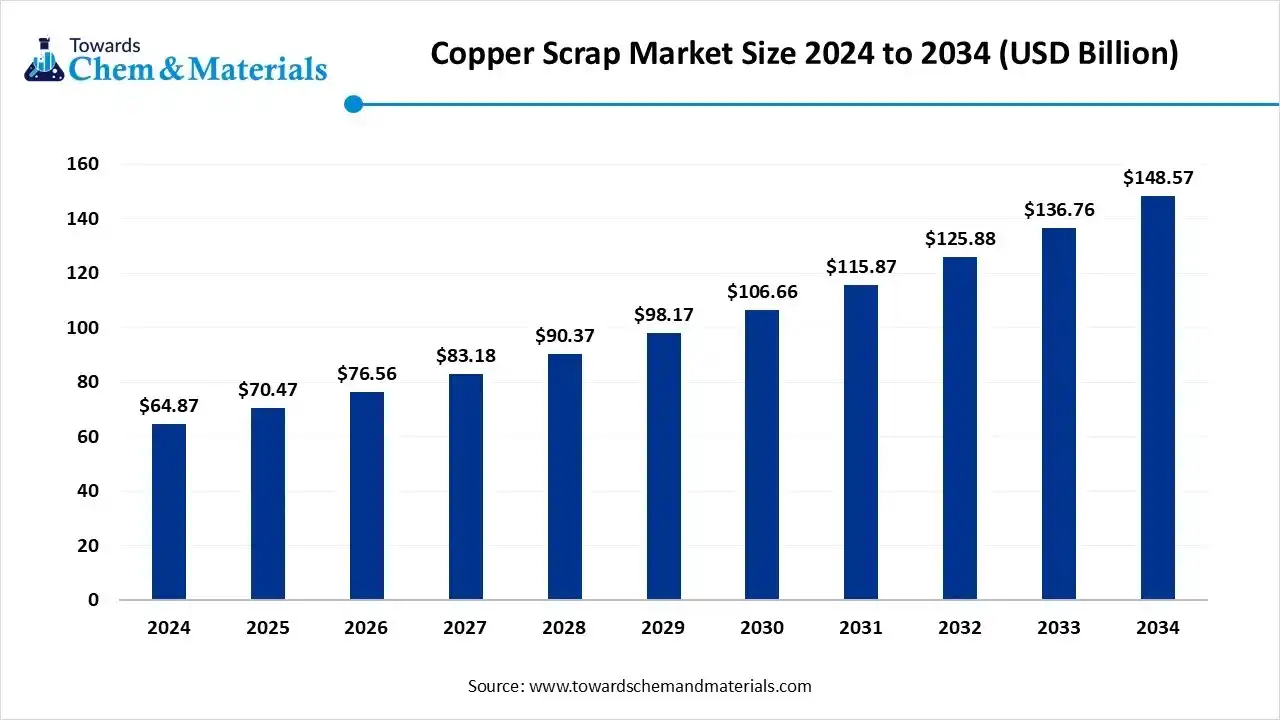

According to Towards Chemical and Materials Consulting, the global copper scrap market size is estimated at USD 70.47 billion in 2025 and is expected to hit around USD 148.57billion by 2034, growing at a compound annual growth rate (CAGR) of 8.64% over the forecast period from 2025 to 2034.

