Fortified Foods Market Size to Exceed USD 343.96 Billion by 2034, Driven by Health Awareness and AI-Enabled Product Innovation

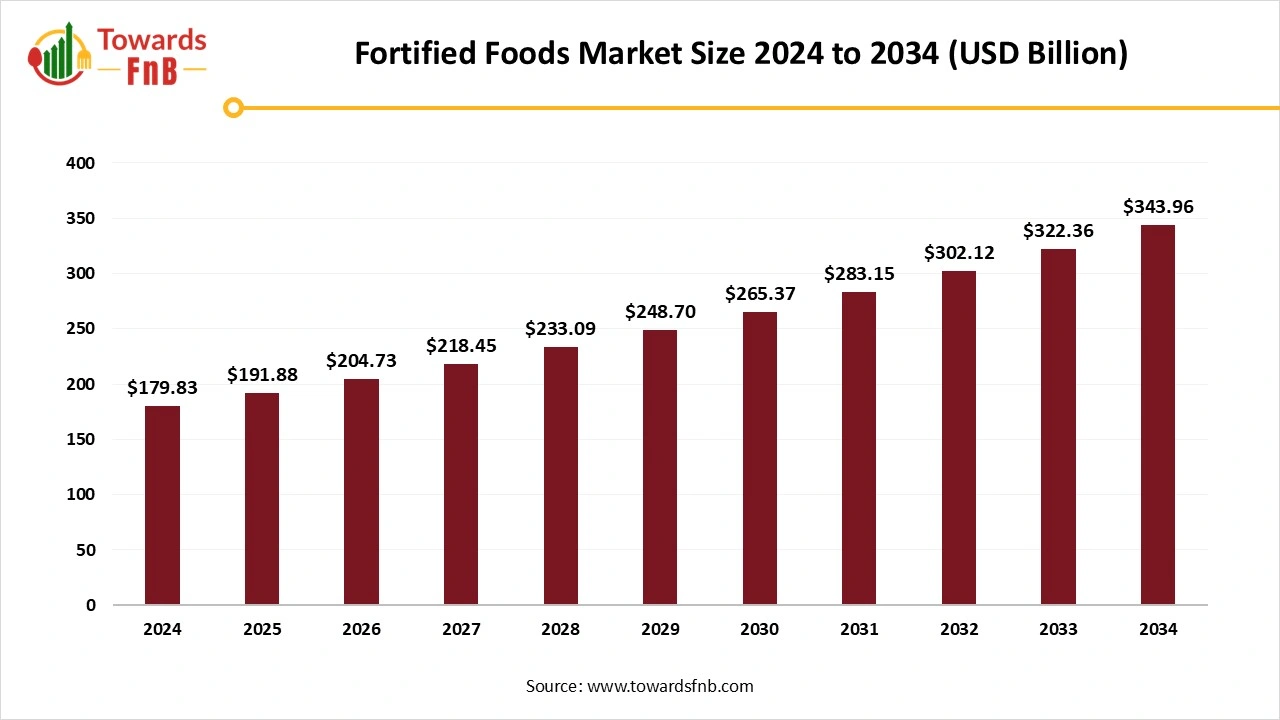

According to Towards FnB, the global fortified foods market size is evaluated at USD 191.88 billion in 2025 and is anticipated to hit USD 343.96 billion by 2034, reflecting at a CAGR of 6.7% from 2025 to 2034. The market expansion is fueled by rising consumer focus on health, widespread fortification programs, and increasing adoption of convenient nutrient-rich foods.

Ottawa, Nov. 10, 2025 (GLOBE NEWSWIRE) — The global fortified foods market size stood at USD 179.83 billion in 2024 and is predicted to increase from USD 191.88 billion in 2025 to reach nearly USD 343.96 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to the increasing health and wellness trend, as well as growing awareness of malnutrition and other nutritional deficiencies. The market is also growing due to high consumer demand for convenient yet nutritious food options among consumers with hectic lifestyles.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5902

Key Highlights of the Fortified Foods Market

- By region, North America dominated the fortified foods market in 2024, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By product type, the fortified dairy products segment led the fortified foods market in 2024, whereas the fortified snacks segment is expected to grow in the foreseeable period.

