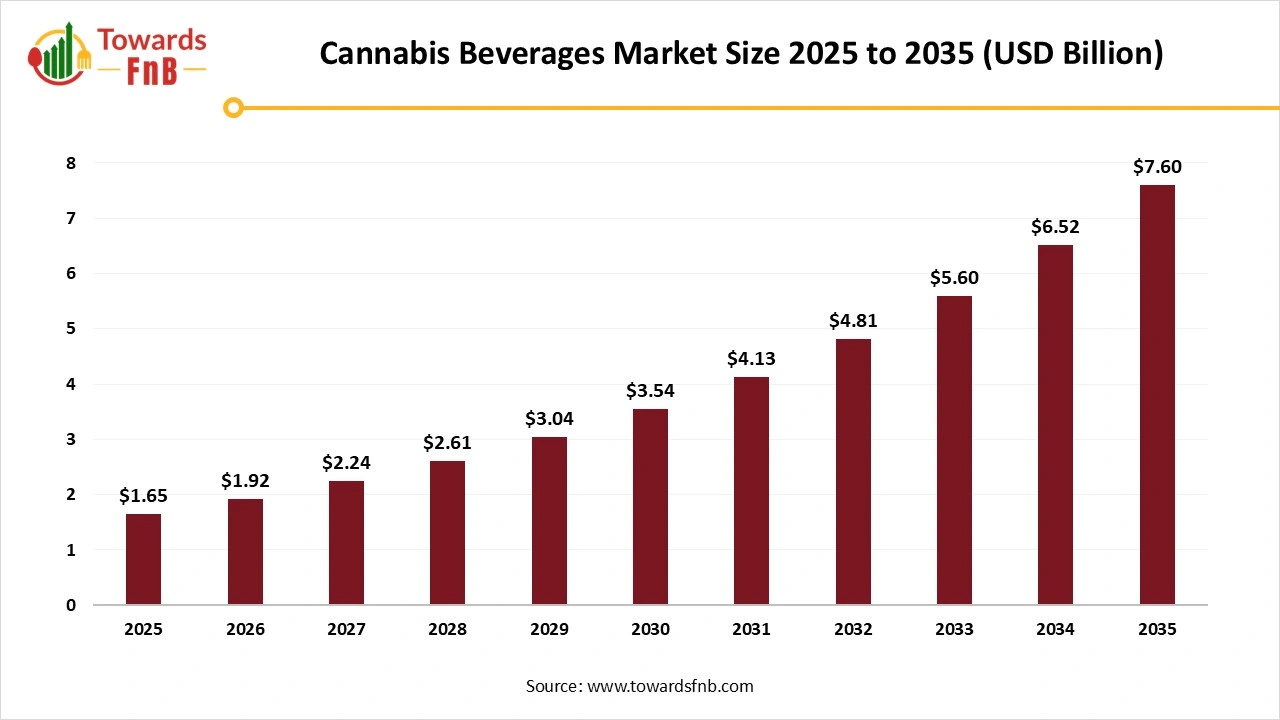

According to Towards FnB, the global cannabis beverages market size is evaluated at USD 1.92 billion in 2026 and expand to approximately USD 7.60 billion by 2035, advancing at CAGR of 16.5% from 2026 to 2035. This rapid growth positions cannabis beverages among the fastest-expanding segments within the broader functional and alternative beverage landscape.

Ottawa, Jan. 21, 2026 (GLOBE NEWSWIRE) — The global cannabis beverages market size was valued at USD 1.65 billion in 2025 and is predicted to grow from USD 1.92 billion in 2026 to reach around USD 7.60 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research.

