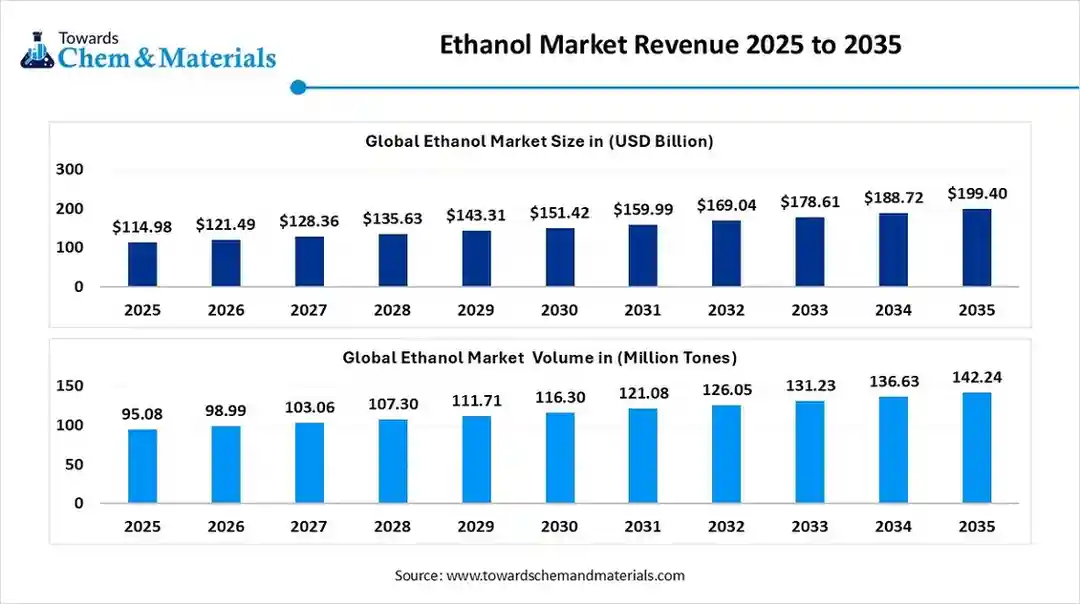

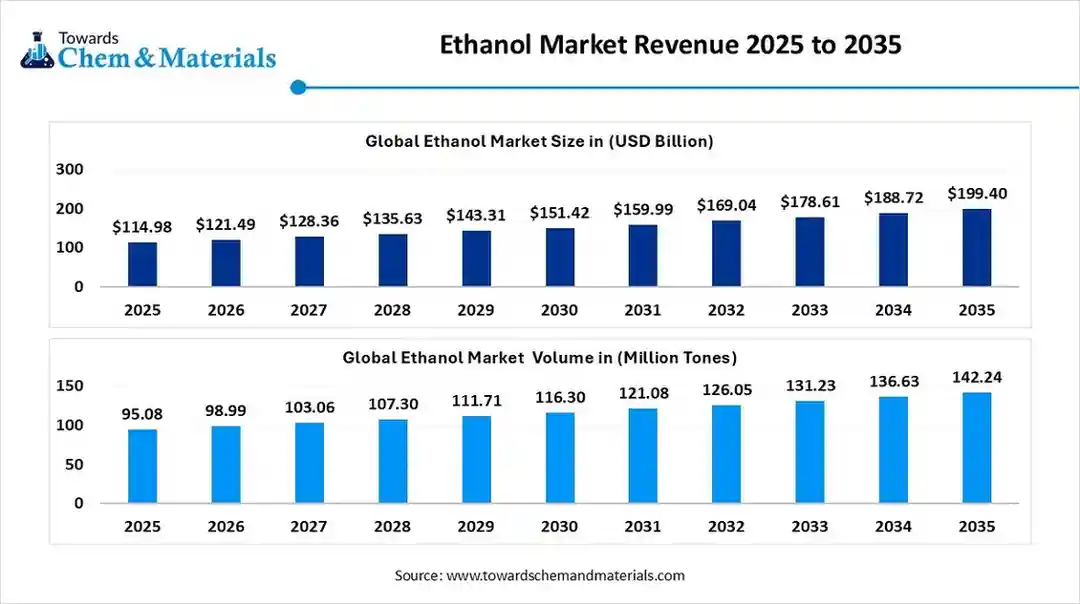

According to Towards Chemical and Materials Consulting, the global ethanol market size is calculated at USD 114.98 billion in 2025 and is expected to be worth around USD 199.40 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.66% over the forecast period 2026 to 2035. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

