KRAS Inhibitors Market to Witness Explosive Growth at a CAGR of 35% During the Forecast Period (2025–2034) Amid Expanding Therapeutic Landscape | DelveInsight

The KRAS inhibitors market is expected to experience substantial growth, driven by rising cancer incidence, improved treatment access, and a robust pipeline including Olomorasib (Eli Lilly), MK-1084 (Merck/Taiho/Astex Pharmaceuticals), Divarasib (Roche), Daraxonrasib (Revoltuion Medicines), Onvansertib (Cardiff Oncology), ELI-002 (Elicio Therapeutics), and others across the 7MM. G12C is the most prevalent KRAS mutation in NSCLC, making it a key target of current therapies. Following the success of KRAS G12C inhibitors, attention is shifting to KRAS G12D as the next major target.

New York, USA, Nov. 12, 2025 (GLOBE NEWSWIRE) — KRAS Inhibitors Market to Witness Explosive Growth at a CAGR of 35% During the Forecast Period (2025–2034) Amid Expanding Therapeutic Landscape | DelveInsight

The KRAS inhibitors market is expected to experience substantial growth, driven by rising cancer incidence, improved treatment access, and a robust pipeline including Olomorasib (Eli Lilly), MK-1084 (Merck/Taiho/Astex Pharmaceuticals), Divarasib (Roche), Daraxonrasib (Revoltuion Medicines), Onvansertib (Cardiff Oncology), ELI-002 (Elicio Therapeutics), and others across the 7MM. G12C is the most prevalent KRAS mutation in NSCLC, making it a key target of current therapies. Following the success of KRAS G12C inhibitors, attention is shifting to KRAS G12D as the next major target.

DelveInsight’s KRAS Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast report includes a comprehensive understanding of current treatment practices, addressable patient population, which includes top indications such as Pancreatic Cancer, Non-small Cell Lung Cancer, Ovarian Cancer, Colorectal Cancer, and others. The selected indications are based on approved therapies and ongoing pipeline activity. The report also provides insights into the emerging KRAS inhibitors, market share of individual therapies, and current and forecasted market size from 2020 to 2034, segmented into leading markets (the US, EU4, UK, and Japan).

KRAS Inhibitors Market Summary

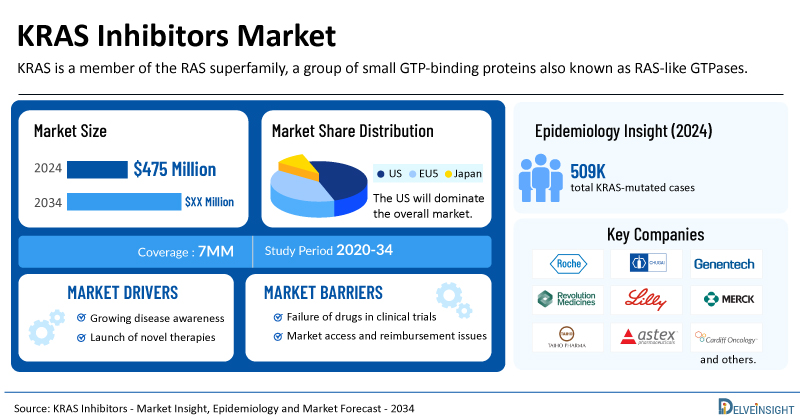

- The market size for KRAS inhibitors was found to be USD 475 million in the leading markets in 2024.

- The United States accounted for the largest KRAS inhibitors treatment market size, approximately 70% of the total market size in the 7MM in 2024, compared to other major markets, including the EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Among the approved KRAS inhibitor drugs, AVMAPKI + FAKZYNJA is expected to capture more KRAS inhibitor market share than KRAZATI and LUMAKRAS throughout the study period (2020–2034).

- The report provides the total potential number of patients in the indications, such as Pancreatic Cancer, Non-small Cell Lung Cancer, Ovarian Cancer, Colorectal Cancer, and others.

