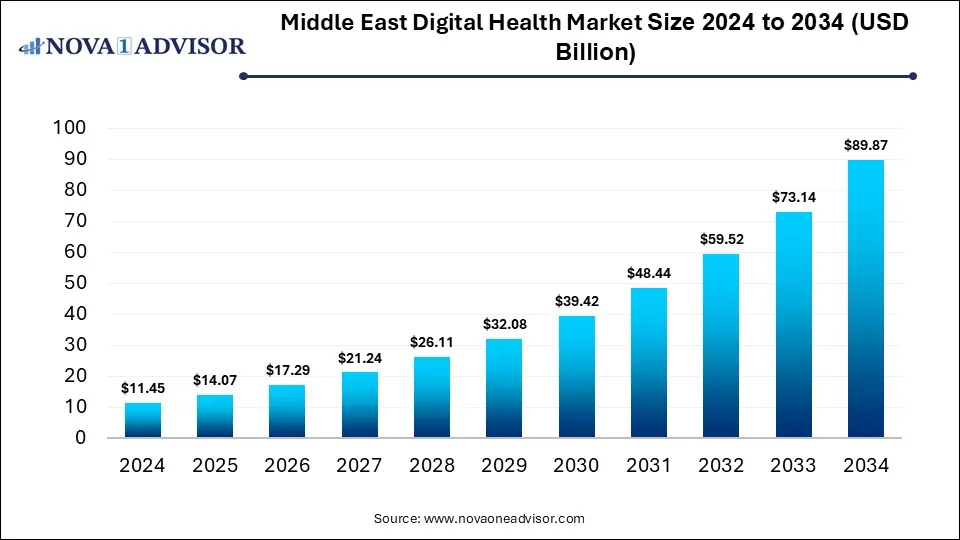

According to Nova One Advisor,the Middle East digital health market size is calculated at USD 14.07 billion in 2025 and is expected to reach around USD 89.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 22.88% over the forecast period from 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) — The Middle East Digital Health market size is calculated at USD 11.45 billion in 2024, grows to USD 14.07 billion in 2025, and is projected to reach around USD 89.87 billion by 2034, growing at a CAGR of 22.88% during the forecast period 2025 to 2034. The market is growing due to rising healthcare digitization, government initiatives, and increasing adoption of telemedicine, AI, and wearable health technologies. Additionally, the demand for remote patient monitoring and efficient healthcare delivery is driving rapid market expansion.

Key Takeaways

- Saudi Arabia dominated the Middle East digital health market with a revenue share in 2024.

- UAE is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the services segment held the largest market share in 2024.

- By component, the software segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the tele-healthcare segment led the market in 2024.

- By technology, the mHealth segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the diabetes segment dominated the market in 2024.

- By application, the obesity segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the patient segment held the highest market share.

- By end user, the providers segment is expected to grow at the fastest CAGR in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/9210

What is Digital Health?

Digital health is the use of technology, like apps, wearables, and AI, to improve healthcare delivery, patient care, and health management. The digital health market is expanding rapidly due to increasing demand for efficient, accessible, and cost-effective healthcare solutions. Rising adoption of telemedicine, mobile health apps, wearable devices, and AI-driven diagnostics is transforming patient care. Growing awareness of preventive healthcare, chronic disease management, and personalized treatment further fuels market growth. Additionally, supportive government initiatives, technological advancements, and the need for remote healthcare services, especially after the COVID-19 pandemic, are accelerating digital health adoption globally, driving continuous market expansion.

- For Instance, In February 2025, Sidra Medicine partnered with Rasmal Ventures through an MoU to bring innovative healthtech startups into its system. This collaboration supports Qatar’s Vision 2030 by boosting digital health development and strengthening the country’s leadership in advanced healthcare technologies.

What are the Primary Growth Drivers of the Middle East Digital Health Market?

The Middle East digital health market includes strong government investments in healthcare digitization, rising adoption of telemedicine, AI, and mobile health solutions, and increasing demand for remote patient monitoring. Growing lifestyle diseases, a tech-savvy population, and expanding health infrastructure further accelerate market expansion. Additionally, national transformation programs and partnerships with global healthtech companies are boosting innovation and digital health integration across the region.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9210

Middle East Digital Health Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 14.07 billion |

| Revenue forecast in 2034 | USD 89.87 billion |

| Growth rate | CAGR of 22.88% from 2025 to 2034 |

| Actual data | 2021 – 2024 |

| Forecast data | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Technology, Component, Application, End use, Country |

| Country scope | Saudi Arabia; UAE; Kuwait; Qatar; Oman |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

What are the Key trends in the Middle East Digital Health Market in 2024?