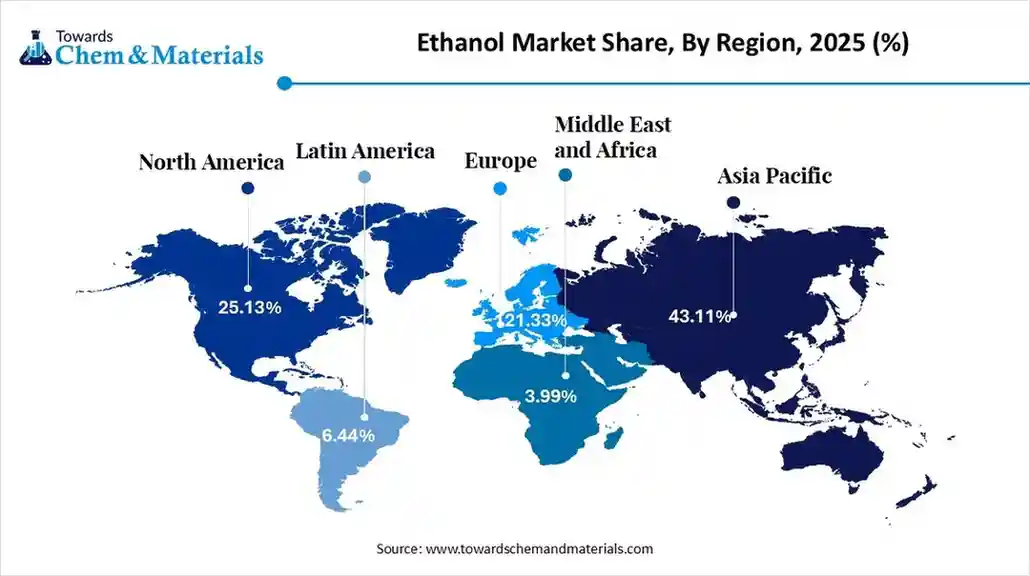

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global ethanol market size was valued at USD 114.98 billion in 2025, the market is projected to grow from USD 121.49 billion in 2026 to USD 199.40 billion by 2035 at a CAGR of 5.66% during the forecast period. Asia Pacific dominated the ethanol market with a market share of 43.11% in 2025.

The global ethanol market is experiencing rapid growth, with volumes expected to increase from 95.08 million tons in 2025 to 142.24 million tons by 2035, representing a robust CAGR of 4.11% over the forecast period. The ethanol market is primarily driven by rising demand for renewable and sustainable fuels, with ethanol widely used as a gasoline additive to reduce carbon emissions and meet regulatory standards.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6028

What is Ethanol?

The global ethanol market is experiencing significant growth, driven by its widespread use as a renewable fuel, industrial solvent, and key ingredient in pharmaceuticals, personal care products, and alcoholic beverages. Increasing demand for ethanol-blended fuels to reduce greenhouse gas emissions and comply with government mandates is a major growth driver, particularly in the U.S., Brazil, and India.

Technological advancements in production processes, including first- and second-generation bioethanol from sugarcane, corn, and cellulosic feedstocks, are improving efficiency and sustainability. Rising investments in biofuel infrastructure and supportive policies from governments further bolster market expansion. Overall, ethanol continues to play a critical role in energy transition, industrial applications, and consumer products, making it a versatile and high-demand commodity globally.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Ethanol Market Report Highlights

- Asia Pacific dominated the ethanol market with a revenue share of 43.11% in 2025.

- By source/feedstock, the bio-based feedstocks segment led the market and accounted for 55% of the global revenue share in 2025.

- By type, the fuel-grade ethanol segment accounted for the largest revenue share of 65% in 2025.

- By end-use industry, the transportation and automotive segment dominated with the largest revenue share of 60% in 2025.

- By distribution channel, the direct supply segment dominated the market and accounted for the largest revenue share of 55% in 2025.

