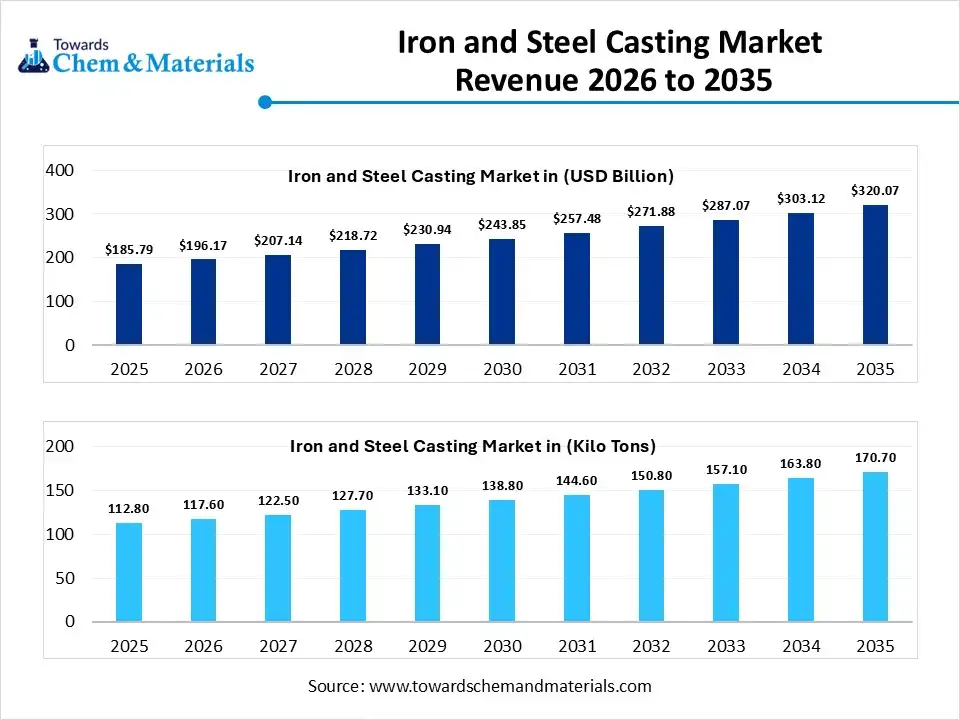

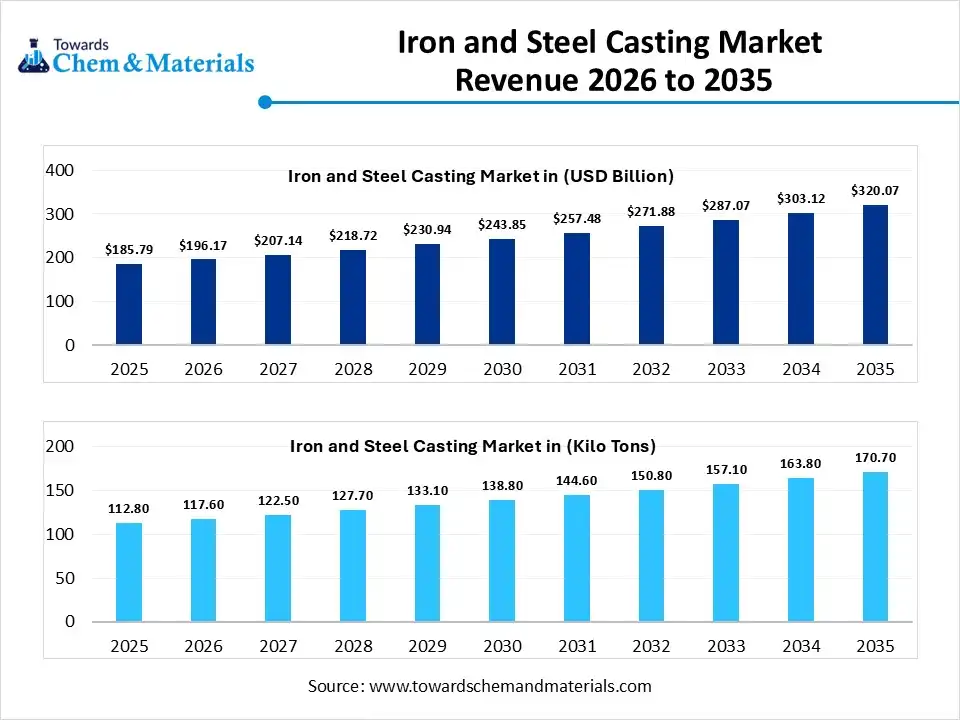

According to Towards Chemical and Materials, the global iron and steel casting market volume was valued at 112.80 kilo tons in 2025 and is expected to be worth around 170.7 kilo tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.23% over the forecast period from 2026 to 2035.

