This report provides an in-depth analysis of the Cell and Gene Therapy industry, highlighting key company revenues, regulatory approvals, and market trends. It has been compiled by Towards Healthcare, a sister firm of Precedence Research, offering valuable insights into the latest developments and financials in this rapidly advancing field.

Ottawa, Feb. 05, 2026 (GLOBE NEWSWIRE) — Cell and gene therapy (CGT) is rapidly advancing, with major players like Novartis, Gilead, and Bristol Myers Squibb leading the market through innovative treatments like CAR-T therapies and gene replacement therapies. Regulatory bodies like the FDA continue to approve new CGT products, reflecting a global push toward revolutionizing treatments for genetic disorders, blood cancers, and more.

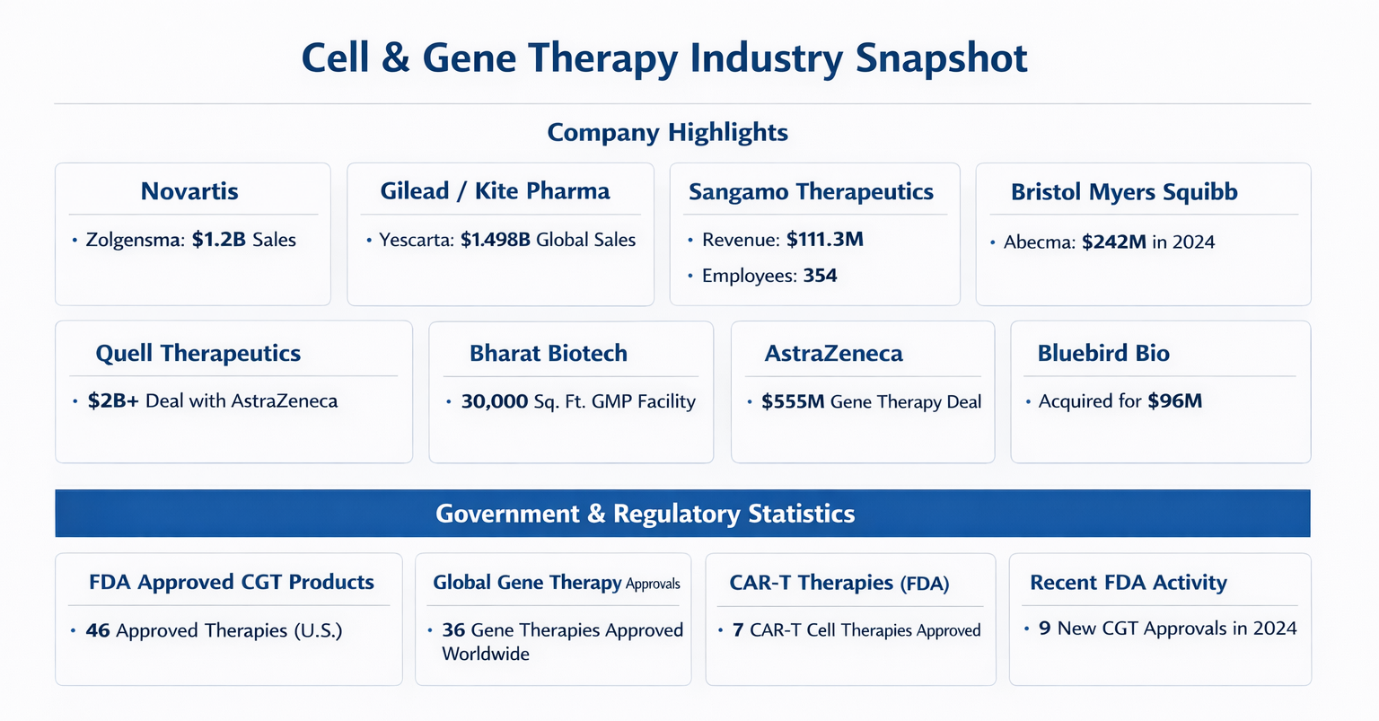

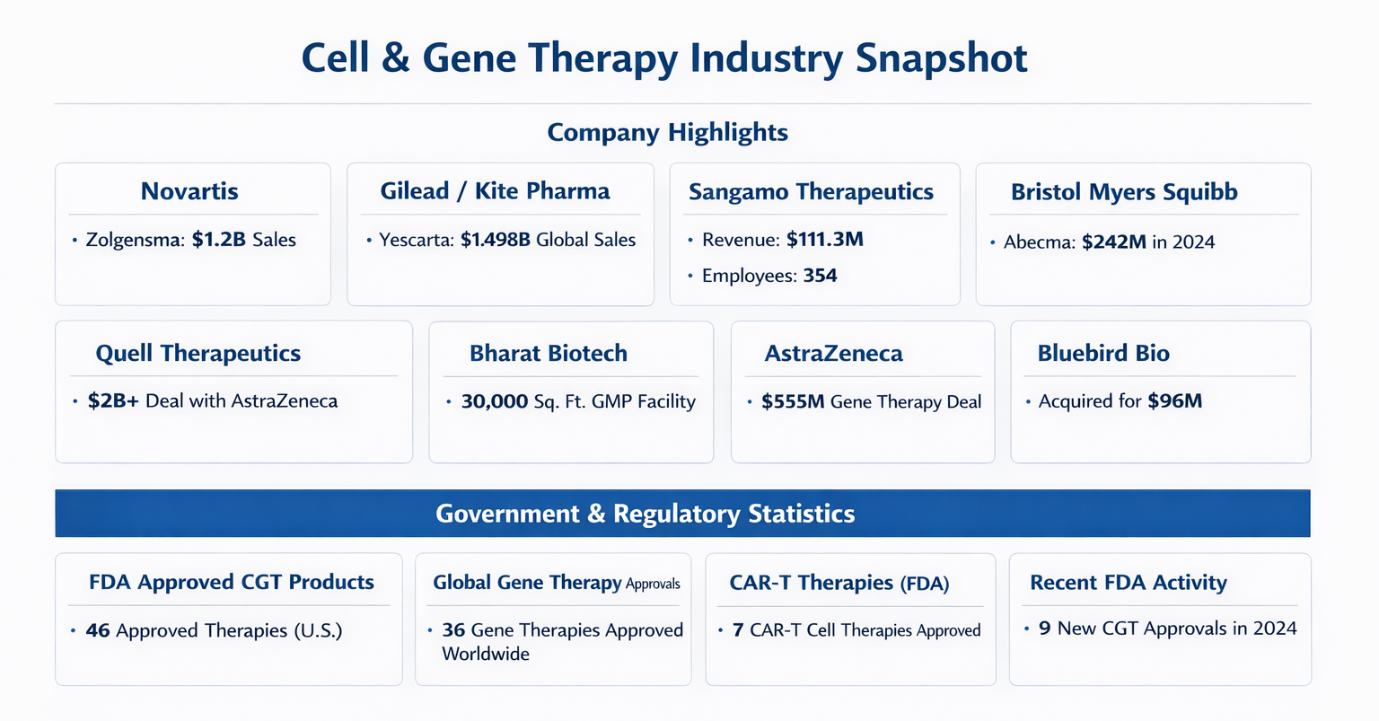

1) Companies Data — Cell & Gene Therapy: Key Metrics

| Company | Data/Metric |

| Novartis AG | Zolgensma gene therapy: $1.2B sales (last year); new expanded indication expected $510M by 2027. |

| Gilead Sciences / Kite Pharma | Yescarta CAR-T therapy: $1.498B global sales (top ranking). |

| Sangamo Therapeutics | 2022 Revenue: $111.3M; Assets: $562.5M; Equity: $295M; Employees: 354. |

| Bristol Myers Squibb / 2seventy bio | Acquisition: $286M cash for 2seventy bio; Abecma sales $242M (2024). |

| Quell Therapeutics | 2025 Turnover: £43.8M; partnership pipeline deal >$2B with AstraZeneca. |

