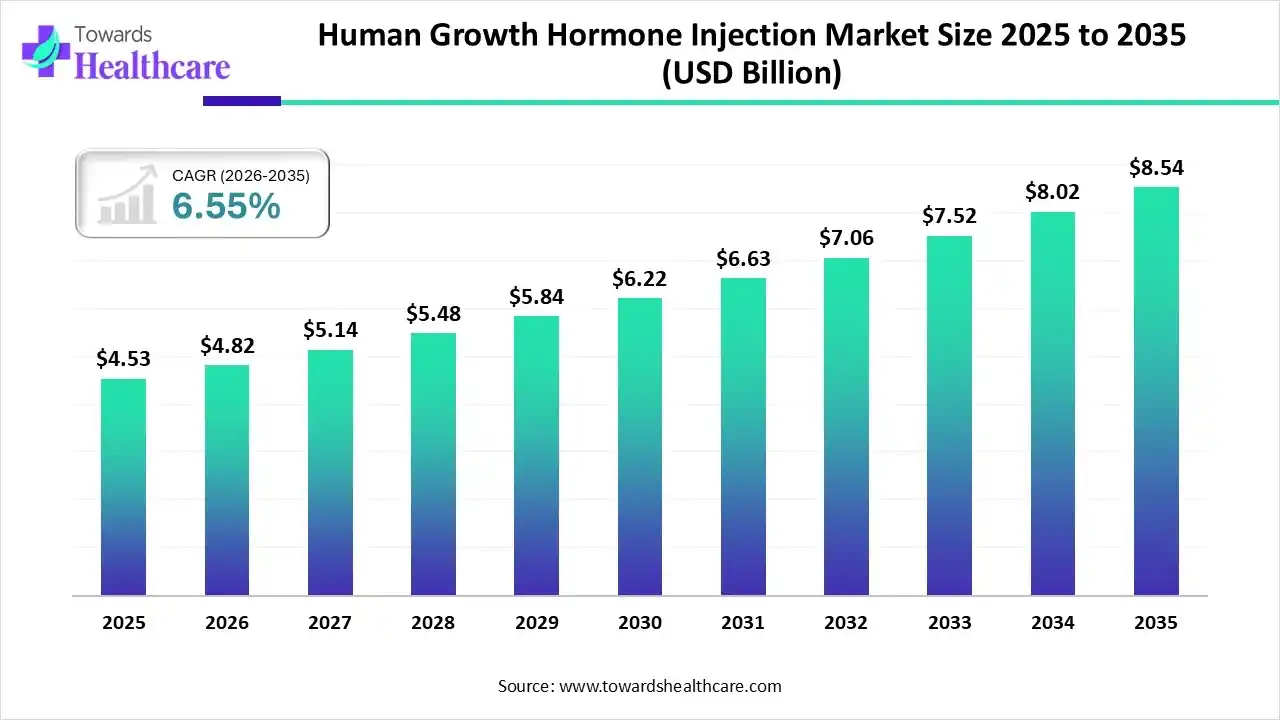

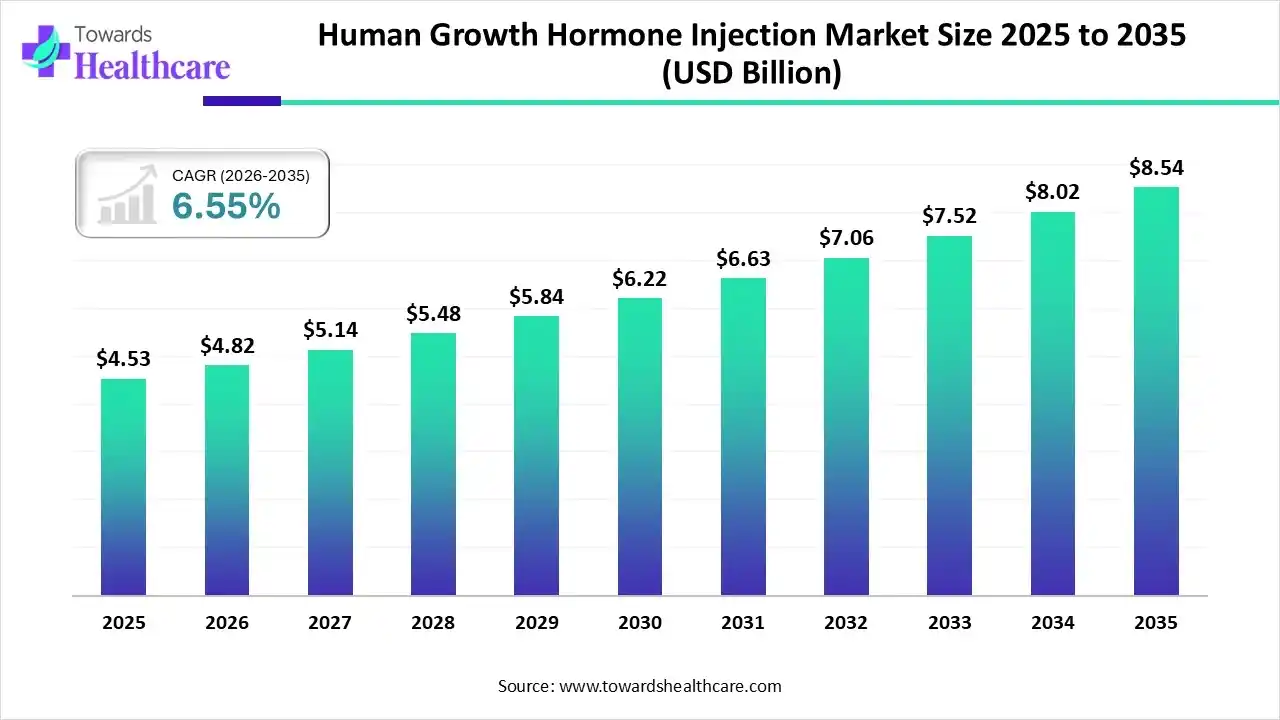

The global human growth hormone injection market size is valued at USD 4.53 billion in 2025 and is predicted to hit around USD 8.54 billion by 2035, rising at a 6.55% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global human growth hormone injection market size is calculated at USD 4.82 billion in 2026 and is expected to reach around USD 8.54 billion by 2035, growing at a CAGR of 6.55% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6369

Key Takeaways:

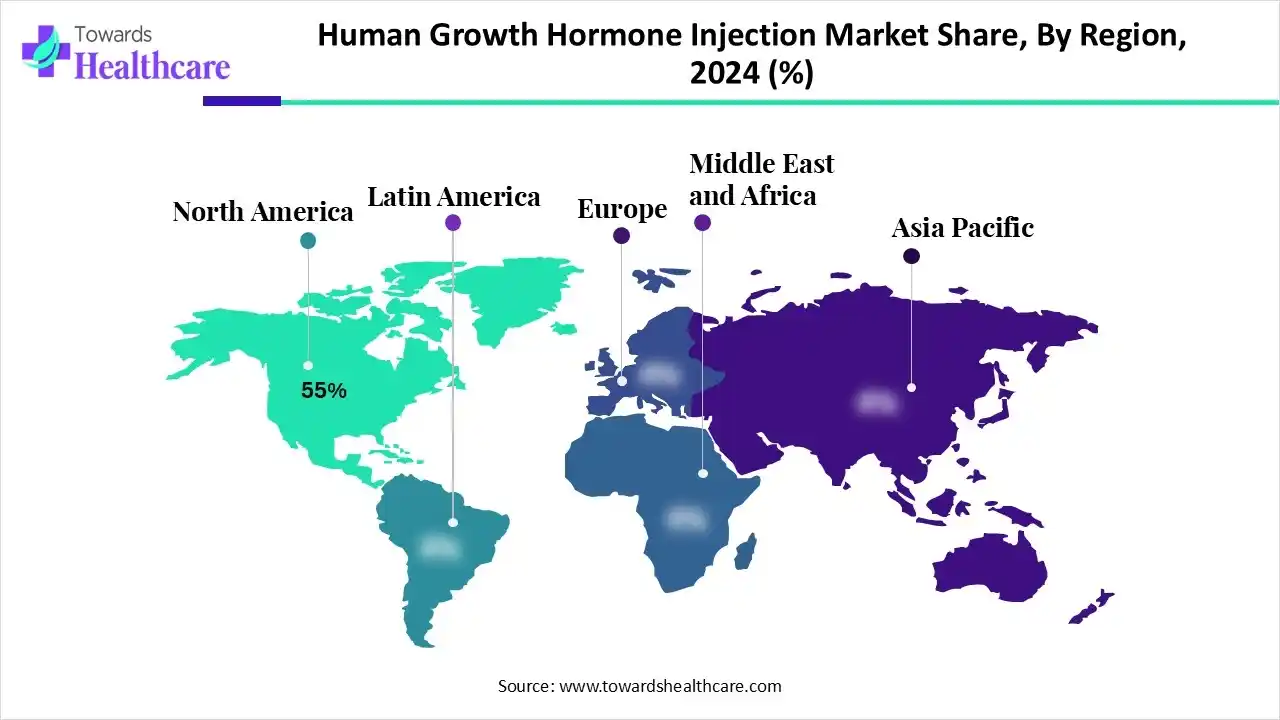

- By region, North America was dominant in the human growth hormone injection Market, with a 55% share.

- By region, Asia Pacific is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By drug type, the branded HGH injections segment held the largest market revenue of 65% in 2024.

- By drug type, the generic HGH injections segment is the fastest-growing over the forecast period, 2025 to 2034.

- By formulation, the recombinant DNA (rDNA) HGH segment was dominant in the market revenue in 2024, with an 85% share.

- By formulation, the natural/extracted HGH segment is the fastest-growing over the forecast period, 2025 to 2034.

- By application, the pediatric growth disorders segment was dominant in the human growth hormone injection market in 2024, with a 40% share.

- By application, the metabolic disorders segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

- By route of administration, the subcutaneous injection segment was dominant in the market in 2024, with a 90% share.

- By route of administration, the intramuscular injection segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

- By distribution channel, the hospital pharmacies segment was dominant in the market in 2024, with a 45% share.

- By distribution channel, the online pharmacies segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

- By type of manufacturer, the in-house manufacturing segment was dominant in the human growth hormone injection market in 2024, with a 70% share.

- By type of manufacturer, the outsourced manufacturing segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

Market Overview:

The human growth hormone injection market worldwide is accelerating as healthcare systems focus on earlier diagnosis and treatment of growth disorders. Increases in pediatric growth hormone deficiency, Turner syndrome, and Prader–Willi syndrome means there will be greater demand for HGH therapy. Additionally, the use of HGH injections in metabolic regulation, and muscle-wasting conditions, as well as in anti-aging research is expanding the number of consumers for human growth hormone injection beyond physicians and society.

Bioengineered recombinant human growth hormone formulations continue to lead the market with improved purity, safety, and efficacy of treatment. Similarly, many pharmaceutical companies are investing millions of dollars in delivery methods that avoid needle injections to reduce pain. Best practice awareness circles and digital health platforms are creating a more accessible HGH delivery method that will likely expand global demand.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Market Growth Factors:

What are the main contributors to the positive global market outlook for HGH injections?

- The growing prevalence of growth hormone deficiency in pediatric and adults is driving the increase in the number of prescriptions. Because more children are screened early, there has been an increase in diagnoses of children with growth disorders and the demand for safe and regulated HGH therapies.