- The total KRAS-mutated cases in the 7MM comprised more than ~509K cases in 2024 and are projected to increase during the forecast period.

- Leading KRAS inhibitor companies, such as Roche, Chugai, Genentech, Revolution Medicines, Eli Lilly and Company, Merck, Taiho, Astex Pharmaceuticals, Cardiff Oncology, Elicio Therapeutics, Jiangsu Hengrui Pharmaceuticals, Genfleet Therapeutics, Innovent, Jacobio Pharma, Tyligand Pharmaceuticals (Suzhou), Silexion Therapeutics, Catalent, Astellas Pharma, Incyte, Pfizer, Bayer, Kumquat Biosciences, Quanta Therapeutics, and others, are developing novel KRAS inhibitors that can be available in the KRAS inhibitors market in the coming years.

- Some of the key KRAS inhibitors in clinical trials include Divarasib (RG6330), Divarasib + Pembrolizumab, Daraxonrasib (RMC-6236), Olomorasib + Pembrolizumab ± Chemotherapy, Olomorasib + Pembrolizumab, MK-1084 + Pembrolizumab, Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX, ELI-002, HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel, DUPERT (Fulzerasib/GFH925) + Cetuximab, JAB-23E73, TSN1611, SIL204, ASP3082, INCB186748, RMC-9805 ± RMC-6236 + cetuximab ± mFOLFOX6, RMC-9805 ± RMC-6236 + gemcitabine + nab-paclitaxel, PF-07985045, PF-07934040, BAY3498264, KQB365 ± cetuximab, QTX3544, and others.

- Among the emerging KRAS inhibitor therapies, Onvansertib is expected to generate the highest KRAS inhibitor revenue by 2034.

Discover which indication is expected to grab the major KRAS inhibitors market share @ KRAS Inhibitors Market Report

Key Factors Driving the KRAS Inhibitors Market

Large, Addressable Patient Population Across Solid Tumours

KRAS is the most frequently mutated of the three RAS genes, followed by NRAS and HRAS. KRAS mutations are commonly associated with several types of cancer, including pancreatic, colorectal, lung adenocarcinomas, ovarian, and others. The United States had the highest number of KRAS mutation cases in NSCLC among the 7MM. ~46% of all KRAS mutation cases in NSCLC in the 7MM were reported in the United States.

Promise of Combination Approaches in KRAS Therapies

Combining KRAS-targeted therapies with other treatment modalities, such as immunotherapies or traditional chemotherapy, holds promise for improving treatment outcomes. The potential for combination therapies creates additional market opportunities and enhances the overall market strength of KRAS mutations.

Expanding Opportunities in the Pan-KRAS Space

Many KRAS inhibitor companies are focusing on developing their candidates in pan-KRAS, like Cardiff Oncology (onvansertib), Immuneering Corporation (IMM-1-104), Jacobio Pharma (JAB-23E73), Eli Lilly and Company (LY4066434), and others are expected to have tremendous market potential due to the broad target patient population they can address.

Advancing Treatment Across Mutation Subtypes and Tumor Types

Several KRAS inhibitor companies, including Roche, Revolution Medicines, Eli Lilly, and others, are advancing promising candidates such as divarasib, daraxonrasib, and olomorasib, with the aim of expanding the therapeutic scope of KRAS-targeted treatments across various mutation subtypes and tumor types.

KRAS Inhibitors Market Analysis

KRAS is a well-known oncogene frequently mutated across multiple cancer types, including NSCLC, PDAC, CRC, and ovarian cancer. Once deemed “undruggable,” KRAS has re-emerged as a major therapeutic target with the advent of mutation-specific inhibitors, particularly those directed against the KRAS G12C mutation. Drugs such as LUMAKRAS/LUMYKRAS (sotorasib) and KRAZATI (adagrasib) selectively bind to KRAS in its inactive GDP-bound form, demonstrating clinical benefit in patients with KRAS G12C-mutated tumors who have received prior treatments.

