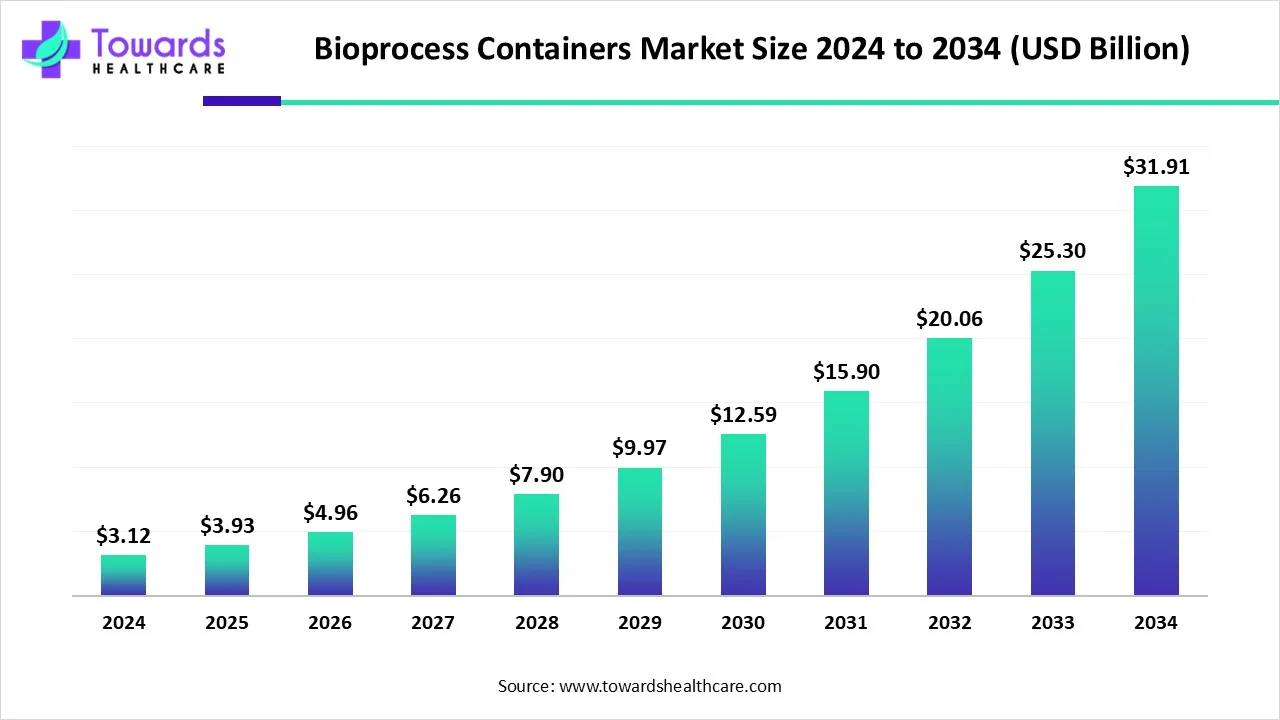

Bioprocess Containers Market to Soar from USD 3.12 Billion in 2024 to USD 31.91 Billion by 2034, Driven by the Shift Toward Single-Use Bioprocessing Systems

The global bioprocess containers market size is calculated at USD 3.93 billion in 2025 and is expected to reach around USD 31.91 billion by 2034, growing at a CAGR of 26.07% for the forecasted period.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global bioprocess containers market size was valued at USD 3.12 billion in 2024 and is predicted to hit around USD 31.91 billion by 2034, rising at a 26.07% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is rising because the biopharmaceutical industry is rapidly shifting toward single-use, disposable systems to meet demands for biologics, vaccines, cell and gene therapies with greater flexibility and reduced contamination risk.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5565

Key Takeaways:

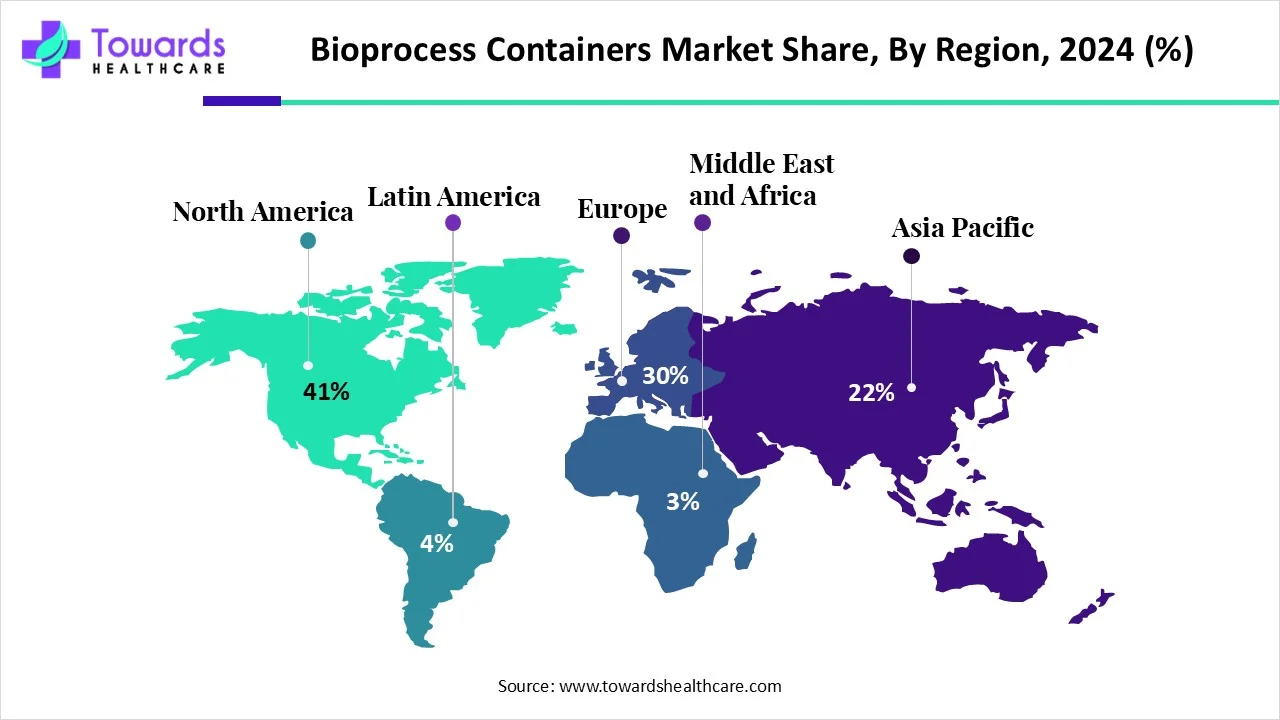

- North America dominated the bioprocess containers market share by 41% in 2024.

- Asia Pacific is estimated to host the fastest-growing market during the forecast period.

- By type, the 2D containers segment led the market in 2024.

- By type, the 3D containers segment is estimated to grow at the fastest CAGR during the forecast period.

- By application, the upstream process segment held the major share of the market in 2024.

- By application, the production process segment is estimated to be the fastest-growing during the predicted time frame.

- By end-use, the pharmaceutical companies segment held the largest share of the bioprocess containers market in 2024.

- By end-use, the biotechnology companies segment is estimated to grow at the fastest rate during 2025-2034.

Market Overview:

The bioprocess containers market involves rapid modernization in biomanufacturing where single-use flexible containers are supplanting traditional systems, with stainless-steel counterparts, to address the need for speed, sterility, and scalability in biomanufacturing and pipelines. As the biopharma industry experiences additional biologic drugs, vaccines, and advanced therapies, adding to the pipeline of biologics, increasing single-use flexible container utilization will continue as they are pre-sterilized and disposable, minimize cross contamination, cleaning and validation issues and increase turnarounds.

In addition, the market is experiencing increasing demand due to the demand for outsourcing, modular manufactured facilities and increasing biotechnology production globally. Given that regulatory bodies and respective companies are embracing flexible manufacturing platforms, the bioprocess containers market will sustain growth going forward.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What are the underlying market drivers?

