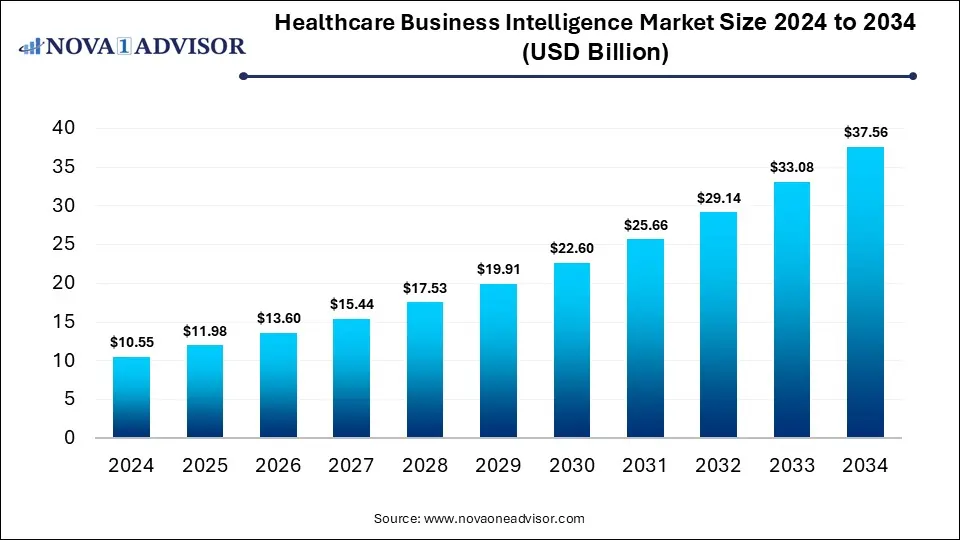

Healthcare Business Intelligence Market Size to Reach USD 37.56 Billion by 2034

According to Nova One Advisor, the global healthcare business intelligence market size is calculated at USD 11.98 billion in 2025 and is expected to reach around USD 37.56 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.54% over the forecast period from 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 10, 2025 (GLOBE NEWSWIRE) — The global healthcare business intelligence market size is calculated at USD 10.55 billion in 2024, grew to USD 11.98 billion in 2025, and is projected to reach around USD 37.56 billion by 2034. The market is projected to expand at a CAGR of 13.54% between 2025 and 2034.

Healthcare Business Intelligence Market Key Takeaways

- By region, North America held the largest share of the healthcare business intelligence market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the software segment dominated the market in 2024.

- By component, the services segment is expected to expand at the fastest rate over the projection period.

- By mode of delivery, the cloud-based segment led the market with a major share in 2024.

- By mode of delivery, the on-premises segment is expected to expand at the highest CAGR in the upcoming period.

- By deployment, the self-service BI segment led the market in 2024.

- By deployment, the corporate BI segment is likely to grow at a significant rate during the forecast period.

- By application, the financial analysis segment dominated the market in 2024.

- By application, the patient care segment is expected to expand at the highest CAGR in the coming years.

- By end use, the healthcare payers segment contributed the largest market share in 2024.

- By end use, he healthcare manufacturers segment is expected to expand at the fastest CAGR between 2025 and 2034.

Market Size & Forecast

- 2024 Market Size: USD 10.55 Billion

- 2034 Projected Market Size: USD 37.56 Billion

- CAGR (2025-2033): 13.54%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/3566

Market Overview

The healthcare business intelligence market revolves around the use of data analytics, reporting, and visualization tools to transform complex healthcare data into actionable insights for decision-making. BI solutions offer numerous advantages, including improved patient care, optimized operational efficiency, reduced costs, and enhanced regulatory compliance across applications like hospitals, clinics, payers, and pharmaceutical companies. The growing need for data-driven decision-making, rising adoption of electronic health records (EHRs), and the increasing pressure to reduce healthcare costs are key factors driving market growth. Additionally, advancements in AI and machine learning integration into BI tools are further accelerating adoption across the healthcare sector.

How Can AI Impact the Healthcare Business Intelligence Market?