- In January 2025, the UAE Ministry of Health and Prevention (MoHAP) presented several advanced digital health projects at Arab Health 2025 within the UAE Health Pavilion. These included AI-based auditing tools, biometric-supported preventive health services, and an integrated licensing system. Together, these innovations highlight the region’s move toward more proactive, technology-driven healthcare delivery.

- In October 2024, the WHO and Saudi Arabia introduced the Hajj health card, a digital tool created through the WHO Global Digital Health Certification Network. This mobile-enabled card stores key medical details like allergies, medications, and vaccination records, helping authorized healthcare teams provide safer, more personalized care to pilgrims during Hajj.

What is the Appearing Challenge in the Middle East Digital Health Market?

The Middle East digital health market is the lack of unified regulations and data standards across countries, which complicates interoperability and secure data exchange. Limited digital skills among some healthcare providers, high implementation costs, and concerns over cybersecurity and patient data privacy further slow adoption. Additionally, integrating advanced technologies into traditional healthcare systems remains difficult, creating gaps between innovation and practical deployment.

Segmental Insights

By Component Insights

How did the Services Segment Dominate the Middle East Digital Health Market in 2024?

The service segment dominated the market in 2024 because healthcare providers increasingly relied on consulting systems integration, cloud support, and ongoing maintenance to manage complex digital health platforms. As hospitals adopted telehealth, AI, and electronic health systems, they required continuous technical expertise to ensure smooth operation and security. This rising need for customization, training, and managed services made the service segment the largest contributor to overall market revenue.

The software segment is set to grow at the fastest CAGR because healthcare systems are rapidly adopting advanced digital platforms, including telemedicine apps, AI analytics, electronic health records, and remote monitoring tools. Increased demand for automation, real-time data insights, and personalized patient management is driving investment in scalable, cloud-based software. Continuous updates, innovation, and integration capabilities further strengthen software’s role as the core enabler of digital health transformation.

- For Instance, In August 2025, TrioTree Technologies introduced an AI-driven voice-to-data solution that captures doctor–patient conversations in 178 languages and converts them into structured records. The tool connects seamlessly with EMRs and was rolled out together with its integration into Oman’s FSA-regulated Dhamani health insurance platform.

Middle East Digital Health Market Size By Component, 2024 to 2034 (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Hardware | 2.63 | 3.17 | 3.80 | 4.57 | 5.48 | 6.58 | 7.88 | 9.45 | 11.31 | 13.53 | 16.18 |

| Software | 4.24 | 5.25 | 6.50 | 8.05 | 9.97 | 12.35 | 15.29 | 18.94 | 23.45 | 29.04 | 35.95 |

| Services | 4.58 | 5.66 | 6.98 | 8.63 | 10.65 | 13.15 | 16.24 | 20.05 | 24.76 | 30.57 | 37.75 |

By Technology Insights

What made the Tele-healthcare Segment Dominant in the Middle East Digital Health Market in 2024?

The tele-healthcare segment led the market in 2024 due to growing demand for remote medical consultations, especially for chronic disease management and follow-up care. Greater smartphone use, improved internet access, and supportive government digital health strategies further accelerated adoption. Hospitals and clinics increasingly used virtual care to reduce patient load, enhance accessibility, and cut operational costs, making tele-healthcare the most widely adopted digital health solution.

The mHealth segment is expected to record the fastest CAGR because mobile-based health apps, wearable devices, and remote monitoring tools are becoming widely across the Middle East. Growing smartphone penetration, rising interest in self-tracking, and government-backed digital wellness programs are accelerating adoption. mHealth also offers low-cost, easily scalable solutions that support chronic disease management, real-time health insights, and continuous patient engagement, real-time health insights, and continuous patient engagement, driving strong future growth.

- For Instance, In May 2024, Bayer and Huma introduced a new digital Heart Health Risk Assessment tool in Saudi Arabia. This initiative supports the country’s Vision 2030 goals by enhancing early detection and promoting more advanced, tech-driven cardiac care.

Middle East Digital Health Market Size By Technology, 2024 to 2034 (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Tele-Healthcare | 3.09 | 3.76 | 4.56 | 5.54 | 6.74 | 8.18 | 9.93 | 12.06 | 14.64 | 17.77 | 21.57 |

| mHealth | 3.78 | 4.67 | 5.77 | 7.14 | 8.82 | 10.91 | 13.48 | 16.66 | 20.59 | 25.45 | 31.45 |

| Healthcare Analytics | 2.29 | 2.86 | 3.56 | 4.44 | 5.53 | 6.90 | 8.59 | 10.70 | 13.33 | 16.60 | 20.67 |

| Digital Health Systems | 2.29 | 2.79 | 3.39 | 4.12 | 5.01 | 6.09 | 7.41 | 9.01 | 10.95 | 13.31 | 16.18 |

By Application Insights

Why the Diabetes Segment Dominated the Middle East Digital Health Market in 2024?

