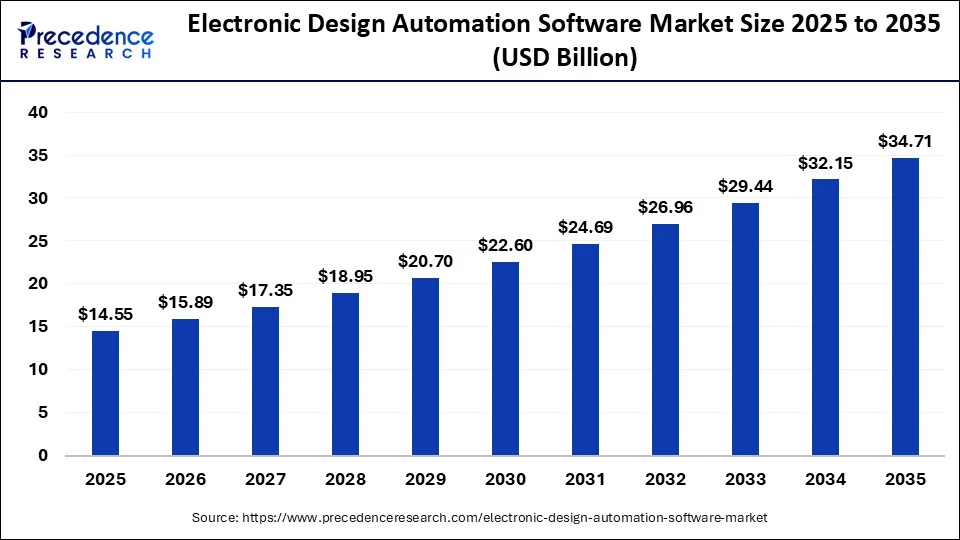

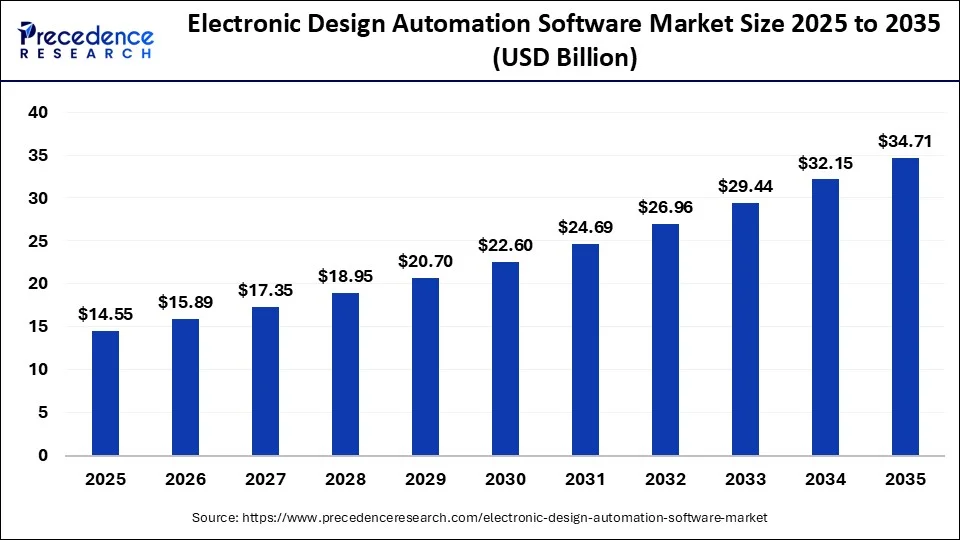

According to Precedence Research, the global electronic design automation software market size surpassed USD 14.55 billion in 2025 and is estimated to hit around USD 15.89 billion by 2035, growing at a CAGR of 9.08% from 2026 to 2035. The proliferation of connected devices and the growing adoption of cloud drive the market growth.

Ottawa, Feb. 02, 2026 (GLOBE NEWSWIRE) — Rising demand for advanced chips across AI, IoT, and automotive applications are driving growth in the Electronic Design Automation software market.

What is the Electronic Design Automation Software Market Size in 2026?