Amgen’s LUMAKRAS became the first KRAS G12C inhibitor to gain FDA approval in 2021 for NSCLC, followed by global authorizations and a subsequent CRC indication in combination with VECTIBIX, based on improved progression-free survival. Patient selection is supported by companion diagnostics like Qiagen’s therascreen KRAS RGQ PCR Kit.

Bristol Myers Squibb’s KRAZATI, launched in 2022, has since outpaced LUMAKRAS in clinical uptake, earning accelerated approvals for both NSCLC and mCRC. LUMAKRAS sales later declined, which Amgen attributed to a price adjustment under a reimbursement agreement in Germany. KRAZATI has also been incorporated into the NCCN Guidelines for CNS-metastatic NSCLC, underscoring its expanding clinical role. Nevertheless, both primary and acquired resistance to KRAS G12C inhibitors remain significant challenges.

Beyond G12C, the pursuit of therapies targeting other KRAS mutations is fueling next-generation development. Verastem’s AVMAPKI FAKZYNJA Co-Pack recently became the first FDA-approved treatment for KRAS-mutated recurrent LGSOC, addressing an unmet clinical need. Combination regimens, pairing KRAS inhibitors with chemotherapy, immune checkpoint inhibitors, or pan-KRAS agents, are also being actively explored.

Leading biopharmaceutical companies are expanding their efforts to target alternative KRAS variants and additional cancer indications, aiming to enhance the therapeutic potential of KRAS inhibition. Firms such as Cardiff Oncology (onvansertib), Immuneering (IMM-1-104), and Verastem (Avutometinib + Defactinib) are developing pan-KRAS strategies. Meanwhile, Roche, Revolution Medicines, and Eli Lilly are advancing next-generation compounds, such as divarasib, daraxonrasib, and olomorasib, to target multiple mutation subtypes and tumor types.

Despite encouraging progress, KRAS-driven cancers continue to present hurdles due to tumor heterogeneity and resistance mechanisms. Continued innovation in targeted therapies, biomarker-guided treatment, and combination strategies will be crucial to harness the therapeutic potential of KRAS inhibition in oncology fully.

Learn more about the KRAS inhibitors @ KRAS Inhibitors Analysis

KRAS Inhibitors Competitive Landscape

The KRAS inhibitor clinical trial landscape includes several promising drugs in early, mid, and late-stage development, with potential for approval in the near future. The emerging landscape holds a diverse range of therapeutic alternatives for treatment, including Olomorasib (Eli Lilly), MK-1084 (Merck/Taiho/Astex Pharmaceuticals), Divarasib (Roche), Daraxonrasib (Revoltuion Medicines), Onvansertib (Cardiff Oncology), ELI-002 (Elicio Therapeutics), and others.

Eli Lilly’s Olomorasib is an investigational, orally administered, potent, and highly selective second-generation inhibitor targeting the KRAS G12C protein. It was purposefully engineered to address KRAS G12C mutations and exhibits pharmacokinetic characteristics that support strong target engagement and high potency, whether used alone or in combination with other therapies. As reported in Eli Lilly’s annual report, the company launched a Phase III clinical trial of olomorasib in first-line KRAS G12C–positive NSCLC in 2024.

Merck/Taiho/Astex Pharmaceuticals’ MK-1084 is an investigational, potent, and particular covalent inhibitor of KRAS G12C. It is being developed in partnership with Taiho Pharmaceutical and Astex Pharmaceuticals (UK), a wholly owned subsidiary of Otsuka Pharmaceutical.

The anticipated launch of these emerging therapies are poised to transform the KRAS inhibitors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the KRAS inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about KRAS inhibitors clinical trials, visit @ KRAS Inhibitors Treatment

Recent Developments in the KRAS Inhibitors Market

- In September 2025, Eli Lilly announced that the US FDA had granted Breakthrough Therapy designation to olomorasib in combination with pembrolizumab for the first-line treatment of patients with unresectable advanced or metastatic NSCLC with a KRAS G12C mutation and PD-L1 expression ≥ 50%, as determined by FDA-approved tests.