The diabetes segment dominated the market in 2024 due to the region’s high and rising prevalence of diabetes, which increased demand for continuous monitoring and digital disease-management tools. Patients and providers widely adopted mobile apps, connected glucose monitors, and teleconsultation services to improve control and reduce complications. Government programs promoting digital diabetes care further strengthened adoption, making it the leading application area in digital health.

- For Instance, In November 2024, PureHealth enhanced its AI-driven Pura app by adding a dedicated diabetes care feature. This new module supports better digital glucose tracking and helps improve diabetes management for users across the UAE.

The obesity segment is projected to grow at the fastest CAGR due to rising obesity rates across the Middle East, driven by lifestyle changes, limited physical activity, and increasing metabolic disorders. This surges in boosting demand for digital weight-management tools, including mHealth apps, wearables trackers, tele-nutrition services, and AI-based personalized wellness plans. Government-led preventive health programs and growing consumer interest in digital fitness solutions further accelerate the market growth.

Middle East Digital Health Market Size By Application, 2024 to 2034 (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Obesity | 2.3 | 2.8 | 3.5 | 4.4 | 5.4 | 6.7 | 8.4 | 10.4 | 12.9 | 15.9 | 19.8 |

| Diabetes | 3.4 | 4.2 | 5.1 | 6.2 | 7.6 | 9.3 | 11.4 | 13.9 | 16.9 | 20.6 | 25.2 |

| Cardiovascular | 2.5 | 3.1 | 3.8 | 4.7 | 5.7 | 7.1 | 8.7 | 10.7 | 13.1 | 16.1 | 19.8 |

| Respiratory Diseases | 1.4 | 1.7 | 2.1 | 2.6 | 3.2 | 4.0 | 5.0 | 6.2 | 7.6 | 9.4 | 11.7 |

| Others | 1.8 | 2.2 | 2.7 | 3.3 | 4.1 | 5.0 | 6.1 | 7.4 | 9.0 | 11.0 | 13.5 |

By Application Insights

What Made the Patients Segment Dominant in the Middle East Digital Health Market in 2024?

The patient segment held the largest market share because individuals increasingly relied on digital tools for remote consultations, chronic disease management, fitness tracking, and self-monitoring. Growing awareness of preventing health, widespread smartphone adoption, and easier access to telemedicine and mHealth apps boosted patient engagement. Additionally, the shift toward personalized, home-based care empowered patients to actively manage their health, making them the primary users of digital health solutions.

- For Instance, In September 2024, Oman’s Ministry of Health added a new feature to the Shifa App that surveys patients who miss their appointments. This update aims to cut down on no-shows and improve overall appointment management.

The provider segment is expected to grow at the fastest CAGR because hospitals and clinics are rapidly adopting digital tools to improve efficiency, enhance diagnostics, and streamline patient management. Rising use of telehealth platforms, AI-driven systems, electronic health records, and remote monitoring solutions is pushing providers to invest heavily in digital transformation. Additionally, national health digitization programs and the need for integrated, data-driven care are accelerating adoption among healthcare providers.

- For Instance, In August 2024, Kuwait’s Ministry of Health introduced a digital system connecting hospitals with warehouses in Subhan. The platform helps unify medical supply requests and improves the efficiency of medicine distribution across facilities.

Middle East Digital Health Market Size By End Use, 2024 to 2034 (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Patients | 3.4 | 4.2 | 5.3 | 6.5 | 8.0 | 9.9 | 12.3 | 15.2 | 18.8 | 23.3 | 28.8 |

| Providers | 5.2 | 6.3 | 7.7 | 9.4 | 11.4 | 14.0 | 17.0 | 20.8 | 25.4 | 30.9 | 37.7 |

| Players | 2.1 | 2.5 | 3.1 | 3.9 | 4.8 | 5.9 | 7.3 | 9.1 | 11.2 | 13.8 | 17.1 |

| Other Buyers | 0.8 | 1.0 | 1.2 | 1.5 | 1.8 | 2.2 | 2.8 | 3.4 | 4.2 | 5.1 | 6.3 |

By Regional Analysis

How is North America contributing to the Expansion of the Middle East Digital Health Market?

