Rising Disease Prevalence, Escalating Healthcare Costs, and Digital Distribution Channels Accelerate Global Adoption of Critical Illness Coverage.

Austin, United States, Feb. 12, 2026 (GLOBE NEWSWIRE) — Critical Illness Insurance Market Size & Growth Analysis:

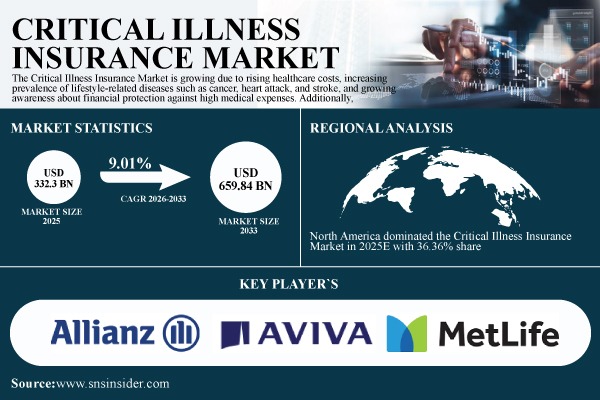

According to SNS Insider, the Critical Illness Insurance Market size was valued at USD 332.3 Billion in 2025E and is projected to reach USD 659.84 Billion by 2033, growing at a CAGR of 9.01% during 2026-2033.

The market growth is mainly driven by the rising healthcare expenditure, the rising prevalence of lifestyle diseases such as cancer, heart attack, and stroke, and growing consumer awareness about financial protection against expensive medical procedures. The increasing use of online distribution channels and the inclusion of critical illness insurance in employer-sponsored benefit plans are also boosting market penetration in developed and developing countries.

Get a Sample Report of Critical Illness Insurance Market: https://www.snsinsider.com/sample-request/8914

Market Size and Forecast:

- Market Size in 2025E USD 332.3 Billion

- Market Size by 2033 USD 659.84 Billion

- CAGR of 9.01% From 2026 to 2033

- Base Year 2024

- Forecast Period 2026-2033

- Historical Data 2021-2024

The U.S. Critical Illness Insurance Market size was valued at USD 90.15 Billion in 2025E and is projected to reach USD 173.54 Billion by 2033, registering a CAGR of 8.59% during 2026-2033. The market in the U.S. is fueled by the rising cost of hospitalization, the rising number of chronic and non-communicable diseases, and the rising preference for supplemental health insurance. The growing number of employer-sponsored insurance plans that include critical illness benefits, as well as an increased awareness of the benefits of a lump-sum payout upon diagnosis, are also fueling the growth of the market in the United States.

Growing Disease Prevalence and Technological Innovations Fuel the Critical Illness Insurance Market

The rising incidence of critical diseases like cancer, cardiovascular diseases, stroke, and organ failure is fueling the demand for financial protection solutions. Critical illness insurance provides a lump sum payment upon diagnosis, which helps policyholders cope with treatment, rehabilitation, and lost income. Increasing out-of-pocket spending on healthcare globally continues to boost the demand for additional coverage beyond conventional health insurance.

Concurrently, the digital revolution in the insurance industry is improving the efficiency and effectiveness of operations. The use of artificial intelligence, automated underwriting, and digital claims processing systems is improving the transparency and speed of claims processing. Government and insurer-led awareness campaigns, especially in developing countries, are further boosting insurance penetration and fueling market growth.

Awareness and Regulatory Complexity Hinder Market Growth

Despite robust market growth prospects, a lack of awareness about policy benefits and exclusions persists, especially in rural and lower-income communities. Lack of standard definitions of covered illnesses among insurers can cause claim disputes and delayed payments, impacting consumer confidence.

Furthermore, strict regulatory environments and dynamic regulatory requirements continue to raise operational costs for insurers. Complex documentation processes and apprehensions about claim denial further hinder widespread adoption, and the lack of a standardized global coverage definition further hinders market standardization across geographies.

Need Any Customization Research on Critical Illness Insurance Market, Enquire Now: https://www.snsinsider.com/enquiry/8914

Segmentation Analysis:

By Policy Type

Individual dominated with 63.55% in 2025E due to higher consumer awareness, flexible premium options, and increasing preference for personalized financial protection plans. Group is expected to grow at the fastest CAGR of 9.71% from 2026 to 2033 driven by expanding employer-sponsored health benefits, corporate wellness initiatives, and insurers partnering with organizations to provide affordable collective coverage options.