- In July 2025, Silexion Therapeutics announced groundbreaking new preclinical data revealing unprecedented inhibition rates of up to 97% in pancreatic cancer cells and almost 90% in colorectal cancer cells. Company on track for the initiation of a Phase II/III clinical trial in Q2 2026.

- In May 2025, Verastem Oncology announced that the US FDA approved AVMAPKI + FAKZYNJA Co-Pack for the treatment of adult patients with KRAS-mutated recurrent Low-grade Serous Ovarian Cancer (LGSOC) who received prior systemic therapy. AVMAPKI and FAKZYNJA Co-Pack is the first and only FDA-approved medicine for this disease.

- In May 2025, Merck anticipated the data readout of its Phase I KANDLELIT-001 study at ASCO 2025 for patients with KRAS G12C-mutated advanced CRC and NSCLC.

- In May 2025, Cardiff Oncology stated in its SEC filing that, contingent upon the results of the CRDF-004 study, it plans to initiate CRDF-005, a Phase III, randomized trial with registrational intent. The FDA has agreed that a seamless trial design incorporating an interim endpoint of ORR, along with DoR, is acceptable for the pursuit of accelerated approval. PFS and the absence of detriment to overall survival will serve as the endpoints for full approval.

- In April 2025, Bristol Myers Squibb announced anticipation of Phase III trial data readouts for KRYSTAL-10 by 2026 for 2L CRC, KRYSTAL-7 trial results in 2028 for 1L NSCLC PD-L1≥50%, and KRYSTAL-4 trial results in 2029 for 1L NSCLC.

What are KRAS Inhibitors?

KRAS is a member of the RAS superfamily, a group of small GTP-binding proteins also known as RAS-like GTPases. The RAS oncogene, originally identified in the rat sarcoma virus, serves as a key signal transducer that regulates essential cellular processes, including proliferation, differentiation, and survival, in both normal and cancerous cells. Among its pathways, the RAS–RAF–MEK–ERK cascade is one of the most extensively studied signal transduction routes, with dysregulation frequently linked to the onset of various cancers. Mutations in the KRAS gene, which encodes a critical signaling protein, are prevalent in several types of cancer, including colorectal, lung, and pancreatic cancers. Historically, KRAS mutations have been challenging to target therapeutically; however, recent research breakthroughs have yielded promising treatment approaches, though these are currently applicable only to NSCLC.

KRAS Inhibitors Epidemiology Segmentation

The KRAS inhibitors market report is a comprehensive and specialized analysis, offering in-depth epidemiological insights for the study period 2020–2034 across the leading markets. Among the selected cancer types, the most KRAS mutant cases are found in CRC, followed by pancreatic cancer, NSCLC, and LGSOC. In the United States, there were about ~66,000 cases of KRAS mutant colorectal cancer in 2024.

The KRAS inhibitor target patient pool is segmented into:

- Total Incident Cases in Selected Indications

- Total KRAS Mutated Cases of Selected Indications

- Total KRAS Variant Cases of Selected Indications

| KRAS Inhibitors Report Metrics | Details |

| Study Period | 2020–2034 |

| KRAS Inhibitors Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key Indications Covered in the Report | Pancreatic Cancer, Non-small Cell Lung Cancer, Ovarian Cancer, Colorectal Cancer, and others |

| KRAS Inhibitors Market CAGR | 35% |

| KRAS Inhibitors Market Size in 2024 | USD 475 Million |

| Key KRAS Inhibitor Companies | Roche, Chugai, Genentech, Revolution Medicines, Eli Lilly and Company, Merck, Taiho, Astex Pharmaceuticals, Cardiff Oncology, Elicio Therapeutics, Jiangsu Hengrui Pharmaceuticals, Genfleet Therapeutics, Innovent, Jacobio Pharma, Tyligand Pharmaceuticals (Suzhou), Silexion Therapeutics, Catalent, Astellas Pharma, Incyte, Pfizer, Bayer, Kumquat Biosciences, Quanta Therapeutics, Amgen, Bristol Myers Squibb (Mirati Therapeutics), Verastem Oncology, and others |

