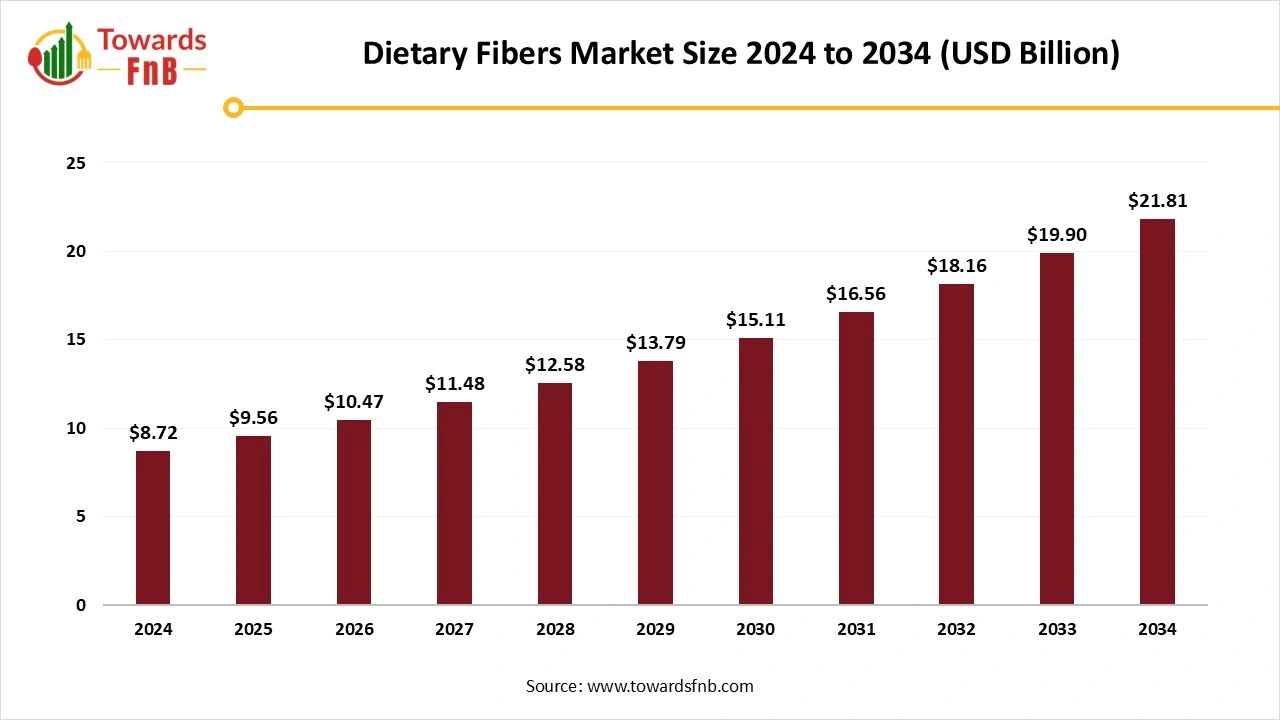

Dietary Fibers Market Size Worth USD 21.81 Billion by 2034, Says Towards FnB

According to Towards FnB, the global dietary fibers market size is set to reach USD 9.56 billion in 2025 and is expected to hit USD 21.81 billion by 2034, reflecting at a CAGR of 9.6% from 2025 to 2034. The growth is due to nuts and legumes’ dietary fibers, which are initially driven by the growing consumer awareness about the health advantages linked with high-fiber diets.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global dietary fibers market size stood at USD 8.72 billion in 2024 and is predicted to increase from USD 9.56 billion in 2025 to reach nearly USD 21.81 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The expansion of this market is supported by a variety of emerging trends, including the integration of fibers into unconventional products such as plant-based meat alternatives, prebiotic sodas, and fortified snacks. The rise of health-conscious consumers, coupled with innovations in dietary fiber sources from traditional grains and legumes to novel sources like algae and insect proteins further fuels the market’s growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5609

Key Highlights of the Dietary Fibers Market

- By region, Asia Pacific dominated the global dietary fibers market in 2024, capturing the largest market share, largely due to the growing food and beverage industry in the region.

- By region, North America is projected to experience strong growth, with a notable compound annual growth rate (CAGR) from 2025 to 2034, driven by shifting consumer lifestyles and the rising popularity of trending diets.

