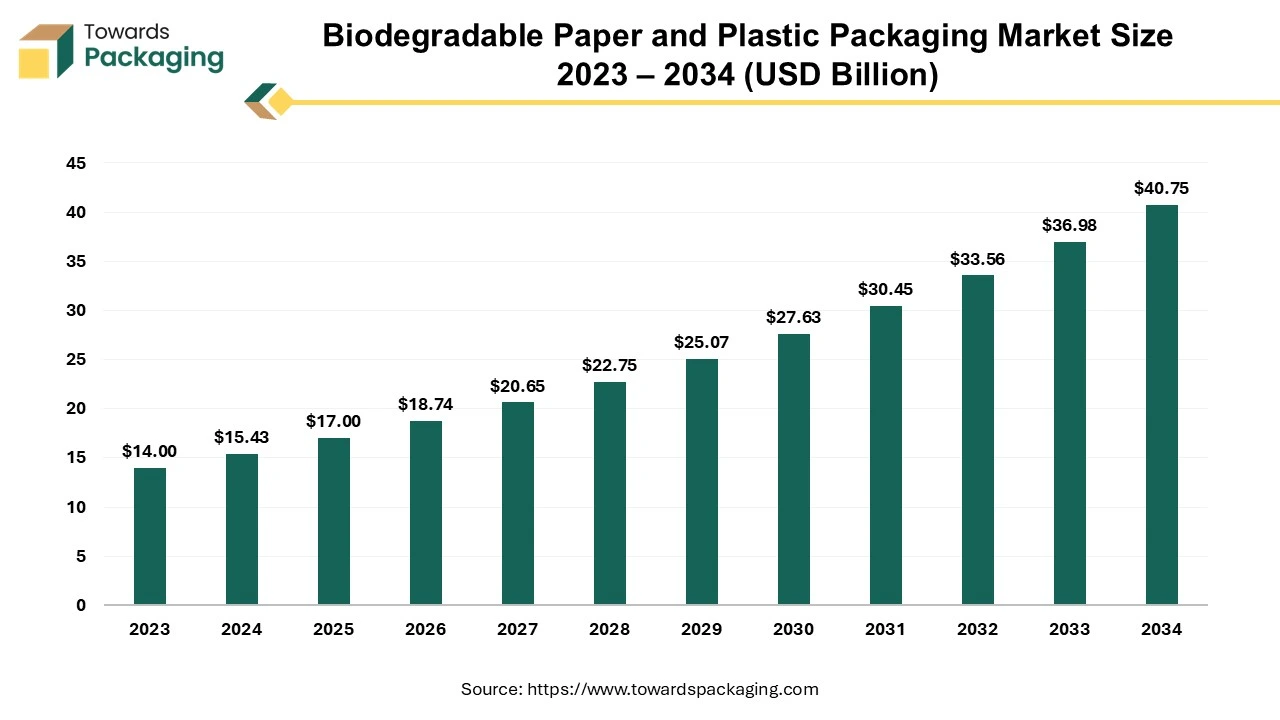

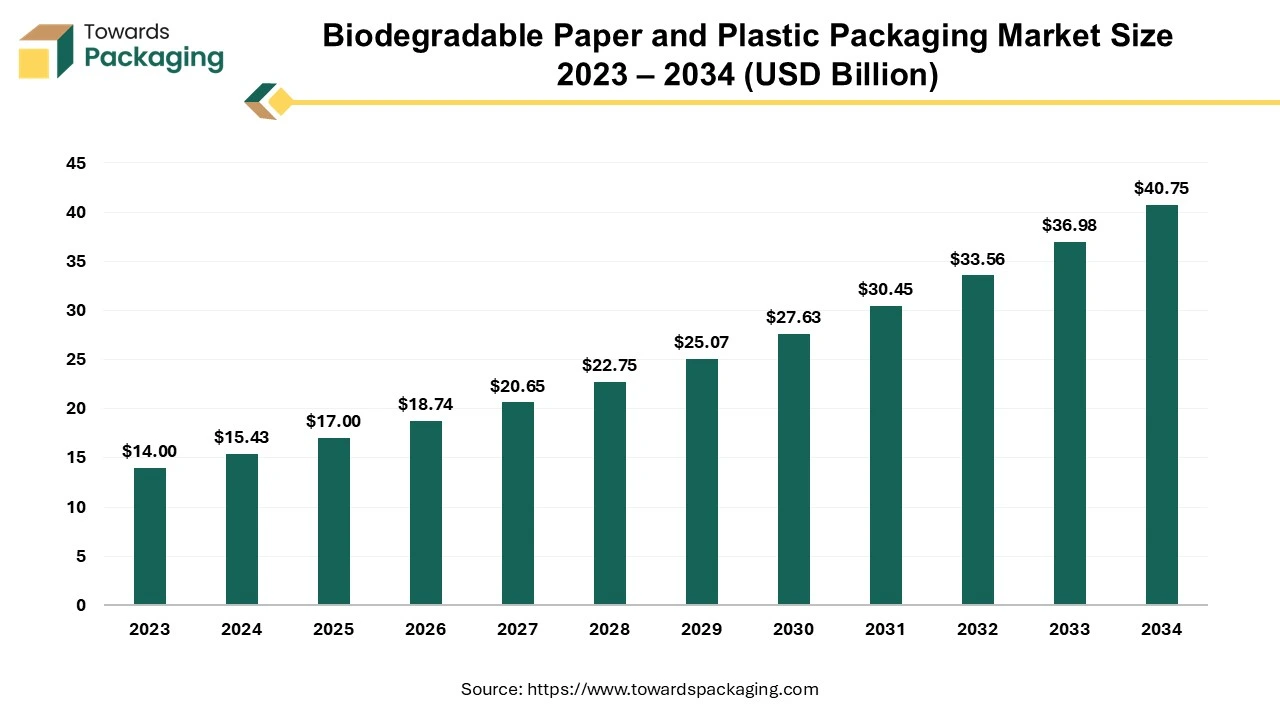

As detailed in the latest report by Towards Packaging, the global biodegradable paper and plastic packaging market is forecast to grow from USD 18.74 billion in 2026 to about USD 40.75 billion by 2034, at a CAGR of 10.20% between 2025 and 2034.

Ottawa, Nov. 17, 2025 (GLOBE NEWSWIRE) — The global biodegradable paper & plastic packaging market, valued at USD 17 billion in 2025, is expected to rise to approximately USD 40.75 billion in 2034, based on a report published by Towards Packaging, a sister firm of Precedence Research.

The biodegradable paper & plastic packaging market is witnessing robust growth driven by rising environmental awareness and stringent government regulations on single-use plastics.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by biodegradable paper & plastic packaging?

The biodegradable paper & plastic packaging market is driven by the global shift toward eco-friendly solutions, supported by regulatory restrictions on plastic waste and increasing consumer demand for sustainable products. Biodegradable paper and plastic packaging refers to materials designed to naturally decompose into non-toxic components through microbial action. Unlike conventional plastics, these packaging materials reduce pollution and landfill waste. They are made from renewable resources such as cornstarch, sugarcane, or paper fibers, offering an environmentally responsible alternative for multiple packaging applications.

North America dominated the market due to strong consumer preference for sustainable products, advanced recycling infrastructure, and major investments by packaging manufacturers. The region’s food and beverage and e-commerce sectors are increasingly adopting biodegradable alternatives to reduce their carbon footprint. Continuous innovations in bio-based materials and compostable packaging solutions further enhance North America’s leadership in this market.

Major Government Initiatives for the Biodegradable Paper & Plastic Packaging Industry:

- Bans on Single-Use Plastics (SUPs): Many governments, including India and the EU, have implemented bans on specific single-use plastic items to directly reduce plastic pollution at its source and drive demand for eco-friendly, biodegradable alternatives.

