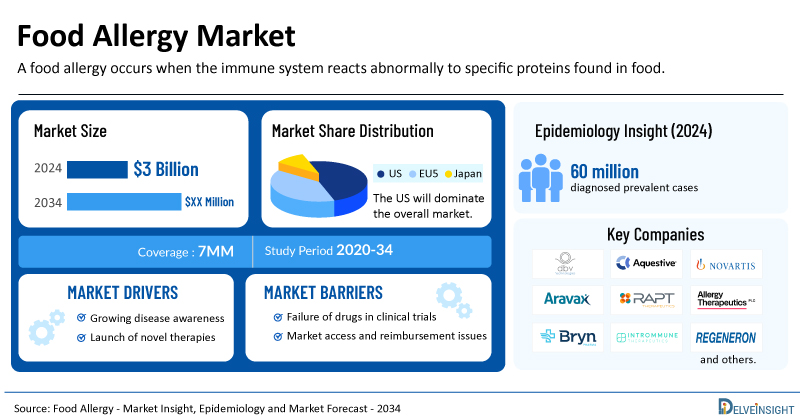

Food Allergy Market Valued at USD 3 Billion across the 7MM, Projected to Grow at CAGR of 11.3% by 2034 | DelveInsight

The food allergy market is expected to surge in the coming years, primarily due to the adoption of recently approved therapies, potential emerging therapies such as Viaskin (DBV712) Peanut Patch (DBV Technologies), PVX108 (Aravax), Remibrutinib (Novartis), SLIT tablet (ALK-Abello), RPT904 (RAPT Therapeutics), ANAPHYLM (epinephrine sublingual film) (Aquestive Therapeutics), and others, an increase in diagnoses, and rising costs.

New York, USA, Nov. 10, 2025 (GLOBE NEWSWIRE) — Food Allergy Market Valued at USD 3 Billion across the 7MM, Projected to Grow at CAGR of 11.3% by 2034 | DelveInsight

The food allergy market is expected to surge in the coming years, primarily due to the adoption of recently approved therapies, potential emerging therapies such as Viaskin (DBV712) Peanut Patch (DBV Technologies), PVX108 (Aravax), Remibrutinib (Novartis), SLIT tablet (ALK-Abello), RPT904 (RAPT Therapeutics), ANAPHYLM (epinephrine sublingual film) (Aquestive Therapeutics), and others, an increase in diagnoses, and rising costs.

DelveInsight’s Food Allergy Market Insights report includes a comprehensive understanding of current treatment practices, emerging food allergy drugs, market share of individual therapies, and current and forecasted food allergy market size from 2020 to 2034, segmented into leading markets (the US, EU4, UK, and Japan).

Food Allergy Market Summary

- The market size for food allergy was found to be USD 3 billion in the leading markets in 2024.

- The United States accounted for the largest food allergy treatment market size, approximately 79% of the total market size in the 7MM in 2024, compared to other major markets, including the EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- In 2024, among all the current food allergy therapies, the highest revenue was generated by Epinephrine, i.e., nearly USD 1.4 billion in the US.

- Based on DelveInsight’s assessment in 2024, the 7MM had approximately 60 million diagnosed prevalent cases of food allergy.

- Key food allergy companies, including DBV Technologies, Aquestive Therapeutics, Novartis, Aravax, RAPT Therapeutics, ALK-Abello, Allergy Therapeutics, Bryn Pharma, Intrommune Therapeutics, Regeneron Pharmaceuticals, and others, are actively working on innovative food allergy drugs.

- Some of the key food allergy therapies in clinical trials include Viaskin (DBV712) peanut patch, ANAPHYLM (Epinephrine Sublingual Film), Remibrutinib (LOU064), PVX108, RPT904, Sublingual Immunotherapy (SLIT)-tablet, VLP Peanut, NDS1C (Epinephrine Nasal Spray), INT301, LYNOZYFIC (linvoseltamab) + DUPIXENT (dupilumab), and others. These novel food allergy therapies are anticipated to enter the food allergy market in the forecast period and are expected to change the market.

