Carbon Steel Market Size to Worth USD 1.80 Trillion by 2035

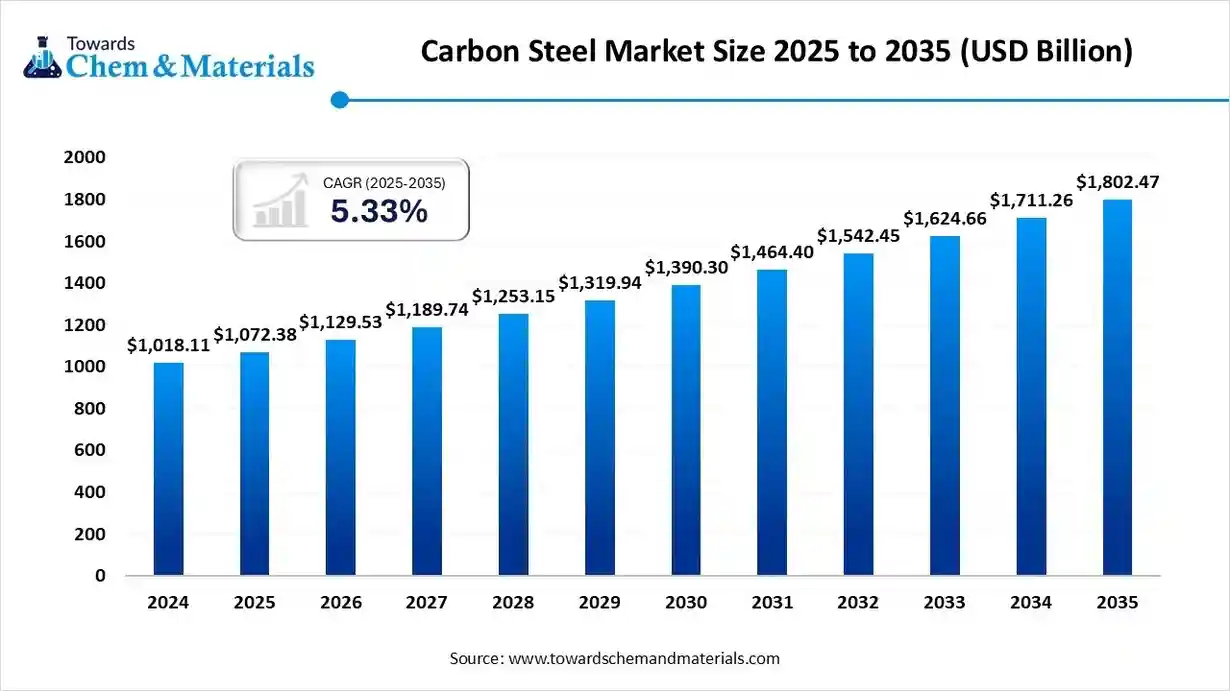

According to Towards Chemical and Materials, the global carbon steel market size is calculated at USD 1,072.38 billion in 2025 and is expected to be worth around USD 1,802.47 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.33% over the forecast period 2026 to 2035.

Ottawa, Nov. 11, 2025 (GLOBE NEWSWIRE) — The global carbon steel market size was valued at USD 1,072.38 billion in 2025 and is predicted to increase from USD 1,129.53 billion in 2026 is anticipated to reach around USD 1,802.47 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.33% over the forecast period from 2026 to 2035. Asia Pacific dominated the carbon steel market with a market share of 67.11% the global market in 2025. The growth of the carbon steel market is driven by increasing demand from infrastructure development, automotive production, and industrial manufacturing. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5673

What is Carbon Steel?

The carbon steel market represents a vital segment of the global metals industry, driven by strong demand from construction, automotive, manufacturing, and energy sectors. Carbon steel is a widely used alloy primarily composed of iron and carbon, with small amounts of other elements such as manganese, silicon, and copper.

Its properties, such as high strength, hardness, and wear resistance, vary depending on the carbon content, which is typically categorized as low, medium, or high carbon steel. Market growth is supported by rapid urbanization, infrastructure expansion, and industrialization in emerging economies, alongside technological advancements in steel production and recycling.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Carbon Steel Market Report Highlights

- The Asia Pacific carbon steel market held the largest share of 67.11% of the global market in 2025.