| Bharat Biotech / Nucelion Therapeutics | New CRDMO setup for CGT manufacturing; 30,000 sq ft GMP facility commissioned. |

| AstraZeneca / Algen Biotechnologies | $555M deal for AI-discovered gene therapies. |

| AstraZeneca / EsoBiotec | Up to $1B acquisition in oncology cell therapies. |

| Bluebird Bio | $96M total deal value; royalties contingent on $600M in sales. |

| CRISPR & Gene Editing Companies | CRISPR Therapeutics, Intellia, Editas, Beam — major R&D players in CGT. |

Novartis AG – Zolgensma (Gene Therapy for SMA)

- Sales Revenue: $1.2B in the past year from Zolgensma, Novartis’ gene therapy product for spinal muscular atrophy (SMA).

- Approval Expansion: In 2024, Zolgensma received expanded approval, and its projected sales are estimated at $510M by 2027.

- Insight: Zolgensma is one of the highest-grossing gene therapies in the world. It is a gene replacement therapy that works to replace the SMN1 gene missing in patients with SMA, a severe neuromuscular disorder.

Gilead Sciences / Kite Pharma – Yescarta (CAR-T Therapy)

- Sales Revenue: Yescarta, a CAR-T cell therapy for cancers, achieved global sales of $1.498 billion.

- Insight: Yescarta is one of the leading products in the CAR-T cell therapy segment, treating blood cancers like diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma. It’s currently one of the top-selling therapies in the CAR-T category.

