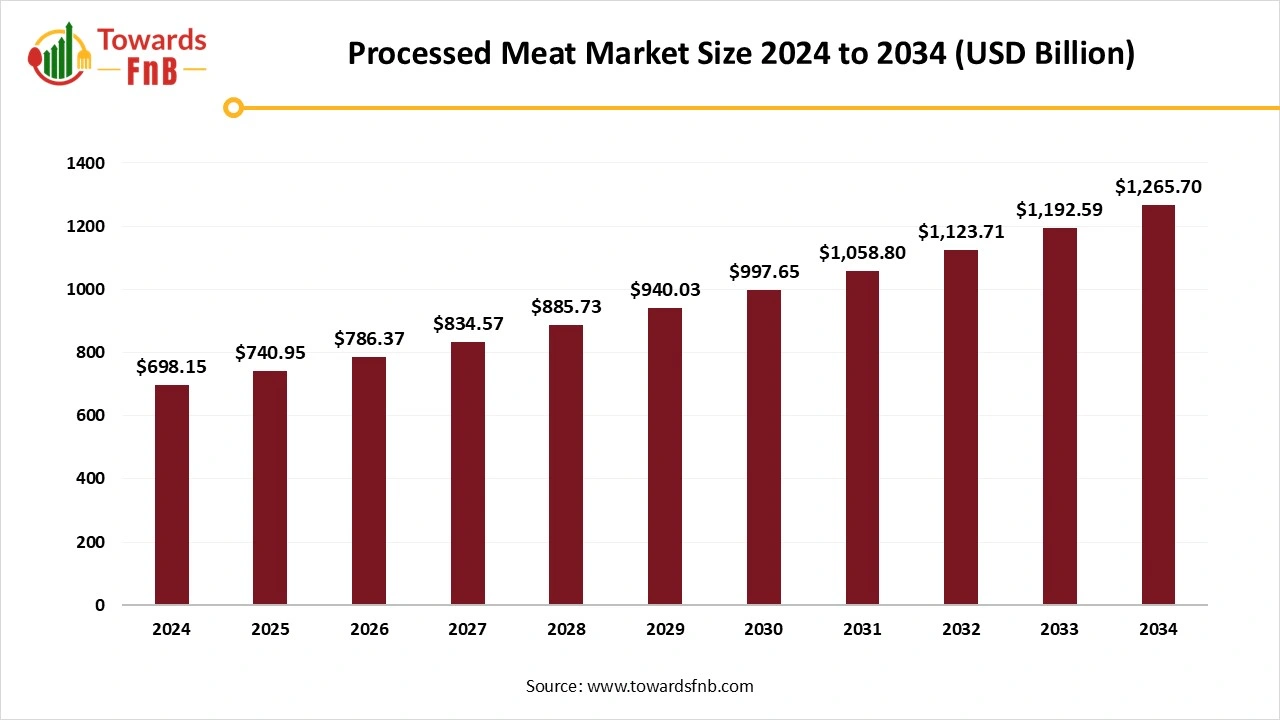

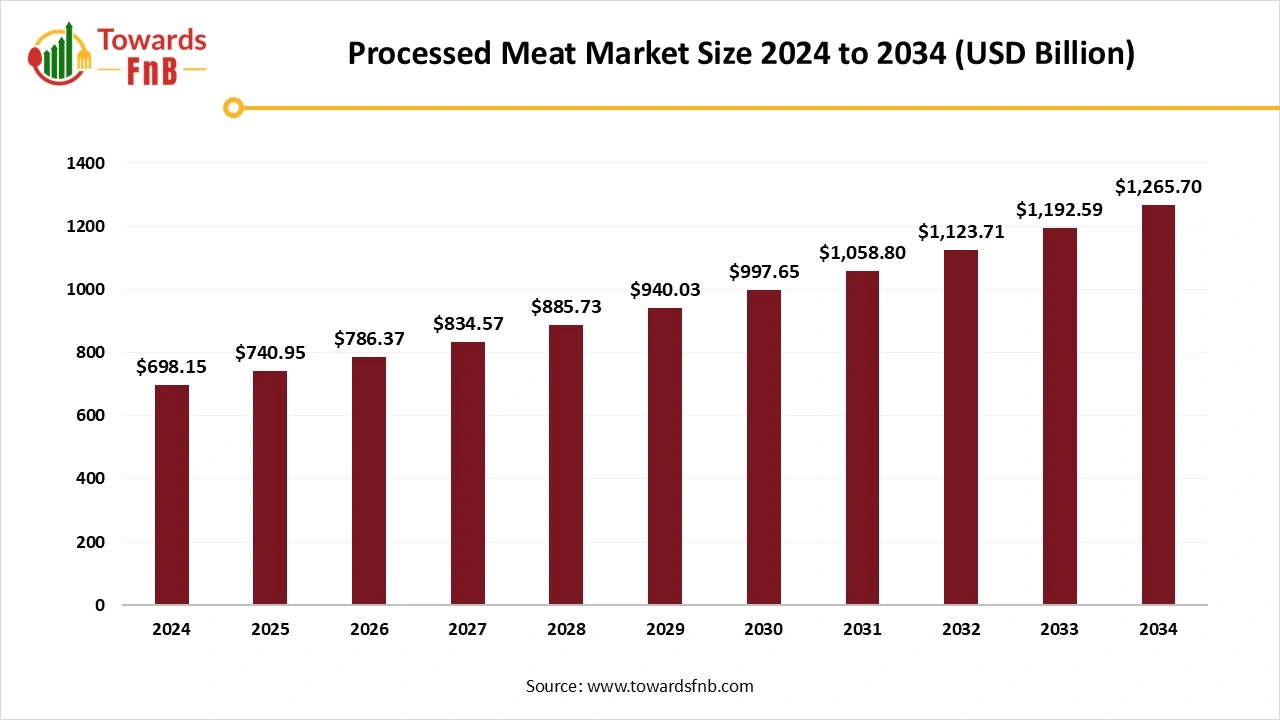

According to Towards FnB, the global processed meat market size is calculated at USD 740.95 billion in 2025 and is anticipated to surge USD 1,265.70 billion by 2034, reflecting at a CAGR of 6.13% from 2025 to 2034. This robust growth underscores the increasing demand for convenience, innovation, and high-protein products that cater to the evolving needs of health-conscious consumers.