The global electronic design automation software market size is valued at USD 15.89 billion in 2026 and is expected to reach nearly USD 34.71 billion by 2035, expanding at a robust CAGR of 9.08% from 2026 to 2035.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/7124

Electronic Design Automation Software Market Key Takeaways

Regional Insights

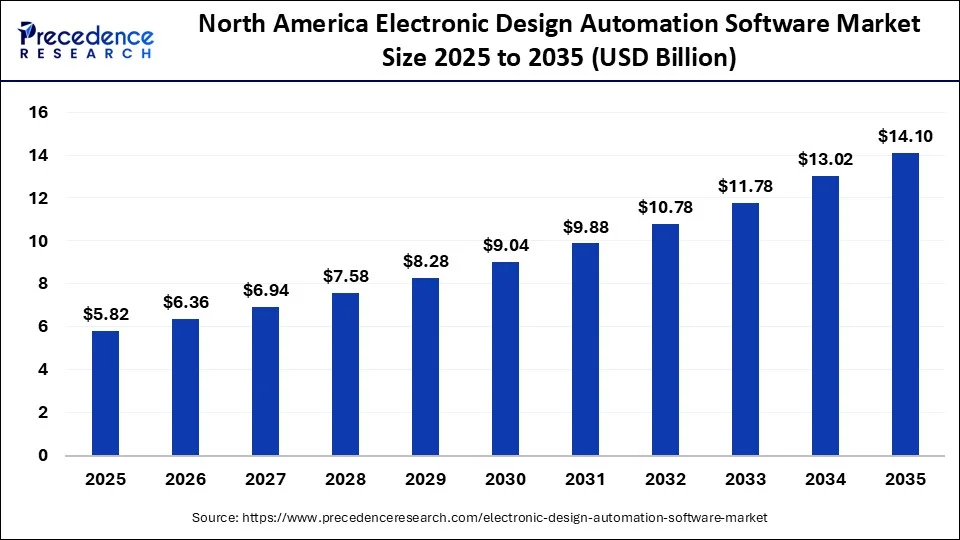

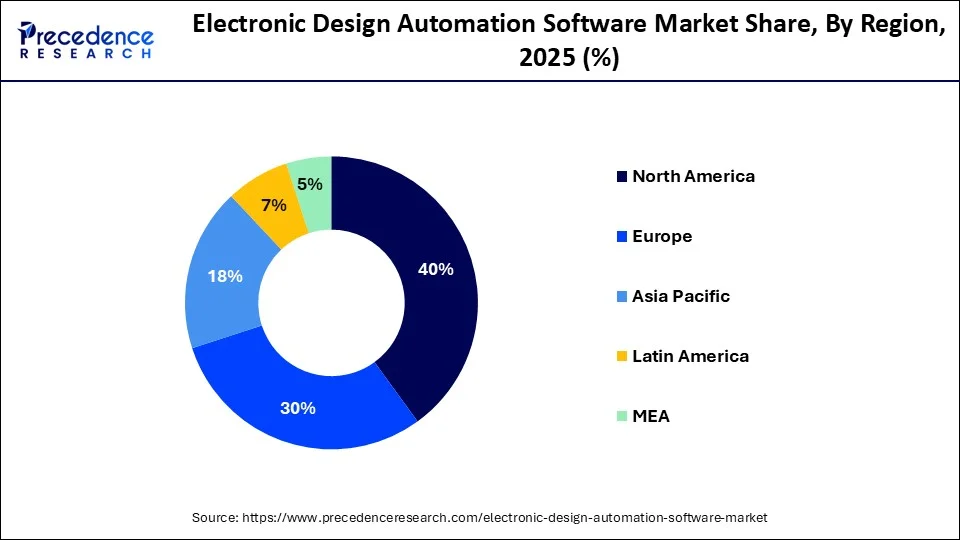

- North America led the electronic design automation (EDA) software market, capturing around 40% of the total share in 2025.

- Asia Pacific is projected to witness the highest CAGR between 2026 and 2035.

By Product Type

- The verification and sign-off segment held the largest share at 26% in 2025.

- The simulation & modeling segment (SPICE, EM, Thermal) is expected to grow at the fastest CAGR from 2026 to 2035.