The market is observed to grow due to growing advancements in technology, such as nano-emulsification and infusion technologies, to improve flavor and bioavailability and maintain dosing accuracy. Higher demand for healthier alternatives to alcohol in refreshing forms also helps to fuel the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5980

Key Highlights of the Cannabis Beverages Market

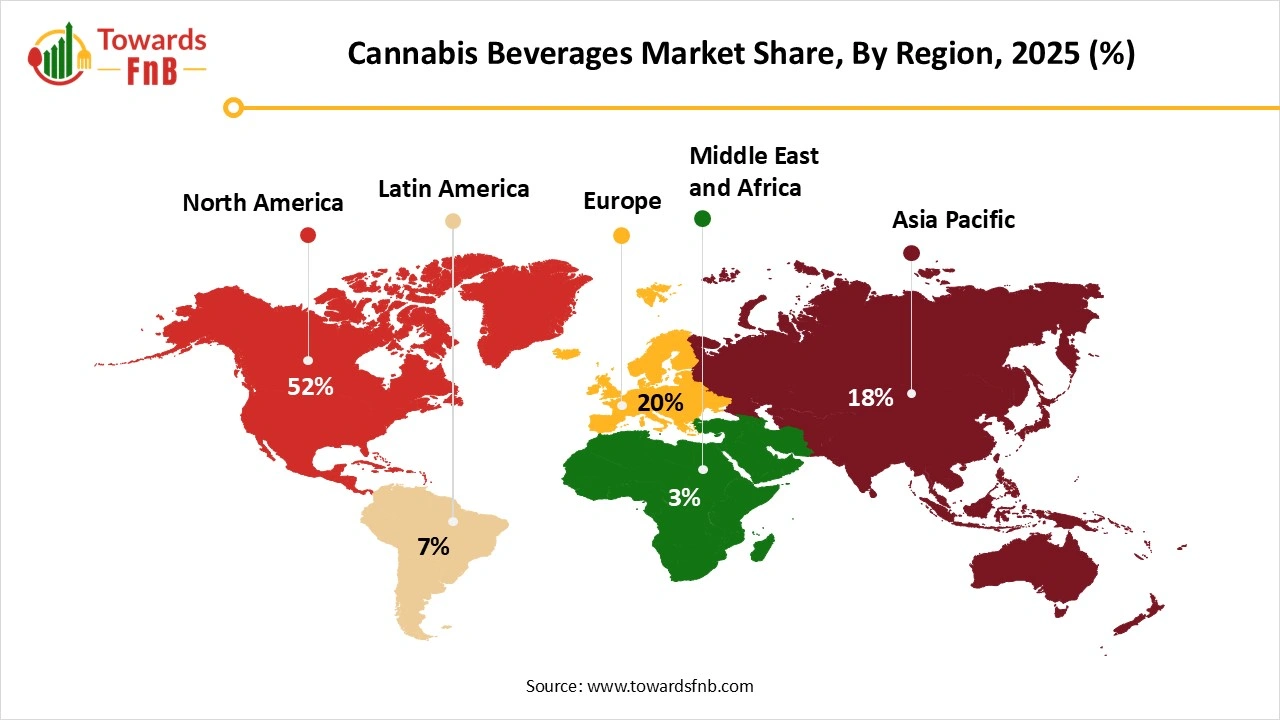

- By region, North America led the cannabis beverages market with largest share of 52% in 2025.

- By region, the Asia Pacific is expected to grow in the forecast period.

- By distribution channel, the online retail segment led the cannabis beverages market in 2025.

- By distribution channel, the specialty stores segment is expected to grow in the foreseeable period.

- By type, the non-alcoholic segment led the cannabis beverages market in 2025.

- By type, the alcoholic segment is observed to grow in the foreseen period.

Product Innovation Fueling the Growth of the Cannabis Beverages Industry

The cannabis beverages market observes growth due to higher demand for healthier alternatives to alcohol, increasing legalization, and higher demand for product innovation. The market focuses on drinks and beverages infused with CBD and THC, such as coffee, mocktails, tea, or sodas, which is helpful for the growth of the market. Such beverages are an ideal replacement for alcohol and hence are highly preferred by consumers globally.

Such drinks also help to promote healthy sleep and treat anxiety, which further propels the growth of the market. Cannabis beverages also help to treat serious issues such as cancer, neurological disorders, and chronic pain, which is further helpful for the growth of the market. The growing demand for such beverages by the growing population of health-conscious consumers, leading to higher demand for low-calorie and low-sugar beverages, also helps to fuel the growth of the market.

Technological Advancements are helpful for the Growth of the Cannabis Beverages Market

Technological advancements in the form of smart packaging, smart branding, sustainable solutions, and following zero-waste methods are some of the major factors helpful for the growth of the market. Technological advancements in the form of automation, enhanced production efficiency, AI, and digitalization, for elevating the product quality, also help to fuel the growth of the market.

