SNS Insider reveals that the U.S. Non-Alcoholic Steatohepatitis Treatment Market will expand from USD 4.56 billion in 2024 to USD 32.55 billion by 2032. This growth is supported by rising disease prevalence, regulatory progress for first-in-class therapies, and broader screening for metabolic disorders.

Austin, Nov. 27, 2025 (GLOBE NEWSWIRE) — Non-Alcoholic Steatohepatitis Treatment Market Size & Growth Outlook

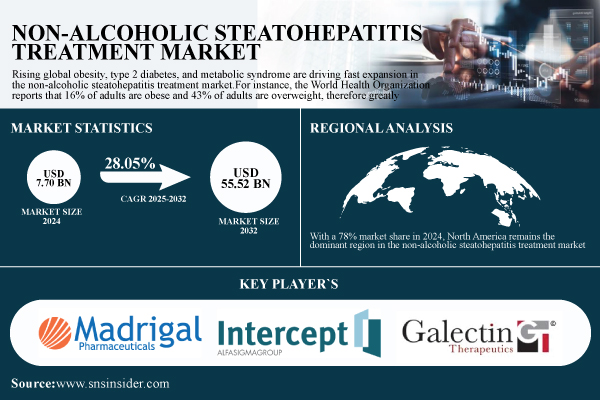

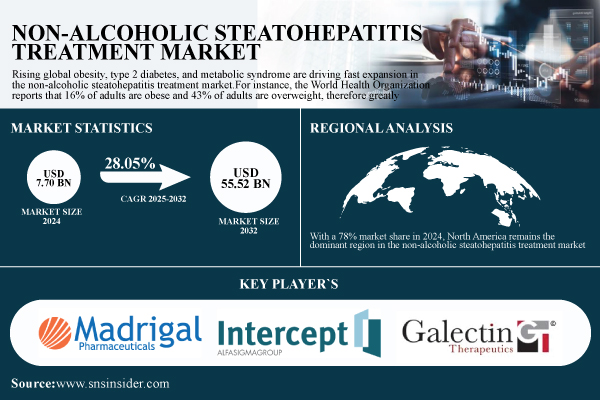

According to SNS Insider, the global Non-Alcoholic Steatohepatitis Treatment Market was valued at $7.70 billion in 2024 and is projected to reach $55.52 billion by 2032 with a CAGR of 28.05% from 2025 to 2032.

The U.S. NASH treatment market accounted for approximately 76% of the regional share in 2024 at $ 4.56 billion. It is forecast to rise to $32.55 billion by 2032 with a CAGR of 27.88% during the same period.

Market growth is driven by rising obesity, diabetes, and metabolic syndrome. The industry is also benefiting from significant progress in late-stage drug trials, expanding physician awareness, and an urgent need for disease-modifying therapies.

Request a Free Sample Report for the Non-Alcoholic Steatohepatitis Treatment Market: https://www.snsinsider.com/sample-request/7042

Market Overview

Non-Alcoholic Steatohepatitis is emerging as one of the most urgent global liver health challenges. This progressive condition, often linked with obesity and insulin resistance, has limited approved therapies and a rapidly growing patient population.

Pharmaceutical innovators, liver health centers, and clinical researchers across the United States and worldwide are advancing new treatment candidates targeting inflammation, fibrosis, lipid metabolism, and metabolic pathways. The surge in late-stage trials, real-world evidence programs, and supportive regulatory pathways is accelerating the shift toward clinically validated NASH therapeutics.

Key Non-Alcoholic Steatohepatitis Treatment Companies Profiled in the Report

- Madrigal Pharmaceuticals Inc.

- Intercept Pharmaceuticals Inc.

- Galmed Pharmaceuticals Ltd

- Inventiva

- Galectin Therapeutics Inc.

- Novo Nordisk A/S

- NGM Biopharmaceuticals Inc.

- AbbVie Inc.

- The Bristol-Myers Squibb Company

- Gilead Sciences Inc.