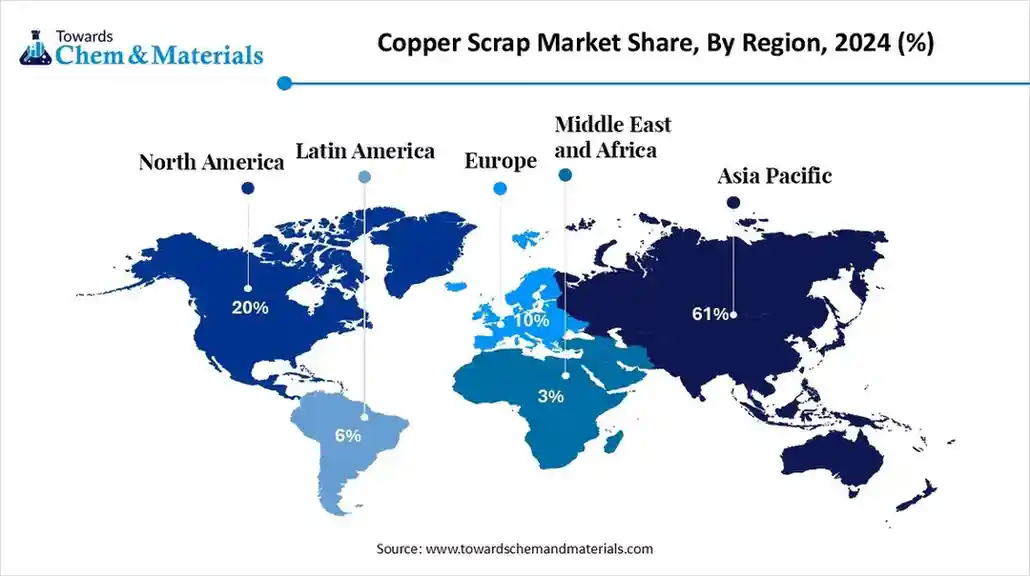

Ottawa, Nov. 14, 2025 (GLOBE NEWSWIRE) — The global copper scrap market size was valued at USD 64.87 billion in 2024 and is anticipated to reach around USD 148.57 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.64% over the forecast period from 2025 to 2034. Asia Pacific dominated the copper scrap market with a market share of 61% in 2024. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.towardschemandmaterials.com/download-sample/5938

What is Copper Scrap?

The copper scrap market is gaining momentum as industries shift towards sustainable and cost-efficient material sourcing. Growth is driven by rising demand from the electrical, electronics, and construction sectors, along with expanding renewable energy and electrification projects. Asia Pacific remains a key hub due to rapid industrialization and advanced recycling practices, while global efforts toward the circular economy and decarbonisation continue to strengthen market prospects.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Copper Scrap Market Report Highlights

- The Asia Pacific dominated the copper scrap market with the largest revenue share of 61% in 2024.

- By feed material, the old scrap segment led the market with the largest revenue share of over 52% in 2024.

- By grade, the #2 copper scrap segment led the market with the largest revenue share of over 32% in 2024.

- By application, the brass mills segment led the market with the largest revenue share of over 64% in 2024.

- By end-use, the electrical & electronics segment dominated the market with the revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period.

Major Applications of Copper Scraps:

- Electrical Wiring and Electronics: Recycled copper is refined to high purity for use in electrical conductors, power cables, motors, and printed circuit boards due to its excellent electrical conductivity.

- Plumbing and HVAC Systems: Copper scrap is a primary material for producing copper pipes, tubes, and fittings for residential and commercial water and heating/cooling systems because of its corrosion resistance.

- Alloy Production (Brass and Bronze): A significant portion of copper scrap is melted and combined with other metals (like zinc and tin) in brass and bronze mills to create a wide range of alloys used in hardware, valves, and industrial machinery.

- Building and Construction: Recycled copper is formed into sheets for architectural uses such as roofing and cladding, offering durability and a long-lasting, low-maintenance building material.

- Transportation and Renewable Energy: The automotive industry uses large amounts of recycled copper in wiring harnesses and heat exchangers, while its demand is growing significantly for components in electric vehicles (EVs), solar panels, and wind turbines.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5938

Copper Scrap Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 76.56 Billion |

| Revenue forecast in 2034 | USD 148.57 Billion |

| Growth rate | CAGR of 8.64% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2034 |

| Report coverage | Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Feed material, grade, application, end-use, region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Key companies profiled | Ames Copper Group; Aurubis AG; CMC; Glencore; Global Metals & Iron Inc.; JAIN RESOURCE RECYCLING PVT LTD.; KGHM METRACO S.A.; OmniSource; LLC.; Pascha GmbH.; Perniagaan Logam Panchavarnam Sdn Bhd; S.I.C. Recycling, Inc. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Key Copper Scrap Company Insights

Some of the key players operating in the market include Glencore, Aurubis, CMC and OmniSource LLC.