The advanced technology also aids AI-driven flavor creation, innovation in functional ingredients, precision fermentation, and various other similar advantages, further fueling the market’s growth. The segment also focuses on improving the flavor of cannabis beverages along with maintaining their nutritional profile in the form of low-sugar and low-calorie variants, further fueling the growth of the market.

Impact of AI in the Cannabis Beverages Market

Artificial intelligence is playing an increasingly important role in the cannabis beverages market by improving formulation consistency, bioavailability control, and regulatory compliance in a highly constrained product environment. Machine learning models are used to analyze cannabinoid solubility, emulsion stability, particle size distribution, and onset-time variability to optimize nano-emulsified THC and CBD delivery systems that provide predictable dosing and repeatable consumer experiences.

In product development, AI accelerates formulation screening by predicting how cannabinoids interact with sweeteners, acids, carbonation, and flavor systems under different storage and temperature conditions, reducing the risk of phase separation or potency drift over shelf life. During manufacturing, AI-enabled process monitoring tools track critical parameters such as homogenization pressure, shear forces, and thermal exposure to ensure uniform cannabinoid dispersion across batches and high-throughput filling lines.

AI is also applied in demand forecasting and portfolio planning to align SKU strength, flavor profiles, and package formats with regional consumption patterns and evolving legal frameworks. From a compliance and risk-management perspective, AI supports potency validation, label accuracy, and batch traceability by mapping formulation data and test results against regulatory requirements enforced by bodies such as Health Canada and state-level oversight aligned with guidance from the U.S. Food and Drug Administration where applicable. Overall, AI acts as a control and standardization layer in the cannabis beverages market, enabling manufacturers to manage dosing precision, reduce formulation risk, and operate more reliably within complex and evolving regulatory boundaries.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cannabis-beverages-market

Recent Developments in the Cannabis Beverages Market

- In September 2025, PakTech announced the launch of PakLock, a certified child-resistant cap engineered for hemp, CBD, and THC-infused beverages. The main aim of the brand is to provide a secure, sustainable, and cost-effective closure solution for brands.

- In October 2025, Horticulture Co., Knoxville, Tenn., the parent company of hemp THC beverage brand Tempter’s, announced the launch of Iverson’s line of hemp beverages, in partnership with global icon Allen Iverson. The launch was powered by Viola at Circle K.

New Trends in the Cannabis Beverages Market

- Higher demand for healthier alternatives, such as low-sugar and low-calorie options that are also available in permissible quantities of cannabinoids, is one of the major factors for the growth of the market.

- Growing demand for health-conscious and sober drinks for social gatherings is another major factor for the growth of the market.

- Functional cannabis drinks paired with cannabis and various other beneficial essentials, such as adaptogens, vitamins, minerals, and herbal extracts, also help to fuel the growth of the market.

- Higher demand for low-dosed or microdosed beverages for consumers seeking a controlled experience is another major factor for the growth of the market.

- Technological innovations such as nano-emulsification, which are helpful for the breakdown of smaller particles to make them water-soluble and allow faster onset of effects, also help to fuel the growth of the market.

Cannabis Beverages Market Dynamics

What are the Growth Drivers of Cannabis Beverages Market?

Higher expansion of legalization of cannabis for medical and recreational purposes in major regions is one of the major market growth drivers. Higher demand for low-calorie and low-sugar options by health-conscious consumers also helps to fuel the growth of the market. Multiple health benefits of cannabis-infused drinks, such as helping to relieve stress and anxiety, treating neurological issues, and also helping to get relief from chronic pain, also help to fuel the growth of the market. Technological innovations helpful to improve bioavailability and ensure consistent dosing also help to fuel the growth of the market.

Regulatory Uncertainties Hampering the Growth of the Market

Lack of federal guidelines differing as per various regions slows down the market’s growth and is also accounted for as one of the biggest restrictions. Such issues also slow down the production, labeling, and testing of hemp-derived products, further restraining the growth of the market. State-level bans on certain hemp-derived or THC products also restrain the growth of the market.