- Growing biologics and advanced therapies pipeline: As monoclonal antibodies, cell and gene therapies, and vaccines are rushing to development, manufacturers are feeling the pressure to change-over and process in a more flexible way. Bioprocess containers enable a simplified workflow and support small; niche production better suited to advanced therapeutic modalities.

- Preference for single-use and modular manufacturing systems: Single-use bioprocess containers have investment is lower, the time to validate is shorter, and the risk of contamination is lower than traditional stainless-steel systems. In addition, the single-use bioprocess containers can be used in either new or retrofit facilities which have the possibility of being more flexible and cost effective.

- Growth of contract manufacturing and outsourcing: As the rise of biotech firms outsourcing development and manufacturing to CDMOs/CROs happens, these service companies are adopting flexible containment options, such as bioprocess containers, in order to be able to do work for several clients at different volumes and different products. This is driving demand for bioprocess containers in the market.

- Geographic expansion and consumer market entry: Biomanufacturing infrastructure is being invested in throughout Asia-Pacific and other emerging regions and there are new production sites, as well as new consumers and markets coming into magnitude for modern containment solutions. If the government and the industry can support capacity expansion, there will bioprocess container uptake.

Key Drifts:

What new Trends are Driving Change in the Market?

Smart and integrated bioprocess containers with sensors, RFID tagging and data connectivity will (be) become more widespread, allowing real-time monitoring and more effective operations. Some manufacturers are developing bio-based films, recyclable materials and designs minimizing waste in bioprocess containers to help customers meet corporate sustainability goals, on demand and in compliance with regulatory pressure.

3D container formats with larger volumes will increase to accommodate the volumes of media, buffer and bulk processing needed to support commercial biologics manufacturing. Modular and plug-and-play cleanroom systems that are pre-configured with single-use bioprocess containers are on the rise, allowing for faster cleanroom commissioning and improved flexibility.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

Whether regarding bioprocess containers, or other single-use systems, the environmental pressure associated with waste and disposal represents one of the biggest challenges for the bioprocess containers market. While bioprocess containers have operational value, the sustainability design challenges of utilizing polymer films and plastics raises the concern for waste, regulatory scrutiny, and added waste-management costs. Until manufacturers develop more sustainable materials, recycling programs or circular-economy models to lessen the environmental pressure, this challenge is likely to lower adoption.

Regional Analysis:

North America is the leading region in the bioprocess containers market by 41% share, primarily attributed to the matured biopharmaceutical sector of the region characterized by an overwhelming number of biologics market players, the presence of established Contract Development and Manufacturing Organizations (CDMOs) and large functional support from the regulatory sphere. Within North America, a focus toward investment in single-use manufacturing, a re-evaluation of infrastructure, innovation hubs, and CDMOs have all supported demand for containers in the region.

The high R&D spend for biologics and adoption of flexible manufacturing technologies, alongside the existence of global players, supports North America’s dominance. Additionally, North America’s advantage of adopting modular facilities and the ability to reconfigure processes to rapidly respond to emergent needs, such as pandemic-level vaccine production, supports continued dominance with this sector.

Asia-Pacific is the fastest-growing segment of the bioprocess containers market since there is increasing investment in biomanufacturing, local biologics and biosimilars capacity expansion, and government support for healthcare infrastructure. Rapid expansion in the region, particularly from China and India, is leading to an increase in manufacturing capacity for vaccines, cell therapies and biopharmaceuticals so that demand for modern containment solutions is also increasing.

At the same time, outsourcing of manufacturing from global players into Asia-Pacific and cost advantages that the region provides are also accelerating that uptake. Regulatory reforms and initiatives are also further developing the local biotech ecosystems to support adoption of single-use bioprocess container technologies. Throughout this transition from contract manufacturing to end-to-end biomanufacturing, the need for flexible and scalable manufacturing container solutions continues grow.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights:

By type:

The 2D bioprocess containers (flat-bag, film-based formats) was the largest contributor to revenue in 2024 among the various types, as these containers are often compatible with several types of media and buffer applications and can more easily be incorporated into existing production lines. Additionally, most manufacturers have become accustomed to utilizing 2D systems over the decades.