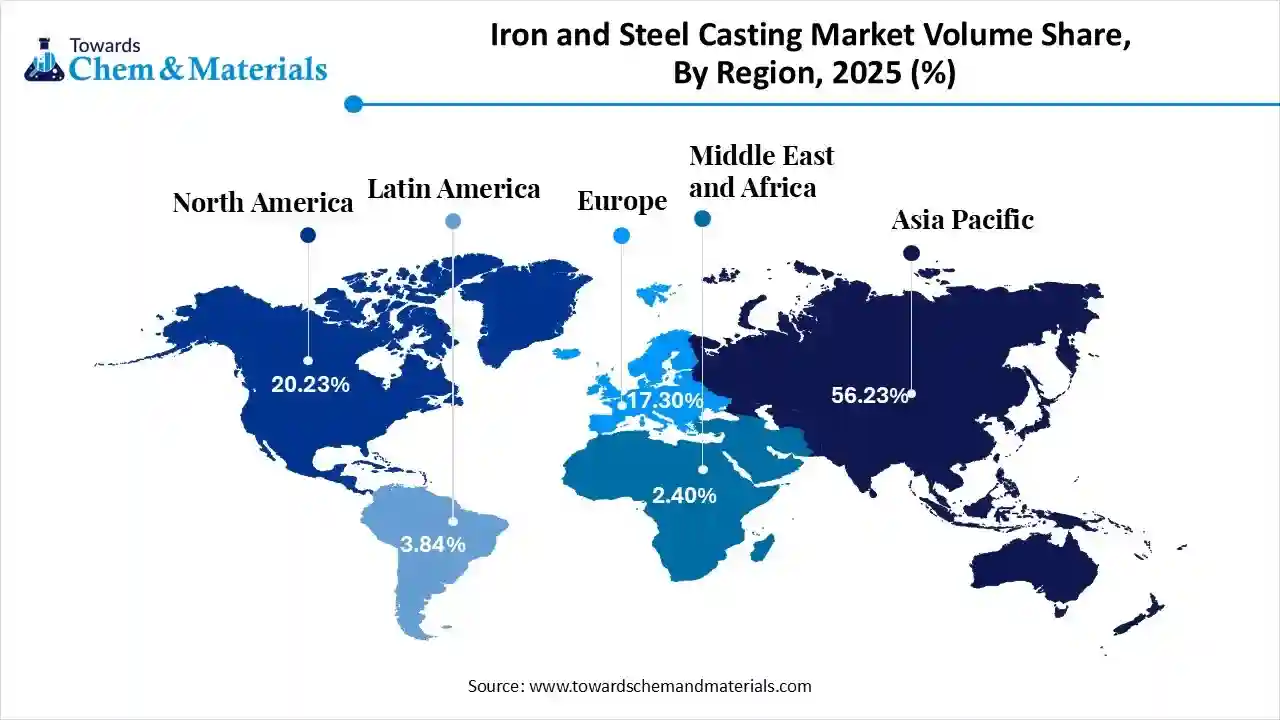

Ottawa, Feb. 02, 2026 (GLOBE NEWSWIRE) — The global iron and steel casting market size was estimated at USD 185.79 billion in 2025 and is expected to increase from USD 196.17 billion in 2026 to USD 320.07 billion by 2035, growing at a CAGR of 5.59% from 2026 to 2035. In terms of volume, the market is projected to grow from 112.8 kilo tons in 2025 to 170.7 kilo tons by 2035. growing at a CAGR of 4.23% from 2026 to 2035. Asia Pacific dominated the iron and steel casting market with the largest volume share of 56.23% in 2025. The iron and steel casting market growth is driven by advanced manufacturing, diversified applications, and due to their strength, resistance, and thermal stability. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6144

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Iron and Steel Casting: Shaping the Future of Industry.