- By end user, the adult segment led the fortified foods market in 2024, whereas the elderly segment is expected to grow in the foreseeable period.

- By nutritional benefits, the vitamins segment dominated the market in 2024, whereas the proteins segment is expected to grow in the foreseeable period.

- By distribution channel, the supermarkets segment led the market in 2024, whereas the online retail segment is expected to grow in the foreseeable period.

Health and Nutrition are helpful for the Expansion of the Fortified Foods Industry

The fortified foods market is observed to grow due to factors such as increasing consumer awareness of health and nutrition, increasing government initiatives to combat malnutrition, and advancing technology in food processing. Consumers today are understanding the importance of fortified foods for overall nutrition, further fueling the growth of the market. The market is also experiencing growth due to higher demand for convenient food options, further leading to higher demand for fortified snacks and ready-to-eat meal options to save time and maintain nutrition, which is further helpful for the market’s growth.

Impact of AI on the Fortified Foods Market

Artificial intelligence is having a transformative impact on the fortified foods market by accelerating innovation, improving production efficiency, and enabling personalized nutrition. In research and development, AI-powered algorithms analyze extensive datasets from nutrition science, consumer health trends, and ingredient interactions to identify optimal nutrient combinations for specific health benefits, such as immunity, bone strength, or cognitive function. Machine learning models help manufacturers design fortified foods that maintain taste, texture, and shelf life while delivering essential vitamins and minerals, significantly reducing the time and cost of product formulation.

AI-driven predictive analytics optimize blending, enrichment, and packaging processes to ensure consistent nutrient distribution and quality. Smart sensors and computer vision systems detect impurities or inconsistencies in real time, maintaining safety and regulatory compliance. AI also supports sustainability by minimizing energy and material waste during production.

AI plays a key role in personalized nutrition by recommending fortified food products tailored to individual dietary needs, age groups, and health conditions. E-commerce platforms and digital health apps use AI to enhance product discovery and engagement, while sentiment analysis of consumer feedback helps companies align products with evolving health and wellness trends.

New Trends of the Fortified Foods Market

- Higher demand for plant-based fortified food options is one of the major factors for the growth of the market.

- Personalization in fortified food options is another major factor for the growth of the market.

- Higher demand for fortified dairy options is another major factor propelling the fortified foods market growth.

- Higher demand for ready-to-eat food options helps to fuel the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/fortified-foods-market

Recent Development of the Fortified Foods Market

- In October 2025, Millers for Nutrition, a large-scale food fortification, announced major milestones across Asia for combating Hidden hunger. The initiative involves the launch of 20 new fortified food brands across India and Bangladesh. The program is currently active in eight countries- Bangladesh, Ethiopia, India, Indonesia, Kenya, Nigeria, Pakistan, and Tanzania. (Source- https://millingmea.com)

Core Government Initiatives for the Fortified Foods Market

- Mandatory fortification of staples: governments require the addition of specific micronutrients to widely consumed staples, such as iodization of salt, iron/folic acid or folic acid + B-vitamins in wheat flour, and vitamin A in oil. This creates guaranteed demand and scale for fortification inputs and premixes.

- Inclusion in public food programs/procurement: governments mandate/encourage use of fortified staples in school meals, food-subsidy programs and social safety nets (mid-day meals, public distribution systems), ensuring large, steady institutional purchases. (Example: school and public distribution programmes using fortified rice/flour.)

- National standards, regulations & labelling rules: UK food authorities set nutrient standards, limits, analytical methods, and labelling regulations for fortified foods (what can be called “fortified”, nutrient declaration, and health claims). Clear standards reduce industry uncertainty and protect consumer trust.

- Financial support & procurement incentives: capital grants, subsidised premix, guaranteed government procurement, or direct budgetary allocations for fortification in targeted programmes (helps smaller mills/processors adopt fortification). (Many countries include fortification budget lines in nutrition programmes.)