- Glencore plc is a global producer of primary metals, copper, energy products, and recycling. Copper ore is extracted and processed in South Africa, the Democratic Republic of Congo, and Australia. It has copper scrap facilities in North America. Its business is divided into two segments, namely metals & minerals and energy products. It has a global presence, buying and selling scrap on a large scale across geographies

- Aurubis is amongst the leading market players and is a global supplier of non-ferrous metals, with copper being its predominant product. It is also an established recycler. Its business is divided into two segments: multimetal recycling (MMR) and custom smelting & products (CSP). The company has a strong presence across Europe and a plant in the U.S. It caters to diverse industries such as construction, electrical, machinery production and plant engineering, transport, chemical and others

Global Metals & Iron Inc., Pascha GmbH., and Perniagaan Logam Panchavarnam Sdn Bhd are some of the emerging market participants.

- Global Metals & Iron Inc. is a privately owned family business and a provider of metal scrap. It has recycling facilities for ferrous and non-ferrous metals across the country. It mainly caters to the Canadian market, with exports to Canada and other regions when business conditions such as currency valuation is attractive. It also processes all grades of copper, bronze/ brass alloys to foundries, smelters, mills, and refiners

- Pascha GmbH is a non-ferrous scrap dealer that aims at providing high-quality processed scrap at cost-effective prices. It mainly provides services in Germany, and to other European markets and is a supplier of aluminum scrap, iron scrap, and copper scrap

What Are the Major Trends in The Copper Scrap Market?

- Increasing shift toward recycling and circular economy practices as industries emphasize sustainable sourcing of copper.

- Growing demand for copper scrap is driven by expansion in electrification, renewable energy infrastructure, and electric vehicles.

- Adoption of advanced sorting, recovery, and processing technologies to improve scrap quality and yield.

- The rising importance of feed material quality and regional supply chain improvements to meet the growing demand for recycled copper.

How Does AI Influence the Growth of the Copper Scrap Industry in 2025?

Artificial intelligence is transforming the copper scrap industry in 2025 by enhancing efficiency, accuracy, and sustainability across the recycling value chain. AI-powered sorting systems are improving material identification and separation, enabling recyclers to recover higher-quality copper with reduced contamination. Predictive analytics supported by AI helps optimize collection, pricing, and logistics by forecasting scrap availability and market fluctuations.

Additionally, AI-driven monitoring systems are aiding in operational automation, minimizing energy use and waste. Together, these advancements are making copper recycling more cost-effective and environmentally responsible, reinforcing the market’s growth momentum through smarter, data-driven processes.

Market Opportunity

Can Recycled Metals Power the Electrification Boom?

With growing demand from electric vehicles and renewable energy systems, recycled copper offers a sustainable solution to supply shortages. Companies investing in advanced recycling and purification can secure a strong position in green manufacturing supply chains.

Can Local Recycling Boost Supply Chain Strength?

Building regional recycling facilities helps reduce import dependence and logistics risks while supporting sustainability goals. Firms developing localized processing systems can benefit from resilient, eco-friendly supply networks.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5938

Copper Scrap Market Segmentation Insights

Feed Material Insights:

Why did the Old Scrap Segment Dominate the Industrial Copper Scrap Market?

The old scrap segment dominated the copper scrap market in 2024. This segment’s growth is attributed to the large availability of post-consumer copper waste from construction, electrical, and industrial applications. Old scrap plays a crucial role in meeting the rising demand for recycled copper, as industries increasingly adopt circular economy practices to reduce dependency on virgin materials.

The recovery of copper from discarded cables, pipes, and machinery has become a key source of sustainable raw material, supporting eco-friendly manufacturing and cost efficiency. With technological advancements in sorting and refining, the old scrap segment continues to strengthen its dominance across both developed and emerging economies.

