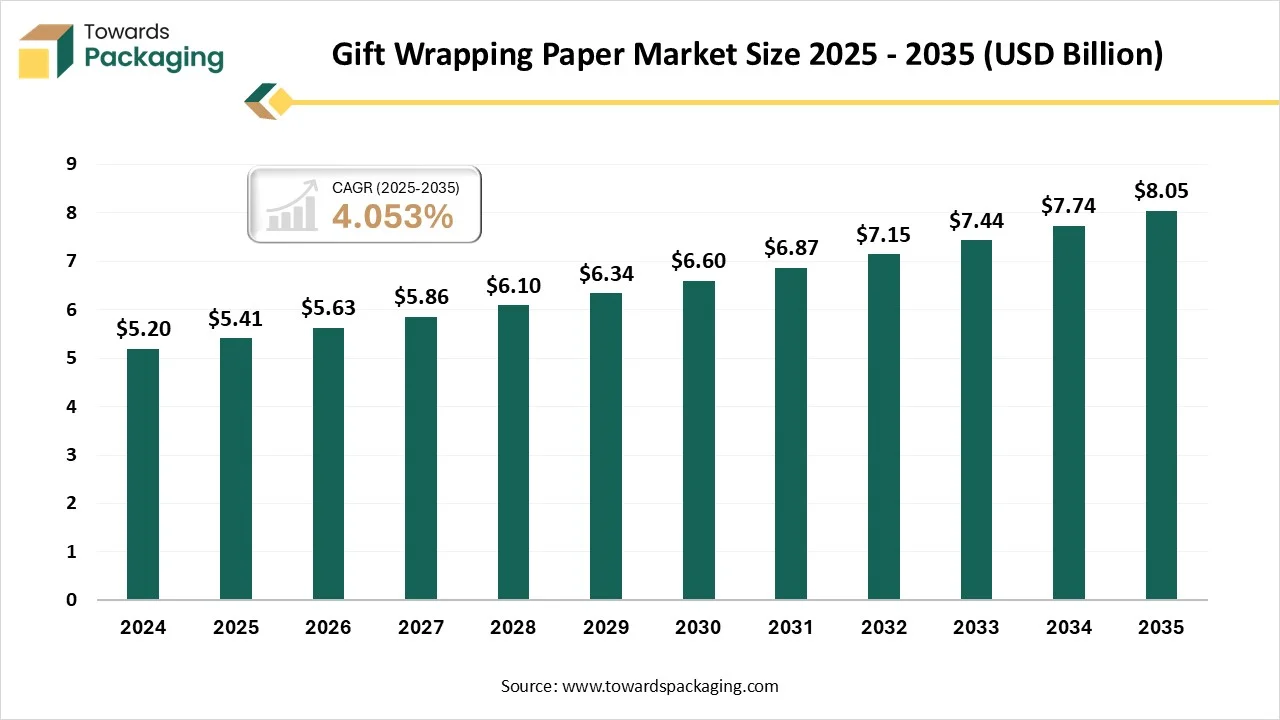

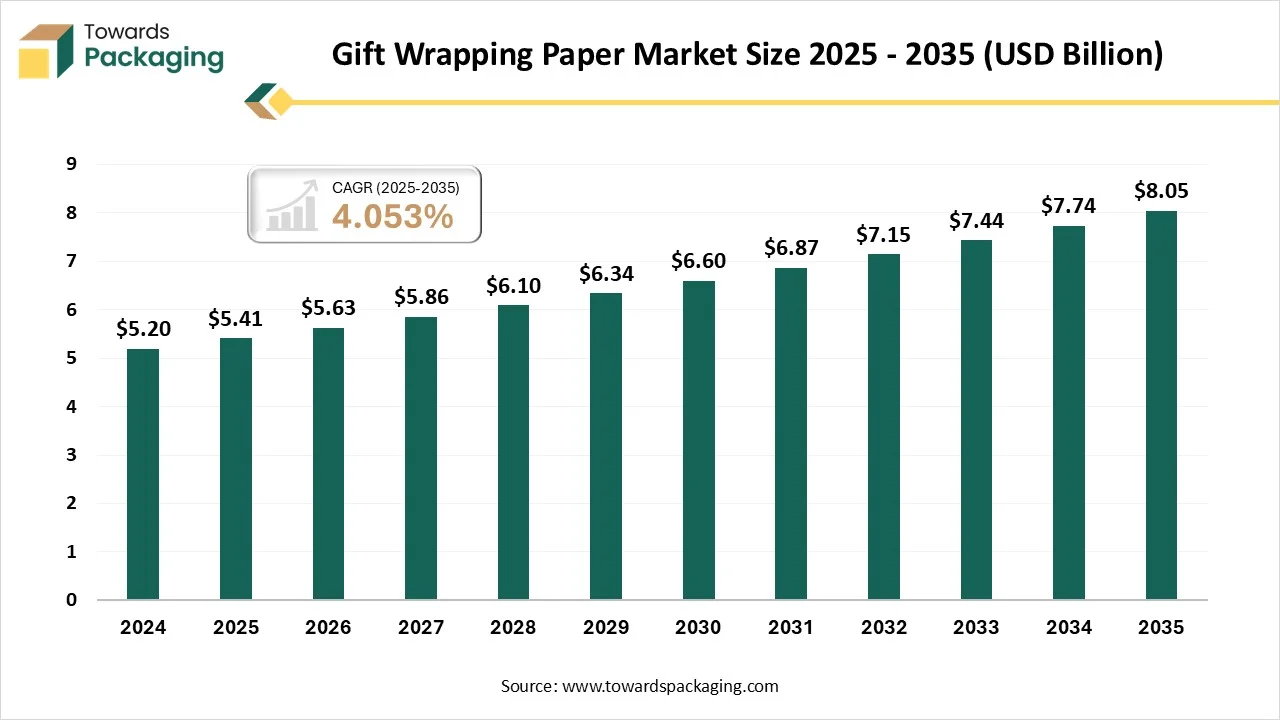

Based on insights from Towards Packaging, the global gift wrapping paper market will likely grow from USD 5.41 billion in 2025 to around USD 8.05 billion by 2035, expanding at a CAGR of 4.05% over the 2025-2035 period.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) — The global gift wrapping paper market was assessed at USD 5.41 billion in 2025, with projections indicating an increase to USD 8.05 billion by 2035, based on insights from Towards Packaging, a sister firm of Precedence Research.

The market is witnessing steady growth driven by rising gifting culture, premium packaging trends, and expanding e-commerce activities. Demand for personalized, eco-friendly, and themed wrapping paper continues to rise, especially during festive and corporate events.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by gift wrapping paper?

Gift wrapping paper refers to decorative sheets used to pack and cover gifts, enhancing their presentation and adding emotional and aesthetic value. The market is driven by increasing gifting culture, rising demand for premium and personalized packaging, expanding e-commerce activities, and growing preference for eco-friendly and themed designs across festive and corporate occasions. Gift wrapping paper comes in various colors, textures, and finishes such as glossy, matte, glitter, metallic, and kraft.

It is widely used for birthdays, weddings, festivals, anniversaries, and corporate gifting, often paired with ribbons and accessories to create visually appealing packaging. North America dominated the gift wrapping paper market due to strong consumer spending on celebrations, high retail penetration, and increasing preference for luxury and sustainable packaging. Manufacturers are focusing on recyclable materials, vibrant prints, and seasonal collections to attract both retail and corporate customers.

What Are the Latest Key Trends in the Gift Wrapping Paper Market?

- Sustainable & eco-friendly materials: Consumers increasingly prefer wrapping papers made from recycled content, biodegradable fibers, or FSC-certified stocks, reflecting rising environmental consciousness.

- Personalization & customization: Unique prints, names, messages, and custom sizes are gaining traction, as gift-givers seek to express individuality and create memorable presentations.

- Premium finishes & textures: Metallic foils, embossing, glitter accents, and specialty textures are used to elevate wrapping paper into a premium gift accessory rather than just packaging.