- Public-private partnerships (PPP) & technical assistance: governments partner with industry, UN agencies, NGOs, and donor programs to supply premix, share fortification technology, and co-finance scale-up and logistics. PPPs accelerate roll-out and quality control.

Top Products in the Fortified Foods Market

| Product Category | Description / Function | Common Fortified Nutrients | Key Applications / End-Use Segments | Leading Brands / Producers |

| Fortified Breakfast Cereals | Ready-to-eat cereals and oats enriched with essential vitamins and minerals for daily nutrition. | Iron, folic acid, vitamin D, calcium, B-complex vitamins | Children’s breakfast foods, adult health cereals | Kellogg’s, Nestlé (Nesvita), General Mills, Post Consumer Brands |

| Fortified Dairy Products | Milk, yogurt, and cheese enriched to address micronutrient deficiencies. | Vitamin D, calcium, vitamin A, probiotics | Functional beverages, school nutrition programs, retail | Danone, Amul, Fonterra, FrieslandCampina |

| Fortified Bakery Products | Bread, biscuits, and flour products enriched for improved dietary balance. | Iron, folic acid, vitamin B12, zinc | Mass consumption foods, government fortification programs | Britannia, Grupo Bimbo, Premier Foods, Mondelez International |

| Fortified Infant & Baby Foods | Baby cereals, formulas, and purees fortified for developmental health. | Iron, DHA, vitamin D, calcium, zinc | Infant and toddler nutrition | Nestlé (Cerelac), Mead Johnson, Abbott (Similac), Danone (Aptamil) |

| Fortified Snack Foods | Energy bars, cookies, and chips with added nutrients targeting on-the-go consumers. | Protein, fiber, vitamins B12 & D, omega-3s | Sports nutrition, functional snacks | Clif Bar, KIND Snacks, RXBAR, Nature Valley |

| Fortified Beverages & Juices | Juices, functional drinks, and fortified waters enriched for immunity and energy. | Vitamin C, D, zinc, electrolytes | Sports & energy drinks, immunity-boosting beverages | PepsiCo (Tropicana Essentials), Coca-Cola (Minute Maid VITA), Yakult Honsha |

| Fortified Edible Oils | Vegetable and cooking oils fortified to combat vitamin deficiencies. | Vitamins A & D, omega-3 fatty acids | Household cooking, mass fortification programs | Cargill, Bunge, Adani Wilmar, Ruchi Soya |

| Fortified Flour & Staple Foods | Rice, wheat flour, maize meal fortified through national food security initiatives. | Iron, folic acid, vitamin B12, zinc | Public health nutrition, school feeding programs | DSM-Firmenich, BASF, Hexagon Nutrition |

| Fortified Confectionery & Chocolates | Chocolates and candies with added micronutrients for functional indulgence. | Iron, calcium, vitamins A & D | Child nutrition, functional indulgence | Nestlé (Milo), Mondelez, Ferrero |

| Fortified Plant-Based Products | Non-dairy milks, meat substitutes, and plant beverages fortified to match animal-based nutrition. | Vitamin B12, iron, calcium, vitamin D | Vegan, lactose-free, and flexitarian consumers | Oatly, Alpro, Beyond Meat, Ripple Foods |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5902

Fortified Foods Market Dynamics

What Are the Growth Drivers of the Fortified Foods Market?

Rising awareness regarding the importance of fortified foods is one of the major factors for the growth of the market. Increasing malnutrition and other major diseases caused by imbalanced nutrition also lead to the growth of the market. The rising prevalence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular problems is also one of the major factors for the growth of the market. Hence, consumers from different age groups demand fortified food and beverages options, further fueling the growth of the market.

Challenge

Regulatory Policies Hampering the Market’s Growth

Regulatory frameworks regarding the fortification of foods are weak in many nations. Hence, such issues hamper the legalization and growth of the market. Poorly enforced laws of food fortification, pressure from interest groups and competitors, and enforcing rules are some of the major factors obstructing the growth of the fortified foods market. Inconsistency in the fortification of foods and beverages is another major issue in the market’s growth.