| Key KRAS Inhibitors | Divarasib (RG6330), Divarasib + Pembrolizumab, Daraxonrasib (RMC-6236), Olomorasib + Pembrolizumab ± Chemotherapy, Olomorasib + Pembrolizumab, MK-1084 + Pembrolizumab, Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX, ELI-002, HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel, DUPERT (Fulzerasib/GFH925) + Cetuximab, JAB-23E73, TSN1611, SIL204, ASP3082, INCB186748, RMC-9805 ± RMC-6236 + cetuximab ± mFOLFOX6, RMC-9805 ± RMC-6236 + gemcitabine + nab-paclitaxel, PF-07985045, PF-07934040, BAY3498264, KQB365 ± cetuximab, QTX3544, LUMAKRAS/LUMYKRAS, KRAZATI, AVMAPKI + FAKZYNJA Co-Pack, and others |

Scope of the KRAS Inhibitors Market Report

- KRAS Inhibitors Therapeutic Assessment: KRAS Inhibitors current marketed and emerging therapies

- KRAS Inhibitors Market Dynamics: Conjoint Analysis of Emerging KRAS Inhibitors Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, KRAS Inhibitors Market Access and Reimbursement

Discover more about KRAS inhibitors in development @ KRAS Inhibitors Clinical Trials

Table of Contents

| 1 | KRAS Inhibitor Market Key Insights |

| 2 | KRAS Inhibitor Market Report Introduction |

| 3 | Executive Summary |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology |

| 6 | KRAS Inhibitor Market Overview at a Glance |

| 6.1 | KRAS Inhibitor Market Share (%) Distribution by Therapies in 2024 in the 7MM |

| 6.2 | KRAS Inhibitor Market Share (%) Distribution by Therapies in 2034 in the 7MM |

| 6.3 | KRAS Inhibitor Market Share (%) Distribution by Indications in 2024 in the 7MM |

| 6.4 | KRAS Inhibitor Market Share (%) Distribution by Indications in 2034 in the 7MM |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Clinical Significance |

| 7.3 | Diagnosis |

| 7.4 | Diagnostic Guidelines and Recommendations for KRAS Inhibitors |

| 8 | KRAS Inhibitor Treatment |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale |

| 9.3 | KRAS Inhibitors Patient Pool |

| 9.3.1 | United States |

| 9.3.1.1 | Total Incident Cases in Selected Indications |

| 9.3.1.2 | Total KRAS Mutated Cases of Selected Indications |

| 9.3.1.3 | Total KRAS Variant Cases of Selected Indications |

| 9.4.2 | EU4 and the UK |

| 9.4.3 | Japan |

| 10 | Marketed KRAS Inhibitor Drugs |

| 10.1 | Key Competitors |

| 10.2 | LUMAKRAS/LUMYKRAS (sotorasib): Amgen |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Developmental Activities |

| 10.2.4 | Clinical Development |

| 10.2.4.1 | Clinical Trial Information |

| 10.2.5 | Safety and Efficacy |

| 10.2.6 | Analyst Views |

| 10.3 | KRAZATI (adagrasib): Bristol Myers Squibb (Mirati Therapeutics) |

| 10.4 | AVMAPKI + FAKZYNJA Co-Pack (avutometinib + defactinib): Verastem Oncology |