- By type, low carbon steel segment held the largest market revenue share of 57.19% in 2025.

- By Product Form, the flat products segment held the revenue share of 41.19% in 2025.

- By Process, the basic oxygen furnace segment held the revenue share of 66.11% in 2025.

- By End-Use, the flat construction & infrastructure segment held the revenue share of 37.43% in 2025.

- By Distribution Channel, the direct sales segment held the revenue share of 62.11% in 2025.

- By Grade, the AISI 1005-1020 series segment held the revenue share of 61.44% in 2025.

Major Government Initiatives for the Carbon Steel Industry?

- Production-Linked Incentive (PLI) Schemes – These provide financial incentives to attract investment and boost domestic manufacturing of high-value specialty steel products, reducing reliance on imports and encouraging advanced production.

- National Green Hydrogen Mission – This initiative promotes the production and use of green hydrogen as a clean energy source for steelmaking processes, replacing traditional fossil fuels to significantly reduce carbon emissions.

- Carbon Credit Trading Scheme (CCTS) – This market-based mechanism, implemented in some regions, incentivizes companies to reduce their greenhouse gas emissions by allowing the trading of carbon credits, thereby making emission reduction more cost-effective.

- Steel Scrap Recycling and Vehicle Scrapping Policies – These policies enhance the availability of domestically generated ferrous scrap by establishing an organized recycling framework, which promotes a circular economy and reduces the need for raw materials and energy-intensive primary production.

- Mandates for Government Procurement of Green Steel – Some governments are considering or implementing policies that require a certain percentage of steel used in public infrastructure and construction projects to be low-emission or “green” steel, creating a guaranteed market and driving demand for sustainable products

Type of Carbon Steel

Carbon steels are categorized by their carbon content and properties. The four main types include:

Low-Carbon Steel (Mild Steel)

Low carbon steel has 0.04–0.3% carbon content and is the most common grade of carbon steel. Mild steel is also considered low carbon steel as it is defined as having a low carbon content of 0.05–0.25%. Mild steel is ductile, highly formable, and can be used for automobile body parts, plates, and wire products. At the higher end of the low carbon content range, and with the addition of manganese of up to 1.5%, mechanical properties are suitable for stampings, forgings, seamless tubes, and boiler plates.

Medium-Carbon Steel

Medium carbon steel has a carbon range of 0.31–0.6% and a manganese range of 0.6–1.65%. This steel can be heat treated and quenched to further adjust the microstructure and mechanical properties. Popular applications include shafts, axles, gears, rails, and railway wheels.

High-Carbon Steel

High carbon steel has a carbon range of 0.6–1% with a 0.3–0.9% manganese content. Properties of high carbon steels make them suitable for use as springs and high-strength wires. These products cannot be welded unless a detailed program of heat treatment is included in the welding procedure. High carbon steel is used for edged tools, high-strength wires, and springs.

Ultra-High Carbon Steel

Ultra-high carbon steel has a carbon range of 1.25–2%, and are known as an experimental alloy. Tempering can produce a steel with a great hardness level, which is useful for applications like knives, axles, or punches.

Invest in Premium Global Insights Immediate Delivery Available (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5673

What Are the Properties of Carbon Steel?

Carbon steel is an umbrella term used to describe a wide variety of steel compositions. The mechanical properties of a specific grade from each carbon steel category (cold-rolled carbon steel) have been listed in Table 1 below using the AISI numbering convention:

Table 1: Carbon Steel Mechanical Properties

| Low Carbon (AISI 1020) | Medium Carbon (AISI 1040) | High Carbon (AISI 1095) | |

| Modulus of Elasticity (GPa) | 186 | 200 | 205 |

| Brinell Hardness | 121 | 201 | 293 |

| Yield Strength (MPa) | 350 | 415 | 570 |

| Ultimate Tensile Strength (MPa) | 420 | 620 | 965 |

| Elongation at Break (%) | 15 | 25 | 9 |

| Shear Modulus (GPa) | 72 | 80 | 80 |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Components of Carbon Steel?