- E-commerce & bundled packaging: With more gifting through online retail, suppliers offer ready-to-ship gift wrap bundles or themed sets and integrate wrapping services into e-commerce platforms.

- Minimalist & versatile designs: Simple patterns, solid colours, and reusable sheets are gaining popularity, enabling gift-givers to adapt the wrap for multiple occasions or recipients.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5433

What is the Potential Growth Rate of the Gift Wrapping Paper Industry?

Rising Demand for Premium Personalized Packaging & Expansion of E-commerce

The expansion of e-commerce and the rising demand for premium personalized packaging have significantly accelerated the growth of the gift wrapping paper industry. Online shopping has increased the volume of gifts shipped directly to recipients, prompting brands and sellers to use attractive wrapping solutions to improve customer experience and enhance unboxing appeal.

At the same time, consumers increasingly seek customized prints, names, messages, and luxury textures, turning wrapping paper into a form of self-expression rather than just protective packaging. This shift encourages manufacturers to offer more design variations, sustainable premium materials, and themed collections, boosting overall market demand across retail and corporate gifting segments.

Regional Analysis:

Who is the leader in the Gift Wrapping Paper Market?

North America dominates the market due to strong consumer spending on celebrations, holidays, and corporate gifting. The region has a high penetration of retail and e-commerce platforms that offer diverse and premium gift-wrapping solutions. Rising demand for personalized, luxury, and sustainable packaging, along with a well-established gifting culture around Christmas, birthdays, and occasions, further strengthens the region’s leadership.

U.S. Gift Wrapping Paper Market Trends

The U.S. leads the North America market due to strong consumer spending on festive and seasonal gifting, along with frequent celebrations such as Christmas, Thanksgiving, birthdays, and weddings. A mature retail sector, rapid e-commerce adoption, and high demand for premium, personalized, and eco-friendly packaging further boost market dominance. Additionally, corporate gifting traditions and a strong brand focus on aesthetic unboxing experiences strengthen the country’s leadership.

What are the Current Trends in the Canadian market?

Canada is the fastest-growing country in the North American market due to increasing preference for sustainable and recyclable packaging, rising festive and cultural gifting traditions, and rapid e-commerce penetration. Growing demand for premium, themed, and personalized wrapping paper across retail and corporate gifting further accelerates the country’s market expansion.

How is the opportunity in the Rise of the Asia Pacific in the Gift Wrapping Paper Industry?

The Asia-Pacific region is the fastest-growing in the market, mainly due to the strong expansion of the retail and e-commerce sectors. Rapid growth of online shopping, rising disposable incomes, and an increasing culture of festive and wedding gifting drive higher demand for attractive, premium, and personalized wrapping solutions across the region.

China Gift Wrapping Paper Market Trends

China dominates the Asia-Pacific market due to its large manufacturing base, high production capacity, and extensive export network. In 2025, China will hold the largest market presence with the highest number of active gift-wrapping paper manufacturers in the region. Strong domestic demand driven by festivals, weddings, and e-commerce growth further strengthens the country’s leadership.

How Big is the Success of the Europe Gift Wrapping Paper Industry?

Europe is a notably growing region in the market due to rising demand for eco-friendly and recyclable packaging, strong gifting culture during seasonal holidays, and high adoption of premium and artistic wrapping designs. Expanding e-commerce platforms and increasing corporate gifting further support the region’s steady market growth.

What are the Ongoing Trends in the U.K. Market?

The U.K. is the fastest-growing country in Europe’s market due to strong consumer inclination toward premium, personalized, and sustainable wrapping solutions. Expanding e-commerce, frequent festive and cultural celebrations, and rising demand for luxury gifting packaging across both retail and corporate events further accelerate the country’s market growth.

How Crucial is the Role of Latin America in the Gift Wrapping Paper Industry?