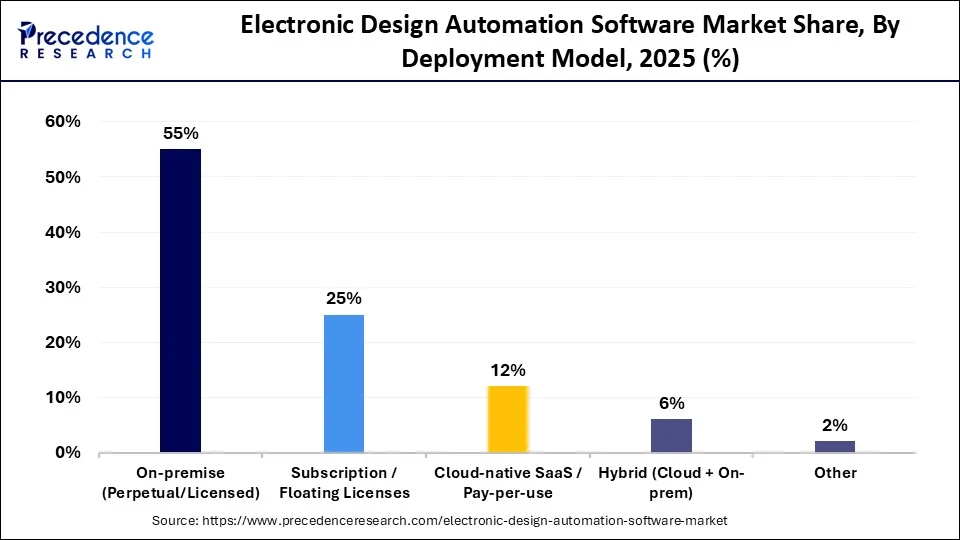

By Deployment Model

- On-premise (perpetual/licensed) solutions dominated the market, accounting for 55% of the share in 2025.

- Cloud-native SaaS / pay-per-use models are anticipated to expand at a strong CAGR during 2026–2035.

By End-User Industry

- Semiconductor and fabless IC design houses held the largest market share of 45% in 2025.

- Electronic systems OEMs are expected to register high growth over the forecast period.

By Application / Use Case

- ASIC/SoC design accounted for the largest share at 40% in 2025.

- System-level and multi-discipline applications (SI/PI, thermal analysis) are forecast to grow at a remarkable CAGR from 2026 to 2035.

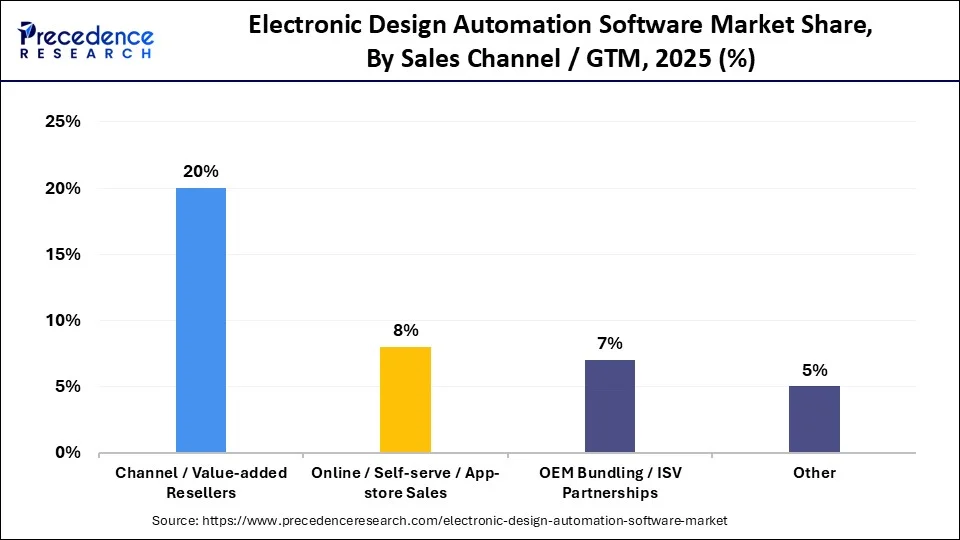

By Sales Channel / Go-to-Market

- Direct enterprise sales dominated with approximately 55% market share in 2025.