AI can significantly impact the healthcare business intelligence market by enhancing data analysis and decision-making processes. AI algorithms can automate data analysis, identify patterns, and predict outcomes with greater accuracy and speed. This allows healthcare organizations to gain deeper insights from their data, leading to improved patient care and operational efficiency. Moreover, AI-powered BI tools can personalize treatment plans and optimize resource allocation. As AI technology continues to evolve, its integration into BI solutions will further drive innovation and transform the healthcare landscape.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/3566

Healthcare Business Intelligence Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 11.98 billion |

| Revenue forecast in 2034 | USD 37.56 billion |

| Growth rate | CAGR of 13.45% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2021 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Component, Mode of Delivery, Application, End Use, Deployment, Geography |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key companies profiled | Microsoft; Oracle; SAP; Salesforce, Inc.; Perficient Inc. (acquired by EQT AB in October 2024); Cloud Software Group, Inc.; Infor(a subsidiary of Koch Industries) ; Domo Inc.; Sisense Ltd.; Panorama Software Inc. (a Top Group Company), IBM Corporation, Innovaccer |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

How is business intelligence transforming health care?

Health care business intelligence tools help health care organizations collect, store, secure, and analyze data. Before you learn about these functions of business intelligence, it may be helpful to understand where health care business intelligence data comes from. In any given health care office or system, data comes in from a lot of different places, including:

- Health records: Information from previous visits or that you give the doctor when filling out paperwork before your appointment.

- Insurance claims: Medical offices track data on the claims they submit to insurance.

- Billing: Health care facilities need to keep track of sending out bills and processing payments.

- Administrative information: Governments and other regulatory bodies may require the hospital to collect and keep track of certain data.

- Patient surveys: Patients can answer questions about their experience using the health care services, and the facility can gather feedback as data.

Health care business intelligence tools help gather a wide net of data and turn it into data you can use to draw business analytics insights. This process starts with data collection and includes data storage. You will also need tools to help you interact with the data, such as data visualization and data mining. In your analysis, you will likely need to predict what could happen in the future or currently, or if a key element of your analysis has changed. Lastly, your health care business intelligence tools can help you create reports to communicate your findings to senior leadership.

Examples of how business intelligence improves health care

Business intelligence tools can be used in many ways to develop data-driven business decisions. In practice, health care business intelligence tools are used in the following areas:

- Lower costs and increase revenue: You can use health care analytics to understand what processes work and where your organization can improve. You can also better understand the competitive landscape you’re operating within and what you can do to build patient loyalty and offer something more than your competition.

- Improve patient outcomes and safety: Health care data analytics give doctors and other care providers more tools to provide better care, such as identifying which patients are at risk for illness, analysing the best treatment options, or identifying other factors in the patient’s environment that can contribute to negative outcomes.

- Enhance research: Using data and machine learning, scientists can make faster progress on research by forecasting how certain drugs will interact or what effects they will have on patients.

- Detect disease earlier: Scientists can use data and machine learning to predict diseases like heart disease or kidney disease. By pairing this enhanced research ability, you can also use health care data to predict the correct treatments for disease.

- Improve preventative and follow-up care: Using health care analytics, hospitals and other health care organizations can predict who’s at risk for missing follow-up care so they can plan interventions accordingly.

- Adjust staff levels: Hospitals can use business analytics to understand when and where they need higher levels of staff and when they could get by with fewer employees working. This insight helps keep the hospital appropriately staffed during busier times while saving labor costs on times that are usually less busy.

- Prevent insurance fraud: Insurance companies and health care organizations can use data to look for patterns that resemble fraud, such as irregularities in billing.

What is Healthcare Business Intelligence?

Healthcare business intelligence is the tools utilized to gain insights from health data. When professionals use those tools to meet the particular requirements of the healthcare sector, they gain insight that leads to better patient results and a well-organized hospital system. These tools often involve resources for collecting data, like data mining, with tools to secure, store, and analyze the data.

Health care business intelligence plays a significant role because health care organizations collect a large amount of data from various sources. Furthermore, health care systems are required to protect their data according to privacy and other guidelines. This can make working with healthcare business analytics complicated unless consumers have a vigorous set of business intelligence tools. This tool supports tracking key performance indicators and patient results to deliver advanced quality, targeted, and more efficient care while managing the affordability of the various health products.

