The U.S. Hydrogen Electrolyzer Market is projected to reach USD 278.81 million in 2025 and grow at an 85.13% annual rate through 2033. Federal funding, tax incentives, and grants are driving deployment of large-scale electrolyzers across industry and mobility, supporting green hydrogen for fuel cell vehicles, low-carbon steel and chemicals, and integration with renewable energy.

Austin, Jan. 30, 2026 (GLOBE NEWSWIRE) — Hydrogen Electrolyzer Market Size & Growth Insights:

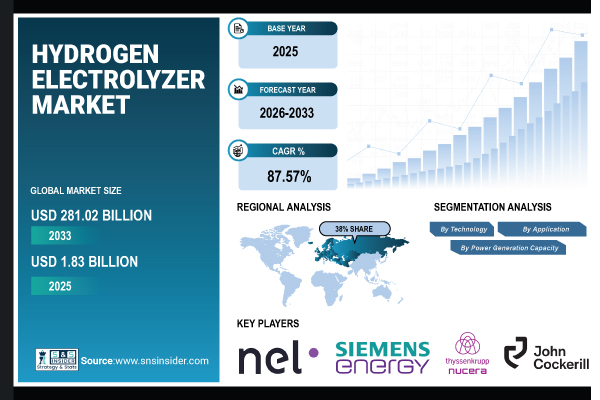

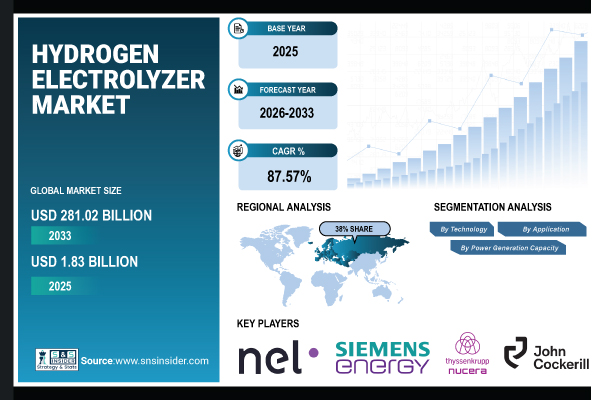

According to the SNS Insider, “The Hydrogen Electrolyzer Market Size was valued at USD 1.83 billion in 2025E and is expected to reach USD 281.02 billion by 2033, growing at a CAGR of 87.57% over 2026-2033.”

Government Incentives and Policy Support to Augment Market Expansion Globally

Governments in many parts of the world are actively promoting the use of electrolyzer technologies through laws, grants, and subsidies that aim to lower carbon emissions. The European Commission set aside more than €3.4 billion for hydrogen projects in Europe as part of the “Important Projects of Common European Interest” (IPCEI) program. This money will go toward making electrolyzers and deploying them on a big scale. The U.S. Inflation Reduction Act gives up to USD 3 per kilogram of clean hydrogen in North America. This encourages private enterprises to put money into making electrolyzers and green hydrogen projects. India’s National Green Hydrogen Mission has promised ₹17,490 crore (about USD 2.1 billion) to build 15 GW of electrolyzer capacity in India by 2030.

Market Size and Growth Projections:

- Market Size in 2025: USD 1.83 Billion

- Market Size by 2033: USD 281.02 Billion

- CAGR: 87.57% from 2026 to 2033

- By Technology: In 2025, Alkaline Electrolyzer dominated with 55% share

- Europe dominates the global market with 38% share in 2025

Get a Sample Report of Hydrogen Electrolyzer Market Forecast @ https://www.snsinsider.com/sample-request/8624

Leading Market Players with their Product Listed in this Report are:

- Nel Hydrogen

- Siemens Energy

- Thyssenkrupp Nucera

- John Cockerill

- Plug Power Inc.

- Enapter

- HydrogenPro

- ITM Power

- Sunfire GmbH

- McPhy Energy

- LONGi Green Energy

- Bloom Energy

- Cummins Inc.

- Asahi Kasei Corporation

- PERIC Hydrogen Technologies

- Beijing SinoHy Energy Co., Ltd.

- Green Hydrogen Systems

- Giner Inc.