Innovative Products Helpful for the Growth of the Cannabis Beverages Market

Availability of functional products with added health benefits, such as vitamins, minerals, and other essentials, also helps to fuel the growth of the market. Such products are helpful in multiple forms, such as helping consumers to get rid of chronic pain, stress, and anxiety. Such products are also helpful for consumers with neurological disorders, further fueling the growth of the market. Improved sleep and other health benefits also aid the growth of the market.

Product Survey of the Cannabis Beverages Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| THC-Infused Beverages | Beverages formulated with tetrahydrocannabinol for psychoactive effects | Carbonated drinks, teas, lemonades | Adult-use cannabis consumers | THC sparkling drinks, infused sodas |

| CBD-Infused Beverages | Non-intoxicating beverages containing cannabidiol for wellness positioning | Still drinks, functional waters, teas | Wellness-focused consumers | CBD waters, CBD teas |

| Low-Dose Cannabis Beverages | Precisely dosed formulations designed for controlled consumption | Micro-dosed cans and bottles | New and social cannabis users | Low-dose THC drink lines |

| Fast-Acting Cannabis Beverages | Formulations using nano-emulsions for rapid onset | Nano-emulsified THC or CBD drinks | Recreational and experiential users | Fast-onset cannabis drinks |

| Cannabis-Infused Sparkling Waters | Light, carbonated beverages with cannabis extracts | Flavored sparkling waters | Lifestyle and sessionable use | Cannabis sparkling water products |

| Cannabis-Infused Energy Drinks | Beverages combining cannabis with stimulant cues | THC or CBD energy-style drinks | Experimental and niche consumers | Cannabis energy beverages |

| Functional Cannabis Beverages | Products positioned around relaxation, sleep, or focus | Herbal blends with cannabinoids | Wellness and functional use cases | Functional cannabis drink formulations |

| Alcohol-Free Cannabis Beverage Alternatives | Cannabis drinks positioned as alcohol substitutes | Social tonics, mocktail-style drinks | Sober-curious and alcohol-avoidant consumers | Cannabis social beverages |

| Water-Soluble Cannabis Ingredients | Ingredient systems enabling beverage formulation | Nano-emulsions, soluble cannabinoid powders | Beverage manufacturers, contract formulators | Water-soluble cannabinoid systems |

| Private Label Cannabis Beverages | Contract-manufactured beverages for licensed brands and retailers | White-label drink formulations | Dispensaries, licensed beverage brands | Private-label cannabis drinks |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5980