By Coverage Type

Cancer dominated with 34.68% in 2025E due to its high global incidence rate and growing awareness of cancer’s financial impact on patients and families. Heart Attack is expected to grow at the fastest CAGR of 9.63% from 2026 to 2033 driven by increasing cardiovascular disease prevalence, sedentary lifestyles, and rising demand for early financial protection against heart-related conditions.

By Distribution Channel

Insurance Brokers/Agents dominated with 39.75% in 2025E owing to their strong customer trust, personalized advisory services, and wide distribution networks that simplify complex policy structures. Online Platforms is expected to grow at the fastest CAGR of 10.35% from 2026 to 2033 driven by rising digitalization, AI-based policy comparison tools, and consumer preference for seamless, quick, and transparent policy purchases.

By End-User

Individuals dominated with 68.45% in 2025E due to rising health awareness, increasing lifestyle-related diseases, and growing demand for financial protection against critical medical expenses. Corporates / Employers is expected to grow at the fastest CAGR of 9.72% from 2026 to 2033 as organizations increasingly include critical illness coverage in employee benefit programs to enhance workforce well-being, retention, and productivity in a competitive job environment.

Regional Insights:

North America dominated the Critical Illness Insurance Market in 2025E with 36.36% share, driven by high healthcare costs, strong consumer awareness, and well-established insurance infrastructure.

The Asia-Pacific Critical Illness Insurance Market is expected to grow at the fastest CAGR of 9.85% from 2026 to 2033, driven by rapid urbanization, improving healthcare infrastructure, and rising awareness of financial protection against severe diseases.

Major Critical Illness Insurance Market Companies Analysis Listed in the Report are

- Aegon N.V.

- Aflac Incorporated

- Allianz SE

- American International Group, Inc. (AIG)

- Aviva plc

- AXA Group

- Bajaj Allianz Life Insurance Co. Ltd.

- Cigna Corporation

- China Life Insurance Company Limited

- Dai‑ichi Life Holdings, Inc.

- Legal & General Group plc

- Manulife Financial Corporation

- MetLife, Inc.

- Ping An Insurance (Group) Company of China, Ltd.

- Prudential plc

- Sun Life Financial Inc.

- UnitedHealth Group Incorporated

- Zurich Insurance Group Ltd.

- China Pacific Insurance (Blue) – China Pacific Insurance Company Limited

- New China Life Insurance Co., Ltd.

Recent Developments:

- In June 2024, Aegon announced that its U.K. individual protection business including life, critical illness, and income protection policies had been transferred to Royal London Mutual Insurance Society Limited.

- In February 2025, Aflac partnered with American Cancer Society to promote early-detection and proactive wellness for cancer, noting in its 2024 survey that 77% of Americans delayed important health check-ups and 60% admitted to avoiding cancer screenings.

Purchase Single User PDF of Critical Illness Insurance Market Report (20% Discount): https://www.snsinsider.com/checkout/8914

Exclusive Sections of the Report (The USPs):

- PRODUCT INNOVATION & CUSTOMIZATION INDEX – helps you assess the share of insurers offering modular or customizable critical illness policies, the number of new plans launched in recent years, and R&D investment in digital underwriting and risk assessment tools.

- CLAIMS PERFORMANCE & CUSTOMER TRUST METRICS – helps you evaluate average claim settlement ratios, claim processing timelines, and the proportion of policyholders opting for multi-illness coverage plans.

- PREMIUM GROWTH & MARKET SHARE ANALYSIS – helps you understand premium growth rates across individual and group policies, average policy values by coverage type (cancer, heart attack, stroke), and the market concentration of top providers (CR5).

- DIGITAL DISTRIBUTION & AI ADOPTION RATE – helps you analyze the share of policies sold through online channels and aggregators, the number of insurers deploying AI-based underwriting or engagement platforms, and online-to-purchase conversion rates.

- REGULATORY & COMPLIANCE BENCHMARKS – helps you track compliance rates with health insurance and data protection regulations, new regulatory frameworks impacting product design, and average approval timelines for new policy launches.

- COMPETITIVE LANDSCAPE & STRATEGIC POSITIONING – helps you gauge the competitive strength of leading critical illness insurance providers based on product portfolio diversification, digital capabilities, claims performance, geographic presence, and recent strategic initiatives.

Browse Other Reports

Healthcare Fraud Detection Market Report

Healthcare Logistics Market Report

Artificial Insemination Market Report

Dental Sterilization Market Report

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.