- Improvements in drug quality and patient confidence is a result of the advances in human growth hormone (HGH) derived from recombinant DNA technology. Molecular engineering is leading to greater purity and lower immunogenicity of HGH, thereby attracting clinicians and patients to the new generation of formulations.

- The increasing use of HGH injections in metabolic diseases, and muscle wasting diseases and conditions, is a growing indication for use. HGH is being increasingly utilized in hospitals and specialty clinics as a result of the previous research to support the assertion.

- The expansion of telehealth and online pharmacy products and services provides better access to hormone therapies. Both digital prescriptions and telehealth are inherently limited by geography and market reach.

- Increasing investment from biotech companies is developing a greater product pipeline in this sector of hormone therapy treatment. Increasing research and development finds continual support for patient friendly hormone therapies that have longer duration of action and can penetrate the market more rapidly.

Key Drifts:

Which current trends are shaping the future HGH injection market pressures?

The trends that are exerting pressure in the human growth hormone injection market shape the market’s dynamics in various ways, such as the transition to long-acting HGH formulations that reduce frequency of injection to improve patient compliance. New entry of smart injection devices that track dosage metrics is receiving support within the developed markets. There are emerging biosimilar products in the market, which results in competition with cheaper products with similar performance.

The additional trend is that there is a growing need for devices that result in minimal invasive delivery and decreases pain, such as auto-injectors and needle-free injectors. These evolving delivery methodologies and increasing focus on individualized hormones are creating market pressure and developing the possibilities of future generations of HGH.

Significant Challenge:

Even though the human growth hormone injection market is having a positive path of growth, significant challenges remain, driven by heavy regulation and worries about misuse. Hormone therapies must be subjected to all quality, safety, and authentication processes, which adds complexity and increased costs to product approval.

Counterfeit and unregulated versions of HGH are available on the Internet and pose a serious threat to both patients and the market. In addition, long-term therapy with hormones needs ongoing monitoring that may be problematic for patients in some developing areas. Collectively, all of these challenges create barriers to scalability and suggest an urgent need for better regulatory alignment and treatment guidelines by physicians.

Regional Analysis:

In 2024, North America accounted for the largest share of the human growth hormone injection market, which can be attributed to the expansion of healthcare infrastructure and spending on specialty biologics. The region is advantaged by its early adoption of recombinant DNA methods and its physician awareness of growth hormone deficiency. The United States remains a key sector due to the high pediatric population and physician insurance coverage for approved HGH therapies. Players in the North American market are heavily engaged in R&D partnerships and the regulatory innovation process through the FDA, ensuring a breadth of high-quality hormone treatment on the market.

The Asia-Pacific region is expected to be the fastest growing market for human growth hormone injection from 2025 to 2034. Rapid development of healthcare infrastructure, especially in China, India, South Korea, and Japan, has greatly improved access to diagnostic and therapeutic services. The growing awareness about pediatric growth disorders and more proactive healthcare screening programs are generating increased demand for HGH therapy. The expansion of medical tourism, particularly for affordable endocrinology, is resulting in more foreign patients in this region.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Segment Insights:

By Drug Type:

As of 2024, branded HGH injections were the clear leader in the drug type category and captured an impressive market share at 65% of total revenue. Brand name products continue to command this category of drug type due to their proven clinical validation, quality of development and dispensing, and level of confidence provided to all users (especially endocrinologists), thus presenting brand as a consistent and reasonable source of purity, stability in the dispensing environment, and assurance of action that pediatrics and chronic metabolic therapy depend on. Furthermore, branded hormones are benefiting from high regulatory scrutiny, in part because they are acknowledged to require high quality, scientifically validated research, and trademark branded products continue to dominate the category.