- By 2034, among all the emerging therapies, the highest revenue is expected to be generated by ANAPHYLM in the 7MM.

Discover which food allergy medications are expected to grab the market share @ Food Allergy Market Report

Key Factors Driving the Growth of the Food Allergy Market

Rising Prevalence of Food Allergies

The increasing prevalence of food allergies worldwide is a primary driver of food allergy market growth. In 2024, the US had approximately 36 million diagnosed prevalent cases of food allergy. The reasons for this increase in prevalence are likely multifaceted. Sensitization via the skin appears to be associated with the development of food allergy, and atopic eczema in infancy is associated with a high risk of developing food allergy.

PALFORZIA’s Oral Administration Advantage

PALFORZIA, administered orally, offers a convenient delivery method, making it a more accessible treatment option compared to traditional subcutaneous (SC), intradermal, and epicutaneous therapies, which may potentially enhance patient adherence and reduce the burden on healthcare systems.

Emerging Opportunities in the Adult Food Allergy Market

An opportunity exists in the adult food allergy market, as there is currently only one approved treatment for this group, with Novartis’ remibrutinib being the only drug under evaluation, presenting potential for growth in the food allergy market.

Strong Food Allergy Pipeline Activity

The food allergy treatment landscape features clinical trials led by Aquestive Therapeutics (ANAPHYLM (epinephrine sublingual film), DBV Technologies (viaskin [DBV712] peanut patch), Novartis (remibrutinib), Aravax (PVX108), ALK-Abello (Sublingual Immunotherapy (SLIT)-Tablet), InnoUp Farma (INP20), and others.

Food Allergy Market Analysis

Currently, available treatment options for food allergies include immunotherapies, such as oral dose escalation with allergenic food proteins or the FDA-approved peanut allergen powder, and biologic therapies like XOLAIR, administered via subcutaneous injection. Other desensitization-based immunotherapies utilizing alternative delivery routes, including sublingual (SLIT) and epicutaneous (EPIT) methods, are under development but have not yet received regulatory approval or reached commercial availability.

The food allergy treatment landscape is evolving rapidly, driven by a growing prevalence of allergies, heightened awareness, and advancements in therapeutic innovation. Traditionally, management has focused on strict allergen avoidance and emergency response measures—most notably, epinephrine autoinjectors such as EpiPen, Auvi-Q, and Adrenaclick. While essential for acute reactions, these approaches do not target the root immune mechanisms and offer no long-term control.

At present, the key approved therapeutic options offering meaningful benefits for patients and clinicians are PALFORZIA (peanut allergen powder), XOLAIR (omalizumab), and NEFFY (epinephrine nasal spray). PALFORZIA is specifically indicated for peanut allergy, whereas XOLAIR can be used across multiple food allergens.

Beyond these approved treatments, several companies are actively advancing novel therapies, signaling robust progress in the field. Key developers include DBV Technologies (Viaskin), Novartis (Remibrutinib), Aravax (PVX108), ALK-Abelló (SLIT-tablet), Allergy Therapeutics (VLP Peanut), and RAPT Therapeutics (RPT904). This expanding pipeline reflects the strong momentum and growing commitment to meeting the substantial unmet needs in food allergy care.

Learn more about the food allergy treatment options @ Food Allergy Treatment Market

Food Allergy Competitive Landscape

The food allergy clinical trial landscape includes some drugs in the development stage that are expected to be approved in the near future. The emerging landscape holds therapeutic alternatives for treatment, including Viaskin (DBV712) Peanut Patch (DBV Technologies), PVX108 (Aravax), Remibrutinib (Novartis), SLIT tablet (ALK-Abello), RPT904 (RAPT Therapeutics), ANAPHYLM (epinephrine sublingual film) (Aquestive Therapeutics), and others.