Sangamo Therapeutics

- Revenue (2022): $111.3 million.

- Assets: Sangamo holds assets worth $562.5M, with equity of around $295M.

- Employees: Sangamo employs around 354 staff members.

- Insight: Sangamo specializes in gene editing technologies and focuses on genetic therapies for rare diseases, such as hemophilia. Despite being an early-stage player compared to Gilead and Novartis, its revenue shows steady progress.

Bristol Myers Squibb / 2seventy bio – Abecma (CAR-T Therapy)

- Acquisition Deal: Bristol Myers Squibb acquired 2seventy bio for $286 million to enhance its portfolio in cell and gene therapies.

- Sales Revenue: Abecma, a CAR-T therapy used to treat multiple myeloma, recorded approximately $242M in sales in 2024, which shows a 32.4% decrease in sales over the previous period.

- Insight: While Abecma is showing a decrease in sales, Bristol Myers Squibb continues to strategically acquire companies to expand its CAR-T portfolio to treat blood cancers.

Quell Therapeutics

- Revenue (2025): £43.8 million.

- Partnership: Quell Therapeutics has secured a $2B deal with AstraZeneca to develop gene therapies.

- Insight: Quell is focused on cell therapy solutions for autoimmune diseases. The deal with AstraZeneca highlights a shift toward long-term strategic partnerships in the gene therapy field.

Bharat Biotech / Nucelion Therapeutics (India)

- Expansion: Bharat Biotech, a major Indian pharmaceutical company, opened a 30,000 sq. ft. GMP facility for manufacturing cell and gene therapies.

- Insight: Bharat Biotech’s expansion into gene therapies and its CGT manufacturing capabilities show India’s growing role in global gene therapy production.

AstraZeneca – Algen Biotechnologies

- Deal Size: AstraZeneca entered into a $555 million deal with Algen Biotechnologies to develop gene therapies for oncology.

- Insight: AstraZeneca’s continuous investments in oncology-focused gene therapies reflect the growing potential of AI-driven drug discovery and gene modification for cancer treatments.

Bluebird Bio

- Acquisition: Bluebird Bio was acquired for $96 million by Carlyle/SK Capital, with future royalties tied to product sales exceeding $600M.

- Insight: Bluebird Bio has specialized in gene therapies for genetic diseases and blood cancers. Its acquisition reflects the increasing consolidation within the gene therapy sector.

Other Gene Therapy Biotech (CRISPR, Intellia, Editas)

- Key Players: CRISPR Therapeutics, Intellia Therapeutics, Editas Medicine, and Beam Therapeutics are the major genetic editing players in the market.

- Insight: These companies are leveraging CRISPR-based technology to create novel genetic therapies targeting diseases such as sickle cell anemia and beta-thalassemia.

2) Government / Regulatory Data on Cell & Gene Therapies

| Regulatory Source | Data Point |

| U.S. FDA — OTAT | Approved Cell & Gene Therapy Products list by FDA. |

| Bioinformant FDA List | 46 FDA-approved cell & gene therapies in the U.S. |

| ASGCT 2025 Landscape | 36 gene therapies approved globally, 71 non-genetically modified cell therapies. |

| FDA Approval Trends | 9 new FDA CGT products in 2024, including cancer and genetic disorder targets. |

FDA – U.S. Regulatory Landscape

- The FDA’s Office of Tissues and Advanced Therapies (OTAT) oversees the approval of cell and gene therapy products.

- FDA Approved Products: Currently, there are about 46 FDA-approved cell and gene therapy products in the U.S.

- Insight: The FDA’s proactive role in granting approval for CGT products, such as CAR-T therapies and gene replacement therapies, is key in providing regulatory assurance to biotech companies.

Global Approvals ASGCT Landscape

- As of 2025, the American Society of Gene & Cell Therapy (ASGCT) reports 36 approved gene therapies globally and 71 non-genetically modified cell therapies.

- Insight: The global approval rates show the growing adoption of gene therapies, with the FDA leading in approvals, followed by regulatory bodies in Europe and Asia.

FDA Approval Trends (2024)

- In 2024, 9 new gene and cell therapies were approved by the FDA, including treatments for cancer, genetic disorders, and blood diseases.

- Insight: This highlights the accelerating pace at which gene and cell therapies are entering the market, reflecting their potential to treat diseases that were previously difficult to address.

FDA Approval Breakdown (CAR-T Therapies)

- The FDA has approved 7 distinct CAR-T products, such as Yescarta, Kymriah, and Abecma. These products are used to treat cancers like DLBCL and multiple myeloma.

- Insight: CAR-T therapies are a major area of focus in the CGT sector, with these products providing new treatment options for patients with difficult-to-treat cancers.