Cannabis Beverages Market Regional Analysis

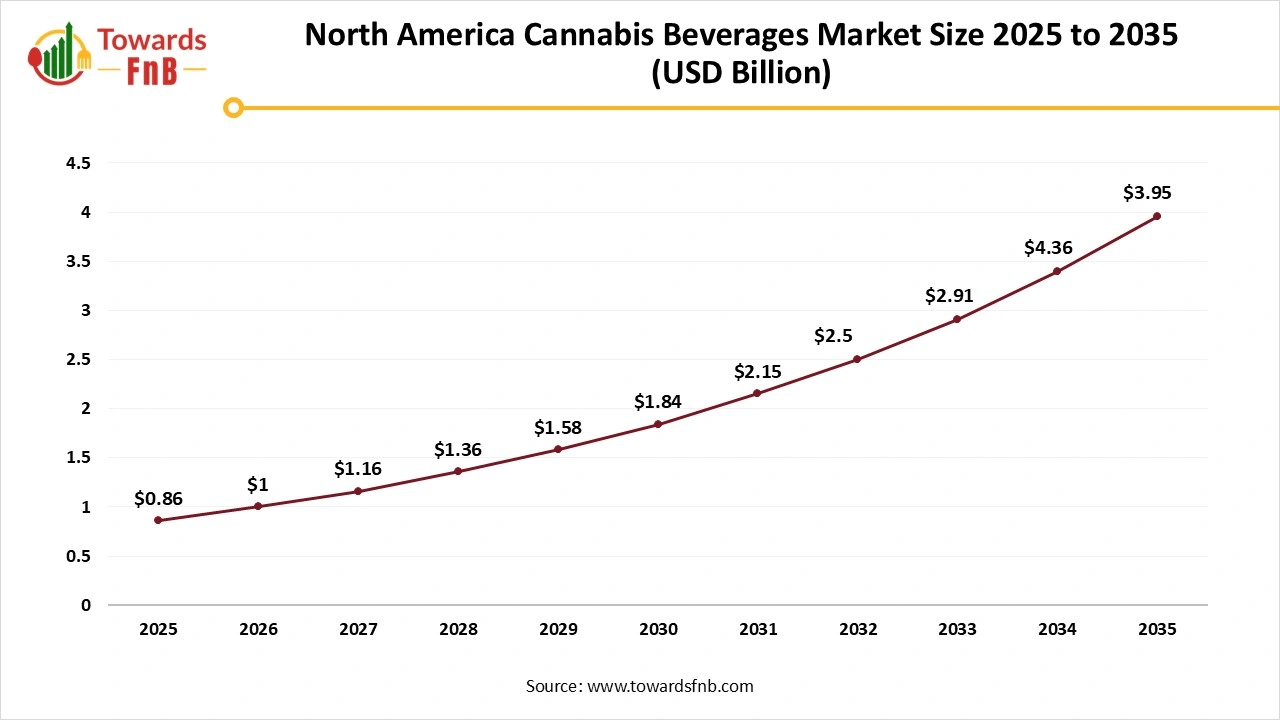

North America led the Cannabis Beverages Market in 2025

North America dominated the cannabis beverages market in 2025, due to higher demand for cannabis-infused and innovative drinks that are also ideal for social events and gatherings. Health-conscious consumers are leading to higher demand for drinks and beverages that are low in calories, low in sugar, and also gluten-free, which further helps to fuel the growth of the market.

Higher shift in consumer preferences leading to higher demand for options such as hybrid seltzers and vodka-based seltzers is a factor for the growth of the market. The US has made a major contribution to the growth of the market due to high demand for options such as flavored, unique innovations, low-calorie, and low-sugar options, fueling the growth of the market.

Asia Pacific is observed to be the fastest-growing region in the Foreseen Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to higher demand for cannabis beverages for various medicinal, recreational, and other purposes. A growing health-conscious population leading to higher demand for beverages low in sugar, low in calories, and also gluten-free options also helps to fuel the growth of the market. Usage of cannabis beverages to treat various health issues, such as stress, anxiety, and chronic pain, also helps to fuel the market growth in the region. China has made a major contribution to the growth of the market due to rising investment in industrial hemp research and development and higher demand for cannabis beverages in functional variants.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to rising consumer awareness regarding CBD and its health benefits. Higher demand for light and refreshing alternatives to alcohol is another major factor for the growth of the market in the region. Germany has made a major contribution to the growth of the market due to higher demand for healthier alcoholic drink alternatives that are low in sugar and low in calories.

Trade Analysis for the Cannabis Beverages Market

What Is Actually Traded (Product Forms and HS Proxies)

- Cannabis-infused ready-to-drink beverages where cannabis components (CBD or THC) are incorporated into water, tea, soda, or juice bases are often classified under HS 2202 (non-alcoholic beverages) or, where intoxicating alcohol is present, HS 2208 (undenatured spirit drinks) depending on composition and customs interpretation. Because cannabis content may subject products to special controls, traders frequently coordinate classification with authorities at import/export.

- Cannabinoid extracts and isolates (such as CBD oil or THC tinctures) used as input ingredients for beverage formulations are typically traded under HS 1302 (vegetable saps and extracts) or HS 3301/3302 (essential oils and fragrance/odoriferous mixtures) depending on source and use.

- Hemp-derived beverage bases and concentrates containing low THC levels compliant with industrial hemp definitions are sometimes classified under general beverage or food preparation codes, subject to national rules on cannabis derivatives.

- Flavor-infused or functional cannabis beverage premixes supplied to manufacturers for local blending are ordinarily cleared under HS 2106 (food preparations not elsewhere specified).

- Packaging components for cannabis beverages such as cans, bottles, and closures are traded under HS 3923 and HS 4819 separate from the beverage content itself.

Top Exporters (Supply Hubs)

- Canada: Leading exporter of cannabis-infused beverages and cannabinoid extracts due to its federally regulated adult-use cannabis market and established export channels for hemp-derived products.