DBV Technologies’ Viaskin Peanut is an epicutaneous immunotherapy (EPIT) that delivers trace amounts of peanut protein through a skin patch to promote immune desensitization. The therapy has received both Fast Track and Breakthrough Therapy Designations from the U.S. FDA. It is currently under evaluation in a Phase III clinical trial involving peanut-allergic children aged 4–7 years. DBV Technologies expects to announce top-line results from the VITESSE trial (NCT05741476) in the fourth quarter of 2025.

Aravax’s PVX108 is a next-generation immunotherapy that aims to reprogram the immune system by using engineered peptides to engage T cells and counteract allergic responses specifically. It is currently being assessed in a Phase II clinical trial for children and adolescents with peanut allergy.

RAPT Therapeutics’ Ozureprubart is an innovative, long-acting anti-IgE mAb bio-better that targets the same epitope as omalizumab for the treatment of food allergies, chronic spontaneous urticaria, and other allergic inflammatory conditions. Engineered to block both free and cell-bound human IgE, a central mediator of allergic responses, Ozureprubart has demonstrated improved pharmacokinetic and pharmacodynamic profiles compared to omalizumab, the first-generation anti-IgE antibody, in early clinical studies.

Aquestive Therapeutics’ Anaphylm Epinephrine Sublingual Film is the first and only orally administered film in clinical development that utilizes Aquestive’s novel epinephrine prodrug. It is being developed for the same intended use as injectable epinephrine, the emergency treatment of Type 1 allergic reactions, including anaphylaxis. Aquestive is addressing the unmet need for an oral epinephrine formulation by applying its proprietary PharmFilm® technology to develop this innovative therapy.

The anticipated launch of these emerging food allergy therapies are poised to transform the food allergy market landscape in the coming years. As these cutting-edge food allergy therapies continue to mature and gain regulatory approval, they are expected to reshape the food allergy market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for food allergy, visit @ Food Allergy Medication

Recent Developments in the Food Allergy Market

- In October 2025, RAPT Therapeutics, Inc. began the prestIgE Phase 2b clinical trial of ozureprubart (formerly known as RPT904) for IgE-mediated food allergies. The randomized, double-blind, placebo-controlled study will be conducted across roughly 30 sites in the U.S., Canada, and Australia.

- In October 2025, Aquestive Therapeutics, Inc. announced that the United States Patent and Trademark Office (USPTO) had granted two new U.S. patents covering Anaphylm, the company’s innovative sublingual film formulation of an epinephrine prodrug.

- In March 2025, the US FDA approved NEFFY for the treatment of Type I allergic reactions, including anaphylaxis, in children aged 4 years and older who weigh 15 to <30 kg (33 to <66 lbs). This approval represents the first significant innovation in the delivery of epinephrine for this patient population in >35 years.

- In March 2025, Allergy Therapeutics stated that the PROTECT trial is progressing as planned, with initial topline data expected to be announced later this summer of 2025.

- In March 2025, DBV Technologies reached an understanding with the US FDA based on written replies to its Type D IND meeting request. The FDA concurred with DBV’s proposal that safety exposure data from the VITESSE Phase III study of the Viaskin Peanut Patch in children aged 4–7 years would be sufficient to support BLA filing for this age group, thereby accelerating the anticipated timeline for BLA submission to the first half of 2026.

What is Food Allergy?

A food allergy occurs when the immune system reacts abnormally to specific proteins found in food. These reactions can be either Immunoglobulin E (IgE)-mediated or non-IgE-mediated. IgE-mediated food allergies represent a significant global health concern, affecting millions of individuals and impacting numerous aspects of daily life. Although any food has the potential to trigger an allergic response, a small number of foods are responsible for most cases, namely milk, eggs, fish, shellfish, tree nuts, peanuts, wheat, and soybeans. Allergic reactions can affect the skin, gastrointestinal tract, cardiovascular system, or respiratory system, resulting in symptoms such as hives, vomiting, coughing, wheezing, throat constriction, tongue swelling, a weak pulse, dizziness, and, in severe cases, potentially fatal anaphylaxis.

