A surge in annuity sales underscores a powerful consumer shift toward guaranteed income amidst economic uncertainty. The dynamic life insurance market is rapidly adapting with technological advancements and innovative products designed to meet evolving retirement planning needs.

Chicago, Nov. 24, 2025 (GLOBE NEWSWIRE) — The global life insurance market was valued at US$ 7.59 billion in 2024 and is expected to reach US$ 16.53 trillion by 2033, growing at an exponential CAGR of 8.9% from 2025 to 2033.

A vast and underserved population presents a remarkable opportunity for expansion. An estimated 102 million adults in the U.S. are currently uninsured or underinsured, and they acknowledge their need for greater life insurance coverage. A significant portion of that group, specifically 50 million, are middle-income Americans who recognize a distinct coverage gap in their financial plans. Furthermore, a pronounced gender disparity exists, with 54 million women reporting insufficient coverage. Households earning less than US$ 50,000 annually are the most likely to express a need for life insurance, indicating a key demographic for targeted market growth.

Download Sample Pages: https://www.astuteanalytica.com/request-sample/life-insurance-market

The existing policy landscape underscores the scale of the current life insurance market. In 2024, there were 134.19 million individual life insurance policies in force across the United States. Additionally, over 118 million people were covered through group life insurance policies. The global nature of this demand is also evident, with markets like Australia reporting that 6.7 million adults currently hold some form of life insurance. These figures highlight both the established foundation and the immense potential for future penetration and growth in the industry.

Key Findings Shaping the Life Insurance Market

| Market Forecast (2033) | US$ 16.53 billion |

| CAGR | 8.9% |

| Largest Region (2024) | North America (32.20%) |

| By Type | Annuity Premiums & Deposits (53%) |

| Top Drivers |

|

| Top Trends |

|

| Top Challenges |

|

Digital Insurtech Investment Rebounds Fueling Industry Wide Transformation

The insurance sector is in the midst of a digital revolution, with insurtech funding signaling a powerful industry shift. Global insurtech funding is projected to reach an impressive US$ 4.2 billion by the end of 2024, with investment already hitting US$ 3.2 billion by the third quarter. The momentum across the life insurance market continued into 2025, as the first quarter saw global insurtech funding surge to US$ 1.31 billion. P&C insurtechs drove much of this recovery, raising US$ 1.13 billion in Q1 2025 alone. Notably, companies centered on artificial intelligence attracted US$ 710.86 million across 60 deals in that same quarter.

While overall deal volume in 2024 declined to 362, the lowest since 2016, the quality of investments has grown. The median deal size for early-stage insurtech startups increased to US$ 3.8 million in 2024. The sector also saw 35 M&A exits and 2 IPOs in 2024. Projections show the global digital insurance market growing by US$ 67.23 billion between 2024 and 2028. This trend is bolstered by major players like Aviva Investors, which launched a £150 million venture fund in December 2024. Moreover, B2B Software as a Service (SaaS) startups captured 43% of total insurtech funding in 2024, highlighting the focus on foundational technology.

AI Driven Underwriting Processes Create Unprecedented Efficiency Gains in the Life Insurance Market

Artificial intelligence is fundamentally reshaping the core process of underwriting. AI is projected to slash insurance underwriting times from a lengthy 3 days down to just 3 minutes. The practical application of this is already evident; one insurer, Hiscox, successfully reduced its underwriting time from 72 hours to a mere 180 seconds. Beyond speed, AI significantly improves risk assessment accuracy by an estimated 20%. This technology also fortifies security, with AI-powered fraud detection systems flagging suspicious claims with over 90% accuracy.

These advancements translate directly to a stronger bottom line and a more agile life insurance market. AI-driven dynamic pricing models can reduce operating costs by a substantial 40%. The application of machine learning in underwriting has already improved accuracy by 54%. Furthermore, sophisticated AI-powered risk models are instrumental in reducing claims leakage by over US$ 17.4 billion annually. The efficiency extends to post-claim processing, where claims automation powered by AI is cutting processing times by up to 73%. Companies like MunichRE are at the forefront, implementing 45,000 models to better estimate future spending and customer behavior.