Saudi Arabia dominated the market in 2024 due to its strong government investments, large population, and rapid progress under Vision 2030’s healthcare transformation agenda. The country accelerated adoption of telemedicine, AI, electronic health records, and nationwide digital platforms. Major funding for smart hospitals, public–private partnerships, and advanced regulatory frameworks further strengthened market leadership. Additionally, Saudi Arabia’s expanding digital infrastructure and emphasis on preventive, technology-driven care supported its leading revenue share.

- For Instance, In October 2024, Saudi Arabia introduced an updated licensing framework aimed at speeding up digital health innovation. The new system makes it easier to develop and roll out medical software, helping streamline approval processes and support faster technology adoption.

How is Asia-Pacific Accelerating the Middle East Digital Health Market?

The UAE is expected to grow at the fastest CAGR due to its strong focus on digital transformation, advanced healthcare infrastructure, and proactive government initiatives supporting AI, telehealth, and smart health platforms. High technology adoption, widespread use of mHealth apps, and continuous investment in innovation hubs further accelerate growth. Additionally, strategic partnerships with global healthtech companies and nationwide policies promoting data-driven, patient-centric care position the UAE as a leading driver of digital health expansion in the region.

- For Instance, In May 2025, Practo introduced its digital healthcare platform in the UAE, offering users convenient access to more than 31,000 doctors and over 3,000 clinics. This launch aims to improve care accessibility and strengthen digital health services in the region.

Middle East Digital Health Market Size By Country, 2024 to 2034 (USD Billion)

| Segment | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Saudi Arabia | 5.5 | 6.7 | 8.2 | 10.1 | 12.3 | 15.1 | 18.4 | 22.6 | 27.6 | 33.8 | 41.3 |

| UAE | 3.2 | 4.0 | 4.9 | 6.1 | 7.5 | 9.3 | 11.5 | 14.2 | 17.6 | 21.8 | 27.0 |

| Kuwait | 1.1 | 1.4 | 1.7 | 2.1 | 2.6 | 3.2 | 3.9 | 4.8 | 6.0 | 7.3 | 9.0 |

| Qatar | 0.9 | 1.1 | 1.4 | 1.7 | 2.1 | 2.6 | 3.2 | 3.9 | 4.8 | 5.9 | 7.2 |

| Oman | 0.7 | 0.8 | 1.0 | 1.3 | 1.6 | 1.9 | 2.4 | 2.9 | 3.6 | 4.4 | 5.4 |

Middle East Digital Health Market Companies

- Philips Healthcare

Philips provides advanced telehealth and remote patient monitoring solutions that enhance chronic disease management and critical care services across the region.

- Cerner Corporation

Cerner offers electronic health record (EHR) systems and health information technologies that streamline hospital workflows and improve data interoperability in Middle Eastern healthcare facilities.

- Siemens Healthineers

Siemens delivers a wide range of digital imaging, diagnostics, and AI-powered healthcare software solutions, supporting precision medicine and operational efficiency.

- Medtronic

Medtronic contributes through connected medical devices and wearable health technologies that enable real-time monitoring and management of chronic conditions.

- IBM Watson Health

IBM integrates AI and data analytics into digital health platforms, enhancing diagnostics, patient management, and personalized treatment strategies.

- Honeywell

Honeywell develops IoT-enabled healthcare infrastructure solutions that support smart hospital initiatives and digital health ecosystems.

- Epic Systems

Epic offers comprehensive EHR platforms widely used by hospitals and clinics in the region, facilitating seamless patient data management.

- Healthigo

Healthigo, a regional player, provides telemedicine and healthcare management platforms tailored to Middle Eastern market needs, improving healthcare accessibility.

- Tata Consultancy Services (TCS)

TCS offers IT consulting and digital transformation services that help healthcare providers integrate and optimize digital health technologies.

- Accenture

Accenture supports digital health innovation with strategy consulting, technology implementation, and managed services in the Middle East.

- Siemens

Siemens plays a significant role in supplying advanced healthcare equipment integrated with digital solutions to hospitals in the region.

- Allscripts

Allscripts provides healthcare IT solutions including EHR, patient engagement tools, and care coordination software to enhance healthcare delivery.

- Samsung Electronics

Samsung contributes through the manufacture of wearable health devices and mobile health technologies used widely for remote monitoring.

- GE Healthcare

GE offers digital imaging and AI-enabled diagnostic tools that aid healthcare providers in improving patient outcomes.

- Nextech

Nextech specializes in cloud-based healthcare software solutions that support telehealth, patient management, and digital workflows for clinics in the Middle East.