Comparative Pricing for Fuels and Co-Products – Adjusted Summary ($/Gallon)

| Product | Current Price | Prior Week Avg | Previous Year | % Change WoW | % Change YoY | ||

| Ethanol (FOB Gulf) | 1.889 | 1.921 | 1.551 | -1.60 | % | 21.80 | % |

| Anhydrous Ethanol (FOB Santos, Brazil) | 2.274 | 2.318 | 2.063 | -1.90 | % | 10.20 | % |

| Hydrous Ethanol (FOB Santos, Brazil) | 2.129 | 2.137 | 1.926 | -0.30 | % | 10.60 | % |

| Anhydrous – Hydrous Spread | 0.145 | 0.181 | 0.14 | -19.90 | % | 3.60 | % |

| Gulf Discount/Premium vs Santos | -0.382 | -0.397 | -0.509 | -3.30 | % | -24.30 | % |

| Ethanol (FOB PNW) | 1.933 | 2.053 | 1.667 | -5.50 | % | 16.00 | % |

| MTBE (FOB Gulf) | 2.239 | 2.268 | 3.015 | -1.30 | % | -26.00 | % |

| MTBE Premium/Discount to Ethanol (FOB Gulf) | 0.351 | 0.347 | 1.476 | 0.50 | % | -48.10 | % |

| Benzene (FOB U.S. Gulf) | 3.079 | 3.148 | 4.271 | -2.20 | % | -28.00 | % |

| Toluene NITN (FOB U.S. Gulf) | 2.907 | 2.93 | 3.679 | -0.80 | % | -21.10 | % |

| Mixed Xylene (FOB U.S. Gulf) | 2.774 | 2.821 | 3.846 | -1.70 | % | -27.80 | % |

| Weighted Avg Aromatic Price (BTX) | 2.852 | 2.893 | 3.85 | -1.40 | % | -26.00 | % |

| Gasoline (FOB Gulf) | 2.038 | 2.044 | 2.314 | -0.30 | % | -11.90 | % |

This table compares weekly, yearly, and current fuel and co-product prices. Ethanol prices in all regions remain below aromatic octane enhancers but above previous-year levels, reflecting stronger demand. Brazilian ethanol (both hydrous and anhydrous) shows mild week-to-week declines but still sits well above last year. Aromatic components such as benzene, toluene, and xylene continue to drop sharply compared to last year, indicating weaker petrochemical margins. Gasoline shows only a slight weekly dip but remains below last year’s pricing. Overall, ethanol markets are relatively firm while petrochemical-derived components continue trending lower.

Global & Thailand Ethanol Market Overview (Adjusted Statistical Data)