- Other Key Participants

Non-Alcoholic Steatohepatitis Treatment Market Report Scope

| Report Attributes | Details |

| Market Size in 2024 | $7.70 Billion |

| Market Size by 2032 | $55.52 Billion |

| CAGR | CAGR of 28.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Key Segments | • By Drug (Vitamin E and Pioglitazone, Obeticholic Acid (OCA), Resmetirom, Lanifibranor, Semaglutide, Cenicriviroc, Aramchol, and Other Drugs) • By Disease Stage (NASH Stage F0, NASH Stage F1, NASH Stage F2, NASH Stage F3, and NASH Stage F4) • By Distribution Channel (Retail and Specialty Pharmacies, Hospital Pharmacies, and Other Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Need Any Customization Research on Non-alcoholic Steatohepatitis Treatment Market, Enquire Now: https://www.snsinsider.com/enquiry/7042

Segmentation Analysis:

By Drug

The Vitamin E and pioglitazone segment dominated the non-alcoholic steatohepatitis treatment market, with 87% of global revenue in 2024. Strong clinical evidence and first-line management guidelines for NASH, especially in patients with insulin resistance and NASH-related comorbidities, anchor their leadership. The semaglutide, a GLP-1 receptor agonist is expected to grow the fastest in the non-alcoholic steatohepatitis treatment market growth, acting both on weight loss and liver inflammation.

By Disease Stage

With a 35% share in 2024, NASH Stage F1 dominated the non-alcoholic steatohepatitis treatment market, reflecting the effect of enhanced early detection and government-backed screening campaigns. NASH Stage F0 is projected to experience the fastest growth, driven by the integration of advanced screening in primary care and increased public health funding for NAFLD therapeutics.

By Distribution Channel

Hospital pharmacies held a 62% non-alcoholic steatohepatitis treatment market share in 2024, supported by their management of complicated NASH cases, delivery of advanced therapies, and participation in key clinical trials for NASH drugs. Driven by accessibility, convenience, and the expansion of pharmacy networks, retail and specialty pharmacies are expected to see the most notable growth in the non-alcoholic steatohepatitis treatment market.

Regional Insights:

With a 78% market share in 2024, North America remains the dominant region in the non-alcoholic steatohepatitis treatment market. The high frequency of metabolic risk factors, including obesity, type 2 diabetes, and hypertension, drives the predominance of the region.

The Asia Pacific region is set to experience the fastest CAGR of 30.2% of the non-alcoholic steatohepatitis treatment market, driven by both a large patient base and rapid healthcare innovation.

Recent Developments:

- In August 2024, Shilpa Medicare shares surged over 11% to a new high following positive Phase 3 trial results for SMLNUD07 (NorUDCA), a potential treatment for Nonalcoholic Fatty Liver Disease (NAFLD), a condition with limited therapeutic options.

Purchase Single User PDF of Non-alcoholic Steatohepatitis Treatment Market Report: https://www.snsinsider.com/checkout/7042

Exclusive Sections of the Report (The USPs):

- PRESCRIPTION TRENDS BY REGION (2024): Helps you understand how treatment adoption varies across North America, Europe, APAC, and emerging markets, highlighting regions with higher physician prescribing rates and stronger clinical awareness for NASH therapies.

- PHARMACEUTICAL VOLUME – PRODUCTION & USAGE (2024): Helps you track manufacturing volume, supply availability, and real-world usage of NASH drugs, enabling assessment of capacity readiness and demand–supply alignment for key therapeutic classes.

- HEALTHCARE SPENDING ON NASH TREATMENT (2024): Helps you evaluate expenditure patterns across government programs, private insurers, hospitals, and out-of-pocket channels, identifying regions where high treatment costs significantly influence access and market growth.

- DIAGNOSTIC & SCREENING TRENDS: Helps you analyze screening rates for NAFLD and NASH—including imaging, biomarker testing, and liver function assessments—critical for understanding early detection levels and expanding treatment eligibility.

- TECHNOLOGY ADOPTION RATE IN NASH DIAGNOSIS & CARE: Helps you uncover emerging opportunities linked to digital biomarkers, AI-based liver assessment tools, and advanced fibrosis detection technologies that are accelerating diagnosis and treatment pathways.

- COMPETITIVE LANDSCAPE & THERAPEUTIC PIPELINE STRENGTH: Helps you evaluate the positioning of leading companies based on pipeline progress, clinical trial success, partnerships, and commercialization strategies shaping the future of NASH treatments.

Related Reports

Type 2 Diabetes Market

Liver Disease Diagnostics Market

GLP-1 Receptor Agonist Market

Metabolic Disorder Therapeutics Market

Anti-Obesity Drugs Market

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.