Food Allergy Epidemiology Segmentation

The food allergy epidemiology section provides insights into the historical and current food allergy patient pool and forecasted trends for the leading markets. In 2024, within the 7MM, on the basis of severity in adults, the number of food allergy cases was more severe, 25 million, than mild to moderate. These numbers are expected to rise by 2034.

The food allergy market report proffers epidemiological analysis for the study period 2020–2034 in the leading markets, segmented into:

- Total Diagnosed Prevalent Cases of Food Allergy

- Allergen-specific Diagnosed Prevalent Cases of Food Allergy

- Gender-specific Diagnosed Prevalent Cases of Food Allergy

- Severity-specific Diagnosed Prevalent Cases of Food Allergy

Download the report to understand food allergy management @ Food Allergy Treatment Options

| Food Allergy Market Report Metrics | Details |

| Study Period | 2020–2034 |

| Food Allergy Market Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Food Allergy Market CAGR | 11.3% |

| Food Allergy Market Size | USD 3 Billion |

| Key Food Allergy Companies | DBV Technologies, Aquestive Therapeutics, Novartis, Aravax, RAPT Therapeutics, ALK-Abello, Allergy Therapeutics, Bryn Pharma, Intrommune Therapeutics, Regeneron Pharmaceuticals, ARS Pharmaceuticals, Alfresa Pharma, Roche, Novartis, Stallergenes Greer, and others |

| Key Food Allergy Therapies | Viaskin (DBV712) peanut patch, ANAPHYLM (Epinephrine Sublingual Film), Remibrutinib (LOU064), PVX108, RPT904, Sublingual Immunotherapy (SLIT)-tablet, VLP Peanut, NDS1C (Epinephrine Nasal Spray), INT301, LYNOZYFIC (linvoseltamab) + DUPIXENT (dupilumab), NEFFY/EURNEFFY, XOLAIR, PALFORZIA, and others |

Scope of the Food Allergy Market Report

- Food Allergy Therapeutic Assessment: Food Allergy current marketed and emerging therapies

- Food Allergy Market Dynamics: Conjoint Analysis of Emerging Food Allergy Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Food Allergy Market Unmet Needs, KOL’s views, Analyst’s views, Food Allergy Market Access and Reimbursement

Discover more about food allergy drugs in development @ Food Allergy Clinical Trials

Table of Contents

| 1 | Food Allergy Market Key Insights |

| 2 | Food Allergy Market Report Introduction |

| 3 | Executive Summary |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology |

| 6 | Food Allergy Market Overview at a Glance |

| 6.1 | Food Allergy Market Share (%) Distribution by Therapies in 2024 in the 7MM |

| 6.2 | Food Allergy Market Share (%) Distribution by Therapies in 2034 in the 7MM |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Food Allergy Symptoms |

| 7.3 | Foods with Allergies |

| 7.4 | Risk Factors for Food Allergy Development |

| 7.5 | Clinical Manifestations |

| 7.6 | Food Allergy Diagnosis |

| 7.7 | Food Allergy Treatment and Management |

| 7.8 | Guidelines |

| 8 | Epidemiology and Patient Population |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale: 7MM |

| 8.3 | Total Diagnosed Prevalent Cases of Food Allergy in the 7MM |

| 8.4 | The United States |

| 8.4.1 | Total Diagnosed Prevalent Cases of Food Allergy in the United States |

| 8.4.2 | Allergen-specific Diagnosed Prevalent Cases of Food Allergy in the United States |

| 8.4.3 | Gender-specific Diagnosed Prevalent Cases of Food Allergy in the United States |

| 8.4.4 | Severity-specific Diagnosed Prevalent Cases of Food Allergy in the United States |

