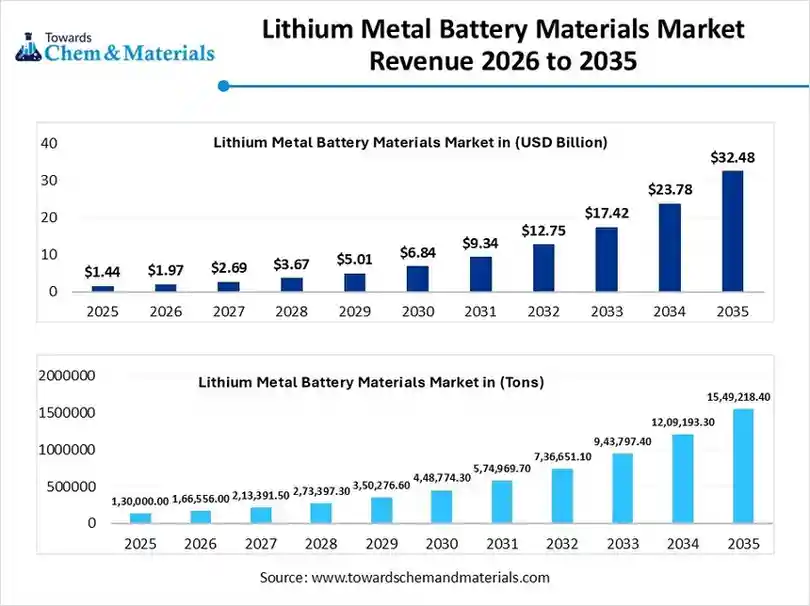

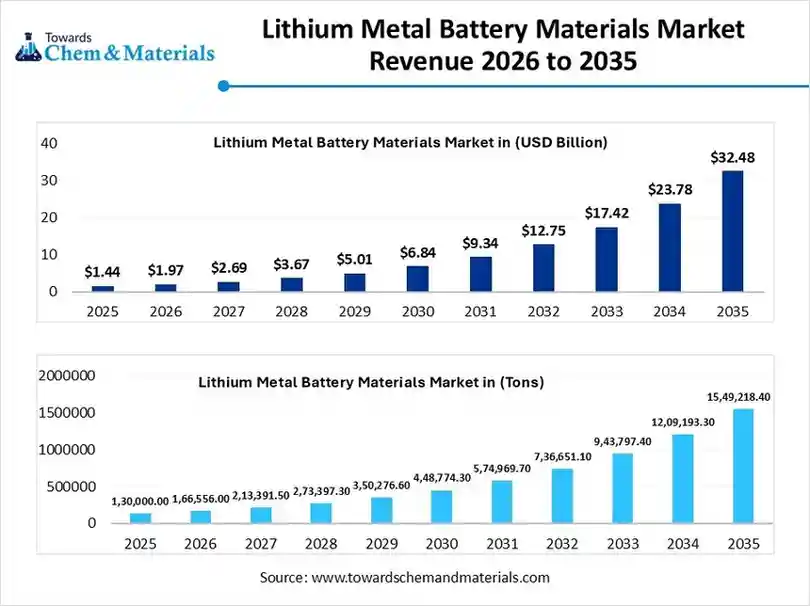

According to Towards Chemical and Materials, the global lithium metal battery materials market volume was valued at 130,000.0 billion in 2025 and is expected to be worth around 1,549,218.4 tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 36.53% over the forecast period from 2026 to 2035.