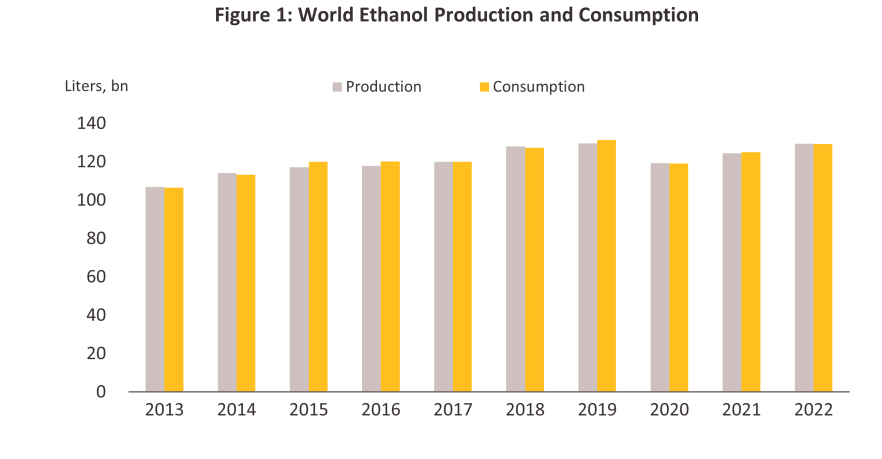

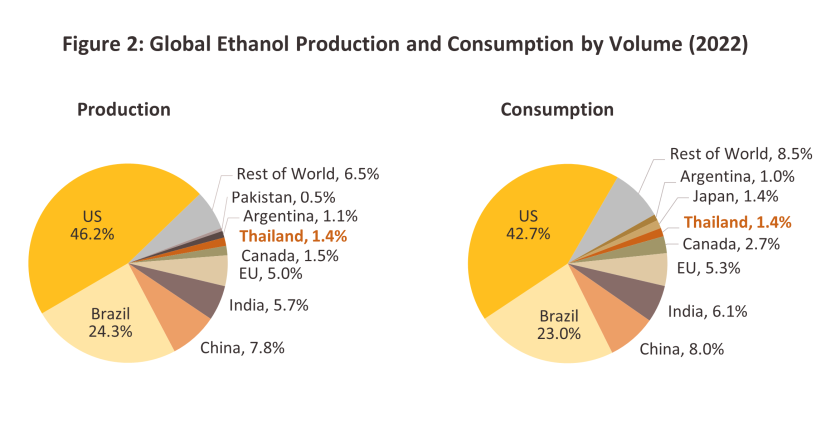

Global demand for ethanol has been steadily increasing, reaching roughly 130 billion liters in 2022, driven by rising fuel consumption, industrial demand, and the post-pandemic recovery. The market is dominated by the US, Brazil, and China, which together contribute just under 80% of global production and use.

Thailand ranks 7th globally in both ethanol production and consumption, with most of its output used in transportation fuels such as E10, E20, and E85 gasohol. The main raw materials used in Thailand are molasses, cassava, and sugarcane, with molasses being the most common due to its steady availability and strong integration with the domestic sugar industry.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6028

Ethanol Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 114.98 billion |

| Market volume in 2025 | 95.08 million tons |

| Revenue forecast in 2035 | USD 199.40 billion |

| Volume forecast in 2035 | 142.24 million tons |

| Growth Rate | CAGR of 5.66% from 2026 to 2035 (Revenue-based) |

| Base year for estimation | 2025 |

| Historical data | 2020 – 2025 |

| Forecast period | 2026 – 2035 |

| Quantitative units | Volume in million liters, Revenue in USD million, and CAGR from 2026 to 2025 |

| Segments covered | Source / Feedstock Insight, Type Insight, End-Use Industry Insight, Distribution Channel Insight, Region |

| Regional scope | North America; Europe; APAC; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; U.K.; France; China; India; Japan; Thailand; Brazil; Mexico |

| Key companies profiled | United Breweries; Aventine Renewable Energy; AB Miller; Archer Daniels Midland Company; Kirin; Pure Energy Inc.; British Petroleum; Cargill Corp. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