The 3D container formats (cube or rectangular tanks) are the only category predicted to grow significantly more than the other types of containers, as they will support larger volumes or bulk media preparation and storage, as well as support large-scale commercial manufacturing capabilities.

By Application:

In 2024, the upstream process segment was the largest application segment in the bioprocess container market. Upstream processes, which include cell culture, media preparation and fermentation, were the biggest share of the bioprocess containers market in 2024 because bioprocess containers are key for media and expansion of cells as well as initial bioreactor feeding in single-use/sterile operations.

In terms of application, the production process segment is projected to be the fastest growing during the forecast period. The production process segment, which includes large-scale harvest, buffer handling, downstream integration and formulation, is projected to grow the fastest as operations are shifting to scalable commercial manufacturing with higher volumes and larger containers/flexible formats.

By End-Use:

In terms of end-use, the pharmaceutical (and biopharmaceutical) companies segment accounted for the largest share of the bioprocess container market in 2024. These companies consumed the largest share of bioprocess containers to support their more extensive biologics manufacturing footprint, higher sterility requirement of their flexible systems, and their role in infusion of capital as we invest in infrastructure.

In terms of end-use, the biotechnology companies’ segment is expected to grow the fastest from 2025-2034. Biotechnology firms (cell and gene therapy firms, niche biologics developers) are expected to grow the fastest due to their increasing outsourcing of manufacturing, adoption of single use system (SUS) containers, and need for more mobile, small to mid-size container solutions as they commercialize.

Recent Developments:

April 15, 2025, Thermo Fisher Scientific, Inc. launched the 5 L DynaDrive Single-Use Bioreactor, enabling seamless scale-up from lab to larger manufacturing scale while integrating sustainable film technologies and supporting faster development workflows.

Browse More Insights of Towards Healthcare:

The global bioprocess automation market is valued at USD 5.4 billion in 2024, expected to reach USD 6.05 billion in 2025, and projected to grow to around USD 16.88 billion by 2034, registering a CAGR of 12.04% between 2025 and 2034.

The global bioprocess bags market is estimated at USD 4.07 billion in 2024, increasing to USD 4.74 billion in 2025, and anticipated to reach approximately USD 18.65 billion by 2034, expanding at a CAGR of 16.44% from 2025 to 2034.

The global bioprocess analyzers market was valued at USD 2.28 billion in 2024, expected to rise to USD 2.54 billion in 2025, and projected to attain USD 6.77 billion by 2034, advancing at a CAGR of 11.54% between 2025 and 2034.

The global upstream bioprocessing market was valued at USD 24.15 billion in 2023 and is projected to reach USD 105.46 billion by 2034, growing at a CAGR of 14.34% during the forecast period from 2024 to 2034.

The global continuous bioprocessing market is valued at USD 349.32 million in 2024, expected to grow to USD 414.5 million in 2025, and reach approximately USD 1,933.16 million by 2034, expanding at a CAGR of 18.66% from 2025 to 2034.

The global single-use downstream bioprocessing market is valued at USD 1.57 billion in 2024, projected to increase to USD 1.79 billion in 2025, and reach around USD 5.9 billion by 2034, expanding at a CAGR of 14.24% between 2025 and 2034.

The sustainable bioprocessing materials market is set for substantial growth from 2024 to 2034, fueled by the growing demand for environmentally friendly materials in biopharmaceutical manufacturing.

The global portable bioprocessing bioreactors market is valued at USD 2.95 billion in 2024, projected to reach USD 3.23 billion in 2025, and expected to attain approximately USD 7.25 billion by 2034.

Bioprocess Containers Market Key Players List:

- Sartorius AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Saint-Gobain (France)

- Meissner Filtration Products, Inc. (U.S.)

- Single Use Support (U.S.)

- Entegris (U.S.)

- CellBios (India)

- Lonza (Switzerland)

Segments Covered in the Report

By Type

- 2D Container

- 3D Container

- Accessories

By Application

- Upstream Process

- Production Process

- Downstream Process

By End-use

- Pharmaceutical Companies

- Biotechnology Companies

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5565

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.