Carbon steel consists of iron alloyed with small amounts of carbon (typically below 1 %, though it can be as high as 2 %), manganese, and silicon, with sulfur and phosphorus present mostly as impurities. Each element added to plain carbon steel plays a specific role in the final properties. For example, manganese is added primarily to help desulfurize steel. However, it can be added in slightly larger quantities, up to 1%, as a substitutional solute to help strengthen the steel. Silicon, on the other hand, is added primarily as a deoxidizer, and is primarily present as a residual element, though it can be added in small amounts for strengthening.

AI Revolutionizing the Carbon Steel Market: Driving Efficiency and Innovation

Artificial intelligence (AI) is transforming the carbon steel market by enhancing production efficiency, quality control, and supply chain management. Through predictive analytics and machine learning, AI enables real-time monitoring of furnace operations, reducing energy consumption and minimizing material waste. Smart automation systems are improving precision in steel processing, leading to higher-quality outputs and lower operational costs. Moreover, AI-driven demand forecasting and inventory optimization are helping manufacturers respond more effectively to market fluctuations, strengthening profitability and sustainability across the carbon steel value chain.

Carbon Steel Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 1,129.53 Biilion |

| Revenue forecast in 2035 | USD 1,802.47 Billion |

| Growth rate | CAGR of 5.33% from 2025 to 2036 |

| Base year for estimation | 2025 |

| Historical data | 2021 – 2025 |

| Forecast period | 2025 – 2035 |

| Quantitative units | Revenue in USD million/billion, Volume in kilotons, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Type, By Product Form, By Process, By Distribution Channel, By Grade, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key companies profiled | HBIS Group; Baosteel Group; ArcelorMittal; Nippon Steel Corporation; POSCO; AK Steel Corporation; NLMK; Evraz plc; United States Steel; JFE Steel Corporation |

Read More News : Stainless Steel Market Size to Worth USD 357.28 Billion by 2034

Read More News : Structural Steel Market Size to Surpass USD 188.63 Billion by 2034

Read More News : Metal Recycling Market Size to Worth USD 1,071.11 Billion by 2034

Read More News : Steel Rebar Market Size to Surpass USD 426.51 Billion by 2034

Read More News : U.S. Metal Recycling Market Size to Cross USD 121.04 Bn by 2034

What Are the Advantages of Carbon Steel?

Carbon steel is one of the most widely used steels due to a variety of advantages as listed below:

- Low Cost: Carbon steel consists of low-cost iron and carbon, making carbon steel significantly cheaper than alloy steel, for example. Alloy steel makes use of more expensive elements like nickel and chrome.

- Heat Treatable: Medium and high-carbon steels can have their properties significantly improved through various heat treatment regimens. Heat treatment can increase ultimate tensile strength, wear resistance, ductility, or hardness.

- Weldability: Carbon steels, especially low-carbon steel are readily weldable. Weldability can be further improved by using lower carbon grades and following appropriate procedures (preheating, stress relief heat treatment, etc) for the steel grade being welded.

The Key Carbon Steel Market Company Insights

Some of the key players operating in the market include ArcelorMittal, AK Steel Corporation, and others.

- ArcelorMittal, headquartered in Luxembourg City, is one of the world’s leading steel and mining companies. With operations in over 60 countries and industrial footprints in 18 countries, the company produced approximately 58 million metric tonnes of crude steel in 2024, making it the second-largest steel producer globally. The company offers a diverse range of products, including flat and long carbon steel products, tailored to meet the needs of different industries. The company has also introduced the XCarb initiative, encompassing ArcelorMittal’s reduced, low, and zero-carbon steelmaking activities.

- AK Steel Corporation, now a subsidiary of Cleveland-Cliffs Inc., is a prominent producer of flat-rolled carbon, stainless, and electrical steel products. The company’s operations are primarily in the U.S., with Indiana, Kentucky, Ohio, and Pennsylvania facilities. AK Steel specializes in producing hot and cold-rolled carbon steel products in the carbon steel segment, including coated and enameling steels. These products are essential for automotive manufacturers, especially for body panels and structural parts.

What are the Major Trends of the Carbon Steel Market?

- Decarbonization and Green Steel Initiatives – The industry is shifting towards sustainable practices like hydrogen-based production and increased scrap use to meet environmental regulations.

- Digital Transformation and Automation – Industry 4.0 technologies such as AI and automation are being integrated to optimize production, improve quality, and enhance efficiency.