- Online, self-serve, and app-store-based sales channels are expected to expand at the fastest CAGR during 2026–2035.

What is Electronic Design Automation Software?

The electronic design automation software market growth is driven by the growing miniaturization of devices, surging use of smart wearables, expansion of AI, increasing need for high-performance computing, transition towards smaller nodes, increasing cloud adoption, growth in consumer electronics, development of 5G infrastructure, and the increasing use of connected cars.

Electronic design automation (EDA) software is a software used for automating the manufacturing, designing, and verifying of electronic systems. The software used to draw schematics, test mixed-signal circuits, check designs, automates components placement, and create layouts. The examples of EDA software are Cadence Design Systems, Altium Designer, Xilinx, Zuken, and others.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Private Industry Investments for Electronic Design Automation Software

- proteanTecs focuses on cloud-based lifecycle analytics software for chips and has raised $226 million in total funding, including a $51 million Series D round in September 2025.

- VSORA is a developer of digital signal processors for 5G communication applications that secured $46 million in a Series C funding round in April 2025.

- Flux AI provides cloud-based electronic design automation tools for integrated circuits and received $12 million in seed funding to advance its AI design assistant.

- SimYog Technology offers electromagnetic analysis and simulation tools for design validation, backed by over $3.99 million in total private funding, including a Series A round.

- Quilter, an AI-powered platform for end-to-end printed circuit board (PCB) design solutions, raised $10 million in Series A funding to automate PCB layout processes.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7124

Key Trends of the Electronic Design Automation Software Market

- Integration of AI and Machine Learning: AI-driven algorithms are being embedded into EDA tools to automate complex tasks, optimize chip layouts, and predict design issues, which significantly enhances efficiency and reduces time-to-market.

- Growing Adoption of Cloud-Based Solutions: The shift to cloud EDA provides scalable computational resources, cost-efficiency, and collaborative platforms that enable global design teams to work together in real time without significant on-premises infrastructure investments.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Market Opportunity

Growing Automotive Industry

The rise in electrification of vehicles and the increasing use of advanced driver-assistance systems increase demand for EDA software. The increased development of software-based vehicles and the focus on maintaining high functional safety in vehicles increase demand for EDA software. The expansion of in-car connectivity and the increasing use of communication systems in vehicles increases demand for EDA software.

The growing complexity of in-vehicle networks and the rising development of virtual models of EVs increase demand for EDA software. The popularity of self-driving features and the development of battery management systems increases adoption of EDA software. The growing automotive industry creates an opportunity for the growth of the EDA software market.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Market Scope

| Report Metrics | Details |

| Market Size in 2025 | USD 14.55 Billion |

| Market Size in 2026 | USD 15.89 Billion |

| Market Size by 2035 | USD 34.71 Billion |

| Market Growth (2026 – 2035) | 9.08% CAGR |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Deployment Model, End-User Industry, Application/Use Case, Sales Channel/GTM, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

➤ Get the Full Report @ https://www.precedenceresearch.com/electronic-design-automation-software-market

Electronic Design Automation Software Market Regional Insights

What is the North America Electronic Design Automation Software Market Size in 2026?

The North America electronic design automation software market size is estimated at USD 6.36 billion in 2026 and is projected to reach approximately USD 14.10 billion by 2035, with a healthy CAGR of 9.25% from 2026 to 2035.

Why North America Dominates the Electronic Design Automation Software Market?

North America dominated the market in 2025 with the largest revenue share of 40%. The strong presence of semiconductor industry companies and the development of complex chips increase demand for EDA software. The increased production of next-gen electronics and the growing adoption of 5G increase demand for EDA software. The expanding automotive industry and the focus on strengthening domestic semiconductor infrastructure create higher demand for EDA. The presence of companies like Cadence Design Systems, Keysight Technologies, Synopsys, and Ansys drives the market growth.