Innovative Personalized Products Reshape The Modern Life Insurance Market

Insurers are actively moving away from generic, one-size-fits-all products. Instead, they are developing customized and flexible policies that cater to specific individual needs. A clear trend in 2025 was the 17% increase in the adoption of policies featuring critical illness and long-term care riders, showcasing a demand for more comprehensive coverage. Similarly, guaranteed universal life policies experienced a healthy 11% growth in 2025. These innovative products are also becoming more substantial. The average face amount for U.S. life insurance policies rose to US$ 178,000 in 2025.

Even niche products are seeing refined demand. For instance, in 2024, the average pre-need coverage amount for single premium policies was US$ 5,352. For multi-pay pre-need policies, that average coverage amount was slightly higher at US$ 6,356 in 2024. Despite the rise of new product types, traditional offerings remain a bedrock of the life insurance market. Whole life insurance still constitutes a significant 61% of all individual policies currently in force, providing a stable foundation upon which innovation can build.

Economic Tailwinds Propel Premium Growth to Never Before Seen Highs

Favorable economic conditions are fueling a period of record-breaking growth in the global life insurance market. Total premiums for individual life insurance reached a record US$ 16.2 billion in 2024. Industry forecasts from LIMRA suggest that life insurance premiums will reach at least US$ 15.9 billion in 2024, confirming a new high-water mark for the industry. On a global scale, insurance companies worldwide witnessed an increase in premiums of EUR 557 billion in 2024. This brought the total global premium income to an astounding EUR 7.0 trillion for the year.

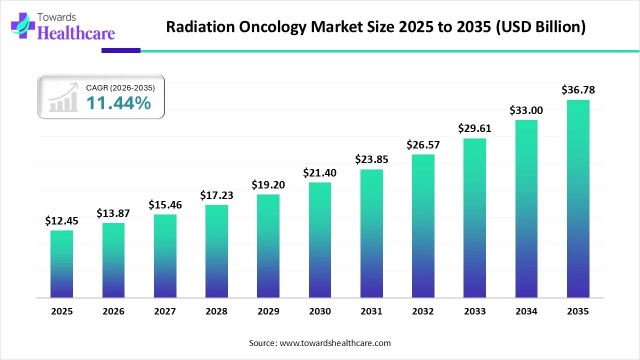

Life insurance remains the dominant segment globally, with a premium income of EUR 2,902 billion in 2024. Projections indicate that total global life insurance premiums are on a trajectory to reach US$ 4.8 trillion by 2035. The broader financial market is also contributing to this growth. Pension de-risking activities are expected to result in over US$ 300 billion of bulk annuity transfers in the UK and US over the next three years. Concurrently, US individual annuity sales are projected to set a new record of over US$ 400 billion in 2024, further strengthening the financial sector.

Evolving Sales Channels Reflect A Strategic Shift in Consumer Engagement

The methods for selling life insurance in the life insurance market are evolving, with a clear and accelerating shift toward digital channels. However, the transition is still in its early stages for full-cycle adoption. Currently, only about 10% of insurance customers utilize digital channels for their complete sales journey. There are geographical variances in this adoption. In Europe, for example, the UK and Ireland were the only markets where more than a quarter of insurance customers reported purchasing their policies online in the last three months of 2024.

Despite the gradual adoption of fully digital purchasing paths, specific products are thriving in this new environment. Term life insurance, in particular, is experiencing strong growth, largely driven by younger, digitally native consumers. The global term life insurance market is projected to reach an incredible US$ 1.57 trillion by 2033. In the near term, term life adoption grew by 8% in 2025. This growth signifies a powerful trend and a critical area of focus for insurers looking to capture the next generation of policyholders in a competitive market.

Superior Customer Experiences Become the New Competitive Battleground

The focus on providing a seamless and engaging customer journey has never been more critical in the life insurance market. Insurers are investing heavily in digital tools to meet and exceed policyholder expectations. In 2025, chatbots and virtual assistants are expected to handle 42% of all customer service interactions, offering instant support. The use of AI in enhancing the customer experience has been shown to boost Net Promoter Scores (NPS) by 29%. Insurers must also recognize new information channels; a 2024 study showed that 59% of Americans now use social media to find financial and insurance information.