- Development of Advanced High-Strength Steels – Innovations are producing lighter, more durable, and high-strength alloys to meet demands in the automotive and construction sectors.

- Growth in Emerging Markets and Infrastructure – Urbanization and government investments in large-scale infrastructure projects, especially in Asia, are driving increased carbon steel demand.

- Circular Economy and Recycling Focus – There is a growing emphasis on advanced recycling processes to reduce raw material reliance and lower energy consumption.

Market Opportunity

- Sustainable Infrastructure Shift

A major opportunity in the market lies in the growing global shift towards sustainable infrastructure and industrial development. Rising investments in smart cities, renewable energy projects, and modern transportation networks are driving the need for stronger and more durable carbon steel materials. Manufacturers are increasingly focusing on producing low-carbon and recycled steel to meet environmental regulations and corporate sustainability goals. Additionally, the use of advanced carbon steel in wind turbines, green buildings, and energy-efficient systems is opening new avenues for long-term market growth.

Limitations & Challenges

- Corrosion Susceptibility – Carbon steel rusts easily when exposed to moisture and oxygen, requiring constant maintenance and protective coatings to ensure durability.

- High Decarbonization Costs – The significant expense and technical challenges of transitioning to green production methods, such as hydrogen steelmaking and using renewable energy, hinder industry-wide efforts to reduce carbon emissions.

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5673

Carbon Steel Market Segmentation Insights

Type Insights

Which Type Leads the Carbon Steel Market?

By type, low carbon steel segment held the largest market revenue share of 57.19% in 2025, due to its excellent ductility, weldability, and cost-effectiveness, making it ideal for a wide range of applications. Its versatility in construction, automotive, and machinery manufacturing drove strong global demand. Additionally, the growing shift towards sustainable and easily recyclable materials further enhanced the adoption of low-carbon steel across multiple industry.

The medium carbon steel segment is growing fastest in the market, due to its balanced combination of strength, hardness, and toughness, making it suitable for both structural and mechanical applications. It was widely used in manufacturing automotive components, machinery parts, and industrial tools requiring higher wear resistance. Moreover, advancements in heat treatment and alloying techniques improved its performance, driving greater adoption across industrial and engineering sector.

Product Form Insights

What Made the Flat Products Segment Dominate the Carbon Steel Market in 2025?

By Product Form, the flat products segment held the revenue share of 41.19% in 2025, due to its extensive use in key industries such as automotive, construction, shipbuilding, and manufacturing. These products, including sheets, plates, and coils, offer superior strength, surface finish, and formability, making them ideal for structural and fabrication applications. Additionally, increasing demand for lightweight and high-performance materials in modern infrastructure and vehicle production reinforced the dominance of the flat products segment.

The pipes & tubes segment is projected to grow fastest in the market, driven by rising demand from the oil and gas, construction, and water infrastructure sectors. Carbon steel pipes and tubes offer excellent strength, corrosion resistance, and durability, making them suitable for high-pressure and structural applications. Furthermore, ongoing pipeline expansion projects and industrial modernization across emerging economies boosted the segment’s growth and market dominance.

Process Insights

Which Process Leads the Carbon Steel Market?

By Process, the basic oxygen furnace segment held the revenue share of 66.11% in 2025, due to its high production efficiency and ability to produce large volumes of high-quality steel at lower costs. Its widespread use in integrated steel plants enabled efficient conversion of molten iron into carbon steel with precise composition control. Additionally, the process’s scalability and compatibility with recycled scrap materials further strengthened its dominance in global carbon.

The electric arc furnace segment is growing fastest in the market, due to its energy efficiency, flexibility in production, and lower environmental impact compared to traditional methods. Its ability to utilize scrap steel as a primary raw material supports sustainability goals and reduced carbon emissions. Moreover, growing investments in modern EAF technologies and renewable energy integration boosted its adoption, solidifying its leadership in carbon steel production.

End-use Industry Insights

Which End-use Industry Dominated the Carbon Steel Market in 2024?

By End-Use, the flat construction & infrastructure segment held the revenue share of 37.43% in 2025, due to massive global investments in urban development, transportation networks, and industrial facilities. Carbon steel’s high strength, durability, and cost-effectiveness made it the preferred material for buildings, bridges, pipelines, and structural frameworks. Additionally, government-backed infrastructure programs and smart city projects further accelerated demand, solidifying this segment’s leadership in the market.