- By segment (raw material), cereals and grains led the market in 2024, holding a dominant share of 49%, fueled by the increasing prevalence of chronic diseases.

- By segment (raw material), the nuts and seeds category is expected to grow at an impressive CAGR of 10.2% between 2025 and 2034, driven by the rising demand for organic ingredients in food products.

- By segment (type), the soluble fiber segment is forecasted to experience a solid CAGR of 9.2% in 2024, owing to the growing demand for soluble dietary fibers.

- By segment (type), the insoluble fiber segment is anticipated to grow at a strong CAGR of 10.2% from 2025 to 2034, spurred by changes in dietary habits.

- By segment (application), the food and beverage industry held the largest market share in 2024, supported by increasing consumer awareness of the health benefits of dietary fibers.

- By segment (end-use), the animal feed sector is expected to grow at the fastest CAGR of 9.8% between 2025 and 2034, driven by the increasing incorporation of dietary fibers into animal nutrition.

Dietary Fibers: Essential for Digestive Health and Nourishing Gut Bacteria

Dietary fibers is a member of the plant-based foods that the body cannot digest. It passes with the assistance of the small intestine and stomach relatively intact, which makes its way to the large intestine, where it has powerful benefits. Insoluble and soluble fibers contribute to health in different ways; hence it tracks a balanced intake of both kinds of essentials.

So, it is the fiber that conveniently dissolves in the water. In the gut, it makes a gel-like substance that assists in slow digestion. This makes a medium and advantageous gut bacteria that can survive. Prebiotics are a kind of soluble fibers that serve as nourishment to gut bacteria.

New Trends in the Dietary Fibers Market:

- Targeted health solutions: Users are shifting beyond general fiber consumption towards functional fibers that solve health goals such as weight management, gut health, and blood sugar control.

- Prebiotic Focus: Prebiotic fibers, which develop advantageous bacteria, are witnessing major development. Instances count fructus, insulin, human milk oligosaccharides (HMOs). Tailored prebiotic subscription services are also developing in order to target users’ particular gut health needs.

- Creative applications: Food producers are adding fiber to unexpected items like dairy alternatives, smoothie, prebiotic sodas, and confectionery in order to develop their nutritional profile.

- Novel Sources: Traditional bran-type fibers are being connected by more high-level soluble fibers that come from sources like oats, chicory root, legumes, and even byproducts from food production like spent grains and citrus peels. Novel sources like insect-based ingredients and algae are also being discovered.

- Fortified staples: Each day, items like breakfast cereals, bread, and snack bars are being changed in order to serve a main fiber boost.

- Plant-based synergy: As plant-based diets develop in popularity, so does the urge for plant-derived fiber sources like psyllium, inulin, and resistant starches. These are being utilized to develop meat and dairy alternatives.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/dietary-fibers-market

Recent Developments in the Dietary Fibers Market:

- In June 2025, Nutrabay disclosed the launch of BioAbsorbe, a future-generation whey protein crafted to solve one of the most prevalent yet under-addressed challenges experienced by protein users, digestive discomfort, and post-absorption too. (Source: https://www.healthcareradius.in)

- In February 2025, Marico’s is one of the top FMCG companies that is ready to update the convenience in the Oats category with the revelation of Saffola Cuppa Oats, which are nutritious, delicious, and hassle-free sacks which is personalised for current fast-moving consumers. (Source: https://www.passionateinmarketing.com)

- In July 2025, Pepsico revealed the launch of a new Pepsi Prebiotic Cola. This latest beverage has the same iconic taste of Pepsi that comes with the perfect functional ingredient of 3 grams of prebiotic fibre. (Source: https://food.ndtv.com

- In March 2025, Activia, which is a Danone-owned yogurts brand, is stretching its fibre and kefir that tangs in order to assist users’ gut health with three new products, which were launched in March. (Source: https://www.foodbev.com

How Does FDA Redefine Dietary Fibers: Convenient Regulations for American Key Players

The FDA’s definition of dietary fiber has reshaped the global dietary fibers market, driving innovation, reformulation, and compliance-driven growth across the food and nutrition industry. By recognizing both naturally occurring “intrinsic and intact” fibers and select isolated or synthetic fibers with proven physiological benefits, the FDA has established a science-backed framework that redefines product labeling, consumer perception, and industry standards. This regulatory clarity is accelerating investment in research-backed ingredients, fostering demand for functional foods, and positioning dietary fiber as a central element in the evolving health and wellness economy. As manufacturers align formulations with FDA guidelines, market differentiation and consumer trust emerge as powerful growth catalysts for the dietary fibers sector.