| 8.5 | EU4 and the UK |

| 8.6 | Japan |

| 9 | Food Allergy Patient Journey |

| 10 | Marketed Food Allergy Drugs |

| 10.1 | Key Competitors |

| 10.2 | PALFORZIA (peanut allergen powder-dnfp): Stallergenes Greer |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Developmental Activities |

| 10.2.4 | Safety and Efficacy |

| 10.2.5 | Analyst Views |

| 10.3 | XOLAIR (omalizumab): Roche and Novartis |

| 10.4 | NEFFY/EURNEFFY (epinephrine nasal spray): ARS Pharmaceuticals, ALK-Abelló, and Alfresa Pharma |

| 11 | Emerging Food Allergy Therapies |

| 11.1 | Key Cross Competition |

| 11.2 | Viaskin (DBV712) peanut patch: DBV Technologies |

| 11.2.1 | Product Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Development |

| 11.2.3.1 | Clinical Trials Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analyst Views |

| 11.3 | Remibrutinib (LOU064): Novartis |

| 11.4 | ANAPHYLM (Epinephrine Sublingual Film): Aquestive Therapeutics |

| 11.5 | NDS1C (Epinephrine Nasal Spray): Bryn Pharma |

| 11.6 | PVX108: Aravax |

| 11.7 | RPT904: RAPT Therapeutics |

| 11.8 | Sublingual Immunotherapy (SLIT)-Tablet: ALK-Abello |

| 11.9 | VLP Peanut: Allergy Therapeutics |

| 11.1 | LYNOZYFIC (linvoseltamab) + DUPIXENT (dupilumab): Regeneron Pharmaceuticals |

| 12 | Food Allergy Market: Seven Major Market Analysis |

| 12.1 | Key Findings |

| 12.2 | Food Allergy Market Outlook |

| 12.3 | Conjoint Analysis |

| 12.4 | Key Food Allergy Market Forecast Assumptions |

| 12.5 | Total Market Size of Food Allergy by Country in the 7MM |

| 12.6 | United States Food Allergy Market Size |

| 12.6.1 | Total Market Size of Food Allergy in the United States |

| 12.6.2 | Market Size of Food Allergy by Therapies in the United States |

| 12.8 | EU4 and the UK Food Allergy Market Size |

| 12.9 | Japan Food Allergy Market Size |

| 13 | Food Allergy Market Unmet Needs |

| 14 | Food Allergy Market SWOT Analysis |

| 15 | KOL Views on Food Allergy |

| 16 | Food Allergy Market Access and Reimbursement |

| 16.1 | United States |

| 16.2 | EU4 and the UK |

| 16.3 | Japan |

| 16.4 | Market Access and Reimbursement of Food Allergy |

| 17 | Bibliography |

| 18 | Food Allergy Market Report Methodology |

Related Reports

Food Allergy Clinical Trial Analysis

Food Allergy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key food allergy companies, including DBV Technologies, Aravax, Xencor, Novartis AG, Vedanta Biosciences, Alladapt Immunotherapeutics, Intrommune Therapeutics, IgGenix, Lapix Therapeutics, Neovacs, Inimmune, among others.

Peanut Allergy Market

Peanut Allergy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key peanut allergy companies including DBV Technologies, Novartis, Aravax, ALK-Abello, InnoUp Farma, Intrommune Therapeutics, Stallergenes Greer, Roche, among others.

Peanut Allergy Clinical Trial Analysis

Peanut Allergy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key peanut allergy companies, including Allergy Therapeutics, DBV Technologies, Novartis, Aravax, ALK-Abello, Intrommune Therapeutics, LAPIX Therapeutics, among others.

Lactose Intolerance Market

Lactose Intolerance Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key lactose intolerance companies including CRitter Pharmaceuticals Inc., a2 Milk Company Ltd, VenterPharma, Eurofarma Laboratorios S.A, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Pipeline Assessment

Healthcare Licensing Services

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.