Global Regulatory Data on Non-Modified Cell Therapies

- There are approximately 9 approved products in the U.S. for non-genetically modified cell therapies, such as stem cell-based treatments.

- Insight: Non-modified cell therapies are becoming increasingly prominent in regenerative medicine, offering solutions for conditions such as cardiac repair and spinal injury.

3) Market Insights & Industry Overview

| Category | Count/Number |

| Total FDA-Approved CGT products (U.S.) | 46 products |

| Approved Gene Therapies (Global) | 36 products |

| CAR-T Therapies (FDA) | 7 distinct CAR-T products |

| Umbilical Cord Cell Therapies (U.S.) | 9 products |

| Therapy/Product | Reported Revenue / Scale |

| Zolgensma (Novartis) | $1.2B (gene therapy sales) |

| Yescarta (Gilead/Kite) | $1.498B (CAR-T sales) |

| Abecma (BMS/2seventy bio) | $242M (2024) |

- The FDA continues to approve cell and gene therapies at a rapid pace, which includes products for oncology, genetic disorders, and blood diseases.

- Companies like Novartis (Zolgensma), Gilead (Yescarta), and Bristol Myers Squibb (Abecma) have seen strong sales, while smaller biotech firms like Sangamo Therapeutics and Quell Therapeutics continue to raise funding for their pipelines.

- The global regulatory landscape is evolving, with an increase in international approvals in regions like Europe and Asia, reflecting the global push toward adopting gene editing technologies.

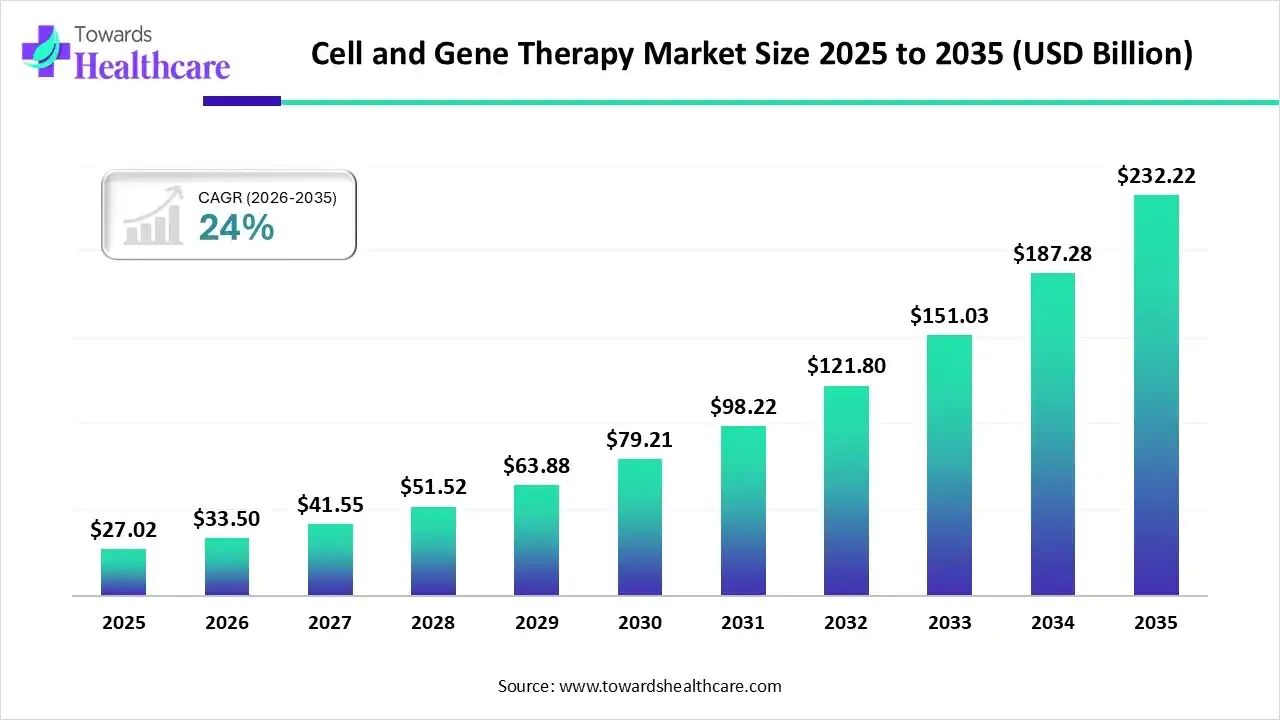

Cell and Gene Therapy Market Size, Shares and Statistical Data by 2035

The cell and gene therapy market size touched US$ 27.02 billion in 2025, with expectations of climbing to US$ 33.5 billion in 2026 and hitting US$ 232.22 billion by 2035, driven by a CAGR of 24% over the forecast period.

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5052

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.