- Extended Producer Responsibility (EPR) Regulations: These policies legally oblige manufacturers, importers, and brand owners to be responsible for the end-of-life management (collection, recycling, and disposal) of their packaging, thereby incentivizing the use of sustainable and easily manageable materials.

- Economic Incentives and R&D Support: Governments offer incentives like subsidies, tax benefits, and funding for research and development to promote the production of innovative, cost-effective, and sustainable packaging materials and to develop the necessary recycling/composting infrastructure.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5436

What Are the Latest Key Trends in The Biodegradable Paper & Plastic Packaging Market?

- Advanced biopolymer innovation: The development of materials such as PLA, PHA, PBAT, and starch-based blends is enabling biodegradable packaging to match traditional plastics in durability and barrier performance.

- Growth of compostable and water-soluble films: Emerging packaging formats (e.g., water-soluble sachets and compostable trays) are gaining traction across food, personal care, and e-commerce sectors.

- Shift toward circular economy and e‐commerce packaging: Suppliers are increasingly focused on packaging designed for reuse, recycling, or industrial composting, driven by booming online retail and regulatory pressure.

- Paper-based packaging gaining share: While bioplastics grow, paper and molded fiber options are expanding rapidly due to their renewability and consumer appeal in sustainable packaging.

- Regional regulatory and brand commitment acceleration: Stricter legislation on single-use plastics, plus more consumer brands committing to 100% sustainable packaging, are driving faster adoption of biodegradable materials.

What is the Potential Growth Rate of the Biodegradable Paper & Plastic Packaging Market?

Growing Demand for Eco-friendly Packaging & Stringent Government Regulations

Rising consumer awareness and preference for eco-friendly packaging are major forces driving the biodegradable paper and plastic packaging market. As consumers become more conscious of environmental pollution and plastic waste, they increasingly choose products packaged in biodegradable or compostable materials. This shift compels brands and manufacturers to adopt sustainable packaging solutions to maintain customer loyalty and brand reputation. Additionally, social media awareness and global sustainability campaigns are accelerating the transition toward eco-conscious consumption, further fuelling market growth across industries like food, cosmetics, and retail.

More Insights of Towards Packaging:

- Connected Packaging Market Size, Segmentation, Regional Outlook, and Competitive Landscape, 2025-2034

- FMCG Packaging Market Size, Share, Trends, Segments, and Forecast 2025-2034

- Nanotechnology Packaging Market Size, Share, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Forecast 2025-2034

- Food Packaging Market Size, Segments Data and Regional Analysis (NA, EU, APAC, LA, MEA) – Competitive Landscape & Manufacturers’ Insights

- Metalized Flexible Packaging Market Size, Share and Segmental Analysis by Region, 2025-2034

- Pet Care Packaging Market Size, Growth Insights, and Key Companies Leading the Industry

- Form-Fill-Seal Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Alcoholic Beverage Packaging Market Size, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Single-use Packaging Market Size, Segments, and Regional Dynamics (North America, Europe, APAC, LA, MEA)

- Meat Packaging Market Size, Segments Data, Regional Analysis & Competitive Landscape

- Tea Packaging Market Size, Segmentation, and Growth Forecast (2025-2034)

- Snacks Packaging Market Size, Segments and Competitive Analysis

- Compostable Packaging Market Size, Segments Data, Regional Insights, and Competitive Landscape Analysis

- Plant-Based Packaging Market Size, Segmentation, and Competitive Analysis (2025-2034)

- Wrist Watch Packaging Market Size, Segments Data, and Regional Analysis

- Packaging 4.0 Market Size, Segments Data, and Competitive Analysis

- Primary Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

Regional Analysis:

Who is the leader in the Biodegradable Paper & Plastic Packaging Market?

