The Payment Analytics Software Market is expanding as organizations adopt AI-driven analytics to manage growing digital transactions, enhance fraud detection, and improve payment efficiency, with the U.S. segment rising from USD 1.10 billion in 2025E to USD 1.61 billion by 2033.

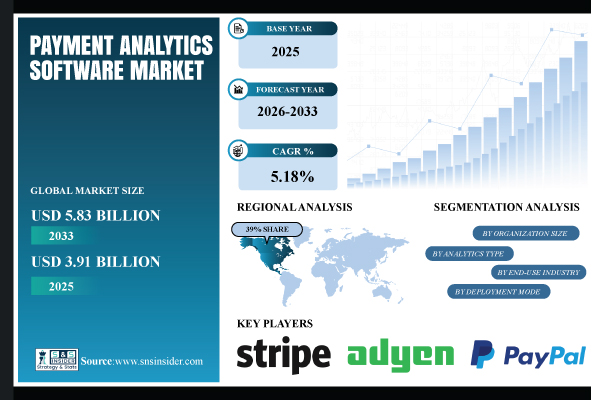

Austin, Jan. 07, 2026 (GLOBE NEWSWIRE) — The Payment Analytics Software Market was valued at USD 3.91 billion in 2025E and is expected to reach USD 5.83 billion by 2033, growing at a CAGR of 5.18% over 2026-2033.

The market for payment analytics software is expanding as a result of growing transaction volumes, the acceptance of digital payments, and the requirement for fraud protection and real-time monitoring. In order to streamline payment procedures, improve consumer satisfaction, and guarantee regulatory compliance, companies in the BFSI, retail, and e-commerce industries are investing in cutting-edge analytics solutions.

Download PDF Sample of Payment Analytics Software Market @ https://www.snsinsider.com/sample-request/9183

U.S. Payment Analytics Software Market was valued at USD 1.10 billion in 2025E and is expected to reach USD 1.61 billion by 2033, growing at a CAGR of 4.95% from 2026 to 2033.

The U.S. Payment Analytics Software Market is growing due to widespread digital payment adoption, increasing transaction volumes, rising fraud prevention needs, and strong investments by banks and e-commerce businesses in AI-driven analytics solutions to optimize payments and ensure compliance.

Segmentation Analysis:

By Organization Size

Large Enterprises dominated with ~64% share in 2025 due to their extensive transaction volumes, complex payment ecosystems, and significant investments in advanced analytics solutions to optimize revenue, ensure compliance, and enhance operational efficiency. Small & Medium Enterprises segment is expected to grow at the fastest CAGR from 2026-2033 as cloud-based and subscription models lower entry barriers.

By Analytics Type

Predictive Analytics dominated with ~34% share in 2025 as it enables organizations to forecast transaction failures, detect fraud patterns, and optimize payment processes proactively. Prescriptive Analytics segment is expected to grow at the fastest CAGR from 2026-2033 due to its ability to provide actionable recommendations, automate payment routing, optimize authorization rates, and support strategic decision-making.

By End-Use Industry

BFSI dominated with ~35% share in 2025 owing to its high transaction volumes, strict regulatory requirements, and focus on fraud prevention. Retail & E-commerce segment is expected to grow at the fastest CAGR from 2026-2033 as digital commerce expansion and multi-channel payments create complex transaction data.

By Deployment Mode

Cloud-Based dominated with ~70% share in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to its scalability, flexibility, and cost-efficiency. Organizations prefer cloud deployment for seamless integration with multiple payment gateways, real-time data processing, and reduced IT infrastructure costs.

If You Need Any Customization on Payment Analytics Software Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/9183

Regional Insights:

North America dominated the Payment Analytics Software Market with the highest revenue share of about 39% in 2025 due to its advanced digital payment infrastructure, high adoption of AI-driven analytics solutions, and presence of major global payment solution providers.

Asia Pacific segment is expected to grow at the fastest CAGR of about 6.78% from 2026-2033 due to rapid digital payment adoption, increasing smartphone and internet penetration, and expanding e-commerce activities.

Real-time Digital Payment Expansion and Rising Transaction Volumes Demand Augment Growth Globally

The complexity and number of transactions are rising due to the quick expansion of digital payments in e-commerce, mobile wallets, and cross-border transactions. To safeguard income, businesses need instant access to information about payment performance, failures, settlement delays, and conversion rates. Real-time monitoring, pattern recognition, and actionable insights across various payment channels are made possible by payment analytics software. Analytics are used by banks, payment processors, and merchants to lower declines, maximize authorization rates, and enhance customer checkout experiences.

Major Key Players:

- Stripe

- Adyen

- PayPal (Braintree)

- ACI Worldwide

- FIS

- Fiserv

- Global Payments

- Worldline

- Visa

- Mastercard

- Oracle (Payments/Analytics)

- SAS

- NICE Actimize

- Forter

- Riskified

- Signifyd

- Featurespace

- Sift

- Corefy

- Chargebee

Buy Full Research Report on Payment Analytics Software Market 2026-2033 @ https://www.snsinsider.com/checkout/9183

Recent Developments:

2025: Stripe’s total payment volume hit USD 1.4 trillion in 2024, driven by AI-enhanced payments analytics and fraud tools.

2025: Adyen released two new POS terminals (S1E4 Pro and S1F4 Pro), improving in-person payment analytics and operational insights for merchants.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.