Efficiency in core processes like claims is also paramount in the life insurance market. The life insurance claims process takes an average of 7.3 days within a superannuation fund and 5.1 days outside of it. More specifically, death benefit claims take an average of around 10 days to process. Companies that excel in customer service are gaining a distinct advantage. In the U.S., a 2025 study ranked Mutual of Omaha highest in customer satisfaction with a score of 707. State Farm followed closely with a score of 697, while Nationwide ranked third with a score of 695.

Integrating Wellness Data Unlocks New Frontiers for Proactive Risk Management

The convergence of insurance and wellness is creating exciting new possibilities. Insurers are increasingly incorporating data from wearable technology to offer health incentives and more personalized policies. The proliferation of these devices is staggering; worldwide shipments of wearable devices are projected to increase to 776 million by the end of 2024. In fact, one in three Americans now owns a wearable device. This trend is creating a massive new data stream that can be leveraged for proactive risk management within the life insurance market.

Consumers are showing a growing willingness to participate in this data exchange. Over half of US consumers, at 54.5%, are open to sharing data from their wearable devices with a life insurer in exchange for a more tailored policy. The primary incentive is financial, cited by 56.6% of consumers, while 44.9% are motivated by personal health and wellness benefits. Insurers are also adapting their platforms for this mobile-first world, with research showing 85% of insurance customer portal access came from mobile devices in 2024. Programs like United Healthcare’s partnership with Fitbit, which allows policyholders to earn up to US$ 1,500 annually toward healthcare services, exemplify this innovative trend.

Need a Customized Version? Request It Now: https://www.astuteanalytica.com/ask-for-customization/life-insurance-market

Term Life Competition Intensifies Among Established Market Leaders in the Global Life Insurance Market

The term life insurance segment is a highly active and competitive arena. Term life insurance sales are expected to reach an all-time high of US$ 3 billion in 2024. Its popularity is clear, as term new annualized premium held a 19% share of the total U.S. individual life insurance market in the first quarter of 2024. The regulatory environment also plays a role, with the estate tax exemption set to sunset at the end of 2025, potentially driving further demand for estate planning solutions. Another key factor is the interim 45% risk-based capital (RBC) factor for residual tranches of structured securities being applied in 2024, although these tranches make up only 0.05% of the more than US$ 8.5 trillion of industry assets.

Established players are vying for dominance in this lucrative space. Prudential Financial currently leads the overall life insurance market with a 9.3% share. MetLife follows with an 8.4% market share, and New York Life holds a 7.7% share. Other key competitors include Northwestern Mutual, whose market share grew to 7.2%, and MassMutual, which maintains a 6.5% share. Finally, Lincoln Financial has also grown its presence, reaching a 6.2% market share in 2025. This intense competition is driving innovation and value for consumers seeking term life solutions.

Life insurance Market Major Players:

- AXA Group

- China Life Insurance Company

- Chubb Limited

- Cigna

- MetLife, Inc.

- New York Life Insurance Company

- Northwestern Mutual

- United Health Group

- Prudential Financial

- Ping An Insurance Group

- Other Prominent Players

Key Market Segmentation:

By Type

- Life Insurance Premiums

- Annuity Premiums and Deposits

- Accident and Health Premiums

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

Need a Detailed Walkthrough of the Report? Request a Live Session: https://www.astuteanalytica.com/report-walkthrough/life-insurance-market

About Astute Analytica

Astute Analytica is a global market research and advisory firm providing data-driven insights across industries such as technology, healthcare, chemicals, semiconductors, FMCG, and more. We publish multiple reports daily, equipping businesses with the intelligence they need to navigate market trends, emerging opportunities, competitive landscapes, and technological advancements.

With a team of experienced business analysts, economists, and industry experts, we deliver accurate, in-depth, and actionable research tailored to meet the strategic needs of our clients. At Astute Analytica, our clients come first, and we are committed to delivering cost-effective, high-value research solutions that drive success in an evolving marketplace.

Contact Us:

Astute Analytica

Phone: +1-888 429 6757 (US Toll Free); +91-0120- 4483891 (Rest of the World)

For Sales Enquiries: sales@astuteanalytica.com

Website: https://www.astuteanalytica.com/

Follow us on: LinkedIn | Twitter | YouTube

CONTACT: Contact Us: Astute Analytica Phone: +1-888 429 6757 (US Toll Free); +91-0120- 4483891 (Rest of the World) For Sales Enquiries: sales@astuteanalytica.com Website: https://www.astuteanalytica.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.