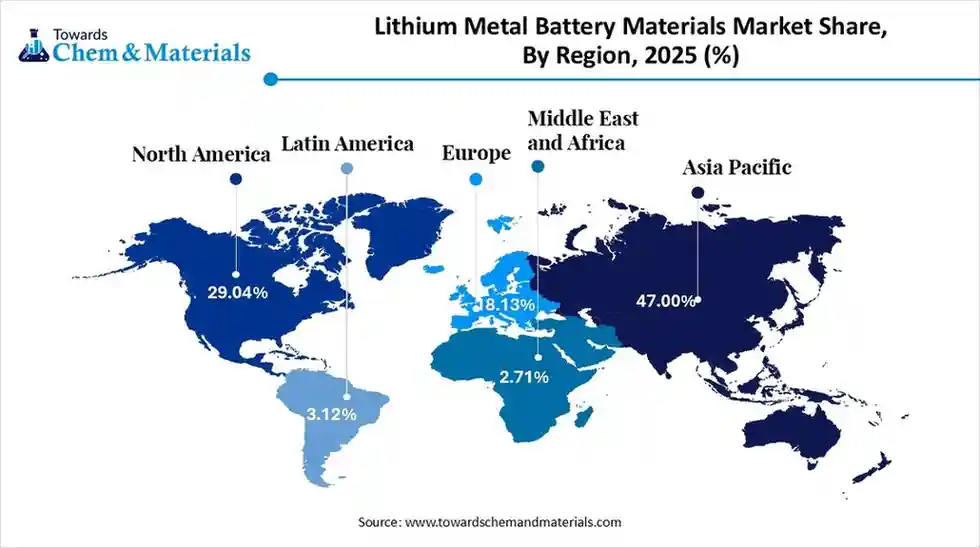

Ottawa, Jan. 19, 2026 (GLOBE NEWSWIRE) — The global lithium metal battery materials market size was estimated at USD 1.44 billion in 2025 and is expected to increase from USD 1.97 billion in 2026 to USD 32.48 billion by 2035, growing at a CAGR of 36.56% from 2026 to 2035. Asia Pacific dominated the lithium metal battery materials market with the largest revenue share of 47.00% in 2025. The global lithium metal battery materials market volume was estimated at 130,000.0 tons in 2025 and is projected to reach 1,549,218.4 tons by 2035, growing at a CAGR of 36.53% from 2026 to 2035. Asia Pacific dominated the lithium metal battery materials market with the largest volume share of 47.00% in 2025. The market is driven by increasing demand for electric vehicles, technological advancement & innovation in high-energy density batteries and renewable energy storage solutions. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6121

What are Lithium Metal Battery Materials?

The lithium metal battery is composed of high-capacity materials that offer higher energy density and improved performance. LMB materials are focused on commercializing solid-state electrolytes and advanced coatings to enhance performance and safety, the increasing demand for specialized cathodes, and leveraging AI for material discovery for future high-performance power solutions.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Lithium Metal Battery Materials Market Report Highlights

- By region, Asia Pacific led the petrochemical recycling market with the largest volume share of over 47.00% in 2025.

By region, Europe is growing at the fastest CAGR in the market during the forecast period due to the transition towards renewable energy resources. - By material type, the cathode active materials segment led the market with the largest volume share of 78% in 2025, due to the explosion of ESS.

- By material type, the protective coatings & interlayers segment is growing at the fastest CAGR in the market during the forecast period due to its capability of accommodating volume changes.

- By cathode chemistry, the lithium nickel manganese cobalt oxide (NMC) segment led the market with the largest volume share of 34% in 2025, due to the balanced performance and improved safety.

- By cathode chemistry, the lithium sulfur (Li-S) segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increased development of long-endurance aircraft.

- By electrolyte type, the liquid electrolytes segment accounted for the largest volume share of 46% in 2025, due to the excellent ionic conductivity.

By electrolyte type, the solid-state electrolytes segment is expected to grow at the fastest CAGR in the market during the forecast period due to the excellent energy density. - By battery type, the rechargeable lithium metal batteries segment dominated with the largest volume share of 41% in 2025, due to the growing use across the electronics industry.

- By electrolyte type, the solid-state lithium metal batteries segment is expected to grow at the fastest CAGR in the market during the forecast period due to the faster charging capabilities.

- By end-use industry, the automotive & transportation segment dominated the market and accounted for the largest volume share of 42% in 2025, due to increased use of electric mobility solutions.

- By end-use industry, the energy & utilities segment is expected to grow at the fastest CAGR in the market during the forecast period due to the expanding renewable energy.