- United States: Significant exporter of hemp-derived cannabinoid beverage ingredients into markets that permit low-THC products, supported by robust beverage and specialty drink manufacturing.

- European Union (Netherlands, Germany): Exporters of specialized cannabinoid formulations and functional beverage components oriented toward CBD markets in regulated jurisdictions.

- Australia: Exporter of cannabinoid isolates and formulated non-alcoholic cannabis beverages into Asia Pacific markets with legal frameworks for hemp products.

Top Importers (Demand Centres)

- European Union: Major importer of hemp-derived beverage inputs and finished low-THC cannabis drinks where permitted under national food regulations.

- United States: Imports premium cannabinoid extracts and proprietary beverage formulations used by domestic craft producers and branded entrants in states where cannabis beverages are legal.

Japan: Importer of hemp-derived CBD beverage inputs due to the regulatory allowance of non-psychoactive cannabinoids. - South Korea: Growing importer of functional cannabis beverage ingredients aligned with consumer interest in wellness drinks.

Typical Trade Flows and Logistics Patterns

- Finished cannabis beverages are shipped via containerized sea freight or air freight depending on perishability, regulatory clearance requirements, and volume.

- Due to legal complexity, many producers export cannabis beverage ingredients (e.g., CBD isolates) rather than finished intoxicating products to avoid import barriers.

- Bulk cannabinoid extracts are transported under controlled documentation, and finished products often require licensed carriers and compliance filings.

- Regional recipe blending and compliance facilities adapt imported inputs to local labeling, dosing, and legal standards before retail distribution.

Trade Drivers and Structural Factors

- Increasing legalization of cannabis and hemp products in key markets expands demand for cannabis-infused beverages.

- Consumer preference for functional drinks incorporating cannabinoids (e.g., relaxation, wellness benefits) supports cross-border sourcing.

- Regulatory divergence on THC content and cannabis legality shapes trade flows and classification strategies.

- Brand innovation cycles and partnerships between beverage companies and cannabis producers drive importation of proprietary formulations.

- Cost and quality differentials in cannabinoid extraction technologies influence sourcing patterns.

Regulatory, Quality, and Market-Access Considerations

- Cannabis beverages must comply with both alcohol and cannabis regulatory frameworks, which differ substantially across jurisdictions and affect tariffs, licensing, and labeling.

- Products may require specific permits or exemptions for THC/CBD content prior to customs clearance.

- Labeling standards covering cannabinoid content, health warnings, and age restrictions are mandatory in most markets.

- Quality control documentation and traceability from source plant material to finished beverage are often required for import approvals.

Government Initiatives and Public-Policy Influences

- Public health regulations governing cannabis products strongly influence market access and trade eligibility in many countries.

- Industrial hemp programs and agricultural policy encourage development of low-THC cannabis beverage ingredients.

- Trade facilitation frameworks and customs cooperation agreements impact the movement of cannabis-related products across borders.

Cannabis Beverages Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 16.5% |

| Market Size in 2026 | USD 1.92 Billion |

| Market Size in 2027 | USD 2.24 Billion |

| Market Size in 2030 | USD 3.54 Billion |

| Market Size by 2035 | USD 7.60 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cannabis Beverages Market Segmental Analysis

Type Analysis

The non-alcoholic segment led the cannabis beverages market in 2025, due to higher demand for healthier alcoholic alternatives, fueling the growth of the market. Higher demand for options that are suitable for social gatherings and options with controlled-release formulations also helps to fuel the growth of the market. Health-conscious consumers leading to higher demand for low-calorie, low-sugar, and gluten-free options also help to fuel the growth of the market. Drinks are helpful to aid high concentration, elevate mood, provide relief from pain, and also help to fuel the growth of the market.

The alcoholic segment is expected to grow in the foreseen period due to rising partnerships between existing cannabis firms and alcohol companies, which will help fuel the growth of the cannabis beverages market in the foreseen period. Higher demand for wellness and novelty cannabis-based products by health-conscious consumers also helps to fuel the growth of the market. Rising demand for cannabis tourism, discreet consumption methods, and product innovation with formulation technology that is water-soluble also helps to fuel the growth of the market.