Opportunity

Product Innovation Is Helpful for the Market’s Growth

One of the major opportunities for the growth of the market involves product innovation. Inclusion of essential nutrients for the overall body and immunity can help the market to grow in the foreseeable period. Inclusion of vitamins, minerals, iron, protein, and fiber in food options such as snacks and beverages will help the growth of the market in the foreseeable period. It will allow consumers to consume nutrient-rich, convenient food, which is helpful for consumers with hectic lifestyles.

Trade Analysis for the Fortified Foods Market

What’s Traded (product categories & HS proxies)

- Fortification premixes & nutrient blends — Vitamins/minerals premixed for addition at mills and food plants (HS proxies: vitamin preparations, premixes; food-supplement ingredient lines).

- Fortified staple foods — Wheat/maize flour, rice, edible oil, and sugar labelled/marketed as fortified (often recorded under standard cereal, flour, oil HS codes).

- Fortified ready-to-eat & beverage products — Fortified dairy drinks, RTD nutrition beverages, infant/toddler formula, and fortified snack/meal replacements (finished-goods HS lines).

- Micronutrient powders/home fortification sachets — Single-serve sachets used in household fortification or program distribution (often recorded under powders/preparations HS codes).

Because many fortified products use standard HS headings, trade analysis often relies on combining HS trade flows with program-level declarations (e.g., government procurement, donor tenders) to isolate “fortified” volumes.

Top Exporters (who supply the world)

- Major ingredient/premix exporters (EU, U.S., China) — Countries with large vitamin/mineral processing and premix industries supply fortified premixes and industrial blends to mills and food processors worldwide. Europe and the U.S. are major origins for high-spec premixes; China supplies large volumes competitively.

- Processed/finished fortified foods (Netherlands, Germany, U.S., India) — Countries with strong food-processing sectors export fortified finished goods: premix-fortified flours and fortified consumer products (e.g., fortified infant cereals, beverage fortifications). The Netherlands and Germany are notable re-export and processing hubs.

- Regional suppliers for staple fortification (India, Pakistan, South Africa, Brazil) — These countries both produce fortified staples for domestic programs and export fortified or fortifiable commodities and premixes to neighboring markets. They also serve as manufacturing bases for fortified blends destined for regional food-aid and commercial markets.

- Specialist exporters (Switzerland, Denmark, Belgium) — Niche exporters of high-purity vitamin/mineral compounds and certified premix formulations used in clinical and infant nutrition.

Top Importers / demand centres (who buys)

- Low- and middle-income regions with nutrition programs (Africa, South Asia, parts of SE Asia) large importers of premixes, fortified blended foods and fortified staples for government fortification programs and donor-funded nutrition initiatives. Procurement is often programmatic (government tenders, UN/NGO supply chains).

- European Union & North America — importers of high-spec premixes, fortified ingredients and finished fortified foods for retail and industrial use; demand concentrated in value-added fortified products and infant nutrition.

- Middle East & North Africa — importers of fortified staples and premixes to support national food-security and subsidy programs.

- Humanitarian procurement channels (global) — international agencies and NGOs import fortified blended foods, ready-to-use supplementary foods (RUSF) and micronutrient powders for emergency nutrition and school feeding.

Fortified Foods Market Regional Analysis

North America Dominated the Fortified Foods Market in 2024

North America led the fortified foods market in 2024 due to rising health consciousness, leading to more attention from the market engaged towards health and wellness. Hence, it leads to higher demand for fortified snacks and meal options, allowing consumers to save time in their hectic schedules and gorge on nutritious meals as well.

The growing population of consumers understanding the importance of consumption of fortified food and beverages for balanced health is one of the major factors for the growth of the market in the region. The US has a major role in the growth of the market of the region due to high consumer knowledge regarding the importance of fortified foods and beverages, which are helpful for the market’s growth.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is observed to be the growing region in the foreseen period due to growing health and wellness, higher concentration on improving nutritional levels, and growing importance of consumption of the right food for maintaining health. Hence, the region is observed to grow in the foreseen period.