- H-TEC Systems GmbH

- Ohmium International

Hydrogen Electrolyzer Market Report Scope:

| Report Attributes | Details |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Technology (Alkaline Electrolyzer (AE), Proton Exchange Membrane (PEM), Solid Oxide Electrolyzer (SOE), Anion Exchange Membrane (AEM)) • By Application (Energy – Power Generation, CHP, Mobility, Industrial – Chemical, Industries, Grid Injection) • By Power Generation (<500 kW, 500–2,000 kW, >2,000 kW) |

Purchase Single User PDF of Hydrogen Electrolyzer Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8624

Key Segmentation Analysis

By Technology

The Alkaline Electrolyzer (AE) will still be the most popular product in 2025, with a 55% market share as its technology is mature, it is cost-effective, and it is widely used in large-scale industrial and energy projects. Proton Exchange Membrane (PEM) is the fastest-growing part of the market, with a predicted CAGR of 92% as it is very efficient, has a modular architecture, and is good for mobile applications like hydrogen fuel cell vehicles.

By Application

Energy—Power Generation will be the market leader in 2025 with a 38% share as electrolyzers are being used with renewable energy projects, grid balancing, and large-scale green hydrogen production for industrial and municipal consumption. The mobility sub-segment is increasing the fastest, at a rate of 95% per year, due to the growing usage of hydrogen fuel cell buses, trucks, and trains.

By Power Generation Capacity

Electrolyzers with more than 2,000 kW capacity made up the greatest proportion at 45% in 2025 as there is a need for hydrogen production on a large scale and for industrial use. The 500–2,000 kW sector is expanding the fastest, at a rate of 88% per year as it may be used in a wide range of medium-sized industrial applications and can be combined with major renewable energy projects.

Regional Insights:

Europe will have 38% of the worldwide market in 2025 owing to strong government policies, such as the EU Green Deal and IPCEI (Important Projects of Common European Interest), which pay for the production of electrolyzers and the use of green hydrogen on a big scale.

Asia Pacific holds 30% of the global market in 2025 and is the fastest-growing region due to rapid industrialization, renewable energy adoption, and government initiatives promoting green hydrogen.

High Capital and Operational Costs May Impede Market Expansion

Electrolyzers need a lot of money to buy equipment, integrate renewable electricity, and build special infrastructure, which makes it hard for smaller companies to use them. A mid-sized PEM electrolyzer company in Europe put off a big expansion because of significant upfront expenses, even though the EU offered to help pay for it. In North America, green hydrogen projects often have high expenses for installation and operation, especially when they use huge electrolyzers that are coupled to renewable energy sources that don’t always work. In Asia as well, subsidies are available, but the cost of imported parts and experienced workers can make projects more expensive.

Do you have any specific queries or need any customized research on Hydrogen Electrolyzer Market? Schedule a Call with Our Analyst Team @ https://www.snsinsider.com/request-analyst/8624

Recent Developments:

- In July 2025, Plug Power Inc. commissioned a 100 MW PEM electrolyzer plant in New York, capable of producing up to 45 tons of green hydrogen daily, supporting heavy transport and industrial decarbonization.

- In February 2025, Air Liquide & TotalEnergies announced a joint investment of over €1 billion to develop two large-scale, low-carbon hydrogen production plants in the Netherlands, including a 200 MW electrolyzer in Rotterdam and a 250 MW electrolyzer in Zeeland.

Exclusive Sections of the Hydrogen Electrolyzer Market Report (The USPs):

- ELECTROLYZER TECHNOLOGY ROADMAP (10–15 YEAR OUTLOOK) – helps you compare the long-term performance, scalability, and commercial readiness of Alkaline, PEM, Solid Oxide, and AEM electrolyzer technologies.

- CAPEX & OPEX COST DECLINE TRAJECTORIES – helps you understand how manufacturing scale, efficiency gains, and learning curves are driving capital and operating cost reductions across electrolyzer types.

- EFFICIENCY & PERFORMANCE BENCHMARKING – helps you track improvements in system efficiency, durability, and operating flexibility that directly impact hydrogen production economics.

- GREEN HYDROGEN LCOH SENSITIVITY ANALYSIS – helps you evaluate the levelized cost of hydrogen under varying electricity price scenarios, revealing regions with the strongest cost competitiveness.

- TECHNOLOGY MATURITY & COMMERCIAL SCALABILITY – helps you identify which electrolyzer technologies are nearing mass deployment versus those still in pilot or early-commercial phases.

- COST CURVE POSITIONING & FUTURE COMPETITIVENESS – helps you anticipate when green hydrogen could reach parity with gray and blue hydrogen across key industrial applications.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.