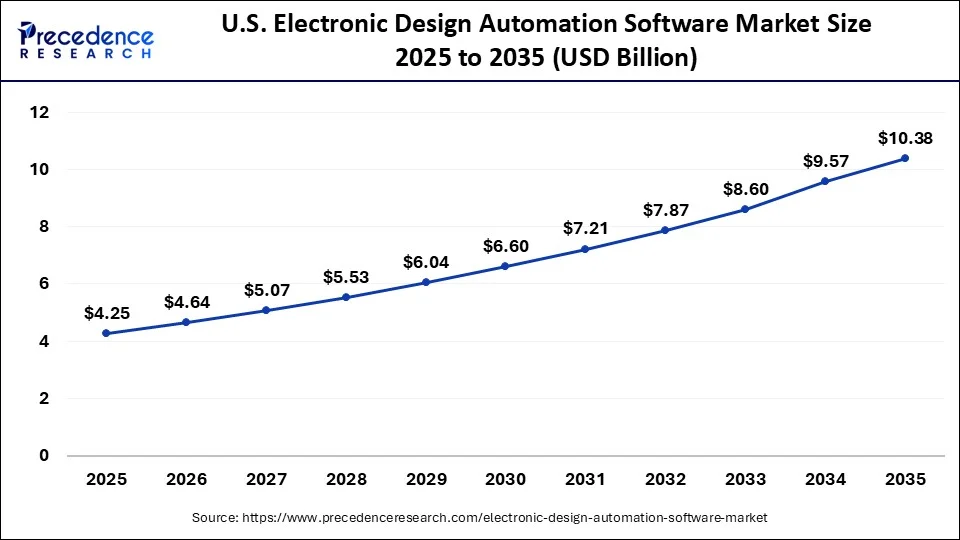

What is the U.S. Electronic Design Automation Software Market Size in 2026?

The U.S. electronic design automation software market size is evaluated at USD 4.64 billion in 2025 and is predicted to reach nearly USD 10.38 billion in 2035, accelerating at a strong CAGR of 9.34% between 2026 and 2035.

U.S. Electronic Design Automation Software Market Trends

The U.S. market is growing steadily, driven by rising demand for advanced semiconductor design as chips become smaller, more complex, and application-specific. A major trend is the integration of artificial intelligence and machine learning into EDA tools to improve design automation, verification accuracy, and time-to-market.

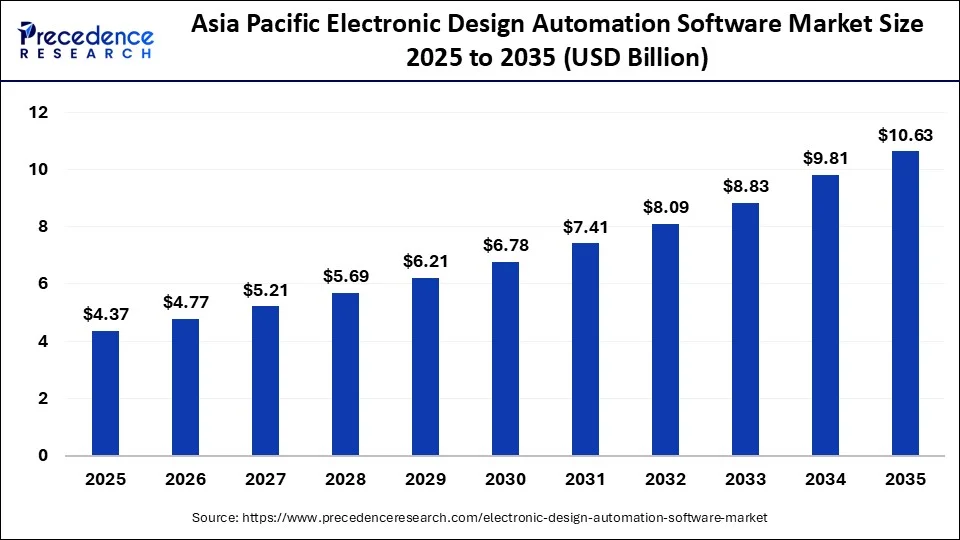

What is the Asia Pacific Electronic Design Automation Software Market Size in 2026?

The Asia Pacific electronic design automation software market size is projected to be worth USD 10.63 billion by 2035, increasing from USD 4.77 billion by 2026, growing at a CAGR of 9.30% from 2026 to 2035.