The automotive & transportation segment is the second-largest segment, leading the market, owing to the material’s excellent strength, formability, and cost-efficiency for vehicle manufacturing. Carbon steel was widely used in producing chassis, body panels, engine components, and structural parts, supporting large-scale automotive production. Furthermore, rising demand for commercial vehicles, electric mobility, and lightweight yet durable materials reinforced the segment’s dominance in the global market.

Distribution Channel Insights

What Made the Direct Sales Segment Dominate the Carbon Steel Market in 2025?

By Distribution Channel, the direct sales segment held the revenue share of 62.11% in 2025, due to strong relationships between manufacturers and end users, ensuring consistent supply and customized product solutions. This sales model allowed producers to offer competitive pricing, faster delivery, and better technical support to industries such as construction and automotive. Moreover, the growing preference for bulk orders and long-term contracts with large industrial clients reinforced the dominance of direct sales in the carbon steel brand.

The distributors & stockists segment is projected to grow fastest over the forecast period, driven by its ability to provide wide product availability and efficient distribution across diverse end-use industries. These intermediaries played a crucial role in meeting the needs of small and medium-scale buyers through flexible order quantities and quick delivery. Additionally, their established supply networks and value-added services, such as inventory management and customized processing, strengthened their dominance in the market.

Grade Insights

Which Grade Leads the Carbon Steel Market?

By Grade, the AISI 1005-1020 series segment held the revenue share of 61.44% in 2025, due to its excellent balance of strength, ductility, and machinability, making it ideal for a wide range of industrial applications. Its versatility in manufacturing automotive components, machinery parts, and structural materials drove high demand across multiple sectors. Furthermore, the series’ cost-effectiveness and ease of forming and welding made it a preferred choice for both manufacturers and end users.

The ASTM A36, S355JR segment is growing fastest in the market, due to their exceptional strength, formability, and weldability, making them ideal for structural and fabrication applications. Their widespread use in construction, heavy machinery, and transportation infrastructure fueled strong and consistent demand. Moreover, their cost efficiency and compliance with international quality standards reinforced their preference among global manufacturers and project developers.

Regional Insights

Asia Pacific Dominates the Carbon Steel Market: The Powerhouse of Global Steel Production and Consumption