Latin America is growing at a considerable rate in the market due to increasing participation in festive and cultural celebrations, rising disposable incomes, and expanding retail and e-commerce penetration. Consumers are showing greater interest in visually appealing, themed, and eco-friendly wrapping options. Growing corporate gifting activities and stronger availability of premium and personalized packaging products further contribute to the region’s continued market expansion and rising demand.

How Big is the Opportunity for the Growth of the Middle East and Africa Gift Wrapping Paper Market?

The Middle East and Africa present a significant growth opportunity in the market due to increasing adoption of premium gifting culture, expanding shopping malls and retail chains, and rising e-commerce penetration. Growing interest in luxury, themed, and eco-friendly wrapping solutions during weddings, festivals, and corporate events further fuels demand. Strengthening consumer spending and product availability continues to open new market opportunities across the region.

More Insights of Towards Packaging:

- Cardboard Sheet Market Size, Segments, Share and Companies

- Pharma Blister Packaging Machines Market Drives at 2.85% CAGR

- Recycled Polypropylene in Packaging Market Drives at 6.73% CAGR (2025-34)

- PVC Packaging Film Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Germany Flexible Packaging Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Trolley Bags Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- AI in Sustainable Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- Industrial Packaging Recycling Services Market Size, Segments, Share and Companies

- Pharmaceutical Composite Films and Bags Market Competitive Landscape & Future Outlook

- Clear Plastic Film Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA)

- Consumer Goods Packaging Market Drives at 5.44% CAGR (2025-34)

- Smart Labels Market Size, Segments, Share and Companies

- Medical Packaging Films Market Size, Segments, Share and Companies

- Smart Corrugated Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies

- North America Corrugated Packaging Market Growth, Key Segments, and Regional Dynamics

Segment Outlook

Material Insights

What made the Kraft Paper Segment Dominant in the Gift Wrapping Paper Market in 2024?

The kraft paper segment is the dominant material segment in the market due to its strong preference for eco-friendly, recyclable, and durable packaging. Its natural texture, affordability, and suitability for printing customized themes make it highly popular across retail and corporate gifting, strengthening its continued leadership in the market.

The recycled paper is the fastest-growing segment in the market due to rising environmental awareness, increasing demand for sustainable packaging, and government emphasis on waste reduction. Its affordability, premium print quality, and suitability for customized designs further drive adoption across retail and corporate gifting applications, boosting rapid segment expansion.

Packaging Insights

How the Primary Dominated the Gift Wrapping Paper Market in 2024?

The primary packaging segment dominates the market because it is directly applied to wrap and present gifts, making it the most widely used form of decorative packaging. Consumers prefer visually appealing and customized wraps to enhance the unboxing experience for birthdays, festivals, weddings, and corporate gifting. Its ability to incorporate premium textures, prints, themes, and sustainable materials further strengthens its adoption across retail and e-commerce, ensuring continuous demand and segment leadership.

The secondary packaging segment is the fastest-growing in the market due to rising use of coordinated accessories such as gift bags, tags, tissue sheets, and decorative boxes that enhance presentation. Growing interest in themed gifting sets, luxury packaging, and premium unboxing experiences, especially in retail and e-commerce, further accelerates its rapid adoption and market expansion.

Sales Channel Insights

How did the Departmental/Convenience/Discount Stores Dominate the Gift Wrapping Paper Market in 2024?

The Department, convenience, and discount stores dominate the sales channel in the market because they provide wide product availability, affordable pricing, and immediate purchase access. Customers can compare colors, textures, and themes in person, encouraging impulse buying during festive seasons and celebrations. Their extensive presence across urban and semi-urban areas further strengthens their market leadership.

The online sales segment is the fastest-growing in the market due to increasing e-commerce penetration and the convenience of doorstep delivery. Consumers can easily explore a wide range of designs, materials, and personalized options that are often unavailable offline. Attractive discounts, subscription gift-wrap bundles, and seasonal promotions further boost the shift toward digital purchasing, especially for festive and corporate gifting.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Gift Wrapping Paper Industry

- In January 2025, IKEA introduced a fresh range of stationery, gift-wrap, and party décor as part of its new year product updates. The launch focused on aesthetically coordinated themes designed to elevate celebration experiences at affordable prices. The collection featured new prints, pastel tones, and reusable elements intended to reduce festive waste.

