The U.S. calibration services market is projected to grow from USD 2.07 billion in 2025E to USD 3.48 billion by 2035. Key drivers include the expansion of advanced manufacturing, increased aircraft and defense spending, rapid semiconductor growth, and strict compliance with FDA, FAA, NIST, and ISO standards.

Austin, Feb. 10, 2026 (GLOBE NEWSWIRE) — Calibration Services Market Size & Growth Insights:

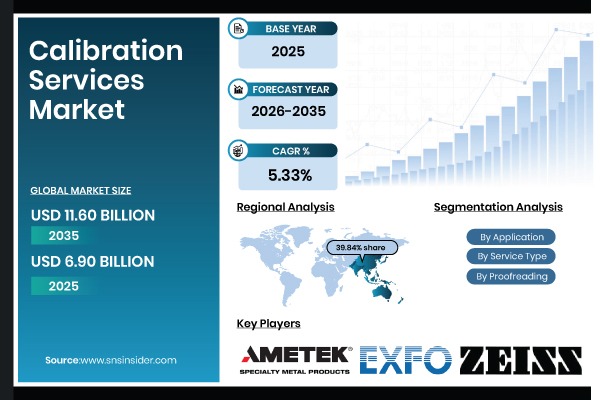

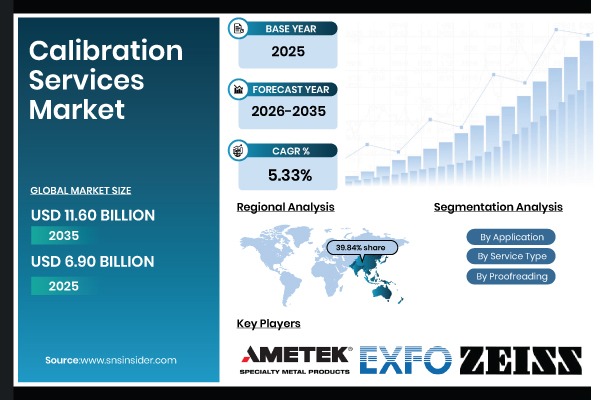

According to the SNS Insider, “The Calibration Services Market Size is estimated at USD 6.90 Billion in 2025E and is expected to reach USD 11.60 Billion by 2035, growing at a CAGR of 5.33% over 2026–2035.”

Rising Regulatory Compliance and Quality Standards to Augment Market Growth Globally

The requirement for quality assurance across sectors and increased regulatory scrutiny are the main factors propelling the calibration services market’s growth. The manufacturing, aerospace, pharmaceutical, electronics, and energy sectors must maintain traceable calibration records in order to comply with ISO 9001, ISO/IEC 17025, FDA 21 CFR, FAA, and IEC regulations. Measurement accuracy, process dependability, and product consistency are all ensured via calibration. As a result, operating a business carries less risk and responsibility. People are beginning to view calibration compliance as a strategic necessity rather than merely a maintenance activity as global supply chains become more intertwined.

Get a Sample Report of Calibration Services Market Forecast @ https://www.snsinsider.com/sample-request/4092

Leading Market Players with their Product Listed in this Report are:

- Ametek Inc.

- Exfo Inc.

- Carl Zeiss AG

- Testo AG

- Eurofins Scientific

- Intertek Group plc

- Danaher Corporation

- Agilent Technologies (now Keysight Technologies)

- Yokogawa Electric Corporation

- Mitutoyo Corporation

- Honeywell International Inc.

- National Instruments Corporation

- Global Calibration Services Inc.

- Fluke Corporation

- Mettler Toledo International Inc.

- Endress+Hauser

- Bureau Veritas

- Pace Analytical Services

- Kistler Group

- Flir Systems Inc.