The new scrap segment is projected to grow at the fastest rate in the copper scrap market during 2025-2034. The expansion is driven by increased recovery of copper waste generated during manufacturing and fabrication processes. New scrap, which includes offcuts, turnings, and defective materials, is easier to collect and recycle due to its high purity and minimal contamination.

As industries aim for resource optimization and cost reduction, manufacturers are integrating closed-loop recycling systems to reuse production waste effectively. This shift supports sustainability goals while creating efficient material flow, making new scrap one of the most dynamic areas of market growth.

Grade Insights:

Which Grade Segment Held the Dominating Share of the Copper Scrap Market in 2024?

The #2 copper scrap segment dominated the market in 2024. This segment benefits from its widespread use in multiple industrial processes where moderate copper purity levels are acceptable. It includes material such as unalloyed copper with minor impurities, which are cost-effective alternatives for secondary smelting and refining. As the demand for recycled copper increases across electrical, plumbing, and manufacturing sectors, #2 copper scrap remains a preferred choice for processors aiming to balance quality and cost.

Application Insights:

Which Application Segment Dominates the Copper Scrap Market?

The brass mills segment dominated the market in 2024. Brass mills utilize large quantities of copper scrap to manufacture rods, sheets, and tubes used across multiple industries. The segment’s dominance stems from strong demand in plumbing, electrical components, and industrial fittings. As sustainability goals become central to manufacturing strategies, brass mills have increased their reliability goals become central to manufacturing strategies, brass mills have increased their reliance on recycled copper to reduce energy consumption and production costs.

The wire rod mills segment is projected to grow at the fastest rate in the coming years. The segment’s growth is propelled by increasing copper usage in power transmission, electronics, and automotive applications. Wire rod mills rely heavily on high-quality recycled copper to produce conductors and cables essential for modern electrification. Growing investment in renewable energy grids and electric mobility is amplifying the need for efficient copper wiring.

End-Use Insights:

Why Does the electrical and electronics Segment Dominate the Copper Scrap Market?

The electrical and electronics segment dominated the market in 2024. This dominance is attributed to copper’s essential role in electrical conductivity, and its emphasis in sustainable production in the electronics industry has encouraged the adoption of recycled copper to meet environmental and cost goals. Recycling copper scrap for electronic applications not only conserves natural resources but also supports responsible manufacturing. As technology continues to evolve, the sector’s consistent demand keeps this segment at the forefront of the market.

The building and construction segment is anticipated to grow at the highest rate over the forecast period. This growth is fuelled by increasing urban development, infrastructure modernization, and sustainable construction practices worldwide. Copper scrap is widely used for plumbing, roofing, and wiring due to its durability and recyclability. Builders and developers are prioritizing recycled materials to lower carbon footprints and reduce raw material costs.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Why Is Asia Pacific Dominating the Copper Scrap Market?

The Asia Pacific copper scrap market size is valued at USD 42.99 billion in 2025 and is expected to surpass around USD 90.73 billion by 2034, expanding at a compound annual growth rate (CAGR) of 8.65% over the forecast period from 2025 to 2034.

The Asia Pacific region dominated the market in 2024. Driven by rapid industrialisation, urban expansion, and aggressive adoption of recycling technologies. In this region, governments and industries are increasingly prioritising sustainable sourcing and circular economy practices, which has boosted demand for recycled copper. As infrastructure upgrades, electric vehicle deployment, and grid modernisation gain momentum, the region’s appetite for scrap copper has grown substantially. The consolidation of collection, sorting, and processing operations within the Asia Pacific has further strengthened its leadership in the market.

China Copper Scrap Market Trends

China is playing a pivotal role in shaping the copper scrap market, thanks to its massive manufacturing base, large-scale infrastructure investments, and commitment to low-carbon sourcing of materials. The country’s expansion in electric vehicles, renewable energy systems, and construction activities has generated high demand for recycled copper feedstock.