Types of Fiber and its Characteristics

| Type of Fiber | Fermentability | Solubility |

| Pectin | Moderate to high | Soluble |

| Guar Gun | High | Soluble |

| Flaxseed | Moderate | Soluble |

| Psyllium | Moderate | Moderately Soluble |

| Beet pulp | Moderate | Mostly Insoluble |

| Flaxseed | Moderate | Soluble |

| Hemicellulose | Moderate | Insoluble |

| Pea Fiber | Moderate | Insoluble |

| Purified cellulose | Low | Insoluble |

| Soybean hulls | Low | Insoluble |

Major Importers of the Dietary Fibers Market

- Archer Daniels Midland Company: A main agricultural converter that transforms crops into food ingredients and other products that contain dietary fibers.

- DuPont De Nemours Inc: The organization’s Nutrition and Biosciences space is a main source of ingredients that market digestive health.

- Cargill, Incorporated: It serves food ingredients and services worldwide that include a variety of dietary fiber products.

- Asia Pacific countries such as India, China, and Vietnam are the main importers of dietary fibers, along with industrialized nations like the United States and countries in Europe. The urge is being driven by a development in health-conscious users and the usage of fiber in functional foods and supplements.

- Europe: Many European countries are the main importers that are well assisted by perfectly established food and beverage industries and a big demand for natural ingredients.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5609

Dietary Fibers Market Dynamics

Opportunity

Fibermaxxing is the Central Part of Dietary Fibers Industry

Fibermaxxing is a grassroots campaign that originated on social media platforms like TikTok, in which users share fiber-rich meals and colourful recipes that count whole foods like berries, chia seeds, whole grains, and legumes. These posts often feature the rams of fiber in delivering anecdotal reports of digestive advantages users experience for perfect regularity, developed satiety, and improved energy.

As the trend develops, it also serves as a crucial consideration, which increases fiber intake too quickly, which can lead to digestive discomfort, including gas and bloating. It includes intentionally developing any daily fiber intake that mainly gives suggested levels through fiber-rich food and sometimes supplements, too.

Challenge

Complexities Backs the Growth of Dietary Fibers

The dietary fiber industry experiences challenges linked to inconstant and developing regulatory standards, complicated extraction and processing technologies, supply chain instability, and consumer hesitation. The regulatory approval procedure for the latest dietary fibers and functional fiber products can be expensive and time-consuming. This can hide inventions and delay the industry entry of the latest products.

Dietary Fibers Market Regional Analysis

Asia Pacific Dominated the Dietary Fibers Market in 2024.

The Asia Pacific region has dominated the region in 2024, as for several Asian users, “healthier food” means less sugar, plant-based, organic, and fortified with necessary nutrients. Across Asia, there is a rising urge for food that assists physical health and promotes long-term well-being. These counts using lesser processed ingredients and concentrating on fresh and natural products. Nutrient-rich foods naturally low in sugar or high in fiber are gaining attention as those filled with minerals and vitamins to solve prevalent dietary deficiencies.

Furthermore, regular Asian Food is healthier and meets perfectly current health trends. Fermented foods like tempeh, kimchi, and miso have been staples in Asian diets for several years and are now classified for their health advantages. These foods are perfect in probiotics that market gut health and assist the immune system. Additionally, several traditional legumes and grains like lentils, brown rice, and mung beans are naturally plant-based and serve as a healthy base for meals that perfectly fit the current concentration on well-being.

With instance to this,

- In September 2025, Tate 7 Lyle PLC, a top leader in ingredient solutions for beverages and healthier food, disclosed Tate& Lyle Sensing as its accurate sensory formulation tool in the Asia-Pacific region. This organisation assists food and drink producers in the region in order to develop products that start with the yoghurt category. (Source: https://asiafoodjournal.com)

- In December 2024, the South Korean government partnered with the sector to reveal 19 reduced-sodium and sugar food and beverage products as it seeks to align with national targets. (Source: https://www.foodnavigator-asia.com)

The North America region is predicted to be a notable region in the foreseeable period. In this region, with respect to food and beverages, psyllium husk is heavily included in breakfast cereals, bakery goods (like biscuits, breads, and muffins), gluten-free formulations, and ice cream, too. In South America, with rising interest in fibre-enriched foods and clean-label products or vegan, these applications are trending and becoming more common.