Distribution Channel Analysis

The online retail segment led the cannabis beverages market in 2025, due to the rising legalization and availability of innovative cannabis-based products on various e-commerce platforms, which helped to fuel the growth of the market. Rising regulatory frameworks and the availability of such beverages at discounted prices also help to fuel the growth of the market. Easy availability of such products with regulated dosage, detailed information, complete privacy, and availability of a variety of options are some of the major factors for the growth of the market.

The specialty stores segment is expected to grow in the foreseeable period due to higher demand for such stores with the rising acceptance of cannabis for medical or recreational purposes. Higher demand for alcoholic and non-alcoholic cannabis-based products and easy availability of various other forms of products are also major factors for the growth of the cannabis beverages market in the foreseeable period. Higher demand for one-stop-shop stores providing a variety of products also helps to fuel the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Strategic Overview and Competitive Impact of Key Players in the Cannabis Beverages Market

- Aurora Cannabis Inc.: Aurora Cannabis Inc. is a vertically integrated cannabis producer with strong capabilities in cultivation, extraction, and derivative product development. In the cannabis beverages market, Aurora’s strategic impact lies in its formulation expertise and medical-grade quality standards, enabling participation in regulated, wellness-oriented drink formats. The company’s focus on premium and export-ready cannabis inputs supports beverage innovation in compliant markets.

- Aphria Inc.: Aphria Inc. has historically emphasized large-scale production efficiency and brand development within the adult-use cannabis segment. Its strategic relevance to cannabis beverages stems from cost-efficient cannabinoid supply and established distribution networks, which support scalable beverage partnerships. Aphria’s consumer-focused branding approach aligns well with mass-market, alcohol-alternative cannabis drinks.

- MedReleaf Corp.: MedReleaf Corp. is known for its pharmaceutical-grade cannabis production and strong medical positioning. In the cannabis beverages market, its impact is driven by high-quality cannabinoid inputs and clinical credibility, making it well-suited for functional and wellness beverage formulations. The company’s standards enhance trust in precision-dosed, health-positioned cannabis drinks.

- Cronos Group Inc.: Cronos Group Inc. plays a strategic role through its focus on innovation, cannabinoid science, and IP-driven product development. The company’s investment in advanced cannabinoid formulations and partnerships strengthens its position in next-generation cannabis beverages. Cronos is particularly influential in driving consistency, shelf stability, and scalable beverage-ready ingredients.

- GW Pharmaceuticals plc: GW Pharmaceuticals plc brings pharmaceutical rigor and cannabinoid research leadership to the broader cannabis ecosystem. While not a direct beverage brand player, its strategic impact lies in legitimizing cannabinoid-based consumption through clinical validation. This credibility indirectly supports the acceptance and regulatory progression of functional cannabis beverage applications.

- CannTrust Holdings Inc.: CannTrust Holdings Inc. operates across cultivation and cannabis-derived product segments, with a renewed emphasis on compliance and quality assurance. In cannabis beverages, the company’s role centers on reliable cannabinoid sourcing and reformulated product pipelines. Its repositioning supports beverage manufacturers seeking dependable, regulation-aligned supply partners.

- VIVO Cannabis Inc.: VIVO Cannabis Inc. focuses on premium cannabis production and medical-market expertise. Its strategic impact in cannabis beverages is linked to high-purity cannabinoid extraction and formulation suitability for wellness and low-dose drink products. The company supports brands targeting medically inclined and health-conscious consumer segments.

- Tilray: Tilray holds one of the strongest strategic positions in the cannabis beverages market due to its global footprint, beverage-alcohol partnerships, and CPG experience. The company actively bridges cannabis and traditional beverage industries, accelerating commercialization of cannabis-infused drinks. Tilray’s scale and brand reach make it a key market shaper.

- OrganiGram Holdings: OrganiGram Holdings is recognized for its indoor cultivation expertise and focus on product consistency. In cannabis beverages, its strategic value lies in reliable cannabinoid quality and formulation-ready extracts, supporting beverage innovation and private-label production. The company is well-positioned for microdosed and flavor-forward drink formats.

Segments Covered in the Report

By Type

- Alcoholic

- Non-alcoholic

By Distribution Channel

- Maa Merchandisers

- Specialty Stores

- Online Retail

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5980

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.