What are the Key Drivers in the Healthcare Business Intelligence Market?

Increasing trend of data proliferation and digitalization in healthcare system as extensive applications of electronic health records (EHRs), integrated devices, and patient portals generate massive, complex data which needs advanced business intelligence tools for interpretation and actionable insights so application of this BI tools by healthcare companies, payers, and providers trust on BI solutions to creates informed, data-backed decisions for enhancing patient results, reducing challneges, and optimizing resources. BI tools are important for analyzing financial and operational data, detecting inefficiencies, lowering costs, and enhancing overall operational performance.

- For Instance In November 2025, Mayo Clinic launched Mayo Clinic Platform Insights to advance digital innovation and quality improvement across healthcare

What are the Ongoing Trends in the Healthcare Business Intelligence Market?

- In November 2025, ArisGlobal, an AI-first technology company at the forefront of life sciences and creator of LifeSphere, announced the launch of NavaX Agents, a major advancement in the company’s AI strategy that brings purpose-built, agentic intelligence to the LifeSphere Unify ecosystem. The NavaX Super Agent will serve as an intelligent orchestration layer, an advanced AI entity that can coordinate multiple specialized agents, each performing narrow tasks, to achieve broader, multi-step goals autonomously.

- In September 2025, Wolters Kluwer Health announced its UpToDate Enterprise Edition is now available to healthcare systems and hospitals in the Asia-Pacific (APAC) region. Designed specifically for large healthcare systems and hospitals, the clinical decision support (CDS) solution, which features AI enhancements, supports healthcare administrators and clinicians to help deliver consistently high-quality care.

- In June 2025, Tecsys Inc., a global leader in supply chain management solutions, announced the launch of TecsysIQ, a cloud-native intelligence layer that helps healthcare organizations unify fragmented data and deliver AI-powered insights across clinical, operational, and financial systems.

What is the Emerging Challenge in the Healthcare Business Intelligence Market?

Data privacy and security is the main challenges of healthcare business intelligence such as protecting sensitive patient health information (PHI) from cyber threats and breaches is a major problem, compounded by strict regulations like HIPAA and GDPR and another challenfe is different healthcare systems use different data formats, making it complex to integrate and merge data into a combined BI platform, which limits the growth of the market.

Regional Analysis

Why did North America Dominate the Market in 2024?

North America is expected to generate the highest demand during the forecast period in the healthcare business intelligence market, as this region’s well-funded medical care institutions and a sophisticated technological environment, there in a high requirement for business intelligence solutions. The government framework places a robust emphasis on patient confidentiality and data security, which pushes the healthcare industry to use reliable and legal data analytics services. A broad range of medical care solutions and specialties are also available in North America, each with particular data analytics needs, which contributes to the growth of the market.

How did the Asia Pacific Grow Notably in the Market in 2024?

The Asia Pacific region is the fastest growing in the healthcare analytics market, as the increasing adoption of digital health solutions, increasing healthcare infrastructure, and growing investments in medical care IT. Evolving economies like India and China are rapidly accepting healthcare analytics to improve healthcare services and enhance patient care. Furthermore, the growing prevalence of chronic diseases and the requirement for data-driven decision-making are driving the demand for healthcare analytics solutions in the Asia Pacific region.

Region-Wise Breakdown of the Healthcare Business Intelligence Market

| Region

|

Market Size (2024) | Projected CAGR (2025-2034) | Key Growth Factors | Key Challenges | Market Outlook | |

| North America | USD 4.4 Bn | 5.82 | % | Advanced healthcare infrastructure, strong EHR adoption, value-based care mandates | Data silos, legacy systems, high total cost of ownership | Dominant market with steady, mature growth. |

| Asia Pacific | USD 3.1 Bn | 6.96 | % | Healthcare digitization, government initiatives, rising IT investment | Infrastructure gaps, talent shortages, governance hurdles | Fastest-growing region |

| Europe | USD 2.5 Bn | 9.81 | % | Strong regulatory frameworks, aging population, digital health mandates | Interoperability issues, fragmented health systems across countries | Stable growth |

| Latin America | USD 0.9 Bn | 4.1 | % | Emerging healthcare digitization, growing BI awareness | Budget constraints and limited BI maturity | Emerging market with strong potential |

| MEA | USD 0.5 Bn | 4.37 | % | Healthcare reforms, investment in digital health infrastructure | Regulatory disparities and uneven infrastructure across countries | Gradual uptake; emerging and underpenetrated |

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/3566

Segmental Insights

By Component Analysis

Which Component Led the Healthcare Business Intelligence Market in 2024?