In the nutraceuticals and pharmaceutical sectors, psyllium is utilised as a bulk-making laxative, in digestive health formulations, and heavily in terms of functional supplement designs. The dairy sector is discovering psyllium’s functionality for the texture updation and fibre enrichment. Though particular North American diary usage data is limited, the worldwide trend displays psyllium as it is being utilised for functionality and nutrition.

With an instance of this,

- In December 2024, the Top cereal brand Cheerios is expanding its profile of flavors in order to reveal a new protein cereal that serves its series named Cheerios Protein. It has 8 grams of protein per serving and offers consumers several options. (Source: https://www.generalmills.com)

- In November 2024, Huhtamaki’s location in Lurgan, Northern Ireland, achieved a major milestone with the official opening of its smooth molded fiber (SMF) manufacturing line. The expansion has marked a crucial step in current loyalty to align with the rising demand for sustainable packaging solutions. (Source: https://www.huhtamaki.com)

Dietary Fibers Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 9.6% |

| Market Size in 2025 | USD 9.56 Billion |

| Market Size in 2026 | USD 10.47 Billion |

| Market Size by 2034 | USD 21.81 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Dietary Fibers Market Segmental Analysis

Raw Material Analysis

The cereals and grains segment has dominated the market in 2024 as they have gained attention as a source of dietary fiber initially due to rising scientific and public awareness of their health advantages during the 20th century. In wholegrain patterns, cereals serve crucial fat, protein, minerals, and vitamins as well as dietary fibre and energy. On the other hand, wholegrains are also high in necessary dietary fibre, which is known to develop health and well-being because of probiotic characteristics and by developing the immune system.

The nuts and seeds segment is expected to rise fastest during the forecast period. Nuts are initially the seeds of plants. Many are the seeds of peanuts, trees, and hence, are the seeds of a legume. Many, that count cashews and walnuts, develop inside leathery fruits, with the nuts parallel to the peach pit within a peach. Others, such as chestnuts and hazelnuts, are differentiated as true botanical nuts (that are rigid dry fruits which do not open to consume as a separate seed.

Just like the seeds that are known as nuts, culinary seeds originate from flowers (sunflowers), vegetables ( pumpkins), or crops that are grown for a variety of uses (like flax or hemp). The advantages the seeds deliver have mostly healthy fibre, fats, and some fiber of about 150 calories per ounce. They do not have about 5 to 9 grams per ounce.

Type Analysis

The soluble dietary fibers segment dominated the market in 2024, as it can completely dissolve in liquid, which includes the fluids that are found inside the digestive tract. As it dissolves, the fiber moves into a gel-like substance, which can slow down digestion. When the fiber reaches the colon, it serves as food for the good bacteria in the gut. This pushes the development of healthier gut bacteria.

As soluble fiber moves through your digestive system, it lowers the cholesterol and helps clear it out of the body. Soluble fiber and weight management are closely linked. Because foods that are rich in soluble fiber are being digested more slowly, they can help us feel fuller longer.

The insoluble dietary fibers segment is expected to rise fastest during the forecast period. Insoluble fiber does not completely dissolve in water. Rather, it adds a heavy load to the stool and assists the food shift quickly through the digestive tract, thereby promoting regular bowel movements and preventing constipation. It protects slow digestion and assists in constipation by speeding up the movement of the food through the digestive tract. Leafy vegetables, nuts, and whole grains are perfect sources of insoluble fiber.

This characteristic makes insoluble fiber advantageous for adding bulk to stool and promotes bowel movements as it plays an important role in tracking digestive health by ensuring the smooth passing of waste through the intestines and preventing constipation.

Application Analysis

The food and beverages segment has dominated the market in 2024, as Fiber is a top claim in terms of food and beverages that are launched and concentrate on functional health benefits. The developing interest in terms of gut health is driving the development of fibre claims in products that showcase the current capability, specifically in regions with developing populations and evolving dietary designs.