| 11 | Emerging KRAS Inhibitor Therapies |

| 11.1 | Key Cross Competition |

| 11.2 | Safety and Efficacy Data of Phase I/II Emerging Drugs |

| 11.3 | Safety and Efficacy Data of Phase I Emerging Drugs |

| 11.4 | Divarasib (RG6330): Roche/Chugai/Genentech |

| 11.5 | Daraxonrasib (RMC-6236): Revolution Medicines |

| 11.6 | Olomorasib (LY3537982): Eli Lilly and Company |

| 11.7 | MK-1084: Merck, Taiho, and Astex Pharmaceuticals |

| 11.8 | Onvansertib: Cardiff Oncology |

| 11.9 | DUPERT (fulzerasib/GFH925): Genfleet Therapeutics and Innovent |

| 11.1 | ELI-002: Elicio Therapeutics |

| 11.11 | D3S-001: D3 Bio |

| 12 | KRAS Inhibitors Market: Seven Major Market Analysis |

| 12.1 | Key Findings |

| 12.2 | KRAS Inhibitor Market Outlook |

| 12.3 | Conjoint Analysis |

| 12.4 | Key KRAS Inhibitor Market Forecast Assumptions |

| 12.5 | Total Market Size of KRAS Inhibitors by Country in the 7MM |

| 12.6 | Total Market Size of KRAS Inhibitors by Indications in the 7MM |

| 12.7 | United States KRAS Inhibitor Market Size |

| 12.8 | EU4 and the UK KRAS Inhibitor Market Size |

| 12.9 | Japan KRAS Inhibitor Market Size |

| 13 | KRAS Inhibitor Market Unmet Needs |

| 14 | KRAS Inhibitor Market SWOT Analysis |

| 15 | KOL Views on KRAS Inhibitor |

| 16 | KRAS Inhibitor Market Access and Reimbursement |

| 16.1 | United States |

| 16.2 | EU4 and the UK |

| 16.3 | Japan |

| 16.4 | Market Access and Reimbursement of KRAS Inhibitors |

| 17 | Bibliography |

| 18 | KRAS Inhibitor Market Report Methodology |

Related Reports

Non-small Cell Lung Cancer Market

Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NSCLC companies, including AstraZeneca, Boehringer Ingelheim, Pfizer, Takeda, Johnson & Johnson Innovative Medicine, Eli Lilly and Company, Merck, Bristol-Myers Squibb, Roche, Shanghai Henlius Biotech, AbbVie, Daiichi Sankyo, Nuvation Bio, PDC*line Pharma, Moderna Therapeutics, Pfizer, GSK, Gilead Sciences, BieGene, Nuvalent, among others.

Colorectal Cancer Market

Colorectal Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key CRC companies, including Mirati Therapeutics, Exelixis, Enterome, Arcus Biosciences, Lyell Immunopharma, AstraZeneca, Novartis Pharmaceuticals, Surgimab, Numab Therapeutics, SOTIO Biotech, Amgen, Sichuan Baili Pharmaceutical, Qilu Pharmaceutical, Bristol-Myers Squibb, NGM Biopharmaceuticals, Takeda, PureTech, Pfizer, Kezar Life Sciences, Salubris Biotherapeutics, among others.

Pancreatic Cancer Market

Pancreatic Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key pancreatic cancer companies, including AstraZeneca, Merck Sharp & Dohme LLC, Bayer, Roche, Celgene, BioLineRx, Alligator Bioscience, Bellicum Pharmaceuticals, OSE Immunotherapeutics, Actuate Therapeutics, FibroGen, NeoImmuneTech, NOXXON Pharma, Silenseed Ltd., Amgen, NGM Biopharmaceuticals, Merus, Mirati Therapeutics, Rexahn Pharmaceuticals, Ocuphire Pharma, Processa Pharmaceuticals, ImmunityBio, Berg, Panbela Therapeutics, GlaxoSmithKline, Eleison Pharmaceuticals, Molecular Templates, Lokon Pharma AB, Cantargia AB, Bristol-Myers Squibb, among others.

Ovarian Cancer Market

Ovarian Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key ovarian cancer companies, including pharmaand GmbH, GlaxoSmithKline (GSK), AbbVie, Eli Lilly, Novartis, Roche, Verastem Oncology, Corcept Therapeutics, AstraZeneca, Genmab, Genelux Corporation, Mural Oncology, Daiichi Sankyo, Merck, Sutro Biopharma, Bristol-Myers Squibb, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

CONTACT: Contact Us Shruti Thakur info@delveinsight.com +14699457679

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.