The software segment accounted for the dominating share of the market in 2024, as BI software allows medical care providers to analyze massive amounts of clinical and operational data, supporting them in making informed decisions. Hospitals that use BI software see up to a 15% development in healthcare decision-making. It supports population health management by offering demographic insights.

Whereas the services segment is predicted to register rapid expansion in the forecasting period, as these services boost operational efficiency. BI identifies inefficiencies in day-to-day operations and aids in streamlining them, leading to advanced resource allocation. BI prepares healthcare professionals with evidence-based, real-time insights that allow advanced decision-making.

Healthcare Business Intelligence Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Software | 5.28 | 6.02 | 6.87 | 7.83 | 8.94 | 10.2 | 11.63 | 13.26 | 15.13 | 17.25 | 19.67 |

| Services | 5.28 | 5.96 | 6.73 | 7.61 | 8.59 | 9.71 | 10.97 | 12.4 | 14.01 | 15.83 | 17.89 |

By Mode of Delivery Analysis

Which mode of delivery dominates the market in 2024?

In 2024, the cloud-based segment captured the biggest share of the healthcare business intelligence market, as healthcare professionals segregate security by handling cybersecurity and encoding in-house while outsourcing data protection and management to cloud service providers. This allows secure management of electronic health records (EHR). Cloud-based healthcare software services amplify healthcare management effectiveness and data approachability. Cloud-based healthcare support allows secure, efficient, and collaborative data organization, enhancing diagnostics and streamlining hospital solutions.

Although the patient care segment will expand fastest during 2025-2034, as business intelligence solutions offer better control, improve security, and compliance for industries with strict data regulations. On-premise BI, investigative key factors such as performance, security, scalability, cost, and ease of application.

By Application Analysis

How did the financial analysis dominate the Market in 2024?

In 2024, the financial analysis segment had the largest share in the Healthcare Business Intelligence Market, as BI tools assist healthcare organizations in analyzing revenue streams, expenditures, and billing patterns to optimize resource use, reduce costs, and enhance profitability. For example, a healthcare network uses BI to track insurance claims, identify patterns of repeated denials caused by missing documentation, and detect suspicious billing activities.

On the other hand, the on-premises segment is expected to grow most rapidly between 2025 and 2034, as BI tools analyze patient data to provide insights that support more accurate diagnoses, personalized treatments, and proactive care. The healthcare industry relies on business intelligence to drive innovation, lower costs, increase revenues, improve claims processing, and streamline supply chain management.

By End-User Analysis

How did the healthcare payers dominate the Market in 2024?

The healthcare payers segment held the largest share of the healthcare business intelligence market in 2024, as payer data supports medical care organizations in optimizing revenue cycles, enhancing care coordination, and detecting areas of inadequacy. With rapidly changing healthcare regulations, payer data can also help organizations stay ahead of government changes and adapt to novel necessities. Payer data support healthcare organizations in identifying areas of improvement, leading to better patient results.

Whereas the healthcare manufacturing segment will expand fastest during 2025-2034, as the healthcare manufacturing industry utilizes business intelligence to revolutionize patient care, lower costs, earn improved revenues, enhance claims management, and modernize supply chain management. It plays a significant role in making healthcare supplementary accessible through business intelligence in healthcare.