Fiber trends disclose that users primarily seek fiber in terms of food and beverages to solve gut health, which overtakes other ingredients. Baby boomers are the generation that is most likely to link fiber with gut health, and millennials are the top searchers for other gut health ingredients.

The animal feed segment is expected to rise Fastest During the Forecast time. Dietary fiber is a crucial element of animal feed nutrition. Its effect relies on main characteristics such as solubility, fermentability, and viscosity that encourage gastrointestinal transit, nutrient digestibility, and microbiome balance. The fermentable fiber assists gastrointestinal health with the assistance of short-chain fatty acid production, and soluble and insoluble fiber affect moisture and stool bulk, too.

Precise analysis of fiber content in the animal feed segment, checking total dietary fiber, is not just crude fiber. By agreeing on fiber’s multifaceted role, clinicians can personalize nutritional management methods to align with particular patient demands and develop clinical results.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Leading Brands in the Dietary Fibers Market

- DuPont de Nemours, Inc.: DuPont provides innovative dietary fiber solutions for food, beverages, and nutraceuticals. They focus on enhancing gut health with sustainable, high-quality fiber ingredients. Their products support digestive wellness through advanced science and technology.

- Lonza: Lonza specializes in dietary fibers and prebiotics that support gut health. Their solutions are used in functional foods and supplements for digestive wellness. Lonza’s focus is on developing fiber ingredients for long-term health benefits.

- Archer Daniels Midland Company (ADM): ADM is a leader in agricultural processing, producing dietary fibers from grains and legumes. Their fibers are used in functional foods and beverages aimed at improving gut health. The company emphasizes sustainable sourcing and clean-label ingredients.

- Ingredion Incorporated: Ingredion produces dietary fibers from a variety of raw materials, such as corn and tapioca. They offer solutions that support digestive health and wellness. Their fibers cater to the growing demand for natural, plant-based food ingredients.

- Roquette Frères: Roquette supplies plant-based dietary fibers derived from peas and other grains. Their fibers promote digestive health, weight management, and blood sugar regulation. Roquette emphasizes sustainability and innovation in fiber sourcing.

- Tate & Lyle: Tate & Lyle provides soluble and insoluble fibers for gut health and digestive support. Their fibers are used in a wide range of food products, focusing on health-conscious consumer needs. They prioritize functional solutions for weight management and wellness.

- Cargill, Incorporated: Cargill produces a variety of dietary fibers from corn, wheat, and other plants. They focus on fibers that promote digestive health and weight management. The company also aims for sustainability in its ingredient sourcing and production.

- Emsland Group: Emsland Group produces dietary fibers from potatoes and peas for food and beverage applications. Their fibers offer functional benefits like water retention and digestive support. They focus on high-quality, plant-based solutions.

- The Green Labs LLC: The Green Labs provides natural dietary fibers sourced from plants. They emphasize clean-label, sustainable products for the health-conscious consumer. Their fibers support gut health and are used in functional food products and supplements.

- Farbest Brands: Farbest Brands produces fibers from fruits and vegetables, focusing on digestive health benefits. Their fibers are used in food, beverage, and supplement products. They prioritize high-quality, natural ingredients for wellness-focused applications.

- Kerry Inc.: Kerry offers dietary fibers that promote digestive health and weight management. Their fiber solutions cater to the growing demand for functional foods and beverages. They are committed to sustainability and innovation in the food ingredients market.

- Taiyo International: Taiyo specializes in dietary fibers derived from rice, oats, and soy. Their fibers help regulate digestion and support gut health. Taiyo focuses on innovative, plant-based solutions for the food and nutraceutical industries.

- AGT Food and Ingredients: AGT produces dietary fibers from legumes, pulses, and grains for food, supplement, and animal feed markets. Their fibers offer health benefits like digestive wellness and heart health support. AGT is committed to sustainable, plant-based ingredients.

Segments Covered in the Report

By Raw Materials

- Fruits & Vegetables

- Cereals & Grains

- Nuts & Seeds

- Legumes

By Type

- Insoluble

- Cellulose

- Hemicelluloses

- Chitin & Chitosan

- Lignin

- Oat Bran

- Wheat Fiber

- Others

- Soluble

- Inulin

- Pectin

- Beta-Glucan

- Corn Fibers

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Animal Feed

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5609

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.