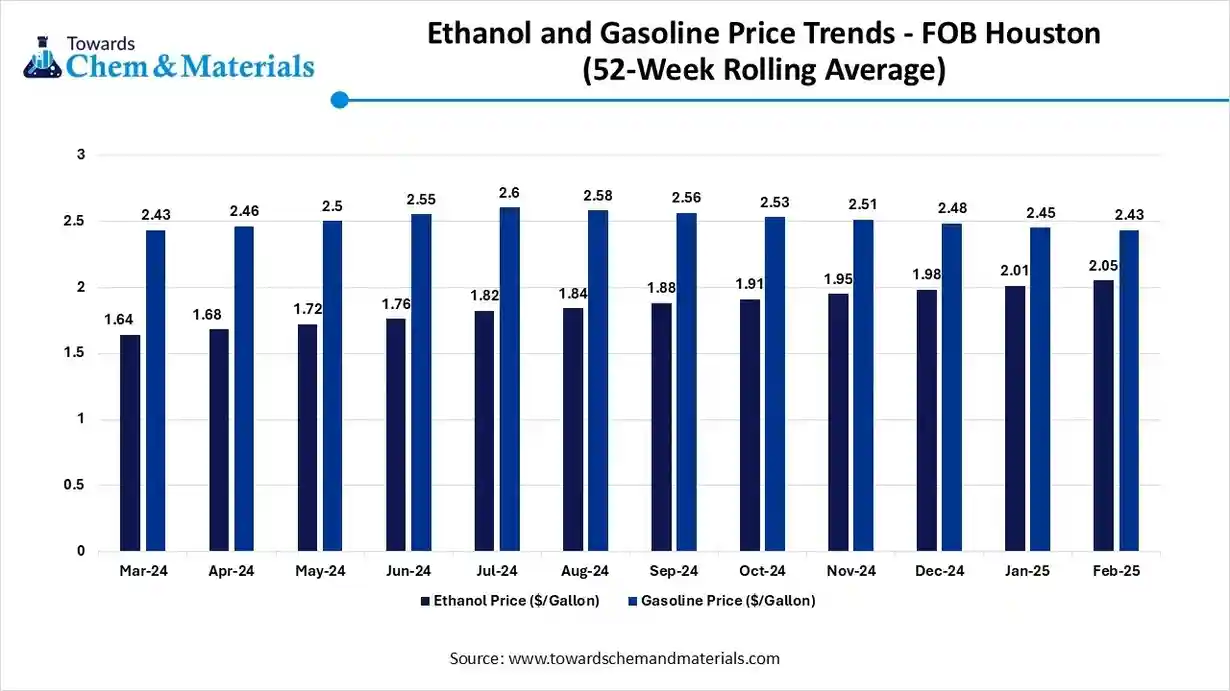

Ethanol and Gasoline Price Trends – FOB Houston (52-Week Rolling Average)

This table shows the 52-week rolling average prices for ethanol and gasoline, measured in U.S. dollars per gallon, for each month from March 2024 to February 2025. The data reveals that the price of gasoline (blue line) has generally been higher than ethanol (orange line) throughout the year, with both prices seeing an overall increase in the second half of 2024. The ethanol price is lower compared to gasoline, and both price trends are gradually rising as the months progress, with gasoline showing slightly more volatility over time.

Smart Spirits: How AI is Revolutionizing the Ethanol Industry

Artificial intelligence is transforming the ethanol industry by optimizing production processes, improving yield, and reducing operational costs. Advanced AI algorithms analyze feedstock quality, fermentation parameters, and energy consumption to enhance efficiency and consistency in ethanol output. Predictive maintenance powered by AI minimizes equipment downtime in large-scale bio-refineries, ensuring smoother operations.

Additionally, AI-driven supply chain and demand forecasting help producers respond dynamically to market fluctuations, from fuel blending requirements to industrial and beverage applications. The integration of AI not only boosts profitability but also supports sustainability by reducing waste and energy usage, positioning the ethanol industry for a smarter, greener future.

Private Industry Investments in Ethanol:

- Balrampur Chini Mills has invested heavily in expanding its distillery capacity to over 1,050 kilolitres per day (KLPD), making it a major ethanol producer that supplies oil marketing companies for the blending program.

- Shree Renuka Sugars has focused on using advanced technology to produce ethanol from sugarcane juice and molasses, aiming to maximize its contribution to the blending program and further expand its significant production capacity of 1,250 KLPD.

- Praj Industries, an engineering company, has invested in developing and supplying technology solutions for biofuel plants, including India’s first retrofitted second-generation ethanol plant that uses agricultural waste as feedstock.

- Triveni Engineering & Industries is setting up new multi-feed distilleries with a combined capacity to produce alcohol from both sugarcane-based feedstocks and grains, aiming to reach a total capacity of 1,100 KLPD to meet rising demand.

- Dalmia Bharat Sugar has strategically increased its ethanol manufacturing capacity to 250 KLPD using a dual-feedstock approach (molasses and grain) to insulate the company from supply chain risks associated with single raw materials.

- Godavari Biorefineries Limited announced an investment of approximately ₹130 crore in a new 200 KLPD corn/grain-based distillery to enhance flexibility and boost ethanol production capacity using internal accruals and debt.

What are the Key Trends of the Global Ethanol Market?

- Growing Adoption as Biofuel and Fuel Additive

Driven by stringent environmental regulations and government blending mandates, ethanol is widely used as a cleaner-burning alternative to traditional gasoline. This trend helps countries reduce greenhouse gas emissions, improve air quality, and enhance energy security by decreasing reliance on imported crude oil.

- Expansion into Diverse Industrial Applications

Beyond fuel, ethanol demand is surging in various industrial sectors, including pharmaceuticals, personal care products, and as an industrial solvent. This diversification, partly accelerated by the need for disinfectants during the pandemic, provides new growth opportunities and a stable demand channel for producers.