Healthcare Business Intelligence Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Payers | 2.95 | 3.33 | 3.75 | 4.23 | 4.77 | 5.37 | 6.06 | 6.83 | 7.69 | 8.67 | 9.77 |

| Healthcare Providers | 5.49 | 6.26 | 7.15 | 8.17 | 9.33 | 10.65 | 12.16 | 13.88 | 15.85 | 18.10 | 20.66 |

| Healthcare Manufacturers | 2.11 | 2.38 | 2.69 | 3.04 | 3.44 | 3.88 | 4.38 | 4.95 | 5.59 | 6.32 | 7.14 |

Healthcare Business Intelligence Market Companies

- Microsoft Corporation

Microsoft contributes to the healthcare BI market through Power BI, offering scalable data visualization, reporting, and dashboard tools that help healthcare providers track performance and outcomes. It integrates with Microsoft Cloud for Healthcare, enabling seamless data management and analytics across clinical, operational, and financial systems.

- Oracle Corporation (including Cerner)

Oracle enhances the healthcare BI landscape through its cloud infrastructure and analytics platforms, especially following its acquisition of Cerner, a major EHR provider. The company enables data integration, population health management, and predictive analytics tailored for hospitals and large health systems.

- IBM Corporation

IBM provides advanced analytics and AI-driven insights through IBM Watson Health, supporting clinical decision-making and value-based care initiatives. It helps healthcare organizations analyze large volumes of structured and unstructured data to optimize patient care and operational efficiency.

- SAP SE

SAP offers enterprise-grade BI and performance management tools that help healthcare providers streamline operations, monitor financial performance, and maintain regulatory compliance. Its analytics solutions integrate with hospital information systems to provide real-time, actionable insights.

- SAS Institute Inc.

SAS specializes in predictive analytics, data mining, and population health management tailored to healthcare providers and payers. Its solutions enable organizations to detect trends, reduce risk, and enhance decision-making through sophisticated statistical models.

- Tableau Software (Salesforce)

Tableau empowers healthcare professionals with user-friendly, interactive data visualization tools that simplify complex data analysis. It is widely used for quality improvement, clinical benchmarking, and strategic reporting across hospitals and health systems.

- Qlik Technologies Inc.

Qlik provides a robust data analytics platform that enables healthcare organizations to integrate and analyze data from multiple sources. Its associative data model allows users to explore clinical, operational, and financial data simultaneously for deeper insights.

- Health Catalyst

Health Catalyst focuses specifically on healthcare, offering a data platform and analytics applications that support clinical, operational, and financial transformation. It enables health systems to leverage data for improving patient outcomes, reducing costs, and advancing value-based care.

- Infor Inc.

Infor delivers cloud-based analytics and enterprise resource planning (ERP) solutions tailored for healthcare organizations. Its platforms support operational efficiency, financial analysis, and workforce management through integrated business intelligence tools.

- Epic Systems Corporation

Epic embeds BI and analytics capabilities within its widely used EHR platform, enabling providers to monitor clinical outcomes, patient safety, and operational metrics. It supports population health and predictive analytics initiatives from within its ecosystem.

What are the Recent Developments in the Healthcare Business Intelligence Market?

- In October 2025, Milliman announced the launch of CareFlowIQ, its powerful and scalable clinical intelligence platform, designed to support healthcare providers and health tech leaders in making smarter, data-driven decisions. By turning fragmented healthcare data into reliable, evidence-based insights, the platform enables users to uncover patient stories, spot care gaps, and improve outcomes with confidence.

- In November 2025, a leading U.S. health technology and clinical intelligence platform announced the availability of its AI-driven Remote Patient Monitoring (RPM) suite, fully embedded across the OmniMD EHR, AI Medical Scribe, AI Clinician, and AI RCM engines.

- In December 2024, Forian Inc., a leading provider of data science-driven information and analytics solutions to the life science, healthcare, and financial services industries, today announced a partnership with Databricks, the data and AI company, to deliver access to its Chartis product, which maps physician and organization affiliations

More Insights in Nova One Advisor:

- Middle East Cosmetic Surgery & Procedure Market – The Middle East cosmetic surgery and procedure market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 5.28 billion by 2034, growing at a CAGR of 9.41% from 2025 to 2034.

- Full Service CRO Market – The global full service CRO market size was estimated at USD 43.75 billion in 2024 and is expected to reach USD 89.67 billion in 2034, growing at a CAGR of 7.44% during 2025-2034.