The market is also expected to grow in the foreseeable period due to escalating lifestyle-related health issues caused by hectic schedules of consumers, further fueling the demand for fortified nutritional food and beverage options, which will be helpful for the market’s growth in the expected timeframe. Countries like India and China have a major role in the growth of the market in the region due to factors such as increasing disposable income and higher demand for plant-based options by vegans.

Europe Is Observed to Have a Notable Growth in the Foreseeable Period

Europe is observed to have a notable growth in the foreseen period due to rising consumer awareness regarding the importance of fortified foods for overall health and their benefits. The government regulations of the region to ensure the complete safety of foods and beverages, along with product safety and efficiency, are another major factor for the growth of the market. Nations such as Germany, France, and the UK have a major contribution to the growth of the market of the region due to the high demand for fortified food options by consumers of the region for enhanced nutritional levels.

Fortified Foods Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.7% |

| Market Size in 2025 | USD 191.88 Billion |

| Market Size in 2026 | USD 204.73 Billion |

| Market Size by 2034 | USD 343.96 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Fortified Foods Market Segmental Analysis

Product Type Analysis

The fortified dairy products market led the fortified foods market in 2024 due to higher demand for nutrition and wellness. Consumers hike in demand for fortified dairy options packed with nutritional elements such as vitamin A, D, iron, calcium, and omega-3 fatty acids. Deficiency of such nutritional elements in the body leads to various health issues, which can turn worse if not treated at the right time. Hence, the segment has a major lead in the growth of the fortified foods industry.

The fortified snacks segment is expected to grow in the expected timeframe due to high demand for snacks and convenient food options that can be easily consumed on the go. Availability of fortified snacks on different platforms is another major factor fueling the growth of the market. Hence, snacks high in vitamins, minerals, and proteins are highly demanded by consumers concerned about health and fitness, and by consumers who focus on completing their daily protein intake. Hence, fortified snacks such as protein bars, chips, and crisps, and other types of snacks, help fuel the growth of the market in the foreseeable period.

End User Analysis

The adult segment led the fortified foods market in 2024 due to the increasing prevalence of lifestyle-related diseases such as obesity, cholesterol, cardiovascular issues, and diabetes. Such issues observed in the adult segment are a major factor for the growth of the market. Hence, adults prefer to opt for fortified snacks and meal options to manage their health vitals, further fueling the growth of the market. It helps them to manage their nutritional profile, which is helpful for the growth of the market.

The elderly segment is observed to grow in the foreseen period due to rising health consciousness among the consumers of the segment. The segment also observes growth due to age-related health issues that might be disturbing if not managed properly at the right time. Hence, the segment has a major contribution to the growth of the market in the foreseeable period. Hence, consumers of the elderly segment focus on their diet and ensure to consume fortified foods on a large scale to maintain their nutritional profile.

Nutritional Benefits Analysis

The vitamins segment dominated the fortified foods market in 2024 due to its array of benefits for humans, which are helpful to maintain their overall health. The rising prevalence of lifestyle-related diseases further fuels the consumption of vitamins to maintain overall health and lower the possible damage that can be caused. Hence, the segment has a major role in the growth of the market.

The protein segment is expected to grow in the foreseeable period due to the rising importance of protein consumption by people of all age groups. Protein helps in muscle building, weight management, and is also essential to keep the body at bay from numerous types of diseases. It helps to boost immunity and keeps one satiated for a longer time. Hence, the segment has a huge consumer base of people concerned about their health and nutrition, especially gym people. Hence, the segment has a major role in the growth of the fortified foods industry in the foreseeable period.

Distribution Channel Analysis

The supermarkets segment led the fortified foods market in 2024 due to the easy availability of such stores, allowing consumers to shop for different types of fortified options, which is helpful for the market’s growth. Such stores have different types of products arranged in specific categories, which are helpful for consumers to shop for the right product and allow them to shop smartly. Such stores also have other relatable products, allowing consumers to browse through new categories as well.