Lithium-ion Battery Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 1.97 Billion / 166,556.0 Tons |

| Revenue forecast in 2033 | USD 32.48 Billion / 1,549,218.4 Tons |

| Growth rate | CAGR 36.56% |

| Base year for estimation | 2025 |

| Dominant Region | Asia Pacific |

| Forecast period | 2026 – 2035 |

| Quantitative units | Value (Billion / Million), Volume (Tons) |

| Segments covered | By Product Type, By End-User Industry, By Region. |

| Key companies profiled | Celanese Corporation, China Petrochemical Corporation (Sinopec), LyondellBasell Industries N.V., Dow Inc, Dairen Chemical Corporation (DCC), Wacker Chemie AG, Kuraray Co., Ltd., INEOS Group, Sipchem (Saudi International Petrochemical Co.), Chang Chun Group, Arkema S.A., Mitsubishi Chemical Group, Showa Denko K.K. (Resonac),Lotte Chemical Corporation, Jiangsu Sopo (Group) Co., Ltd. |

Private Industry Investments for Lithium Metal Battery Materials:

- Sion Power: LG Energy Solution made an equity investment in this US-based startup, which holds core patents for lithium metal battery technologies, to accelerate the development of next-generation batteries.

- QuantumScape: This company, which develops solid-state lithium metal batteries, received a total of $300 million in investments from Volkswagen to support the development and mass production of its technology.

- Solid Power: Ford and BMW were major investors in Solid Power’s Series B financing round, providing a combined $130 million to help accelerate the commercialization of EV-grade all-solid-state batteries.

- Redwood Materials: Ford, Amazon, and Goldman Sachs Asset Management were among the investors in a $776 million Series C venture funding round for Redwood Materials, a private company focused on sustainable battery recycling and materials commercialization.

- LIFT ENERGY: This Italian startup produces lithium-metal batteries with surface-treated anodes that increase energy density and enable safer, longer-lasting solid-state performance.

What Are the Major Trends in the Lithium Metal Battery Materials Market?

- Shift Towards Solid-State Electrolyte: The industry is shifting towards solid-state systems to remove fire risk and dendrite growth, enabling safe, high-density batteries with faster charging capabilities.

- Rising Demand in Industrial scale: The demand for lightweight, high-performance power sources in aerospace and defense is accelerating the adoption of advanced Li-S and Li-metal chemistries.

- Emerging Specialized Anode Technologies: The focus on anode-free battery setups and protective nanometre-thin coatings, boosting energy density and manufacturing processes.

- Supply Chain Reshoring and Verticalization: The global efforts towards localizing production of high-purity lithium foils and advanced cathode materials, aiming at domestic supply security.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6121

Global Lithium Metal Battery Materials Market Dynamics

Driver

What is the Single Most Important Driver for the LMB Materials Market?

The evolution of the electric vehicle is a key growth driver for LMB materials. The automotive industry is rapidly shifting towards lithium metal anodes because their high theoretical capacity, compared to traditional graphite, enables longer driving ranges and preserves valuable resources for future use.

Restraint

What is the Primary Technical Restraint for Lithium Metal Materials?

The most significant challenge is the formation of lithium dendrites. These needle-like microscopic structures grow from the anode during charging cycles and can penetrate the separator, leading to internal short circuits and safety risks. The high reactivity of lithium also results in shorter cycle life due to the continuous weakening of the active material and electrolyte.

Market Opportunity

What is the Best Opportunity in the Current Lithium Metal Battery Materials Market?

The transition towards solid-state battery (ASSB) architectures represents a key opportunity for material suppliers by replacing liquid electrolytes with solid polymers, ceramics, and sulfides. Additionally, the focus on dendrite-resistant materials by manufacturers and the technological shift for mass production of high-energy-density cells creates a new market ecosystem.

How is AI Revolutionizing the Lithium Metal Battery Materials?

The artificial intelligence for material discovery is rapidly growing in the market, which is used to stimulate electrolyte and cathode pairings and machine learning, accelerating the R&D process for novel electrolyte formulations, allowing researchers to identify stable and high-performance chemical formulas, and accelerating the commercialization of next-generation lithium metal batteries.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6121

Lithium Metal Battery Materials Market Segmentation Insights

Material Type Insights

How did the Cathode Active Materials Segment dominate the Lithium Metal Battery Materials Market in 2025?

The cathode active material (CAM) segment dominates the market because it acts as the main performance determinant and cost contributor. It influences energy density and operating voltage, serving as the key holdup even with high-capacity anodes. Most R&D infrastructure focuses on CAM innovations like high-nickel and cobalt-free formulations, which are vital as the industry shifts to solid-state architectures requiring stable cathodes for next-generation safety and performance.