- Advancements in Sustainable Production Technologies

The market is shifting towards more sustainable sources like cellulosic ethanol, produced from non-food biomass such as agricultural waste and residues. These technological innovations address food security concerns associated with first-generation feedstocks (like corn and sugarcane) and align with circular economy principles.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6028

Ethanol Market Segmentation Insights

Segment Analysis

Source/Feedstock Insights

The bio-based feedstocks segment dominated the market in 2025 due to growing demand for sustainable and renewable sources of ethanol, driven by environmental regulations and carbon reduction goals. Feedstocks such as sugarcane, corn, and cellulosic biomass became the preferred raw materials, offering higher efficiency and lower environmental impact compared to fossil-based alternatives. Rising government incentives and subsidies for bioethanol production encouraged large-scale adoption of bio-based feedstocks.

Type Insights

The fuel-grade ethanol segment led the market in 2025 due to the increasing global emphasis on renewable energy and reducing carbon emissions in the transportation sector. Rising adoption of ethanol-blended fuels, such as E10 and E85, to meet government mandates and emission standards significantly boosted demand. Expanding production capacities in key markets like the U.S., Brazil, and India ensured a steady supply to meet growing fuel consumption. Technological improvements in fermentation and distillation processes enhanced yield and cost-efficiency, making fuel-grade ethanol more competitive.

End-use Industry Insights

In 2025, the transportation and automotive segment led the market due to the widespread adoption of ethanol-blended fuels, such as E10 and E85, aimed at reducing greenhouse gas emissions and meeting stringent fuel quality regulations. Rising global vehicle ownership and increasing demand for cleaner, renewable fuels in both developed and emerging markets drove consistent ethanol consumption. Government mandates, subsidies, and incentives for biofuel use further strengthened the segment’s growth.

Distribution Channel Insights

In 2025, the direct supply segment led the market because producers increasingly preferred supplying bulk ethanol directly to fuel blenders, industrial users, and large beverage manufacturers to ensure quality, consistency, and timely delivery. Direct supply allowed buyers to access high-purity ethanol in required volumes without intermediaries, reducing costs and simplifying logistics. Rising demand from the transportation sector for ethanol-blended fuels, as well as from pharmaceutical and industrial applications, strengthened reliance on direct sourcing. Long-term contracts between ethanol producers and major end-users ensured supply security amid fluctuating feedstock prices.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