Within the drug type category, between 2025 and 2034, generic HGH injectable drug types will show the fastest growth rate, as affordability of hormone therapy will take precedence over conditional consumer preferences for healthcare drugs. Although generic drug types garner similar therapeutic benefits as branded drug types, they offer significant savings to the consumer.

Generic products may represent tolerable solutions to hormone therapy in lower-income or upper middle-income countries. Both patients and providers of healthcare are often more accepting to a lower priced generic replacement for branded. Emerging manufacturers in Asia and Latin America show significant development of generics, and mastering the logistics of making high-quality biosimilar products, and passing the certifications for these formulations in their respective governments.

By Formulation:

Recombinant derived DNA growth hormone (rDNA HGH) drug delivery systems accounted for 85% of total HGH revenues in the year 2024, confirming rDNA as the gold standard delivery system for growth hormone formulation. Recombinant DNA is therefore the largest segment because of its robustness in clinical practice, as well as the molecular purity and lower risk of contamination of this form of hormone rDNA HGH as opposed to its predecessor forms of HGH.

In clinical practice rDNA HGH is responsible for mimicking the naturally occurring human growth hormone. This underscores their importance to facilitating the therapeutic response particularly in both pediatrics and adult populations. Regulatory agencies the world over approve rDNA formulations due to their safety profile, while searching for more efficacy and purposes in therapeutic treatment, however, the continued rDNA market will continue to inspire use with patients, providers, caregiving groups, and health-policy verify choices.

Natural or extracted formulations of growth hormone should be the fastest growing segment between the years 2025-2034 as consumer preference continues to trend toward biologically-based therapies. Natural or extracted growth hormone formulations have been utilized less as a market compared to rDNA and biogenic product formulations of growth hormone as they have historically not held the same level of predictability and reliability.

Advancements in purification technologies have made natural and extracted growth hormone congruency with alternative forms of hormones including rDNA. There will likely be an increased demand for alternative biologically based therapies simply because they have little to no synthesized in the process of extract and purification.

By Application:

In 2024, Pediatric growth disorders will remain the leading application for HGH injections, accounting for 40% of total market share. Conditions such as growth hormone deficiency, Turner syndrome, and chronic renal insufficiency all require appropriate and consistent hormone therapy to achieve optimal developmental outcomes. Parents, pediatric specialists, and healthcare systems are utilizing burgeoning early diagnosis programs to identify growth disorders sooner, allowing them to initiate treatment earlier. The clinical guidelines that support HGH use in children supports their acceptance in hospitals and endocrinology centers

The metabolic disorders segment will be the fastest growing application from 2025 to 2034, due to growing cases of obesity, muscle-wasting diseases, and metabolic syndrome. HGH therapy can support improved lipid metabolism, increased muscle mass, and improved physiological regulation, providing a potential intervention for adult metabolic issues. There are increasing clinical studies which validate the role of HGH as an endocrine therapy in relation to metabolic health, which is helping physician acceptance. The interest of patients who are seeking non-invasive and medically supervised metabolic intervention therapies will also be driving demand.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Route of Administration

Subcutaneous injections led the route of administration segment in 2024, with an overwhelming 90% share. The preference for this route of administration is due to the ease of delivery, minimal discomfort, and suitability for self-administration, which is enhanced for many patients during long-term hormone therapy. New auto-injector devices are improving accuracy and patient comfort with the subcutaneous delivery route, which has led to higher rates of patient adherence to their treatment plan. Since the subcutaneous route allows for stable hormone absorption with predictable pharmacokinetics, there are many advantages of this route of administration in pediatric and chronic-care patients.

Intramuscular injections will experience the fastest growth between 2025 and 2034 as attention grows for specific clinical circumstances that would require rapid or targeted hormone absorption. While hospitals and specialty clinics provide better treatment options for hospital patients that have been recently admitted due to other acute metabolic or endocrine conditions, this is not targeted towards patients that are suffering from acute or chronic metabolic disease. Research on optimized intramuscular delivery and improved needle technologies is reducing discomfort and improving acceptance.