The protective coatings & interlayers segment is anticipated to grow fastest, by providing a solution to the dendrite problem by stabilizing the reactive lithium-metal interface and preventing short circuits and fires. As the industry moves toward high-performance, solid-state designs, these coatings enhance safety and durability, attracting investment to extend cycle life without compromising energy density. AI integration accelerates the discovery of ultra-stable materials for commercial use in automotive and aerospace sectors.

Cathode Chemistry Insights

Which Cathode Chemistry Segment Dominates the Lithium Metal Battery Materials Market in 2025?

The lithium nickel manganese cobalt oxide (NMC) segment maintains its market dominance, offering an optimal balance of energy density, power, and thermal stability for premium EVs. NMC supports high-voltage performance with lithium metal anodes, supported by a global manufacturing infrastructure and high-nickel innovations to reduce cobalt reliance. It remains the preferred choice for automotive and aerospace applications, prioritizing long-distance performance and fast charging.

The lithium sulfur (Li-S) segment offers significant growth during the projected period, offering higher theoretical energy density at lower costs by using abundant sulfur, thus eliminating dependence on expensive minerals for sustainable power. Its growth is driven by the aerospace and electric aviation sectors, where ultra-lightweight materials extend drone and aircraft range. Advances in electrolytes that mitigate the shuttle effect have made Li-S commercially viable for large-scale energy storage.

Electrolyte Type Insights

How did the Liquid Electrolyte Segment Dominate the Lithium Metal Battery Materials Market in 2025?

The liquid electrolytes segment dominates due to existing large-scale manufacturing infrastructure, making it more cost-effective and scalable than solid-state alternatives. It provides high ionic conductivity and electrode wetting, vital for efficient metallic lithium systems. The development of advanced additives enhances lithium anode stability, safety, and formulation flexibility for market growth.

The solid-state electrolytes segment grows fastest as it enables safe, high-energy-density batteries by replacing flammable liquids with non-combustible ceramic or polymer materials that suppress dendrite growth. This technology allows higher energy densities and temperature stability, adopted by automotive OEMs and aerospace firms. Investment and AI-driven discoveries boost its commercialization.

Battery Type Insights

How did the Rechargeable Lithium Metal Batteries Segment hold the Largest Share of the Lithium Metal Battery Materials Market?

The rechargeable lithium metal batteries segment has the largest market share, driving the transition to durable electric mobility and aerospace sectors. They offer high energy density and recyclability, with investment focused on exceeding energy densities and improving cyclability. The shift to solid-state architectures and advanced anode protections is key to next-gen portable and power supply chains.

The solid-state lithium metal batteries are an emerging segment projected to grow at a CAGR between 2026 and 2035, representing a safety and energy density revolution. Non-combustible electrolytes block dendrites and moderate fire risks, making them ideal for high-performance automotive and aerospace applications for a safe& compact footprint. Rapid Industry expansion and AI-optimized material interfaces fueled adoption as the future standard for electric mobility.

End-Use Industry Insights

Which End-Use Industry Dominated the Lithium Metal Battery Materials Market in 2025?

The automotive and transportation segment led the market due to its need for high-performance energy storage, especially for extended EV range. The massive consumer demand for high-density materials like NMC cathodes and ultra-thin lithium foils, surpassing traditional lithium-ion capabilities. This sector’s focus on premium and long-haul transport enables market share and innovation, particularly in developing safe, solid-state batteries for global vehicle platforms.

The energy & utilities segment is anticipated to grow fastest, offer high energy density and efficiency for grid-scale storage by accelerating renewable integration. Utilities are moving from lithium-ion to LMB to store more energy in smaller spaces, lowering costs. The rapid growth is supported by solid-state energy storage systems, providing superior safety and thermal stability, important for large utility developments driving the demand for specialized cathodes and stable electrolytes as the push for a decarbonized, stabilized power grid strengthens.

Regional Insights

How did Asia Pacific Dominate the Lithium Metal Battery Materials Market?