Recent Developments in the Middle East Digital Health Market

- In May 2025, WHX Tech revealed plans for its first event in Dubai, set for September 8–10, to boost digital health adoption in the Middle East. The gathering will bring together more than 5,000 health tech professionals and 300 exhibitors to present advancements in AI diagnostics, smart hospital technologies, and telemedicine solutions.

- In May 2025, MedIQ secured USD 6 million in Series A funding to scale its AI-driven digital health platforms across Saudi Arabia, Qatar, and other Gulf countries. The company plans to broaden its offerings, which include EHR systems, revenue cycle tools, telehealth services, and AI-based clinical support, while aligning with the region’s Vision 2030 digital transformation goals.

More Insights in Nova One Advisor:

- Life Science Cloud Market – The global life science cloud market size was estimated at USD 25.65 billion in 2024 and is projected to hit USD 106.05 billion in 2034, growing at a CAGR of 15.25% during 2025-2034.

- CRISPR-based Gene Editing Market – The global CRISPR-based gene editing market size was valued at USD 6.15 billion in 2024 and is anticipated to reach around USD 24.37 billion by 2034, growing at a CAGR of 14.76% from 2025 to 2034.

- Advanced Therapy Medicinal Products CDMO Market – The global advanced therapy medicinal products CDMO market size was estimated at USD 7.45 billion in 2024 and is projected to hit around USD 42.25 billion by 2034, growing at a CAGR of 18.95% during the forecast period from 2025 to 2034.

- U.S. Pet Insurance Market – The U.S. pet insurance market was valued at USD 5.44 billion in 2024 and is projected to hit USD 31.40 billion by 2034, growing at a CAGR of 19.16% over the forecast period 2025 to 2034.

- Biopharmaceuticals Contract Manufacturing Market – The global biopharmaceuticals contract manufacturing market size was estimated at USD 45.15 billion in 2024 and is projected to hit around USD 131.71 billion by 2034, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034.

- Metal Implants And Medical Alloys Market – The global metal implants and medical alloys market size was estimated at USD 18.45 billion in 2024 and is expected to reach USD 45.10 billion in 2034, expanding at a CAGR of 9.35% over the forecast period of 2025-2034.

- Orthodontic Headgear Market – The global orthodontic headgear market size was estimated at USD 1.35 billion in 2024 and is expected to hit USD 2.26 billion in 2034, expanding at a CAGR of 5.3% during the forecast period of 2025-2034.

- U.S. Single-use Bioprocessing Market – The U.S. single-use bioprocessing market size is calculated at USD 9.65 billion in 2024, grows to USD 11.10 billion in 2025, and is projected to reach around USD 39.24 billion by 2034, grow at a CAGR of 15.06% from 2025 to 2034.

- Single Cell Genome Sequencing Market – The global single cell genome sequencing market size was estimated at USD 4.85 billion in 2024 and is projected to hit around USD 22.14 billion by 2034, growing at a CAGR of 16.4% during the forecast period from 2025 to 2034.

- Single-use Bioprocessing Market – The global single-use bioprocessing market size is calculated at USD 33.55 billion in 2024, grows to USD 39.01 billion in 2025, and is projected to reach around USD 151.48 billion by 2034. grow at a CAGR of 16.27% from 2025 to 2034.

- Exosome Research Market – The global exosome research market size is calculated at USD 192.15 million in 2024, grows to USD 225.72 million in 2025, and is projected to reach around USD 961.41 million by 2034, expanding at a CAGR of 17.47% from 2025 to 2034.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Middle East Digital Health Market.

By Technology

- Tele-Healthcare

- Tele-care

- Activity Monitoring

- Remote Medication Management

- Tele-health

- LTC Monitoring

- Video Consultation

- Tele-care

- mHealth

- Wearables

- BP Monitors

- Glucose Meters

- Pulse Oximeters

- Sleep Apnea Monitors

- Neurological Monitors

- Activity Trackers/Actigraphs

- mHealth Apps

- Medical Apps

- Fitness Apps

- Services

- mHealth Service, By Type

- Monitoring Services

- Independent Aging Solutions

- Chronic Disease Management & Post-acute Care Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

- mHealth Services, By Participants

- Mobile Operators

- Device Vendors

- Content Players

- Healthcare Providers

- Monitoring Services

- mHealth Service, By Type

- Wearables

- Healthcare Analytics

- Digital Health Systems

- EHR

- E-prescribing systems

By Component

- Hardware

- Software

- Services

By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

By End Use

- Patients

- Providers

- Players

- Other Buyers

By Country

- Saudi Arabia

- UAE

- Kuwait

- Qatar

- Oman

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9210

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.