Iron and steel casting, characterized by transforming molten alloys into high-performance components using molding techniques, is significant for modern infrastructure. It supports global supply chains with materials due to their strength, wear resistance, and thermal stability. Researchers shift from traditional foundry methods to advanced manufacturing, emphasizing automation and precision to meet heavy machinery and transportation demands. It serves as an industrial health indicator, with value driven by producing complex, near-net-shape parts and precision metallurgy that optimize cost and durability.

Iron and Steel Casting Market Report Highlights

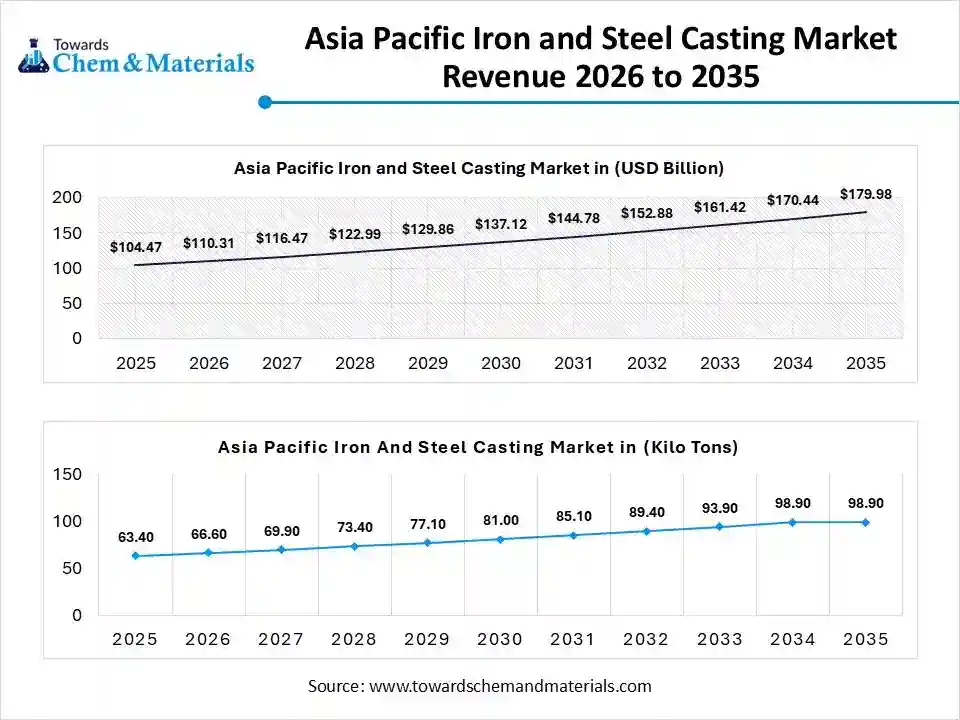

- The Asia Pacific dominated the global iron and steel casting market with the largest volume share of 56.23% in 2025.

- The iron and steel casting market in North America is expected to grow at a substantial CAGR of 4.76% from 2026 to 2035.