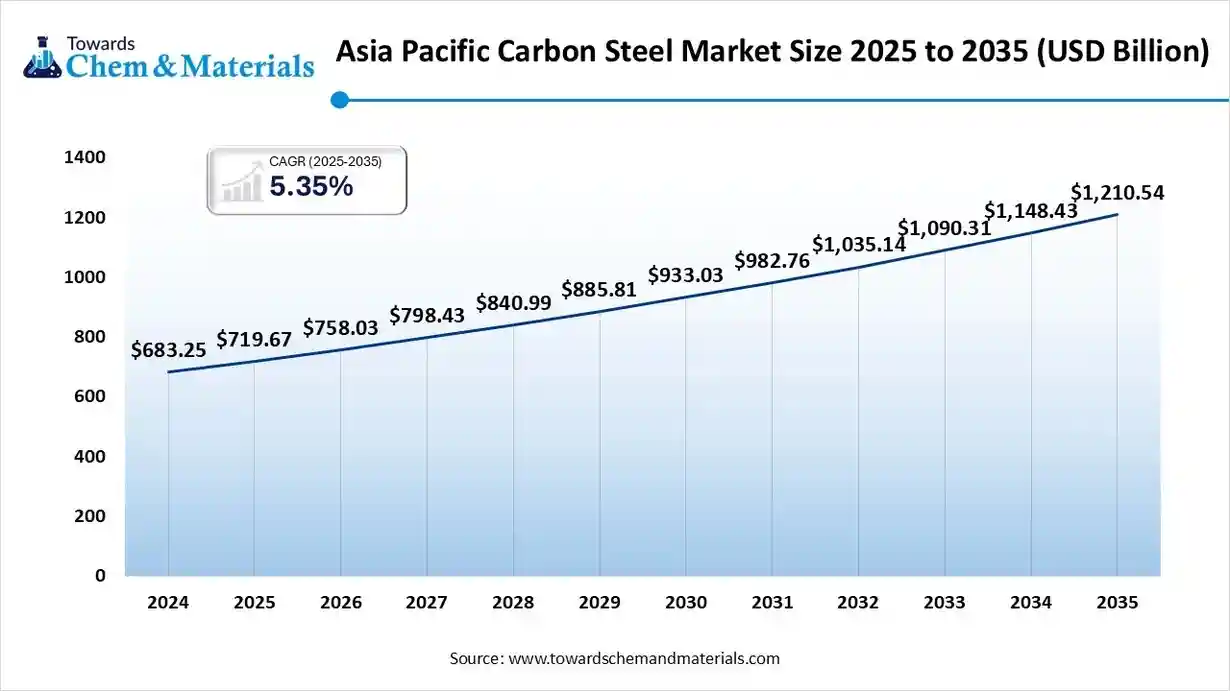

The Asia Pacific carbon steel market size was valued at USD 719.67 billion in 2025 and is expected to reach USD 1,210.54 billion by 2035, growing at a CAGR of 5.35% from 2026 to 2035. The Asia Pacific carbon steel market held the largest share of 67.11% of the global market in 2025.

Asia Pacific dominates the carbon steel market due to its massive industrial base, rapid urbanization, and strong infrastructure development across major economies like China, India, and Japan. The region benefits from abundant raw material availability, large-scale manufacturing capacity, and government investments in construction and transportation projects. Additionally, the rising demand for automobiles, machinery, and renewable energy infrastructure further strengthens Asia Pacific’s position as the central hub of global carbon steel production and consumption.

China Carbon Steel Market Trends

The China market is witnessing steady growth, driven by robust demand from the construction, automotive, and manufacturing sectors. Ongoing infrastructure development, urban expansion, and government initiatives like “Made in China 2025” are fueling large-scale carbon steel consumption. The country is also focusing on upgrading steel production with energy-efficient and low-emission technologies to meet sustainability goals.

The carbon steel market in North America is supported by robust demand from the construction, automotive, energy, and manufacturing sectors. The U.S. leads the region in production and consumption, with carbon steel playing a key role in infrastructure development projects such as bridges, highways, pipelines, and public buildings. The passing of the U.S. Infrastructure Investment and Jobs Act, which allocates over USD 1.2 trillion for infrastructure upgrades over the next decade, is expected to boost demand for carbon steel across multiple applications significantly. Growing investments in commercial construction, transport networks, and energy transmission lines in Canada and Mexico further contribute to a steady demand for structural and low-carbon steel products.

U.S. Carbon Steel Market Trends

The carbon steel market in the U.S. accounted for the largest market revenue share in North America in 2024. In the U.S., carbon steel is widely used in construction, automotive, and energy industries. Large infrastructure projects such as roads, bridges, airports, and rail systems continue to support steady demand. The automotive industry is another major user of carbon steel in the U.S., especially for making vehicle frames, engine parts, and exhaust systems. In 2024, over 10 million vehicles were produced in the country, and production is expected to grow in 2025. Electric vehicle manufacturing is also rising, with carbon steel still playing a key role in structural and internal components. At the same time, steelmakers in the U.S. are investing in cleaner technologies like electric arc furnaces to meet environmental goals and reduce emissions, ensuring the long-term sustainability of the domestic carbon steel industry.

Europe Carbon Steel Market Trends

The carbon steel market in Europe is anticipated to grow at the fastest CAGR during the forecast period. In the automotive sector, Europe is home to some of the world’s largest car manufacturers, including Volkswagen, BMW, Stellantis, and Renault. These companies continue to use carbon steel for vehicle chassis, structural parts, and engine components. The demand for strong yet affordable materials remains high with the ongoing shift toward electric vehicles. At the same time, European steel producers are under pressure to reduce emissions, leading to increased investment in green steel technologies and low-carbon production methods. These efforts are expected to shape the future of the carbon steel market in Europe while keeping it competitive and environmentally aligned.