By distribution channel:

Hospital Pharmacies continue to serve as the leading institution for diagnosing patients’ medical conditions, medications prescribed, and developing treatment plans for hormone deficiencies, all of which solidify their holdings in the healthcare space. Patients may be influenced by the rigor of regulatory controls to purchase human growth hormone solely through the pharmacy in order to establish patient safety and confidence in the authenticity of the medication. In addition to education to the patient and monitoring dosage of the patient, both of which can improve patient outcomes.

Online pharmacies will see the highest growth rate between 2025-2034 as the global digital healthcare ecosystem expands. Patients prefer to shop on the online platform due to the convenience, home delivery, and access to a wider range of products. As telemedicine continues to grow and become more common, endocrinologists can generate a prescription for a human growth hormone prescription, and the patients can then fill that prescription via the online channel. Improved authentication system development/requirements along with regulation for online pharmacies has increased the amount of patients/prescribers that trust their choice to purchase hormonal therapy through upcoming online channels.

By Type of Manufacturer:

In-house manufacturing accounted for 70% of the market share in 2024, and the size of this accounted for share of the market is due to the demands of strict quality and consistent manufacturing procedures for recombinant human growth hormones. The larger biopharmaceutical companies have invested in production in-house to maintain standards of strict purity testing, prvention of contamination of products, and protecting proprietary technologies related to the development and manufacturing of the human growth hormones. Furthermore, vertical integration as the supply chain is controlled by the in-house manufacturing facilities by securing approved regulatory status for the product.

Outsourced manufacturing will provide the fastest growth between 2025-2034, as more pharmaceutical companies expand their use of contract manufacturing organizations (CMO’s) due to cost reduction and quicker production turnaround than the pharmaceutical companies would present in-house. Clarity is also shown with pharmaceutical companies flexibility in adjusting production levels without large capital access, especially in the case when production demands increase significantly. Changes in CMO capability to process biologics more rapidly have brought different levels of production for the human growth hormone products, as now the unit production price has become a more competitive price for pharmaceutical companies.

Recent Developments:

In June 2024, Pfizer announced advancements in its long-acting growth hormone candidate Somatropin-LA, highlighting promising Phase 3 results for pediatric growth hormone deficiency. The company emphasized improved weekly dosing benefits.

Human Growth Hormone Injection Market– Value Chain Analysis

R&D

The research and development (R&D) processes for human growth hormone injection mainly include recombinant DNA technology, widespread testing, and multiple clinical trial phases. HGH is produced synthetically using genetically engineered bacteria to confirm a plentiful and effective supply.

Key Players: Ipsen and GeneScience Pharmaceuticals Co., Ltd.

Clinical Trials and Regulatory Approvals

Clinical trials of human growth hormone injection involve progression that is highly regulated, needs extensive documentation and oversight, and characteristically progresses through Phase 1, Phase 2, and Phase 3 studies before regulatory approval.

Key Players: Pfizer Inc. and Merck & Co., Inc.

Patient Support & Services

Patients receiving human growth hormone (HGH) injections are typically provided with inclusive services to help them throughout their treatment. These services mainly focus on informing patients and caregivers, confirming safe and correct administration of the drug.

Key Players: Eli Lilly and Ascendis Pharma

Top Vendors and their Offering

- Novo Nordisk: Novo Nordisk spent approximately $9 billion in 2025 to “create additional capacity across the supply chain,” according to its 2024 annual report filed with the U.S. Securities and Exchange Commission on Wednesday. That amount is an increase from the nearly $6.3 billion the Danish drugmaker spent last year to bolster its manufacturing capabilities

- Pfizer: Pfizer has conducted extensive clinical trials and established patient registries to study the long-term safety and effectiveness of its HGH treatments.

- Eli Lilly and Company: Eli Lilly’s main HGH offering is Humatrope, a form of somatropin manufactured using recombinant DNA technology.