- In May 2025, Paper Source released the Jeremiah Brent “Elements” designer collaboration, which included a curated line of sophisticated gift-wrapping designs. The collection introduced elevated textures, modern muted palettes, and nature-inspired artwork across wrap sheets and accessories. The launch was targeted at consumers who prioritize luxury and minimalist aesthetics in gifting.

- In January 2025, Hallmark Licensing, LLC announced a new partnership with Lacey Chabert to develop a special holiday-season product collection. The collection is set to debut during the 2025 holiday season and features greeting cards, gift-wrapping paper and entertaining essentials under Chabert’s signature style. The design draws inspiration from vintage Hallmark motifs, aiming to blend nostalgic appeal with a fresh celebratory touch.

Top Companies in the Global Gift Wrapping Paper Market & Their Offerings:

- DS Smith Plc: DS Smith Plc primarily manufactures industrial paper and packaging solutions like corrugated boxes and display packaging, not consumer-facing gift wrapping paper.

- Oji Paper Co. Ltd.: Oji Paper Co. Ltd. (Oji Holdings Corporation) is a major producer of a wide range of paper and pulp products, but its offerings do not specifically include branded consumer gift wrapping paper.

- Smurfit Kappa Group Plc: Smurfit Kappa Group Plc focuses on large-scale paper-based packaging solutions, such as containerboard and corrugated packaging, rather than pre-packaged consumer gift wrap.

- Stora Enso Oyj: Stora Enso Oyj provides renewable products in packaging, wood products, and paper, with its offerings concentrated on bulk and industrial materials, not consumer gift wrapping paper.

- Nippon Paper Group Inc.: Nippon Paper Group Inc. is a comprehensive paper manufacturer, producing various paper and paperboard products, but does not offer consumer gift wrapping paper.

- HighPoint Packaging: HighPoint Packaging does not offer consumer gift wrapping paper; it is likely involved in industrial packaging or related business services.

- Twin Rivers Paper Company: Twin Rivers Paper Company is a specialty paper producer, manufacturing base papers that might be converted into wrapping papers by other companies but does not sell finished gift wrap directly to consumers.

- Kraft Wrap Inc.: Information indicates Kraft Wrap Inc. is not a major player in the consumer market; its services likely relate to industrial or commercial wrapping solutions.

- Madico Inc.: Madico Inc. specializes in coated films and engineered surfaces (e.g., window films, not gift wrapping paper).

- The Paper Company India: The Paper Company India sells various consumer-oriented paper goods and offers a selection of designer gift wrapping sheets for direct purchase by consumers.

Segment Covered in the Report

By Material

- Kraft Paper

- Recycle Paper

- Bleached Paper

- Unbleached Paper

By Packaging

- Primary

- Secondary

By Sales Channel

- Departmental/Convenience/Discount Stores

- Hyper/Supermarket

- Online Sales

- Others (Independent/Specialty Stores)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5433

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight – Check It Out:

- Corrugated Automotive Packaging Market Size, Regional Share (NA/EU/APAC/LA/MEA) and Competitive Analysis

- North America Corrugated and Folding Carton Packaging Market Size, Value Chain & Trade Analysis 2025-2034

- Corrugated Bubble Wrap Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Temperature Controlled Packaging Solutions Market Size, Segments, Share and Companies

- Integrated Circuit Packaging Market Trends: SMT, Advanced Packaging, and AI Adoption

- Corrugated Sheet Board Market Drives at Strong CAGR (2025-34)

- Single Wall Corrugated Boxes Market Size & Share 2034

- Plastic Corrugated Sheets Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Volume-Optimized Corrugated Packaging Systems Market Size & Share

- Corrugated Packaging Market Trends, Investment Opportunities and Competitive Landscape (2025-2034)

- Plastic Container Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA)

- Aerosol Cans Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Packaging Laminates Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Sharps Container Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Packaging Solutions Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.