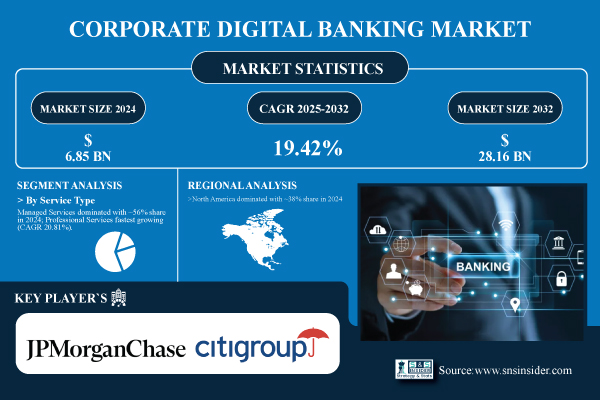

Corporate Digital Banking Market Size to Reach USD 28.16 Billion by 2032, Driven by Rising Adoption of Secure and Real-Time Financial Solutions

The growth of the corporate digital banking sector is propelled by increasing demand for secure, real-time, and seamless banking solutions, supported by digital transformation initiatives, AI-driven automation, enhanced customer experiences, and efficient cash and treasury management.

Austin, Oct. 07, 2025 (GLOBE NEWSWIRE) — The global Corporate Digital Banking Market was valued at USD 6.85 billion in 2024 and is expected to reach USD 28.16 billion by 2032, growing at a CAGR of 19.42% from 2025-2032.

Corporate digital banking is changing as a result of the growing need for AI-driven solutions and advanced data analytics, which provide businesses with useful financial information. AI is used by businesses to forecast cash flows, identify fraud, and examine spending trends in order to improve planning. Treasurers and CFOs may effectively manage liquidity, maintain compliance, and match banking operations with company strategy with the help of advanced analytics. The increasing amount of financial data necessitates the use of clever digital instruments since manual monitoring is no longer feasible. Banks provide corporates with more individualized services through automation and predictive models, which increases adoption and trust. The rise of the digital banking market is greatly accelerated by this trend.

Download PDF Sample of Corporate Digital Banking Market @ https://www.snsinsider.com/sample-request/8349

Key Players:

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Citigroup Inc.

- HSBC Holdings plc

- BNP Paribas

- Barclays plc

- Deutsche Bank AG

- UBS Group AG

- Goldman Sachs Group, Inc.

- Morgan Stanley

- Royal Bank of Canada

- Toronto-Dominion Bank

- Mitsubishi UFJ Financial Group, Inc.

- Sumitomo Mitsui Financial Group, Inc.

- ING Group

- Credit Suisse Group AG

- Société Générale S.A.

- Banco Santander, S.A.

- Standard Chartered PLC

Corporate Digital Banking Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 6.85 Billion |

| Market Size by 2032 | USD 28.16 Billion |

| CAGR | CAGR of 19.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Cash Management, Payments, Liquidity Management, Trade Finance, Others) • By Service Type (Professional Services, Managed Services) • By Deployment Mode (On-Premises, Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) • By End-User (BFSI, Retail, Manufacturing, IT and Telecommunications, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on Corporate Digital Banking Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8349

Segmentation Analysis:

By Service Type, Managed Services Dominated with 56% Share in 2024; Professional Services is the Fastest Growing Segment with a CAGR of 20.81%

Managed Services segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as enterprises preferred outsourcing to reduce operational costs, enhance efficiency, and ensure secure banking processes. Professional Services segment is expected to grow at the fastest CAGR over 2025-2032 due to rising demand for consulting, implementation, and integration expertise.

By Organization Size, Large Enterprises Led with a Share of 65% in 2024; Small and Medium Enterprises is the Fastest-growing Segment at a CAGR of 20.75%

Large Enterprises segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as they require complex, scalable solutions for global operations. Small and Medium Enterprises segment is expected to grow at the fastest CAGR over 2025-2032 driven by their increasing shift toward affordable, cloud-based digital banking solutions.

By Solution, Payments Segment Led the Market with a Share of 31% in 2024; Liquidity Management Segment is Growing at a CAGR of 22.19%

Payments segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as digital transactions, real-time processing, and cross-border payments became critical. Liquidity Management segment is expected to grow at the fastest CAGR from 2025 to 2032 as corporations increasingly focus on optimizing cash flow and working capital.

By End-User, in 2024, the BFSI Segment Dominated with a 30% Share in 2024; Retail Segment is Growing the Fastest at a CAGR of 22.17%

BFSI segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as financial institutions rapidly digitized operations to improve efficiency, customer experience, and compliance. Retail segment is expected to grow at the fastest CAGR from 2025 to 2032 driven by rising demand for personalized digital services, seamless payments, and loyalty integration.

North America Dominated the Market with a Share of 38% in 2024; Asia Pacific is Projected to Grow with the Fastest CAGR of 21.47% Over 2025-2032

North America dominated the Corporate Digital Banking Market with the highest revenue share in 2024 due to early adoption of advanced financial technologies, strong digital infrastructure, and presence of leading banking institutions. Asia Pacific is expected to grow at the fastest CAGR during 2025-2032 driven by rapid digitalization, increasing smartphone penetration, and rising adoption of cloud-based banking solutions.

Recent Developments:

- 2025 — JPMorgan Chase and Coinbase launched a strategic partnership enabling direct bank-to-wallet transfers, Ultimate Rewards redemption for crypto funding, and Chase credit card usage on Coinbase streamlining crypto access for mutual customers.

- 2025 — Citigroup continues its global rollout of CitiDirect® Commercial Banking, now serving over 57% of its commercial clients. The AI-enhanced platform delivers seamless account access, proactive guidance, streamlined KYC renewals, and ERP integration.

Buy Full Research Report on Corporate Digital Banking Market 2025-2032 @ https://www.snsinsider.com/checkout/8349

Exclusive Sections of the Report (The USPs):

- PRICING & COST STRUCTURE ANALYSIS – helps you understand the average service fees, regional pricing variations, and forecasted price trends influenced by AI, blockchain, and API integration, guiding strategic pricing and ROI-based decisions.

- ADOPTION & INTEGRATION METRICS – helps you assess the digital maturity of corporate clients through platform adoption rates, ERP/treasury integration levels, and multi-service usage trends, enabling identification of high-growth user segments.

- OPERATIONAL EFFICIENCY INDEX – helps you evaluate improvements in processing speed, automation levels, and manual process reduction, offering insights into cost savings and productivity gains achieved through digital transformation.

- SECURITY & COMPLIANCE BENCHMARKS – helps you gauge corporate compliance with regional/international regulations, adoption of multi-factor authentication, and AI-driven fraud detection, ensuring risk management and trust-building.

- TECHNOLOGICAL IMPACT FORECAST – helps you track future cost and efficiency shifts driven by emerging technologies like AI, blockchain, and APIs, providing a forward-looking view of innovation-led competitiveness.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.