Global medical billing outsourcing market growth is fueled by rising administrative complexity in healthcare, increasing focus on revenue cycle optimization, and growing adoption of outsourced healthcare IT services.

Austin, Texas, Jan. 07, 2026 (GLOBE NEWSWIRE) — Medical Billing Outsourcing Market Size & Growth Analysis:

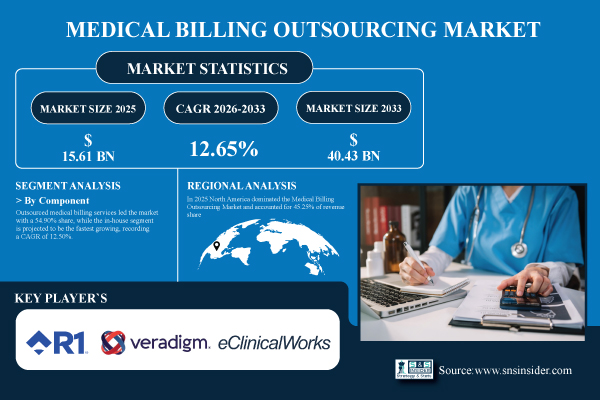

According to SNS Insider, The Medical Billing Outsourcing Market size is estimated at USD 15.61 billion in 2025 and is projected to grow at a CAGR of 12.65% to reach USD 40.43 billion by 2033 during the forecast period of 2026–2033.

The increasing burden of regulatory compliance, coding complexity, and claim management across healthcare providers is significantly contributing to market growth. Healthcare organizations are increasingly outsourcing billing operations to reduce operational costs, minimize claim denials, improve cash flow, and allow providers to focus on core clinical services. The growing adoption of electronic health records (EHRs), value-based care models, and automated billing solutions is further accelerating demand for specialized medical billing outsourcing services. The shift toward digital healthcare infrastructure and the rising volume of patient data continue to support sustained market expansion.

Get a Sample Report of Medical Billing Outsourcing Market: https://www.snsinsider.com/sample-request/8870

U.S. Medical Billing Outsourcing Market Insights:

The U.S. Medical Billing Outsourcing Market is estimated at USD 4.33 billion in 2025 and is projected to reach USD 11.00 billion by 2033, expanding at a CAGR of 12.39% over the forecast period of 2026–2033.

Growth in the U.S. market is driven by high healthcare expenditure, frequent updates to reimbursement policies, and increasing adoption of outsourced revenue cycle management services among small and mid-sized healthcare providers. The rising prevalence of private insurance plans, Medicare and Medicaid billing complexity, and strong demand for HIPAA-compliant billing solutions are further supporting market growth. Additionally, staffing shortages and increasing labor costs within in-house billing departments are accelerating the shift toward third-party medical billing service providers.

Medical Billing Outsourcing Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 15.61 Billion |

| Market Size by 2033 | USD 40.43 Billion |

| CAGR | CAGR of 12.65% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Medical Billing Outsourcing Market Segmentation Analysis:

By Component

Outsourced medical billing services led the market with a 54.90% share since health care providers are outsourcing their in-house billing procedures to external companies. The in-house segment is projected to be the fastest growing, recording a CAGR of 12.50% as hospitals are using enhanced software and automation tools for greater control over revenue cycle and data management within internal teams.

By Service Type

The front-end services dominated with a 46.28% market share in 2025 as patient registration, insurance verification and scheduling have a substantial presence on the market owing to their necessity in preventing claim denials and keeping billing clean. The back-end services are expected to grow fastest at a CAGR of 13.54% driven by the focus on maximizing reimbursement rates and minimizing revenue leakages for healthcare providers.

By End-User

The hospitals accounted for the largest share of 50.61% in 2025 as they have more number of patients to serve, require special billing requirements, and also outsource their operations for better response. The ambulatory surgical centers are anticipated to expand most rapidly with a CAGR of 14.37% as they outsource their billing more frequently in order to better handle increased patient throughput, cut down on operational costs and maintain a timely reimbursement amidst surging demand for outpatient care.

By Deployment

The cloud-based solutions held the majority share of 60.53% in 2025 as healthcare providers are adopting cloud solutions for billing, charting, and other operations that offer flexibility, scalability, and cost-effectiveness. The on-premise segment is forecasted to witness the highest growth at a CAGR of 13.40% due to data-sensitive institutions who want more control, security and ability to customize.

