The U.S. BCD Power IC Market is estimated at USD 0.75 billion in 2025 and is expected to reach USD 1.28 billion by 2033, growing at a CAGR of 6.92% from 2026–2033. Growth is driven by strong semiconductor R&D, wider power electronics adoption, investment in energy-efficient systems, and rising demand from EVs, ADAS, and industrial automation.

Austin, Jan. 19, 2026 (GLOBE NEWSWIRE) — BCD Power IC Market Size & Growth Insights:

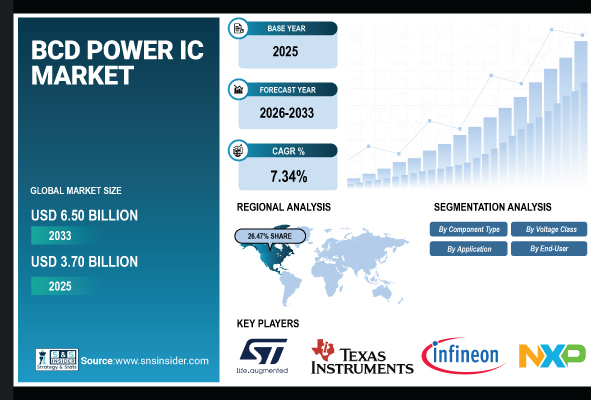

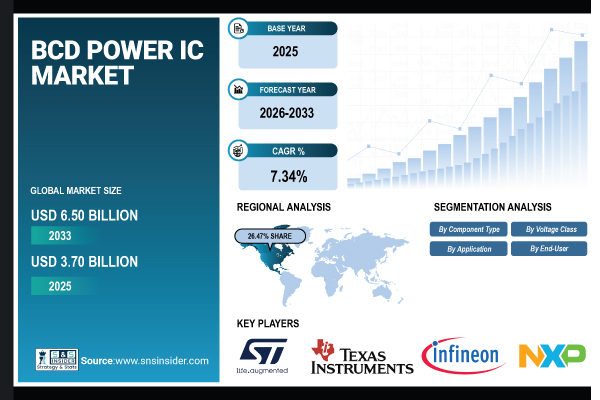

According to the SNS Insider, “The BCD Power IC Market Size was valued at USD 3.70 Billion in 2025E and is projected to reach USD 6.50 Billion by 2033, growing at a CAGR of 7.34% during 2026-2033.”

Rising Demand for Efficient Power Management to Propel Market Growth Globally

The growing need for effective, high-performance power management solutions in the consumer electronics, automotive, industrial, and telecommunications industries is the main factor propelling the global BCD Power IC market. Strong high-voltage and mixed-signal power integrated circuits (ICs) are now much more necessary for applications, such as motor control, battery management systems, onboard chargers, and ADAS modules due to the rapid expansion of electric cars (EVs) and hybrid electric vehicles (HEVs). Furthermore, because BCD Power ICs can combine analog, digital, and power functions on a single chip, increasing efficiency, reliability, and space utilization, their use is being accelerated by the growth of industrial automation, robotics, renewable energy systems, and smart factories.

Get a Sample Report of BCD Power IC Market Forecast @ https://www.snsinsider.com/sample-request/9337

Leading Market Players with their Product Listed in this Report are:

- STMicroelectronics

- Texas Instruments

- Infineon Technologies

- NXP Semiconductors

- Maxim Integrated

- Analog Devices (ADI)

- ON Semiconductor (onsemi)

- Renesas Electronics

- Rohm Semiconductor

- Diodes Incorporated

- Power Integrations

- Alpha & Omega Semiconductor (AOS)

- Magnachip Semiconductor

- GlobalFoundries

- TSMC (Taiwan Semiconductor Manufacturing Company)

- UMC (United Microelectronics Corporation)

- Vishay Intertechnology

- Tower Semiconductor

- Hua Hong Semiconductor

- Presto Engineering

BCD Power IC Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 3.70 Billion |

| Market Size by 2033 | USD 6.50 Billion |

| CAGR | CAGR of 7.34 % From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Device/Component Type (BCD Discretes, BCD Analog ICs, BCD Mixed‑Signal ICs, BCD Power Management ICs, and BCD High‑Voltage Drivers) • By Voltage Class (Low Voltage (< 60 V), Medium Voltage (60 V – 300 V), and High Voltage (> 300 V)) • By Application (Automotive Electronics (e.g., ADAS, motor control, EV/HEV systems), Industrial & Power Electronics (e.g., motor drives, UPS, robotics), Consumer Electronics (e.g., adapters, power supplies) • By Telecommunications (e.g., base station power modules)), and End-User (Automotive OEMs & Tier‑1 Suppliers, Industrial Equipment Manufacturers, Consumer Electronics Brands, and Telecom & Networking Equipment Makers) |

Purchase Single User PDF of BCD Power IC Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9337

Design Complexity and Reliability Challenges May Restrain Market Expansion

The growing design complexity involved in combining high-voltage, analog, and digital functionalities on a single chip while preserving dependability and thermal performance is a major barrier to the BCD Power IC market. Longer certification cycles, particularly for industrial and automotive applications, stringent safety and regulatory requirements, and issues with heat dissipation and device dependability might impede the quick acceptance of a product in some end-use industries and postpone its commercialization.