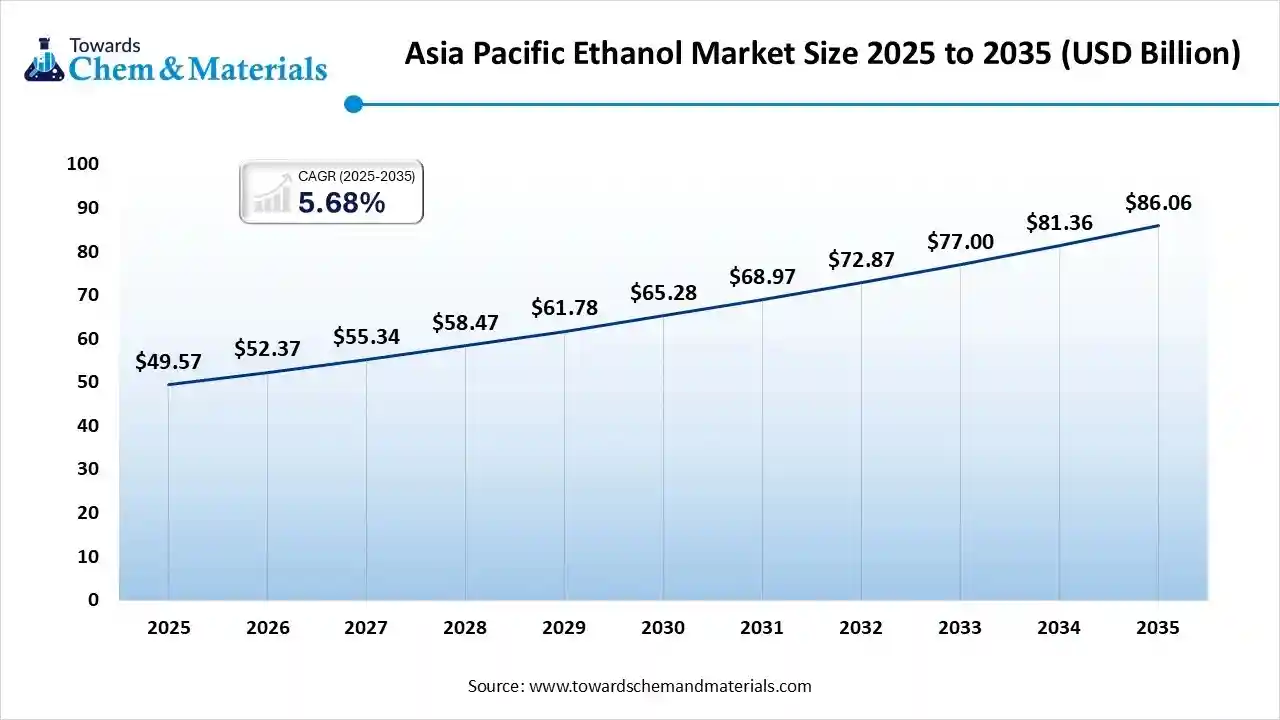

The Asia Pacific ethanol market size was valued at USD 49.57 billion in 2025 and is expected to reach USD 86.06 billion by 2035, growing at a CAGR of 5.68% from 2025 to 2035. Asia Pacific dominates the ethanol market with a share of 43.11% in 2025.

Asia-Pacific Leads the Charge: Dominating the Global Ethanol Market

Asia-Pacific emerged as a dominant player in the global market in 2025, driven by strong demand from the transportation sector and expanding industrial applications. Rapidly growing automotive markets in countries like China and India fueled adoption of ethanol-blended fuels to meet emission regulations and reduce reliance on fossil fuels. Government policies, subsidies, and renewable energy initiatives further incentivized large-scale ethanol production and consumption. The region’s abundant availability of feedstocks such as sugarcane, corn, and cassava supported cost-effective bioethanol production.

China Ethanol Market Trends

In the Asia-Pacific market, China is the leading country in 2025. This leadership is driven by the country’s massive transportation sector and stringent government policies promoting renewable fuels to reduce carbon emissions and improve air quality. China has actively implemented ethanol-blended fuel mandates, such as E10 adoption, across several provinces, creating consistent demand for fuel-grade ethanol. The country also benefits from growing domestic production using corn and cassava feedstocks, supported by investments in advanced bioethanol technologies to improve efficiency and sustainability.

Latin America on the Fast Track: The Rapidly Growing Ethanol Market

Latin America recorded the fastest growth in the global market in 2025, driven by large-scale bioethanol production from sugarcane, particularly in Brazil, one of the world’s largest ethanol exporters. Rising adoption of ethanol-blended fuels in the transportation sector, supported by government mandates and sustainability initiatives, significantly boosted demand. Technological advancements in production and processing improved yield and efficiency, making ethanol more cost-competitive. Expanding industrial and beverage applications further strengthened consumption across the region.

Brazil Ethanol Market Trends

Brazil is the leading country in the Latin America market in 2025. Its dominance is driven by large-scale ethanol production from sugarcane, which is highly efficient and cost-effective compared to other feedstocks. The country has a long-established ethanol fuel program, with widespread adoption of ethanol-blended fuels in the transportation sector, supporting both domestic consumption and exports. Government policies and incentives promote biofuel use, while continuous investment in production technology enhances yield and sustainability.

Top Companies in the Ethanol Market & Their Offerings

- Cremer Oleo GmbH Co.KG: This company is a trading company that sources and distributes plant-based technical and sustainable bioethanol from partners worldwide for use in cosmetics, pharmaceuticals, food, and technical applications.

- Alto Ingredients (Ireland): Alto Ingredients (Ireland) is a producer and distributor of renewable fuels and essential ingredients, including specialty alcohols.

- AGRANA Beteiligungs-AG: AGRANA produces bioethanol by refining agricultural raw materials like sugar beet, alongside its primary business of producing sugar, starch, and fruit products.