By Specialty

Radiology billing dominated with a 31.15% share in 2025 due to high number of imaging services and the intricate documentation needs and coding expertise required specialization. Anesthesia billing emerged as the fastest growing segment, registering a CAGR of 14.32% as the need for more procedures further necessitates advanced billing systems capable of managing complex timed-based coding/claim concerns contrasted by payment sprawl and updates in reimbursement.

Need Any Customization Research on Medical Billing Outsourcing Market, Enquire Now: https://www.snsinsider.com/enquiry/8870

Regional Insights:

In 2025, North America dominated the Medical Billing Outsourcing Market and accounted for 45.25% of revenue share, this leadership is due to high application of medical services and technology. Asia Pacific is expected to witness the fastest growth in the Medical Billing Outsourcing Market over 2026-2033, with a projected CAGR of 13.37% due to increasing adoption of digital practice among healthcare provider for billing services.

Major Players Analysis Listed in the Medical Billing Outsourcing Market Report are

- R1RCM Inc.

- Veradigm LLC

- eClinicalWorks

- Oracle

- Kareo Inc.

- Quest Diagnostics Incorporated

- AdvancedMD Inc.

- Promantra Inc.

- McKesson Corporation

- Athenahealth

- DrChrono

- CareCloud

- Invensis

- GeBBS Healthcare Solutions

- Omega Healthcare Management Services

- 24-7 Medical Billing Services LLC

- MediBillMD

- iCareBilling

- Unity Communications

- SupportYourApp

Recent Developments:

- In May 2025, R1RCM Inc. announced a strategic investment from Khosla Ventures and launched its “R37” AI lab to accelerate innovation in AI-driven healthcare revenue management, enhancing automation, efficiency, and intelligence across end-to-end billing and reimbursement operations.

- In May 2025, Veradigm LLC’s board expanded its 2024 Stock Incentive Plan by six million shares, totaling eleven million grants, to strengthen employee retention, align executive incentives, and support ongoing innovation in digital health and revenue cycle management solutions.

Key Medical Billing Outsourcing Market Segments

By Component

- In-house

- Outsourced

By Service Type

- Front-End Services

- Middle-End Services

- Back-End Services

By End-User

- Hospitals

- Physician Offices

- Ambulatory Surgical Centers

- Diagnostic & Imaging Centers

By Deployment

- Cloud-Based

- On-Premise

By Specialty

- Radiology Billing

- Pathology Billing

- Anesthesia Billing

- Cardiology Billing

- Others

Purchase Single User PDF of Medical Billing Outsourcing Market Report (20% Discount): https://www.snsinsider.com/checkout/8870

Exclusive Sections of the Report (The USPs):

- CLAIMS VOLUME & UTILIZATION METRICS – helps you assess market scale and operational intensity by tracking the number of claims processed annually, average claims per healthcare provider, and utilization levels of outsourced billing platforms.

- BILLING CYCLE EFFICIENCY IMPROVEMENT INDICATORS – helps you evaluate performance gains by comparing billing cycle times before and after outsourcing and measuring improvements in claim submission and reimbursement speed.

- OUTSOURCING ADOPTION & PENETRATION RATES – helps you understand demand dynamics by analyzing the percentage of healthcare providers outsourcing billing functions, adoption differences between hospitals and clinics, and deployment preferences.

- CLOUD VS ON-PREMISE DEPLOYMENT INSIGHTS – helps you identify technology shift trends by examining the share of cloud-based billing platforms versus on-premise systems across provider types.

- WORKFORCE PRODUCTIVITY & TURNAROUND METRICS – helps you benchmark operational efficiency by assessing the number of professionals employed, claims processed per employee, and average turnaround time for claim resolution.

- AUTOMATION & AI-DRIVEN BILLING INTELLIGENCE – helps you uncover innovation opportunities by tracking automation levels using AI/RPA, adoption of EHR-integrated billing systems, and growth in AI-enabled coding and claims management.

Access Complete Report Details of Medical Billing Outsourcing Market Analysis & Outlook: https://www.snsinsider.com/reports/medical-billing-outsourcing-market-8870

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.