Key Segmentation Analysis

By Device/Component Type

BCD Power Management ICs dominated with 30.86% in 2025 driven by their widespread use in automotive power systems, industrial power supplies, and consumer electronics applications requiring efficient voltage regulation and power control. BCD High‑Voltage Drivers is expected to grow at the fastest CAGR of 9.32% from 2026 to 2033 supported by increasing adoption in electric vehicles, industrial motor drives, renewable energy systems, and high-voltage power distribution applications.

By Voltage Class

Medium Voltage (60 V – 300 V) dominated with 41.86% in 2025 due to its broad applicability across automotive electronics, industrial power systems, consumer power supplies, and motor control applications. High Voltage (> 300 V) is expected to grow at the fastest CAGR of 7.96% from 2026 to 2033 driven by growing adoption in electric vehicles, renewable energy inverters, industrial power conversion systems, and high-voltage infrastructure applications.

By Application

Automotive Electronics dominated with 34.97% in 2025 supported by strong demand from electric and hybrid vehicles, advanced driver-assistance systems, motor control units, and onboard power management solutions. Industrial & Power Electronics is expected to grow at the fastest CAGR of 8.13% from 2026 to 2033 driven by rising adoption of industrial automation, robotics, renewable energy systems, motor drives, and uninterruptible power supplies, all of which require robust and efficient power control solutions.

By End-User

Automotive OEMs & Tier‑1 Suppliers dominated with 35.69% in 2025 driven by increasing integration of power electronics in electric vehicles, advanced driver-assistance systems, body electronics, and powertrain applications. Industrial Equipment Manufacturers is expected to grow at the fastest CAGR of 7.96% from 2026 to 2033 supported by expanding industrial automation, robotics, renewable energy installations, motor control systems, and modernization of industrial power infrastructure worldwide.

Regional Insights:

North America accounted for 26.47% of the global BCD Power IC market in 2025, supported by strong demand from automotive, industrial, telecommunications, and data center applications.

Asia Pacific dominated the BCD Power IC market with a 36.97% share in 2025, driven by rapid industrialization, growing consumer electronics production, and strong automotive electrification, particularly in electric vehicles and hybrid systems.

Do you have any specific queries or need any customized research on BCD Power IC Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9337

Recent Developments:

- In November 2025, ST unveiled GaNSPIN GaN‑based power ICs optimized for motion control in appliances and industrial drives, boosting energy efficiency and enabling lighter, more compact power modules.

- In March 2025, TI introduced advanced power‑management devices including the industry’s first 48 V integrated hot‑swap eFuse and a family of integrated GaN power stages to address high power density and efficiency needs in modern data centers driven by AI and high‑performance computing.

Exclusive Sections of the BCD Power IC Market Report (The USPs):

- DEVICE & VOLTAGE PERFORMANCE METRICS – helps you evaluate revenue and shipment distribution across BCD discrete devices, analog ICs, mixed-signal ICs, power management ICs, and high-voltage drivers, along with performance efficiency across low, medium, and high voltage classes.

- AUTOMOTIVE & INDUSTRIAL DEMAND ANALYSIS – helps you understand demand concentration across automotive electronics, industrial power systems, consumer electronics, and telecommunications, with specific insight into adoption growth in ADAS, motor control, and electric or hybrid vehicle platforms.

- TECHNOLOGY INTEGRATION & POWER EFFICIENCY TRENDS – helps you identify innovation and optimization opportunities by analyzing average power efficiency improvements and the level of BCD Power IC integration in high-voltage and power management applications.

- MARKET SHARE & FINANCIAL PERFORMANCE INDICATORS – helps you assess competitive positioning through revenue growth rates, manufacturer market share by shipments and revenue, and average selling price trends by voltage class and end-use sector.

- DESIGN-IN CYCLE & CUSTOMER RETENTION METRICS – helps you evaluate supplier stickiness and time-to-market dynamics by tracking product qualification cycles, OEM and Tier-1 supply share, and long-term customer retention across automotive and industrial users.

- SUPPLY CHAIN DEPENDENCY & OEM EXPOSURE – helps you identify concentration risk and demand stability by examining production allocation toward automotive OEMs and Tier-1 suppliers versus other end-user industries.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.