Browse More Insights of Towards Healthcare:

The global human blood products market size was estimated at US$ 43.54 billion in 2023 and is projected to grow to US$ 76.36 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.24% from 2024 to 2034.

The global human platelet lysate market size is calculated at US$ 587 million in 2025, grew to US$ 677 million in 2026, and is projected to reach around US$ 2416 million by 2035. The market is expanding at a CAGR of 15.19% between 2026 and 2035.

The global human combinatorial antibody libraries market size is calculated at US$ 116.2 in 2024, grew to US$ 122 million in 2025, and is projected to reach around US$ 189.57 million by 2034. The market is expanding at a CAGR of 5.04% between 2025 and 2034.

The global human biofluid collection services market size is calculated at US$ 1.48 billion in 2024, grew to US$ 1.58 billion in 2025, and is projected to reach around US$ 2.93 billion by 2034. The market is expanding at a CAGR of 7.08% between 2025 and 2034.

The global human chorionic gonadotropin market was estimated at US$ 758.56 million in 2023 and is projected to grow to US$ 1,522.76 million by 2034, rising at a compound annual growth rate (CAGR) of 6.54% from 2024 to 2034.

The global human microbiome market size was estimated at US$ 0.94 billion in 2024, projected to increase to US$ 1.23 billion in 2025 and reach US$ 13.87 billion by 2034, showing a healthy CAGR of 30.97% across the forecast years.

The global human coagulation factor VII market size was estimated at US$ 1.21 billion in 2023 and is projected to grow to US$ 1.82 billion by 2034, rising at a compound annual growth rate (CAGR) of 3.74% from 2024 to 2034.

The recombinant human hair keratin protein market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2024 to 2034.

The global cell therapy human raw materials market size was estimated at US$ 2.91 billion in 2023 and is projected to grow to US$ 22.75 billion by 2034, rising at a compound annual growth rate (CAGR) of 22.38% from 2023 to 2034.

Top Companies in the Human Growth Hormone Injection Market

- Pfizer Inc.

- Novo Nordisk A/S

- F. Hoffmann-La Roche AG

- Eli Lilly and Company

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis Group)

- Genentech, Inc.

- Ascendis Pharma A/S

- Chugai Pharmaceutical Co., Ltd.

- LG Chem Ltd.

- BioMarin Pharmaceutical Inc.

- Intas Pharmaceuticals Ltd.

- Abbott Laboratories

- Amgen Inc.

- OPKO Health, Inc.

- Ipsen Pharma

- Samsung Bioepis

- Bharat Serums and Vaccines Ltd.

- Zydus Cadila

Segments Covered in the Report

By Drug Type

- Branded HGH Injections

- Specialty Branded HGH

- General Branded HGH

- Generic HGH Injections

- Biosimilar HGH

- Non-biosimilar Generics

By Formulation/Technology

- Recombinant DNA (rDNA) HGH

- Somatropin-based rDNA

- Modified rDNA variants

- Natural/Extracted HGH

By Application/Therapeutic Area

- Pediatric Growth Disorders

- Growth Hormone Deficiency (GHD) in children

- Turner Syndrome

- Prader-Willi Syndrome

- Adult Growth Hormone Deficiency (AGHD)

- Hypopituitarism

- Age-related HGH decline

- Metabolic Disorders

- Obesity management

- Muscle wasting in chronic illness

- Other Indications

- Short stature due to chronic renal insufficiency

- HIV/AIDS-related wasting

- Other rare endocrine disorders

By Route of Administration

- Subcutaneous Injection

- Pre-filled pens/syringes

- Reconstituted vials

- Intramuscular Injection

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct-to-Patient/Home Delivery

By Type of Manufacturer

- In-house Manufacturing

- Outsourced Manufacturing

- Contract Development & Manufacturing (CDMO)

- Contract Research Organizations (CRO)

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6369

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.