The online retail segment is expected to grow in the foreseeable period due to the convenience offered by the segment, allowing consumers with hectic lifestyles to shop for desired products with the ease of sitting at home. E-commerce platforms have a broad range of fortified products, allowing consumers to keep refreshing their taste palates while maintaining their nutritional profile. Hence, such factors help to fuel the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Frozen Food Market: The global frozen food market size reached USD 203.15 billion in 2024 and is projected to grow from USD 214.32 billion in 2025 to nearly USD 347.01 billion by 2034, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size was calculated at USD 20.22 billion in 2024 and is anticipated to increase from USD 22.38 billion in 2025 to an estimated USD 55.88 billion by 2034, witnessing a CAGR of 10.7% during the forecast period from 2025 to 2034.

Top Companies in the Fortified Foods Market

- Unilever – Unilever produces a wide range of fortified foods through brands such as Knorr, Horlicks, and Lipton, focusing on improving global nutrition and addressing micronutrient deficiencies. The company integrates fortification into staple products, including soups, beverages, and spreads, as part of its Sustainable Living Plan and nutrition improvement initiatives.

- Cargill – Cargill supplies fortified ingredients such as vitamins, minerals, and customized nutrient premixes used in dairy, cereal, and beverage formulations. The company partners with food and beverage producers to develop fortified products that enhance health outcomes and meet regional nutritional standards.

- Reckitt Benckiser – Reckitt offers fortified nutritional products through its brands like Enfamil and Sustagen, providing essential vitamins, minerals, and proteins for infant, maternal, and adult nutrition. The company’s focus on science-backed formulations supports its mission to address malnutrition and wellness globally.

- PepsiCo – PepsiCo fortifies a range of food and beverage products under brands like Quaker and Tropicana with essential nutrients such as iron, calcium, and vitamins. The company’s global strategy integrates nutrition enhancement in product development, particularly for emerging markets with high nutritional gaps.

- Herbalife – Herbalife manufactures fortified nutritional supplements, protein shakes, and functional foods designed to support weight management and overall wellness. Its fortified meal replacement products and powders are enriched with vitamins and minerals tailored for balanced nutrition.

- BASF – BASF is a leading supplier of micronutrients, vitamins, and fortification ingredients used across the global food industry. The company provides customized nutritional premixes and bioavailable vitamin blends, supporting the fortification of staples such as flour, rice, and dairy products.

- Hoffmann-La Roche – Hoffmann-La Roche produces high-quality vitamins and nutritional ingredients for fortified foods through its nutrition and health science division. The company’s expertise in micronutrient formulation supports fortification programs aimed at addressing global vitamin and mineral deficiencies.

- Ajinomoto – Ajinomoto fortifies food products with amino acids, vitamins, and minerals to improve taste and nutritional value. Its portfolio includes fortified seasonings, soups, and beverages, focusing on protein balance and micronutrient supplementation in everyday diets.

- General Mills – General Mills integrates fortification into its breakfast cereals and snack products, offering essential nutrients such as iron, calcium, and B vitamins. Brands like Cheerios and Wheaties exemplify the company’s commitment to improving public health through accessible fortified foods.

- Kellogg’s – Kellogg’s is a global pioneer in fortified cereals, providing products enriched with iron, folic acid, and essential vitamins. The company’s nutrition programs focus on supporting healthy growth and combating micronutrient deficiencies through daily breakfast foods distributed worldwide.

Segment Covered in the Report

By Product Type

- Fortified Dairy Products

- Fortified Cereals

- Fortified Beverages

- Fortified Snacks

By End User

- Infants

- Children

- Adults

- Elderly

By Nutritional Benefit

- Vitamins

- Minerals

- Protein

- Fiber

By Distribution Channel

- Supermarkets

- Online Retail

- Convenience Stores

- Health Food Stores

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5902

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.