North America leads the market due to strong environmental regulations, advanced waste management infrastructure, and high consumer awareness of sustainability. The region’s major packaging manufacturers actively invest in biopolymer innovation, while leading food, beverage, and e-commerce companies increasingly adopt eco-friendly materials to reduce plastic waste and carbon emissions.

What are the Ongoing Trends in the U.S. Market?

The U.S. dominates the North American market due to robust government initiatives promoting sustainability, strong R&D capabilities, and the presence of major packaging companies. High consumer preference for eco-friendly products, advanced recycling systems, and growing adoption of compostable packaging across food, retail, and logistics sectors further strengthen its leadership.

What are the Current Trends in the Canada Market?

In Canada, the market is shaped by a strong regulatory push and booming e-commerce. A federal ban on many single-use plastics accelerates the switch to compostable containers, while food delivery services adopt sustainable packaging. Meanwhile, paper-based solutions are gaining ground as consumers prefer eco-friendly materials over plastics.

How is the Opportunistic is the Rise of the Asia Pacific in the Biodegradable Paper & Plastic Packaging Market?

The Asia-Pacific region is growing fastest in the market due to rapid industrialization, expanding food delivery and e-commerce sectors, and increasing government initiatives to curb plastic waste. Rising environmental awareness, availability of low-cost raw materials, and growing investment in biopolymer production further accelerate the adoption of eco-friendly packaging solutions across the region.

What are the Ongoing Trends in China’s Market?

China dominates the Asia-Pacific market due to strong government policies promoting sustainability, large-scale manufacturing capacity, and rising consumer demand for eco-friendly packaging. The country’s rapid e-commerce growth, technological advancements in bioplastics, and increasing corporate investments in green packaging initiatives further reinforce its leading market position.

How Big is the Success of the Europe Biodegradable Paper & Plastic Packaging Market?

Europe is a notably growing region in the market due to strict environmental regulations, strong recycling infrastructure, and widespread adoption of circular economy principles. Growing consumer preference for sustainable products and active initiatives by major retailers and food manufacturers to replace single-use plastics drive the region’s market expansion.

What are the Ongoing Trends in the U.K. Market?

The U.K. is expected to dominate the European market due to its strong government policies on plastic reduction, innovative packaging technologies, and high consumer awareness of sustainability. Major retailers and food brands actively transitioning to biodegradable alternatives further strengthen the country’s leadership in eco-friendly packaging adoption.

How Crucial is the Role of Latin America in the Biodegradable Paper & Plastic Packaging Market?

Latin America plays a crucial role in the market due to growing environmental initiatives and rising consumer demand for sustainable products. Countries like Brazil, Mexico, and Chile are promoting biodegradable materials through government policies and corporate commitments. The expanding food, beverage, and retail industries are increasingly adopting eco-friendly packaging to reduce plastic pollution and enhance brand sustainability.

How Big is the Opportunity for the Growth of the Middle East and Africa Biodegradable Paper & Plastic Packaging Market?

The Middle East and Africa present significant growth opportunities in the market due to rising environmental awareness, urbanization, and supportive government initiatives promoting sustainable development. Expanding food service, retail, and e-commerce sectors are driving demand for eco-friendly packaging. Additionally, investments in green manufacturing and waste management infrastructure are boosting regional market potential.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Type Insights

What made the Starch-Based Plastic Segment Dominant in the Biodegradable Paper & Plastic Packaging Market in 2024?

The starch-based plastic segment dominates the market due to its cost-effectiveness, easy availability of raw materials, and excellent biodegradability. Derived from renewable sources like corn and potatoes, starch-based plastics offer strong mechanical properties and are widely used in food packaging, shopping bags, and disposable tableware applications.

Polylactic acid (PLA) is the fastest-growing segment in the market. Its rapid growth is driven by increasing adoption in food packaging, disposable cutlery, and films due to its clarity, strength, and compostability. Additionally, advancements in fermentation technology and cost-effective production from renewable resources like corn and sugarcane enhance its market expansion.

