrier coatings for paperboard that are food-safe and environmentally responsible, facilitating the replacement of traditional plastic films.

- Solenis LLC: Solenis is a market leader in water-based barrier coatings, expanding its production capacity to provide compostable and food-safe solutions that align with stringent environmental regulations.

- Searo Labs: This UK-based startup formulates smart, biodegradable films and coatings from seaweed to create a natural, plastic-free barrier alternative that can also include freshness indicators.

- Terram Lab: Terram Lab provides proprietary, plastic-free, water-based coating technologies that deliver grease and moisture barrier protection while maintaining compatibility with existing composting and recycling streams.

Key Trends of the Barrier Coatings for Flexible Packaging Market

- Shift Toward Mono-Material Structures: To improve recyclability, the industry is moving away from complex multi-material laminates toward single-polymer structures (such as all-polyethylene or all-polypropylene) enhanced by ultra-thin barrier coatings. These advanced coatings enable a single-material package to achieve the same oxygen and moisture protection as traditional foil-lined alternatives while remaining compatible with standard recycling streams.

- Expansion of Sustainable and PFAS-Free Materials: There is a rapid transition toward water-based, bio-based, and PFAS-free coatings derived from renewable sources like seaweed, starch, and lignin to meet stringent global environmental regulations. These innovations aim to provide essential grease and moisture resistance for “paperized” packaging formats without using persistent “forever chemicals” that hinder composting and recycling efforts.

Market Opportunities

- Rising demand for recyclable and mono-material packaging creates strong growth potential for advanced barrier coatings.

- Expansion of food, pharmaceutical, and e-commerce packaging increases the need for high-barrier, lightweight solutions.

- Growing focus on bio-based and compostable coatings opens new opportunities for sustainable product development.

- Adoption of smart and active packaging technologies offers scope for value added barrier coating innovations.

Segmental Insights

By Coating Type

The polymer-based coatings segment dominates the barrier coatings for flexible packaging market due to its mechanical strength, compatibility with a variety of flexible substrates, and superior moisture and gas barrier qualities. These coatings, which prevent spoiling and increase shelf life, are frequently used in food, beverage, and pharmaceutical packaging. Their established supply chains and cost effectiveness support their market leadership

The biopolymer & water-based coatings segment is the fastest-growing, fueled by the growing need for environmentally friendly and sustainable packaging options. Adoption is accelerating due to growing consumer awareness and regulatory pressure to reduce plastic waste. These coatings are very appealing for packaging applications that are focused on the future because they provide barrier performance that is comparable to that of traditional polymers and are recyclable or biodegradable.

By Substrate Material

The plastic films segment is the dominant substrate material in the barrier coatings for flexible packaging market because of its superior barrier qualities, durability, and light weight when paired with coatings. They are widely used in consumer goods, food, and beverage packaging because they offer reliable defense against contamination, moisture, and oxygen. Their dominant position is further supported by the well-established infrastructure for the production and processing of plastic film.

The paper & bio-based films segment is the fastest-growing substrate material segment, demonstrating a move toward environmentally friendly packaging. Strong growth is being driven by rising consumer demand for environmentally friendly products as well as advancements in coated paper films that enhance barrier performance. These materials are being used by businesses more frequently to comply with legal requirements and sustainability objectives.

By Application

The food & beverage segment dominates the barrier coatings for flexible packaging market, since packaged foods need to be extremely protected from microbial contamination, moisture, and oxygen. Coated flexible packaging is the largest application segment worldwide because it guarantees a longer shelf life, product freshness, and decreased spoilage. This dominance is reinforced by widespread consumption and the expansion of packaged food in emerging markets.

The pharmaceuticals & healthcare packaging segment is the fastest-growing due to the growing need for high-barrier, secure, and tamper-evident packaging. The growing pharmaceutical industry and stringent regulations for medications that are sensitive to moisture and oxygen are driving up demand for specialized barrier coatings. The use of cutting-edge coated films for pouches, blister packs, and vials is driving this market’s expansion.

By Distribution Channel

The direct supply channel dominates the barrier coatings for flexible packaging market, as direct procurement is preferred by big manufacturers and end users for large orders. This guarantees dependable delivery, consistent product quality, and improved cost control. For ongoing production and specialized barrier coating solutions, multinational corporations depend on direct supply agreements.

The online/specialty platforms segment is growing rapidly, driven by increasing demand for customized or smaller orders as well as digitization. These platforms increase access to cutting-edge barrier coatings by offering small and medium-sized businesses flexible procurement options. This growth is accelerated by the rapid adoption of e-commerce in packaging materials.

More Insights of Towards Packaging:

- Stand-Up Pouch Market Size, Trends and Competitive Landscape (2026–2035)

- Fiber Trays for Meal Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Retail Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. 503B Compounding Pharmacy Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

- EPE Foam Packaging Market Size, Trends and Segments (2026–2035)

- Mailer Packaging Market Size, Trends and Segments (2026–2035)

- Semiconductor and IC Packaging Materials Market Size and Segments Outlook (2026–2035)

- Health and Hygiene Packaging Market Size and Segments Outlook (2026–2035)

- Pharmaceutical Containers Market Size, Trends and Regional Analysis (2026–2035)

- Fiber Bale Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Bulk Liquid Transport Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- 3d IC and 2.5d IC Packaging Market Size, Segmentation, Regional Insights, and Competitive Landscape (2025-2035)

- Cannabis Packaging Market Size, Trends and Segments (2026–2035)

- Ampoules Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- High Impact Corrugated Boxes Market Size, Trends and Competitive Landscape (2026–2035)

- End-of-Line Packaging Market Size, Trends and Segments (2026–2035)

- Clinical Trial Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Panel Level Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Rigid Tray Market Size and Segments Outlook (2026–2035)

- Cider Packaging Market Size and Segments Outlook (2026–2035)

By Region

Asia Pacific dominates the barrier coatings for flexible packaging market because packaged food, drinks, and consumer goods are produced on a large scale. The demand for flexible packaging with barrier coatings is driven by the fast industrialization of dense populations and growing disposable incomes in nations. Its leadership is further reinforced by the existence of significant coating and film manufacturers in the area.