How is the Asia Pacific experiencing the Fastest Growth in the Electronic Design Automation Software Industry?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The huge manufacturing of electronics and the rapid expansion of IoT increase demand for EDA software. The ongoing digitalization across industries and increasing investment in domestic chip manufacturing increase demand for EDA software. The explosion of consumer electronics and the well-developed semiconductor manufacturing base support the market growth.

India Electronic Design Automation Software Market Trends

India’s market is growing rapidly, supported by the expansion of the country’s semiconductor design and electronics manufacturing ecosystem. A key trend is the rising adoption of cloud-based and AI-enabled EDA tools, which help reduce infrastructure costs and speed up design and verification cycles.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Market Segmentation

Product Type Insights

Why Verification and Sign-Off Segment Dominates the Electronic Design Automation Software Market?

The verification and sign-off segment dominated the market in 2025. The strong focus on preventing yield loss and the need for functional correctness of chips increases demand for verification and sign-off. The increasing need for error prevention in chip manufacturing and the ongoing complexity in chip management increase the demand for verification and sign-off. The growing use of verification and sign-off in the aerospace & defense industry drives market growth.

The simulation & modelling segment is the fastest-growing in the market during the forecast period. The growing complexity in integrated circuits and the focus on identifying issues early increase demand for simulation & modelling. The popularity of smart manufacturing and the increasing use of advanced communication increase demand for simulation & modelling. The expansion of cloud-based platforms supports the overall market growth.

Deployment Model Insights

How did the On-Premise hold the Largest Share in the Electronic Design Automation Software Market?

The on-premise segment held the largest revenue share in the market in 2025. The focus on data security in companies and the growing advanced semiconductor manufacturing increases demand for on-premise services. The customization availability, lower latency, and familiarity of on-premise service help market expansion. The growing use of on-premise service in the defense industry drives market growth.

The cloud-native SaaS/pay-per-use segment is experiencing the fastest growth in the market during the forecast period. The transition towards OPEX and the focus on simplifying Ip sharing increases demand for cloud-native SaaS. The popularity of microservices and the growth in fabless startups increase demand for cloud-native SaaS. The growing development of AI technologies supports the market growth.

End-User Industry Insights

Which End-User Industry Dominated the Electronic Design Automation Software Market?

The semiconductor & fabless IC design houses segment dominated the market in 2025. The growing complexity in the production of chips and the rapid growth in the fabless model increase demand for EDA software. The strong focus on PPA across various industries and the increased integration of IP blocks with semiconductors increase demand for EDA software. The growing chiplets and the increasing investment in advanced nodes drive the market growth.

The electronic systems OEMs segment is the fastest-growing in the market during the forecast period. The growing complexity of electronic devices and the development of high-performance devices increase demand for EDA software. The proliferation of connected devices and the increasing use of electronics in the aerospace industry increase demand for EDA software. The growing adoption of custom electronics supports the overall market growth.

Application Insights

Why did the ASIC/SoC Design Segment hold the Largest Share in the Electronic Design Automation Software Market?

The ASIC/SoC design segment held the largest revenue share in the market in 2025. The increasing use of SoCs in the automotive sector and the higher rate of smartphone production increase demand for EDA software. The booming 5G infrastructure and the need for power-efficient architectures require EDA software. The shift towards smart devices drives market growth.

The system-level & multi-discipline segment is experiencing the fastest growth in the market during the forecast period. The growing development of specialized chips and the integration of hardware & software increases demand for EDA software. The increasing popularity of more power-efficient devices and the ongoing digital transformation increase demand for EDA software, supporting the overall market growth.

Sales Channel Insights

How Direct Enterprise Sales Segment Dominated the Electronic Design Automation Software Market?

The direct enterprise sales segment dominated the market in 2025. The growing demand for customized tools and the focus on building direct relationships with customers increase the demand for direct enterprise sales. The high availability of technical support and the increasing need for IP protection drive market growth.

The online/ self-service/ app-store sales segment is the fastest-growing in the market during the forecast period. The focus on reducing hardware investment and the on-demand computational power increases demand for online sales. The self-service control on online sales helps market expansion. The growing popularity of remote work supports the market growth.

Top Companies in the Electronic Design Automation Software Market & Their Offerings:

Tier 1:

- Siemens EDA: Delivers a full spectrum of IC and PCB tools, most notably the Calibre platform for physical verification and Xpedition for enterprise-level systems design.