Material Insights

How the Plastic Segment Dominates the Biodegradable Paper & Plastic Packaging Market in 2024?

The plastic material dominates the market due to its superior flexibility, durability, and wide application range. Biodegradable plastics, such as PLA and PHA, offer comparable performance to conventional plastics while ensuring environmental safety. Their adaptability across industries like food packaging, agriculture, and consumer goods further strengthens their market leadership.

The paper material dominates the market due to its renewable nature, easy recyclability, and strong consumer acceptance. It offers excellent printability, versatility, and cost-effectiveness for packaging applications. Growing restrictions on single-use plastics and increasing demand for sustainable alternatives further strengthen paper’s dominance in eco-friendly packaging solutions.

End User Insights

What made the Food & Beverages Segment Dominant in the Biodegradable Paper & Plastic Packaging Market in 2024?

The food and beverage segment dominates the market due to the rising demand for sustainable packaging to preserve freshness and reduce waste. Growing consumption of packaged foods, regulatory pressure to limit plastic use, and increasing adoption of compostable containers and films further enhance this segment’s market leadership.

The personal and home care segment is the fastest-growing in the market due to increasing consumer preference for eco-friendly products. Brands are adopting biodegradable materials to enhance sustainability, reduce plastic waste, and align with green marketing trends, especially in packaging for cosmetics, toiletries, and household cleaning products.

Recent Breakthroughs in the Biodegradable Paper & Plastic Packaging Industry

- In January 2025, Smart Planet Technologies introduced EarthCoating-Bio, a new PLA- and mineral-based barrier coating designed to replace polyethylene in paper cups and food packaging. The coating enhances moisture and oxygen resistance while maintaining recyclability and compostability. It allows paper packaging to perform like plastic without compromising sustainability, helping brands meet eco-regulations and improve circularity.

- In February 2025, During the Packaging Innovations 2025 Expo in the UK, the EP Group launched RePapaPac, a high-strength biodegradable paper bag made for multiple reuse cycles. The innovation combines strong cellulose fibers with compostable coatings, offering a greener alternative to traditional plastic retail and visitor bags. It demonstrates how paper can achieve durability and versatility while remaining recyclable and biodegradable, aligning with Europe’s tightening plastic-reduction laws.

- In February 2025, Power Adhesives launched Tecbond 110B-PR, a new biodegradable hot-melt adhesive optimized for high-speed packaging lines. It provides excellent bonding for cartons, trays, and wraps used in sustainable packaging. The adhesive is formulated from renewable biopolymers, enabling eco-conscious manufacturers to maintain packaging performance while significantly reducing environmental impact. Its launch supports a large-scale industrial transition toward fully biodegradable assembly materials.

- In May 2025, Researchers at the University of Queensland developed a biodegradable biocomposite combining PHA (polyhydroxyalkanoate) and wood fibers. This material naturally decomposes in soil, freshwater, and marine environments, making it ideal for food packaging such as fruit punnets and trays. The innovation demonstrates how agricultural and wood waste can be transformed into high-performance, environmentally safe packaging, reducing dependency on fossil-based plastics.

- In June 2025, on World Environment Day 2025, UKHI, an Indian green tech company, launched EcoGran, a next-generation biodegradable biopolymer made from agricultural waste such as sugarcane. The material is designed to replace traditional plastics in flexible and rigid packaging applications. EcoGran offers high tensile strength and complete biodegradability, providing industries like FMCG and agriculture with a scalable, cost-effective, and compostable packaging alternative.

- In June 2025, Shellworks, a UK-based biomaterials innovator, unveiled a fully home-compostable pipette dropper made from Vivomer, a plastic-free, bacteria-derived biomaterial. This innovation targets the beauty and personal care sectors, replacing petroleum-based droppers with biodegradable versions that maintain transparency, flexibility, and resistance. The launch emphasizes the growing trend of compostable packaging within the cosmetics industry, aligning with consumer demands for zero-waste beauty products.