- The Europe iron and steel casting market segment accounted for the major volume share of 17.30% in 2025.

- By material type, the iron casting segment dominated the market and accounted for the largest volume share of 78.23% in 2025.

- By material type, the steel casting segment is expected to grow at the fastest CAGR of 5.68% from 2026 to 2035 in terms of volume.

- By process, the sand-casting segment led the market with the largest revenue volume share of 38.5% in 2025.

- By application, the automotive components segment dominated the market and accounted for the largest volume share of 32% in 2025.

- By end use, the industrial manufacturing segment led the market with the largest revenue volume share of 41% in 2025.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6144

Iron and Steel Casting Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 196.17 Billion / 117.60 Kilo Tons |

| Revenue Forecast in 2035 | USD 320.07 Billion / 170.70 Kilo Tons |

| Growth Rate | CAGR 5.59% |

| Forecast Period | 2026 – 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Casting Process, By Application Area, By End-Use Sector, By Regions |

| Key companies profiled | Nucor Corporation (USA), Kobe Steel, Ltd. (Japan), Neenah Foundry Company (USA), Metal Technologies Inc. (USA), ArcelorMittal S.A. , Waupaca Foundry, Inc. , Georg Fischer AG (GF Casting Solutions), Hitachi Metals, Ltd. (Proterial) , Thyssenkrupp AG , Brakes India Private Limited , Grede Holdings LLC , Nippon Steel Corporation , POSCO Holdings , Tata Steel Limited , China Baowu Steel Group , Nelcast Limited |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments for Iron and Steel Casting

- ArcelorMittal: A global steel giant, involved in steel casting and recycling acquisitions, focusing on advanced process automation and low-carbon steelmaking technologies.

- JSW Steel: This company is investing heavily in capacity expansion, including new greenfield steel plants and acquisitions, to meet growing demand for construction and automotive steel.

- Tata Steel: India’s oldest private steel producer, Tata Steel is a major investor in integrated steel plants and sustainable steelmaking practices.

- Nucor Corporation: Nucor, a leading North American steel producer, has focused on recycling assets acquisition and supplying low-embodied carbon steel (Econiq™-RE) to automotive manufacturers like Mercedes-Benz.

- GF Casting Solutions (Georg Fischer AG): This company is establishing a global network of “mega-casting” machines to meet the rising demand for large structural components, especially in the automotive sector.

- Kobe Steel, Ltd.: Known by its brand name KOBELCO, this Japanese manufacturer invests in a diverse portfolio of innovative products and technologies across various industries, including iron and steel casting.

- Nelcast Limited: An Indian company, Nelcast is a key player operating in the iron and steel casting market, providing components for a wide range of applications.

- PTC Industries Ltd: This company is involved in high-value-added investment casting, supplying components that require precision for specialized sectors like aerospace and defense.

Iron and Steel Casting Market Trends

- Focus on Sustainability: Environmental regulations are driving the rising adoption of cleaner melting technologies. Sustainability initiatives are pushing manufacturers towards improved waste management systems, influencing market dynamics.

- Advanced Automotive Sector Expansion: The automotive industry is the largest consumer of castings, driving the need for advanced automotive needs a lightweight casting material that offers better fuel economy, improved performance characteristics, and lower emissions

- Consumer Demand: The growing demand is due to Customers seek customized casting solutions that meet precise industrial needs and performance standards. It includes construction, automotive, and end-users prefer high Quality and reliability.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6144

Iron and Steel Casting Market Dynamics

Driver

Advancement in Precision Foundry Technologies

The adoption of 3D printed sand molds and automated pouring systems has revolutionized the foundry process. These technological advancements facilitate the fabrication of complex, lightweight designs that were previously unachievable, thereby decreasing material waste and facilitating more rapid production cycles for complex industrial application parts that are driving the market.