North America Copper Scrap Market Trends

The copper scrap market in North America held a significant revenue share in 2024. Copper scrap recycling in North America is vital for addressing high copper demand for the redevelopment of aging infrastructure. Recycled copper scrapes are widely used in electric vehicles and constructions. The demand for copper scrap in the region is further driven by the inclination to develop a green economy. The sustainable nature of copper scraps is crucial for minimizing the carbon footprint, making it a substitute for primary metal production.

U.S. Copper Scrap Market Trends

The copper scrap market in U.S. is expected to be driven by the rising clean energy, electrification, and gradual regularization of recycling value chain. As a result of growing demand for copper scrap and usage of their products in various applications, many market players are adopting strategic initiatives to stay ahead in a competitive market. Amongst them are Ames Copper Group, Aurubis, Igneo, and Wieland.

The Canada copper scrap market is expected to grow at the fastest CAGR during the forecast period, as copper manufacturing and recycling metal forms a key contributor to the country’s economy. According to the government of Canada, in 2022 over 510,782 tonnes of copper was produced from the Canadian mines, more than half of it originated from British Columbia. In 2022, Canada’s exports of copper and copper-based products were estimated at USD 9.4 billion. Canada has a robust copper recycling industry, with significant amounts recovered in the Quebec-based (Rouyn-Noranda and Montréal) smelter and refineries. High exports and domestic recycling refineries are paving landscape for the market expansion.

Europe Copper Scrap Market Trends

The copper scrap market in Europe directly contributes to the EU economic growth as the metal supply in the region primarily depends on the recycling of copper scrap. According to the European Recycling Industries’ Confederation (EuRIC), 44% of EU copper demand is met by recycling scrap copper. Furthermore, since recycling metals is highly labor intensive, it has created a wide variety of job opportunities in Europe, which includes the collection and sorting of end-of-life products that contain metals.

The Spain copper scrap market is anticipated to witness the fastest CAGR during the forecast period, owing to more inclination towards recyclability, EVs, and renewable energy. Recovery resilience program (RRP) is anticipated to be implemented as a priority, and the scrap sector is hoping to address its challenges of increasing prices and availability, which is currently met primarily through imports. It is a significant importer of copper scrap, primarily from France, Portugal, UK, Italy, and Germany.

The copper scrap market in UK exports increased by 1.62% between November 2022 and November 2023, which is a key contributor to the country’s economy, according to Other Eligible Communities (OEC). Despite the moderate fragmentation of the UK market, EMR and Sims Group UK account for a major revenue share. Furthermore, the strong manufacturing presence, particularly in the West Midlands is driving the profitability of the marketgrowth.

Central & South America Copper Scrap Market Trends

The copper scrap market in Central & South America is anticipated to witness the significant CAGR from 2025 to 2034. The growth can be attributed to the efforts undertaken by the International Copper Association (ICA) to copper mining, smelting, refining, and recycling in this region by 2050.

The Brazil copper scrap market growth can be attributed to the flourishing energy generation industry and surging investments by automobile manufacturers in Brazil. It is a predominant producer of copper ore and is home to many important mines. In terms of the closed-loop model for metal, Brazil is a front-runner in terms of recycling policy and initiatives. Implementation of government initiatives and policies will fuel the adoption of a circular economy for waste management in the country. This has encouraged key end-use industries of copper, primarily automotive companies, to set up a base in the country.

Why Is the Middle East and Africa Set to Grow the Fastest in The Copper Scrap Market?

The Middle East and Africa region is projected to expand at the fastest rate in the market, thanks to burgeoning infrastructure development, heightened adoption of renewable energy systems, and rising electric vehicle penetration, which drive demand for recycled copper. Additionally, expansion of power grid upgrades and construction in several countries within the region is reinforcing the need for copper scrap as a sustainable feedstock for material supply chains.