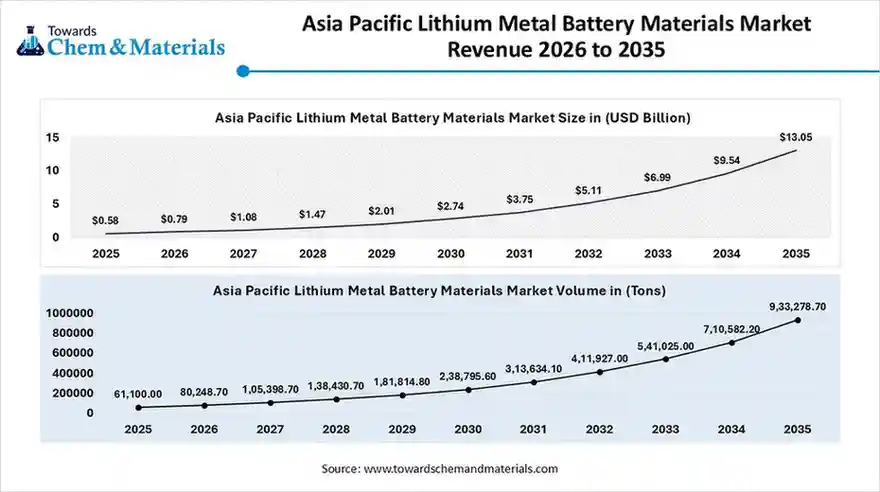

The Asia Pacific lithium metal battery materials market size was valued at USD 0.58 billion in 2025 and is expected to be worth around USD 13.05 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 36.53% over the forecast period from 2026 to 2035.

The Asia Pacific lithium metal battery materials market volume was estimated at 61,100.0 million tons in 2025 and is projected to reach 933,278.7 million tons by 2035, growing at a CAGR of 31.34% from 2026 to 2035.

Asia Pacific dominates the market due to its large manufacturing scale and integrated supply chain. It is the global hub for advanced material processing, producing most of the world’s high-purity lithium foils, electrolytes, and cathodes. This is supported by strong government policies and capital investments from electronics and automotive OEMs pushing toward next-generation batteries. Its infrastructure in EV and electronics markets ensures continuous leadership in material innovation and industrial output.

India Lithium Metal Battery Materials Market Trends

India’s market is expanding rapidly due to rising demand from electric vehicles, consumer electronics, and grid-scale energy storage. Efforts to secure domestic sources of critical minerals and reduce import dependence are gaining momentum through policy support and resource exploration.

Why is Europe the Fastest-Growing Region in the Lithium Metal Battery Materials Industry?

Europe is experiencing the fastest growth during the forecast period in the market, driven by strict decarbonization mandates and technology innovation with a self-sufficient supply chain, which pushed the industry towards high-energy-density materials like lithium metal and solid-state electrolytes. The region initiative in green lithium extraction from geothermal brines, and the circular economy focus through advanced material recycling to ensure energy security, accelerating market expansion.

Germany Lithium Metal Battery Materials Market Trends

Germany’s market is rapidly growing as EV adoption and energy storage demand surge, boosting the need for lithium-based materials and advanced cell components. The country remains heavily dependent on global supply chains for lithium and other critical minerals, driving strategic efforts in securing imports, domestic processing, and partnerships to enhance supply resilience.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

More Insights in Towards Chemical and Materials:

Asia Pacific Battery Raw Materials Market Size to Hit USD 93.11 Bn by 2034

Sodium Ion Battery Material Market Size to Hit USD 40.74 Bn by 2035

Lead Acid Battery Recycling Market Size to Hit USD 33.24 Bn by 2035

Organic Acids Market Size to Hit USD 26.46 Billion by 2035

Benzoic Acid Market Size to Hit USD 2.98 Bn by 2035

Polylactic Acid Market Size to Reach USD 11.74 Bn by 2035

Sulfuric Acid Market Size to Surpass USD 56.63 Billion by 2035

Lactic Acid Market Size to Hit USD 9.82 Billion by 2034

Formic Acid Market Size to Reach USD 4.69 Billion by 2034

Butyric Acid Market Size to Reach USD 639.38 Million by 2034

Peracetic Acid Market Size to Hit USD 1722.24 Million by 2034

Monochloroacetic Acid Market Volume to Reach 790.12 Kilo Tons by 2034

Acetic Acid Market Size to Exceed USD 31.78 Billion by 2034

Biaxially Oriented Polypropylene (BOPP) Market Size to Hit USD 224.40 Billion by 2035