- Cardinal Ethanol LLC: Cardinal Ethanol is a US-based company engaged in the production of fuel ethanol.

- Sekab: Sekab is involved in the production and supply of bioethanol, which it markets as an environmentally friendly chemical and fuel.

- Nordzucker: As Europe’s second-largest sugar manufacturer, Nordzucker produces bioethanol from sugar beet as a secondary product alongside its main sugar business.

- Marquis Energy: Marquis Energy is a major US-based producer of ethanol, notably focusing on large-scale production facilities.

- Tereos: This agricultural cooperative conglomerate operates in the processed agricultural raw materials market and produces alcohol (ethanol) and starch in its various factories.

More Insights in Towards Chemical and Materials:

- Ethanol Market : The global ethanol market size is calculated at USD 114.98 billion in 2025 and is predicted to increase from USD 121.49 billion in 2026 and is projected to reach around USD 199.40 billion by 2035, The market is expanding at a CAGR of 5.66% between 2026 and 2035.

- Ethanol 2.0 Market ; The global ethanol 2.0 market size is calculated at USD 121.61 billion in 2025 and is predicted to increase from USD 130.35 billion in 2026 and is projected to reach around USD 243.50 billion by 2035, The market is expanding at a CAGR of 7.19% between 2026 and 2035.

- Ethanol Market ; The global ethanol market stands at 95.08 million tons in 2025 and is forecast to reach 142.24 million tons by 2035, expanding at a CAGR of 4.11% from 2026 to 2035.

- Methanol Market : The global methanol market volume was reached at 12.37 million tons in 2024 and is expected to be worth around 18.50 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period 2025 to 2034.

- Green Methanol Market : The global green methanol market size accounted for USD 2.66 billion in 2024 and is projected to hit around USD 17.84 billion by 2034, expanding at a CAGR of 20.96% during the forecast period from 2025 to 2034.

- Bioethanol Yeast Market : The global bioethanol yeast market size is estimated at USD 20.69 billion in 2024, is projected to grow to USD 23.35 billion in 2025, and is expected to reach approximately USD 69.43 billion by 2034. the market is projected to expand at a compound annual growth rate (CAGR) of 12.87% between 2025 and 2034.

- U.S. Methanol Market : The U.S. methanol market size was reached at USD 5.32 billion in 2024 and is expected to be worth around USD 12.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.22% over the forecast period 2025 to 2034.

- Bioplastics Market : The global bioplastics market volume is calculated at 1,140,000.0. tons in 2024, grew to 1,373,016.0 tons in 2025 and is predicted to hit around 73,21,706.6 tons by 2034, expanding at healthy CAGR of 20.44% between 2025 and 2034.

- Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

Ethanol Market Top Key Companies:

- Cremer Oleo GmbH Co.KG

- Alto Ingredients (Ireland)

- AGRANA Beteiligungs-AG

- Cardinal Ethanol LLC

- Sekab

- Nordzucker

- Marquis Energy

- Tereos

Recent Breakthrough in the Ethanol Industry

- In August 2025, a detailed response to certain concerns raised on the impact of 20% Ethanol Blended Petrol (E-20) on mileage and vehicle life was issued by the Ministry of Petroleum and Natural Gas. NITI Aayog’s study on life cycle emissions of Ethanol unveiled GHG emissions in the case of utilization of sugarcane and maize-based Ethanol to contain less by 65% and 50% respectively, compared to petrol.

Ethanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Ethanol Market

By Source / Feedstock

- Bio-based Feedstocks

- Corn

- Sugarcane

- Wheat

- Barley

- Cassava

- Cellulosic Feedstocks

- Agricultural Waste

- Forestry Residues

- Energy Crops

- Synthetic Ethanol (petrochemical route)

By Type

- Fuel-Grade Ethanol

- Industrial-Grade Ethanol

- Beverage-Grade Ethanol

- Pharmaceutical-Grade Ethanol

By End-Use Industry

- Transportation & Automotive

- Chemicals & Petrochemicals

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care

- Household & Cleaning Products

By Distribution Channel

- Direct Supply to Blenders & Refineries

- Industrial Distributors

- Chemical Traders

- Retail / Fuel Networks

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6028

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.