Restraints

High Initial Capital Investment

The establishment of modern casting requires capital investment for specialized machinery and pollution control systems, but this limits the market expansion and slower adoption of pioneering manufacturing techniques in emerging industries.

Market Opportunity

Innovation and R&D

The strategic alliance prioritizes R&D efforts to innovate manufacturing processes, enhance product quality, and improve cost-effectiveness. Producers are aiming to develop innovative alloys, refining casting techniques, and 3D printing to create difficult molds and cores to meet the rising demand for high-strength casting. Rapid industrialization and renewable energy are also fostering innovation.

Smart Solutions, Smarter Markets: Technology Transforming Iron and Steel Casting Production.

The technological advancement maximizes efficiency, reducing waste and improving precision. AI-driven processes reduce scrap rates while AI-powdered sensors ensure continuous production and reduce downtime. Additionally, automated quality inspection enables high speed and precision of components to meet the stringent safety standards required for the aerospace and automotive industry.

Iron and Steel Casting Market Segmentation Insights

Material Type Insights

How Did the Iron Casting Segment Dominate the Iron and Steel Casting Market?

Iron casting dominates the global market due to its cost-efficiency and excellent mechanical properties, making it hard to match with other materials. Its high carbon content lowers melting point and improves fluidity, allowing precise, complex shapes with minimal machining. Grey and ductile iron castings offer high strength, wear resistance, and vibration damping, which are crucial for industrial machinery and automotive parts. Its recyclability and established large-scale processes make it a reliable, affordable choice for infrastructure and transport.

The steel casting segment is anticipated to grow fastest, vital for high-strength, high-performance components. Unlike iron, cast steel provides superior tensile strength, toughness, and ductility, essential for aerospace, defense, and renewable energy. Its ability to be customized for corrosion and heat resistance supports advanced electric-vehicle parts and high-pressure equipment. The adoption of digital twin, automation, and additive manufacturing reduces lead times and defects, making steel casting ideal for complex, lightweight, durable solutions.

Process Insights

Why did the Sand-Casting Segment hold the biggest share in the Iron and Steel Casting Market?

The sand-casting segment dominated the market, due to its flexibility, cost-effectiveness, and ability to produce complex parts that other methods cannot replace. It has high temperature resistance and low tooling costs and is suitable for prototyping and large-scale production, especially for metals with high melting points like steels and irons. The heavy industries include automotive, construction, and energy, accelerating the growth. Continuous innovations like 3D sand printing and digital simulation have improved efficiency, mold accuracy, and lead times, setting its leadership in high-strength metal components.

The die casting segment is experiencing the fastest growth in the market during the projected period, driven by the transition to lightweight vehicle designs and electric mobility. Advances in high-pressure casting and automation enable the manufacturing of durable parts to optimize performance and efficiency. It is key for future electronics and telecommunication hardware. Additionally, the industrial adoption of sustainable practices using recycled materials makes it vital for modern manufacturing and innovation in technology.

Application Insights

Which Application Segment Dominates the Iron and Steel Casting Market?

The automotive components segment maintains its market dominance because it provides structural parts for internal combustion and electric vehicles. Castings are a key choice for high-stress parts like engine blocks and brakes due to heat resistance, vibration damping, and cost. The leadership is boosted by Automated molding and precision casting techniques, which allow the production of complex, high-strength, safety-compliant components efficiently.

The railway & infrastructure segment offers significant growth during the projected period, driven by investments in modernizing transit and sustainable urban development. The construction of high-speed rail, bridge, and tunnel projects requires durable, long-lasting steels with structural integrity, fueling the segment. Additionally, governments focus on low-carbon transport and resilient public work infrastructure, fostering growth in specialized castings for tracks, heavy-duty supports, and seismic structures, which drives innovations in corrosion-resistant alloys.

End-Use Sector Insights

How did the industrial manufacturing Segment Dominate the Iron and Steel Casting Market?