North America Crop Protection Chemicals Market Size to Hit USD 23.20 Billion by 2035

Cathode Materials Market Size to Hit USD 115.04 Billion by 2035

Renewable Diesel Market Size to Hit USD 60.43 Billion by 2035

Steel Wire Rope Market Size to Hit USD 19.79 Bn by 2035

Bio-polyols Market Size to Hit USD 21.47 Bn by 2035

Asia Pacific Polymer Foam Market Size to Hit USD 131.7 Bn by 2035

Lay-up Composites Market Size to Hit USD 120.15 Bn by 2035

PAN-based Carbon Fiber Market Size to Hit USD 10.16 Bn by 2035

Polyhydroxyalkanoate (PHA) Market Size to Hit USD 586.98 Mn by 2035

Metal Injection Molding Parts Market Size to Hit USD 18.58 Bn by 2035

Ulexite Market Size to Hit USD 1,477.76 Million by 2035

Recent Breakthrough in the Lithium Metal Battery Materials Industry:

- In January 2026, ProLogium and Darfon Energy Tech announced a strategic partnership at CES 2026, which aims to launch solid-state battery solutions precisely for e-bikes and light electric vehicles. This addresses the demand for performance efficiency and charging capability.https://prologium.com/prologium-and-darfon-energy-tech-announce-strategic-partnership-ahead-of-ces-2026/

Top Companies in the Lithium Metal Battery Materials Market & Their Offerings:

Tier 1:

- Tianqi Lithium Corporation: Produces high-purity lithium carbonate and hydroxide, while also manufacturing lithium metal for various industrial and battery applications.

- POSCO Future M (formerly POSCO Chemical): Supplies a diverse range of cathode and anode active materials and is currently developing next-generation lithium metal-type anodes.

- SQM (Sociedad Química y Minera de Chile): Focuses on the large-scale production of high-purity battery-grade lithium carbonate and hydroxide extracted from brine deposits.

- Livent Corporation: Specializes in performance lithium compounds, including high-purity lithium metal and its proprietary LIOVIX™ printable lithium formulation for pre-lithiation.

- Ganfeng Lithium Co., Ltd.: Operates as a vertically integrated leader producing lithium metal, lithium salts, and specialized solid-state electrolyte materials.

- Albemarle Corporation: Provides essential battery materials, including lithium carbonate, hydroxide, and battery-grade lithium metal products and alloy powders.

- Umicore: Manufactures high-performance cathode active materials (NMC) and is advancing silicon-based anode materials and catholytes for solid-state batteries.

- BASF SE: Offers a broad portfolio of advanced cathode active materials (CAM) and provides closed-loop battery recycling services to recover lithium and other metals.

- Mitsubishi Chemical Group: Supplies critical battery components, including natural and synthetic graphite anode materials and specialized Sol-Rite™ formulated electrolytes.

- Sumitomo Metal Mining Co., Ltd.: Specializes in high-nickel cathode active materials such as NCA and NMC and recently expanded into lithium iron phosphate (LFP) materials.

Tier 2:

- Samsung SDI

- Panasonic Holdings Corporation

- CATL (Contemporary Amperex Technology Co., Limited)

- Solid Power, Inc.

- QuantumScape Corporation

- SES AI Corporation

- Ilika plc

- Johnson Matthey

- LG Chem

- Toray Industries, Inc.

Lithium Metal Battery Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Lithium Metal Battery Materials Market

By Material Type

- Lithium Metal Foils & Anodes

- Cathode Active Materials

- Electrolytes

- Separators

- Current Collectors

- Protective Coatings & Interlayers

By Cathode Chemistry

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Sulfur (Li–S)

- Lithium Cobalt Oxide (LCO)

- High-Nickel & Advanced Cathode Materials

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel & Hybrid Electrolytes

- Polymer Electrolytes

- Sulfide-Based Electrolytes

- Oxide-Based Electrolytes

By Battery Type

- Lithium Metal Primary Batteries

- Rechargeable Lithium Metal Batteries

- Solid-State Lithium Metal Batteries

- Lithium–Sulfur Batteries

- Lithium–Air (Li–O₂) Batteries

By End-Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics OEMs

- Energy & Utilities

- Healthcare & Medical Devices

- Industrial Manufacturing

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6121

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.