Latin America Carbon Steel Market Trends

The carbon steel market in Latin America is seeing steady demand for carbon steel, mainly driven by infrastructure development, construction projects, and industrial expansion. Countries like Brazil, Mexico, Argentina, and Chile are investing in roads, bridges, railways, and public housing, which rely heavily on carbon steel for structural applications. Brazil, in particular, is the region’s largest producer and consumer of carbon steel, supported by a strong domestic steel industry and major construction programs. Mexico also shows solid demand, especially with the growth of its automotive manufacturing sector and cross-border industrial exports to the U.S.

Middle East and Africa Surge Ahead: The Fastest-Growing Frontier in the Global Carbon Steel Industry

The Middle East and Africa (MEA) region is emerging as the fastest-growing market for carbon steel, fueled by massive infrastructure projects, industrial expansion, and diversification efforts under national development plans like Saudi Vision 2030 and UAE Vision 2050. Rapid urbanization, population growth, and rising investments in oil and gas, construction, and renewable energy sectors are driving strong demand for durable and cost-effective steel solutions.

Saudi Arabia Carbon Steel Market Trends

Saudi Arabia dominates the regional market due to its massive infrastructure projects and strong industrial base driven by Vision 2030 initiatives. The country’s expanding construction, oil and gas, and manufacturing sectors generate substantial demand for high-quality carbon steel products. Additionally, significant investments in domestic steel production and advanced manufacturing technologies have strengthened Saudi Arabia’s position as the regional leader in the carbon steel market.

Top Companies in the Carbon Steel Market & Their Offerings:

- ArcelorMittal – provides a wide range of carbon steel profiles, plates, and seamless pipes for construction and energy applications.

- Nippon Steel Corporation – offers various carbon steel products such as hot-rolled and cold-rolled sheets, coated steel sheets, and pipes for use in vehicles, electrical equipment, and construction.

- POSCO – manufactures and supplies carbon steel sheets and plates, including low-emission products, for use in industries such as automotive and construction.

- Baosteel Group Corporation – offers a broad portfolio of carbon steel coils, plates, pipes, and bars, which are sold both domestically and internationally.

- HBIS Group Co., Ltd. – produces a variety of carbon steel products, such as plates, sheets, wire rods, and various steel sections for equipment manufacturing, rail transit, and construction.

- Tata Steel – offers carbon steel products like CR sheets, TMT steel bars for construction, and other industrial applications.

- United States Steel Corporation – provides carbon flat-rolled steel products, including hot-rolled and coated sheets with various protective finishes for applications in automotive, construction, and appliances.

- JFE Steel Corporation – specializes in carbon steel pipes, tubes, and wire rods, along with steel plates for various machine parts, automobiles, and construction.

- Nucor Corporation – produces a wide variety of carbon and alloy steel products, including merchant bar, rebar, beams, plate, and sheet steel, as North America’s largest recycler.

- Thyssenkrupp AG – offers flat carbon steels, such as hot-rolled and coated sheets, and specialized products like bluemint® steel, a brand for CO2-reduced steel.

More Insights in Towards Chemical and Materials:

- Green Steel Market : The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

- Carbon Black Market : The global carbon black market stands at 15.15 million tons in 2025 and is forecast to reach 21.83 million tons by 2034, expanding at a CAGR of 4.14% from 2025 to 2034.

- Stainless Steel Market : The global stainless steel market stood at approximately 14.19 million tons in 2025 and is anticipated to be likely to reach approximately 21.51 million tons in 2034. growing at a CAGR of 4.73% from 2025 to 2034.

- Steel Rebar Market : The global steel rebar market stands at 368.91 million tons in 2025 and is forecast to reach 530.10 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034.

- Structural Steel Market : The global structural steel market size was approximately USD 119.12 billion in 2025 and is projected to reach around USD 188.63 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 5.24% between 2025 and 2034.

- Flat Steel Market : The flat steel market size accounted for USD 687.55 billion in 2024 and is predicted to increase from USD 724.33 billion in 2025 to approximately USD 1,157.84 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034.

- Hot Rolled Coil (HRC) Steel Market : The global hot rolled coil (HRC) steel market size accounted for USD 355.42 billion in 2024, grew to USD 375.86 billion in 2025, and is expected to be worth around USD 621.65 billion by 2034, poised to grow at a CAGR of 5.75% between 2025 and 2034.