Calibration Services Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025E | USD 6.90 Billion |

| Market Size by 2035 | USD 11.60 Billion |

| CAGR | CAGR of 5.33% From 2026 to 2035 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Proofreading (In-house, OEM, Third-Party Vendor) • By Service Type (Mechanical, Electrical, Dimensional, Thermodynamics) • By Application (Industrial & Automation, Electronics, Aerospace & Defence, Communication, Others) |

Purchase Single User PDF of Calibration Services Market Report (20% Discount) @ https://www.snsinsider.com/checkout/4092

Key Segmentation Analysis:

By Proofreading

Third-Party Vendors held the largest market share of 46.18% in 2025 due to their accredited laboratories, broad service portfolios, and cost efficiency. OEM calibration services remain essential for proprietary and high-complexity equipment, especially in electronics, aerospace, and advanced testing systems.

By Service Type

Electrical calibration dominated with a 31.74% share in 2025 owing to the large use of electrical and electronic instruments across manufacturing, telecom, energy, and electronics sectors. Dimensional calibration is projected to grow at the fastest CAGR of 9.12% during 2026–2033 due to the surging precision manufacturing, CNC machining, semiconductor fabrication, and metrology-intensive industries.

By Application

Industrial & Automation accounted for 38.96% of the market in 2025 caused by the extensive use of sensors, gauges, controllers, and test instruments in manufacturing environments. Aerospace & Defense is the fastest-growing application segment owing to the strict safety standards, complex avionics systems, and increased defense spending.

Regional Insights:

In 2025, Asia Pacific held a 39.84% global market share, dominating the calibration services industry. Rapid industrialization, robust electronics and automobile manufacturing, and significant infrastructure projects in China, Japan, South Korea, and India are all contributing to an increase in demand.

Advanced manufacturing, aerospace and defense dominance, higher semiconductor investments, and stringent regulatory enforcement are expected to propel North America‘s growth at a compound annual growth rate (CAGR) of 8.67%.

High Service Costs and Downtime May Impede Market Expansion Globally

Equipment downtime and calibration expenses continue to be major issues, particularly for small and medium-sized enterprises. Advanced calibration for high-precision instruments necessitates expensive equipment, qualified experts, and accredited labs, which drives up service costs. Additionally, off-site calibration may result in operational issues, particularly in locations where production is continuous. Although on-site calibration minimizes downtime, it is typically more expensive, which deters cost-conscious consumers.

Do you have any specific queries or need any customized research on Calibration Services Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/4092

Recent Developments:

- In July 2023, Ametek expanded its calibration service network to support high-precision aerospace and power applications.

- In June 2023, Zeiss enhanced its industrial metrology calibration services with advanced digital measurement traceability solutions.

Exclusive Sections of the Calibration Services Market Report (The USPs):

- QUALITY & COMPLIANCE PERFORMANCE METRICS – helps you assess service reliability and regulatory readiness through calibration interval trends, out-of-tolerance rates, accreditation penetration (NABL, ISO/IEC 17025, UKAS), and turnaround time benchmarks across regions and provider types.

- DEMAND INTENSITY & UTILIZATION INDICATORS – helps you identify demand concentration and capacity pressure by analyzing calibration volume per manufacturing output, audit-driven demand spikes, re-calibration frequency, and repeat business patterns.

- TECHNOLOGY ADOPTION & DIGITAL MATURITY INDEX – helps you uncover operational efficiency gaps by tracking adoption of automated calibration software, paperless systems, uncertainty measurement trends, and mobile versus in-lab service deployment.

- SERVICE DELIVERY & OPERATIONAL EFFICIENCY METRICS – helps you benchmark provider performance using mean time to calibrate (MTC), turnaround time (TAT), and mobile or on-site versus in-lab service mix across industries.

- COST STRUCTURE & ECONOMIC DECISION MODELS – helps you evaluate pricing sensitivity, cost of quality (CoQ) impact, contract versus ad-hoc revenue mix, and capex versus opex trade-offs for in-house calibration lab setup.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Other Trending Research Reports:

Chiplet Market

Chip-On-Board Led Market

Commercial Display Market

Commercial Security System Market

Connected Living Room Market

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.