China Barrier Coatings for Flexible Packaging Market Trends

China’s market is being driven by rising demand for extended shelf life and improved protection in food, beverage, and pharmaceutical packaging. Sustainability is a major trend, with manufacturers increasingly adopting water-based, bio-based, and recyclable barrier coatings to comply with environmental regulations and brand owner commitments.

Europe is the fastest-growing market for barrier coatings, backed by sustainable projects and strict environmental laws. To adhere to EU packaging regulations, businesses are using biopolymer and water-based coatings along with paper and biobased substrates. Strong CAGR growth in the area is driven by rising demand for cutting-edge barrier solutions and environmentally friendly packaging.

Germany Barrier Coatings for Flexible Packaging Market Trends

Germany’s market is increasingly shaped by strong sustainability and circular-economy drivers, with companies adopting recyclable, PFAS-free, and bio-based coatings to comply with stringent EU and national packaging regulations. Robust recycling infrastructure and the German Packaging Act (VerpackG) are pushing demand for advanced recyclable barrier solutions that support high recycling rates and extended producer responsibility schemes.

Recent Developments in the Barrier Coatings for Flexible Packaging Industry

- In August 2024, Siegwerk announced new barrier and heat-seal coatings for paper mills, which are printable and offer a more sustainable alternative to partially non-recyclable film or foil-based barriers. These innovations aim to enable the use of mono-materials, thereby significantly improving the recyclability of flexible packaging in the sense of a circular economy.

- In July 2024, Smart Planet Technologies launched HyperBarrier, a ternary nanocomposite coating for paper-based flexible packaging, offering up to a twenty-fold improvement in oxygen barrier performance over traditional polyethylene coatings. This technology opens new doors for brands to switch from plastic to paper-based packaging while ensuring product freshness and shelf life.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Barrier Coatings for Flexible Packaging Market & Their Offerings:

- ACTEGA GmbH: Global leader in sustainable, high-performance water-based coatings.

- Amcor Plc: Leading provider of recyclable, high-barrier packaging solutions.

- BASF SE: Supplies innovative chemical resins for advanced barrier films.

- Berry Global Inc.: Manufactures diverse engineered materials and protective barrier films.

- Constantia Flexibles: Specializes in lightweight, recyclable laminates for global markets.

Other Players

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huhtamäki Oyj

- Kuraray Co., Ltd.

- Michelman, Inc.

- Mondi Plc

- PPG Industries, Inc.

- Sealed Air Corporation

- Sonoco Products Company

Segments Covered in the Report

By Coating Type

- Polymer-Based Coatings (EVOH, PVDC, PVOH, Acrylics)

- Biopolymer Coatings (PLA, Starch, Chitosan)

- Aluminum Oxide (AlOx) Coatings

- Silicon Oxide (SiOx) Coatings

- Water-Based Barrier Coatings

- Others (Wax, Nano-Coatings, Hybrid Solutions)

By Substrate Material

- Plastic Films (PET, BOPP, PE, Nylon)

- Paper & Paperboard

- Aluminum Foil

- Compostable / Bio-based Films

By Application

- Food & Beverages (snacks, dairy, confectionery, beverages, frozen food)

- Pharmaceuticals & Healthcare (blisters, sachets, medical pouches)

- Personal Care & Cosmetics

- Industrial & Chemical Packaging

- Agriculture & Pet Food Packaging

By Distribution Channel

- Direct Supply to Packaging Converters

- Packaging Material Distributors

- Online / Specialty Packaging Suppliers

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5922

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight – Check It Out:

- Boxboard Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Corrugated Plastic Tray Market Size and Segments Outlook (2026–2035)

- Topical Drugs Packaging Market Size and Segments Outlook (2026–2035)

- Tinplate Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Micro Perforated Films for Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Cornstarch Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Reclosable Zipper Market Size, Trends and Segments (2026–2035)

- Bubble Wrap Packaging Market Size, Trends and Segments (2026–2035)

- Rigid Sleeve Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Hazardous Goods Packaging Market Size and Segments Outlook (2026–2035)

- Advanced Recycled Materials (ARM) in Packaging Market Size, Trends and Segments (2026–2035)

- Recyclable Paper Wrapper Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Corrugated Sheets Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Consumer Goods Sustainable Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2026-2035

- Food and Beverage Metal Cans Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Industrial Drums Market Size and Segments Outlook (2026–2035)

- Multi Depth Corrugated Box Market Size, Trends and Regional Analysis (2026–2035)

- Non-Corrugated Boxes Market Size, Trends and Regional Analysis (2026–2035)

- Inflatable Bags Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Heavy Duty Corrugated Packaging Market Size, Trends and Regional Analysis (2026–2035)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.