- Low-Carbon Construction Material Market : the global low-carbon construction material market size is calculated at USD 298.22 billion in 2025 and is expected to reach USD 601.63 billion by 2034, growing at a CAGR of 8.11% from 2025 to 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market : The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Bio-based Polycarbonate Market : The global bio-based polycarbonate market size accounted for USD 80.97 million in 2025 and is forecasted to hit around USD 182.5 million by 2034, representing a CAGR of 9.45% from 2025 to 2034.

- Specialty Carbon Black Market : The global specialty carbon black market size accounted for USD 3.52 billion in 2025 and is forecasted to hit around USD 8.54 billion by 2034, representing a CAGR of 10.35% from 2025 to 2034.

- Sodium Carbonate Market : The global sodium carbonate market size was valued at USD 13.03 billion in 2024 and is expected to hit around USD 16.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.60% over the forecast period 2025 to 2034.

- Carbon Dioxide Removal Market : The global carbon dioxide removal market size was valued at USD 733.77 million in 2024 and is expected to hit around USD 2,864.36 million by 2034, growing at a compound annual growth rate (CAGR) of 14.59% over the forecast period 2025 to 2034.

- Carbon Disulfide Market : The global carbon disulfide market size was valued at USD 148.51 million in 2024 and is growing to approximately USD 215.64 million by 2034, with a developing compound annual growth rate (CAGR) of 3.8% over the forecast period 2025 to 2034.

- Asia Pacific Steel Rebar Market : The Asia Pacific steel rebar market size was reached at USD 142.16 billion in 2024 and is expected to be worth around USD 248.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.76% over the forecast period 2025 to 2034.

- Europe Steel Rebar Market : The Europe steel rebar market size was valued at USD 145.11 billion in 2024 and is expected to hit around USD 224.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period from 2025 to 2034.

- U.S. Steel Rebar Market : The U.S. steel rebar market size was estimated at USD 7.31 billion in 2025 and is predicted to increase from USD 7.70 billion in 2026 to approximately USD 11.59 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034.

Carbon Steel Market Top Key Companies:

- AK Steel Corporation

- ArcelorMittal

- Baosteel Group

- Evraz plc

- HBIS Group

- JFE Steel Corporation

- Nippon Steel Corporation

- NLMK

- POSCO

- United States Steel

Recent Developments

- In February 2025, Gunung Raja Paksi Tbk (GRP), signed a multi-million-dollar deal with Primetals Technologies to become Asia’s first supplier outside China of zero carbon endless hot rolled coil (HRC) for export to Europe. The new production line is expected to be operational by 2027, coinciding with the European Union’s carbon border adjustment mechanism (CBAM) regime, positioning GRP as a leader in low-carbon steel manufacturing in Southeast Asia.

- In July 2025, Tata Steel announced starting of its UK low-carbon EAF-based steel making project and commence operations by 2027. Homegrown Tata Steel has gained all required approvals for its USD 1.5 billion project at Port Talbot.

Carbon Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Carbon Steel Market

By Type

- Low Carbon Steel (Mild Steel) (Carbon content ≤ 0.25%)

- Medium Carbon Steel (Carbon content 0.25% – 0.60%)

- High Carbon Steel (Carbon content > 0.60%)

- Ultra-High Carbon Steel (Carbon content > 1.00%)

By Product Form

- Flat Products

- Hot Rolled Coil (HRC)

- Cold Rolled Coil (CRC)

- Sheets & Plates

- Long Products

- Rebars

- Wire Rods

- Structural Sections

- Pipes & Tubes

- Seamless

- Welded (ERW, SAW)

- Bars

- Round Bars

- Square Bars

- Hexagonal Bars

By Process

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Shipbuilding

- Energy & Power

- Industrial Machinery

- Oil & Gas

- Consumer Goods & Appliances

- Railways & Metro

- Defense & Aerospace

By Distribution Channel

- Direct Sales (to OEMs/Industries)

- Distributors & Stockists

By Grade

- AISI/SAE 1005–1095 Series

- EN Standards (e.g., EN 10025 S275JR, S355JR)

- ASTM Grades (e.g., ASTM A36, AISI 1045, 1060)

- JIS Grades (e.g., SS400)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3900) https://www.towardschemandmaterials.com/checkout/5673

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.