- CRISPR Technology Market – The global CRISPR technology market size is calculated at USD 6.25 billion in 2024, grew to USD 7.29 billion in 2025, and is projected to reach around USD 28.93 billion by 2034. The market is expanding at a CAGR of 16.56% between 2025 and 2034.

- Pet Insurance Market – The global pet insurance market size was valued at USD 19.15 billion in 2024, and is predicted to be worth around USD 96.63 billion by 2034, registering a CAGR of 17.57% during the forecast period 2025 to 2034.

- Rotator Cuff Repair Market – The global rotator cuff repair market size was estimated at USD 899.85 million in 2024 and is expected to hit USD 1,870.20 million by 2034, expanding at a CAGR of 7.59% during the forecast period from 2025 to 2034.

- Animal Pregnancy Test Kit Market – The global animal pregnancy test kit market size was estimated at USD 54.35 million in 2024 and is projected to reach USD 83.76 million by 2034, growing at a CAGR of 4.42% from 2025 to 2034.

- Life Science Cloud Market – The global life science cloud market size was estimated at USD 25.65 billion in 2024 and is projected to hit USD 106.05 billion in 2034, growing at a CAGR of 15.25% during 2025-2034.

- CRISPR-based Gene Editing Market – The global CRISPR-based gene editing market size was valued at USD 6.15 billion in 2024 and is anticipated to reach around USD 24.37 billion by 2034, growing at a CAGR of 14.76% from 2025 to 2034.

- Advanced Therapy Medicinal Products CDMO Market – The global advanced therapy medicinal products CDMO market size was estimated at USD 7.45 billion in 2024 and is projected to hit around USD 42.25 billion by 2034, growing at a CAGR of 18.95% during the forecast period from 2025 to 2034.

- U.S. Pet Insurance Market – The U.S. pet insurance market was valued at USD 5.44 billion in 2024 and is projected to hit USD 31.40 billion by 2034, growing at a CAGR of 19.16% over the forecast period 2025 to 2034.

- Biopharmaceuticals Contract Manufacturing Market – The global biopharmaceuticals contract manufacturing market size was estimated at USD 45.15 billion in 2024 and is projected to hit around USD 131.71 billion by 2034, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034.

- Metal Implants And Medical Alloys Market – The global metal implants and medical alloys market size was estimated at USD 18.45 billion in 2024 and is expected to reach USD 45.10 billion in 2034, expanding at a CAGR of 9.35% over the forecast period of 2025-2034.

- Orthodontic Headgear Market – The global orthodontic headgear market size was estimated at USD 1.35 billion in 2024 and is expected to hit USD 2.26 billion in 2034, expanding at a CAGR of 5.3% during the forecast period of 2025-2034.

- U.S. Single-use Bioprocessing Market – The U.S. single-use bioprocessing market size is calculated at USD 9.65 billion in 2024, grows to USD 11.10 billion in 2025, and is projected to reach around USD 39.24 billion by 2034, grow at a CAGR of 15.06% from 2025 to 2034.

- Single Cell Genome Sequencing Market – The global single cell genome sequencing market size was estimated at USD 4.85 billion in 2024 and is projected to hit around USD 22.14 billion by 2034, growing at a CAGR of 16.4% during the forecast period from 2025 to 2034.

Healthcare Business Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Nova One Advisor has segmented the global healthcare business intelligence market

By Component

- Software

- Services

By Mode of Delivery

- On-premise

- Cloud-based

- Hybrid

By Application

- Financial Analysis

- Claims Processing

- Revenue Cycle Management

- Payment Integrity and Fraud, Waste, & Abuse (FWA)

- Risk Adjustment and Risk Assessment

- Clinical Analysis

- Quality Improvement and Clinical Benchmarking

- Clinical Decision Support

- Regulatory Reporting and Compliance

- Comparative Analytics/Effectiveness

- Precision Health

- Operational Analysis

- Supply Chain Analysis

- Workforce Analysis

- Strategic Analysis

- Patient Care

By End Use

- Payers

- Healthcare Providers

- Healthcare Manufacturers

By Deployment

- Self-service BI

- Corporate BI

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/3566

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.