Saudi Arabia Copper Scrap Market Trends

In Saudi Arabia, industrial expansion, construction activity, and national recycling initiatives are driving the copper scrap market forward, positioning the country as an important player within the regional growth story. The country’s strategic push to integrate recycled materials into circular economy goals and develop domestic processing capacity further underpins the attractiveness of the scrap segment.

Top Companies in the Copper Scrap Market & Their Offerings:

- Glencore sources and processes complex copper scrap globally, including e-waste, to produce high-purity refined copper cathodes at its smelters and refineries.

- Global Metals & Iron Inc. is a non-ferrous scrap metal trader involved in the collection, processing, and sale of various metals, including copper scrap.

- JAIN RESOURCE RECYCLING PVT LTD. processes various copper scraps (such as wires and e-waste) at its Indian facilities to produce copper ingots and granules for B2B applications.

- KGHM METRACO S.A. trades copper-bearing materials, including scrap, which is integrated into KGHM’s smelters to produce copper anodes, cathodes, and wire rods.

- OmniSource, LLC. is a substantial metal recycling company involved in the collection, processing, and resale of ferrous and non-ferrous scrap metals, with copper being a key non-ferrous material it handles.

- Pascha GmbH specializes in the international trade of a wide range of ferrous and non-ferrous scrap metals, supplying the European market with various grades of copper scrap.

- Perniagaan Logam Panchavarnam Sdn Bhd is a Malaysian-based company that trades and recycles various metal scraps, with copper scrap forming a core part of its non-ferrous metal offerings to the market.

- S.I.C. Recycling, Inc. provides comprehensive recycling services for industrial and commercial clients, focusing on the processing and waste management of various scrap materials, including copper.

More Insights in Towards Chemical and Materials:

- Copper Market : The global copper market is expected to reach a volume of approximately 26.93 million tons in 2025, with a forecasted increase to 38.86 million tons by 2034, growing at a CAGR of 4.16% from 2025 to 2034.

- Copper Wire Market : The global copper wire Market is expected to reach a volume of approximately 23.15 million tons in 2025, with a forecasted increase to 36.81 million tons by 2034, growing at a CAGR of 5.29% from 2025 to 2034.

- Copper Foil Market : The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034.

- U.S. Copper Market : The global copper scrap market size is calculated at USD 70.47 billion in 2025 and is expected to reach USD 148.57 billion by 2034, growing at a CAGR of 8.64% from 2025 to 2034.

- Asia-Pacific Copper Market : The Asia-Pacific copper market size is estimated at USD 192.92 billion in 2025 and is expected to hit around USD 344.08 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034.

- Europe Copper Market : The Europe copper market size is calculated at USD 50.45 billion in 2024, grew to USD 53.1 billion in 2025, and is projected to reach around USD 84.16 billion by 2034. The market is expanding at a CAGR of 5.25 between 2025 and 2034.

Copper Scrap Market Top Key Companies:

- Ames Copper Group

- Aurubis AG

- CMC

- Glencore

- Global Metals & Iron Inc.

- JAIN RESOURCE RECYCLING PVT LTD.

- KGHM METRACO S.A.

- OmniSource, LLC.

- Pascha GmbH.

- Perniagaan Logam Panchavarnam Sdn Bhd

- S.I.C. Recycling, Inc.

Recent Developments

- In October 2025, the international Copper Study Group reports that slower production growth has shifted the refined copper market toward a deficit in 2026, enhancing the value of scrap cropper as a strategic input for supply chains.

- In February 2025, the European copper institute and other European fabricators have urged the European commission to tighten export controls on copper scrap to prevent supply leaks and protect local secondary metal industries.

Copper Scrap Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Copper Scrap Market

- Feed Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2034)

- Old Scrap

- New Scrap

- Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2034)

- Bare Bright

- #1 Copper Scrap

- #2 Copper Scrap

- Other Grades

- Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2034)

- Wire Rod Mills

- Brass Mills

- Ingots Makers

- Other Applications

- End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2034)

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation Equipment

- Consumer and General Products

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 – 2034)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5938

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.