- On 10 September 2025, GreenPack Innovations launched a new line of eco-friendly flexible packaging solutions targeting industries such as food & beverage, pharmaceuticals, and consumer goods. These new films are designed to reduce environmental impact while delivering improved shelf-life and performance for packaged products.

- On 3 September 2025, Xampla (UK) raised USD $14 million to scale its plant-protein-derived biodegradable alternatives to single-use plastics, including packaging linings, films, and sachets. This funding boost underscores the maturity of bioplastic innovation and commercialisation efforts.

- In August 2025, in Singapore, SMX (Security Matters) partnered with Bio-Packaging to introduce molecularly traceable biodegradable packaging. The new system integrates invisible molecular markers and blockchain technology, allowing tracking of raw materials, production origins, and composting results. This innovation promotes supply chain transparency, supports extended producer responsibility (EPR) compliance, and enhances consumer trust in genuinely sustainable packaging claims.

Top Companies in the Global Biodegradable Paper & Plastic Packaging Market

- Riverside Paper Co. Inc. Offers repulpable and biodegradable water-soluble paper products for e-commerce applications.

- SmartSolve Industries Specializes in completely water-soluble paper and films for eco-friendly packaging and labels.

- Özsoy Plastik Provides various biodegradable plastic packaging solutions to reduce environmental impact.

- Ultra Green Sustainable Packaging Focuses on providing eco-friendly alternatives to traditional single-use plastics and styrofoam.

- Hosgör Plastik Offers biodegradable plastic packaging options across different industry sectors.

- Eurocell S.r.l Provides various biodegradable options within its sustainable packaging product lines.

- Tetra Pak International SA Develops paperboard-based cartons designed for recyclability and using plant-based, renewable materials.

- Kruger Inc. Creates sustainable, 100% recycled fiber packaging as an alternative to non-recyclable materials.

- Amcor PLC Offers a wide portfolio of sustainable solutions, including recycle-ready flexible packaging with bio-based coatings.

- Mondi Provides extensive “EcoSolutions” range, including recycle-ready barrier packaging and biodegradable options.

Segments Covered in the Report

By Type

- Starch Based Plastic

- Cellulose Based Plastics

- Polylactic Acid

- Polyhydroxyalkanoates

By Material

- Plastic

- Paper

By End User

- Food and Beverage

- Catering Service Wares

- Personal and Home Care

- Healthcare

- Others

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5436

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Poultry Packaging Market Size, Segments Data, and Regional Analysis (NA, EU, APAC, LA, MEA) with Competitive Insights

- Seed Packaging Market Size, Segmentation, Regional Insights and Competitive Dynamics

- Pesticide Packaging Market Size, Segments, Companies, Competitive Analysis

- Returnable Transport Packaging Market Size, Segmentation, and Regional Insights

- Packaging Automation Market Size, Segmentation, Regional Insights & Competitive Landscape

- Secondary Packaging Market Size, Growth Forecast, and Key Segments

- Packaging 5.0 Market Trends, Segments, Regional Performance, and Competitive Strategies

- Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Plastic Food Packaging Market Size, Segments, and Regional Analysis

- Paper and Paperboard Packaging Market Size, Segments, and Regional Analysis (2025-2034)

- Luxury Packaging Market Size, Segments Data, Regional Analysis (NA, EU, APAC, LA, MEA)

- Cold Chain Packaging Refrigerants Market Size, Segments, Regional Data, and Competitive Landscape

- Pharmaceutical Plastic Packaging Market Size, Segments, Regional Trends

- Food Service Packaging Market by Product, End-User, Region, and Key Manufacturers

- Personal Care Packaging Market Size, Segments, Regional Data, and Competitive Analysis

- PCR Plastic Packaging Market Size, Share, Segments, Trends and Key Players (2024-2034)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.