- Ansys: Specializes in high-fidelity multiphysics simulation software, such as HFSS and RedHawk, to analyze electromagnetics, thermal behavior, and power integrity.

- Keysight Technologies: Focuses on the PathWave design suite, providing industry-standard tools for RF, microwave, and high-speed digital circuit simulation.

- Altium: Offers Altium Designer, a popular and unified software environment that integrates schematic capture, 3D PCB layout, and design data management.

- Zuken: Provides advanced solutions for multi-board system design and complex electrical wire harness engineering through its CR-8000 and E3.series platforms.

- Silvaco: Leads in Technology Computer-Aided Design (TCAD) software used to model semiconductor fabrication processes and device-level physics.

- Empyrean Technology: Supplies a comprehensive suite of tools for analog and mixed-signal IC design, with a strong focus on flat-panel display technologies.

- Aldec: Focuses on functional verification and emulation, offering tools like Riviera-PRO for FPGA and ASIC RTL simulation and debugging.

- OneSpin Solutions: Specializes in formal verification software used to mathematically prove the correctness and security of digital hardware designs.

- Apache Design: Now integrated into Ansys, it provides critical power-integrity and noise-analysis solutions for large-scale system-on-chip (SoC) designs.

- Tanner EDA (Siemens): Provides an integrated, cost-effective flow for custom analog, mixed-signal, and MEMS design within the Siemens EDA ecosystem.

Tier 2:

- Blue Pearl Software

- Xpeedic Technology

- Ansys Lumerical

- ProteanTecs

- Cadence Design Systems

- Third-Party IP Vendors (EDA-integrated

- Efinix

- Mentor/Tanner

Recent Developments

- In November 2024, Keysight launched an electronic design automation software suite for amplifying the productivity of designers with AI. The software range includes high-speed digital design, RF circuit design, device characterisation, and device modelling. (Source: https://www.expresscomputer.in)

- In October 2025, SiCarrier launched EDA software for manufacturing chips. The software includes PCB and schematic capture. The software verifies final chip designs and accelerates the design process. (Source: https://www.huaweicentral.com)

- In October 2025, Nanoacademic collaborated with Kothar to develop an EDA software suite. The EDA supports the semiconductor industry and has two components, like Kothar’s Quantum Symbolic Algebra Engine & Nanoacademic’s QTCAD. (Source: https://quantumcomputingreport.com)

Segments Covered in the Report

By Product Type

- Verification & Sign-off

- Formal verification & equivalence checking

- Sign-off/timing/power/signal integrity tools

- IC Design / Front-end (RTL, Synthesis)

- RTL design & logic synthesis

- High-level synthesis (HLS)/ESL tools

- Physical Design & Implementation

- Placement & routing

- Floorplanning/optimization

- PCB Design & Board-level CAD

- PCB layout & routing

- PCB schematic capture

- Simulation & Modeling (SPICE, EM, Thermal)

- Circuit simulation, electromagnetic simulation

- Thermal, SI/PI simulation

- IP & Library Solutions

- Standard cell libraries, IP cores (memory, interface IP)

- DFT & Test

- Scan, ATPG, test compression, BIST tools

- EDA Services & Consultancy

- Integration, consulting, flow enablement

- Others/Miscellaneous

By Deployment Model

- On-premise (perpetual/licensed)

- Subscription/Floating licenses

- Cloud-native SaaS/Pay-per-use

- Hybrid (cloud+on-prem)

- Other

By End-User Industry

- Semiconductor & Fabless IC Design Houses

- Electronic Systems OEMs

- Foundries & IDM

- PCB & EMS providers

- Academic & Research

- Government/Defense/Aerospace

- Other

By Application/Use Case

- ASIC/SoC Design

- FPGA Design & Toolchains

- PCB & Board-level Design

- Package/Substrate Co-design

- System-level & Multi-discipline (SI/PI, thermal)

- MEMS & Sensor design

- Power & Thermal analysis

- Other

By Sales Channel/GTM

- Direct enterprise sales

- Channel/Value-added resellers

- Online/Self-serve/App-store sales

- OEM bundling/ISV partnerships

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/7124

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.