The industrial manufacturing segment remains dominant, providing heavy-duty machinery and structural components that withstand extreme mechanical stress and harsh environments, including manufacturing turbine housings, pumps, and large agricultural equipment. The rapid adoption of precision casting and additive manufacturing techniques creates intricate and net-shape parts with higher durability that support infrastructure advancements and capacity expansion.

The energy (wind/solar) segment is an emerging segment projected to grow at a CAGR between 2026 and 2035. Due to increased demand for steel and castings for wind turbines, gearboxes, and solar tracking systems that endure harsh conditions. As green energy projects for power grid modernization expand due to the requirement for high-strength, corrosion-resistant materials with integration of advanced metallurgy, precision casting is vital for durable, sustainable infrastructure.

Regional Insights

How did Asia Pacific Dominate the Iron and Steel Casting Market?

The Asia Pacific iron and steel casting market was estimated to be USD 104.47 billion in 2025 and is projected to reach USD 179.98 billion by 2035, at a CAGR of 5.61% during the forecast period. By volume, the market is projected to grow from 66.60 kilo tons in 2026 to 98.9 kilo tons in 2035. growing at a CAGR of 5.06% from 2026 to 2035.

Asia Pacific led the global market as the key hub for heavy industrial production and infrastructure, driven by a massive manufacturing ecosystem supporting automotive, construction, and renewable energy demands. The abundance of raw materials and an integrated supply chain made it ideal for high-volume casting. Rapid urbanization, transit network expansion, and advanced casting technology continued to produce high-quality, cost-competitive output for domestic and global markets.

India Iron and Steel Casting Market Trends

India’s market is growing steadily, supported by strong demand from automotive, infrastructure, railways, and construction sectors. Government initiatives such as “Make in India” and increased public spending on infrastructure are boosting domestic production and capacity expansion. Automotive lightweighting trends are driving a shift towards high-quality ductile and alloy steel castings.

Why is North America the Fastest-Growing Region in the Iron and Steel Casting Market?

North America’s iron and steel casting market is set to grow due to expansion in the industry and modernized infrastructure, fueled by domestic manufacturing, aerospace and defense, and electric vehicle sectors. The substantial investments in renewable energy and infrastructure projects like wind farms and advanced power grids increase demand for durable, high-quality castings. Adoption of automation, additive manufacturing, and cleaner melting technology helps regional producers meet strict standards, fostering market growth.

U.S. Iron and Steel Casting Market Trends

The U.S. market is experiencing moderate growth, driven by demand from automotive, aerospace, construction, and energy sectors. Infrastructure modernization and the reshoring of manufacturing are supporting increased domestic casting production. Foundries are focusing on advanced materials, precision casting, and automation to address labor shortages and improve efficiency.

More Insights in Towards Chemical and Materials:

Precious Metal Market Size to Surpass USD 1,147.61 Billion by 2035

Steel Wire Rope Market Size to Hit USD 19.79 Bn by 2035

Magnesium Powder Market Size to Hit USD 667.14 Million by 2035

Automotive Stainless Steel Market Size to Hit USD 179.79 Bn by 2035

Coated Steel Market Size to Hit USD 606.68 Billion by 2035

Aluminum Flat Products Market Size to Hit USD 112.15 Bn by 2035

Steel Casting Market Size to Hit USD 66.80 Bn by 2035

Steel Market Size to Reach USD 2.66 Trillion by 2035

Copper Products Market Size to Surpass USD 651.19 Billion by 2035

Iron and Steel Market Size to Hit USD 2.95 Trillion by 2035

Metal Stamping Market Size To Surpass USD 385.66 Billion By 2035

Metal Recycling And Recovery Market Size to Surpass USD 957.06 Bn by 2035

Ferro Alloys Market Size to Surpass USD 132.88 Billion by 2035

U.S. Nickel Market Size to Surpass USD 17.45 Billion by 2034

U.S. Copper Market Size to Worth Around USD 26.33 Bn by 2034

Asia Pacific Steel Rebar Market Size to Surpass USD 248.88 Bn by 2034

Europe Steel Rebar Market Size to Hit USD 224.28 Billion by 2034

U.S. Steel Rebar Market Size to Exceed USD 11.59 Billion by 2034

Steel Rebar Market Size to Reach USD 426.51 Billion by 2034

Copper Scrap Market Size to Surge USD 148.57 Billion by 2034

Structural Steel Market Size to Reach USD 188.63 Billion by 2034

Stainless Steel Market Size to Surge USD 357.28 Billion by 2034

Asia-Pacific Copper Market Size to Reach USD 344.08 Bn by 2034

Europe Copper Market Size to Reach USD 84.16 Billion by 2034

Flat Steel Market Size to Hit USD 1,157.84 Billion by 2034

Recent Breakthrough in the Iron and Steel Casting Industry

- In December 2025, Japan’s JFE Steel Corporation made a significant broadening of its scope in the surging Indian steel market by announcing a contract to acquire a 50% stake in JSW Steel’s Bhushan Power & Steel business. This partnership is set to enhance market reach and merge production capabilities across the Asia-Pacific.

https://timesofindia.indiatimes.com/business/india-business/japans-jfe-to-buy-50-in-bhushans-steel-business/articleshow/125755779.cms

- In November 2025, Calderys announced that it had successfully authorized and begun commercial production of a new basic monolithics line at its CAPES plant in Odisha, India. It reflects activity in the broader materials/ metallurgical sector.

https://calderys.com/news-and-media/calderys-advances-its-brand-new-facility-india-commissioning-basic-monolithics-line

Top Companies in the Iron and Steel Casting Market & Their Offerings:

- ArcelorMittal S.A. offers semi-finished and finished steel products like slabs and billets for diverse industrial applications.

- Thyssenkrupp AG focuses on high-quality flat carbon steel and precision-cast slabs for the automotive and energy sectors.

- Waupaca Foundry, Inc. produces gray and ductile iron castings for the automotive, commercial vehicle, and agriculture markets.

- Brakes India Private Limited specializes in safety-critical iron castings and braking system components for global vehicle manufacturers.

- Grede Holdings LLC manufactures highly engineered iron castings used in heavy-duty truck, automotive, and industrial engines.

- Nippon Steel Corporation provides specialized steel castings and forgings for large-scale infrastructure and heavy machinery.

- POSCO Holdings supplies a wide range of cast steel products tailored for the shipbuilding, energy, and automotive industries.

- Tata Steel Limited produces integrated steel products, including wire rods and structural castings, through high-scale manufacturing.

- China Baowu Steel Group delivers a massive portfolio of iron and steel castings, including high-grade plates and silicon steel.

- Nelcast Limited manufactures ductile and grey iron castings primarily for the heavy commercial vehicle and tractor segments.

- Georg Fischer AG develops lightweight iron and non-ferrous casting solutions for the automotive and aerospace industries.

- Hitachi Metals, Ltd. offers high-grade specialty steel and heat-resistant iron castings for mobility and industrial equipment.

Iron and Steel Casting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Iron and Steel Casting Market

By Material Type

- Iron Casting

- Gray Iron Casting

- Ductile Iron Casting

- White Iron Casting

- Malleable Iron Casting

- Steel Casting

- Carbon Steel Casting

- Alloy Steel Casting

- Stainless Steel Casting

By Casting Process

- Sand Casting

- Die Casting

- Investment Casting (Lost Wax)

- Centrifugal Casting

By Application Area

- Automotive

- Industrial Machinery

- Pipes & Fittings

- Railway

- Energy & Power

By End-Use Sector

- Automotive & Transportation

- Construction & Infrastructure

- Industrial Manufacturing

- Energy, Oil & Gas

- Aerospace & Defense

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6144

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.