Ottawa, Nov. 27, 2025 (GLOBE NEWSWIRE) — The global processed meat market size stood at USD 698.15 billion in 2024 and is predicted to increase from USD 740.95 billion in 2025 to reach around USD 1,265.70 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow due to rising demand for ready-to-eat options, innovative flavors, and high-protein options that help individuals ditch unhealthy snacking and maintain protein intake on the go.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5928

Key Highlights of the Processed Meat Market

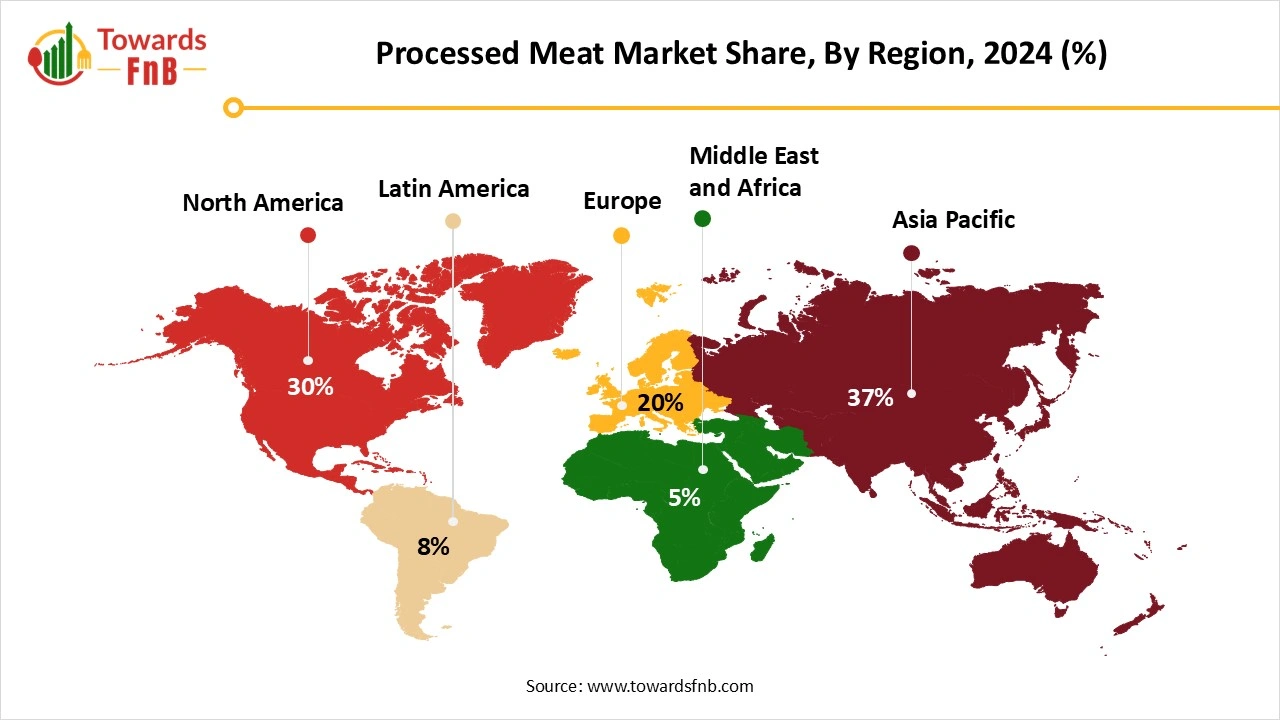

- By region, Asia Pacific dominated the global processed meat market with a 37% share in 2024, while the Middle East & Africa is expected to experience the fastest growth, with a projected CAGR of 8.5% during the forecast period.

- By product type, the fresh processed meat segment accounted for a significant 35% of the market share in 2024. However, the cooked/ready-to-eat meat segment is anticipated to grow at a robust CAGR of 9.5% from 2025 to 2034.

- By meat type, poultry held a substantial 40% share of the processed meat market in 2024, but the beef segment is expected to grow at a projected CAGR of 7.5% during the forecast period (2025–2034).

- By distribution channel, supermarkets and hypermarkets dominated the market, capturing 45% of the share in 2024. On the other hand, the online retail and e-commerce segment is expected to see significant growth, with a projected CAGR of 11.5% between 2025 and 2034.

- By end-use, the household/retail segment led the market with a 50% share in 2024, while the foodservice sector is expected to grow at a CAGR of 9.5% from 2025 to 2034.

Higher Demand for Convenient Options is helpful for the Processed Meat Industry’s Growth

Hectic lifestyles of consumers leading to higher demand for convenient meal options are one of the major factors for the growth of the processed meat market. Processed meat cuts are versatile for preparing various recipes and dishes, allowing consumers to enjoy global flavors and further fueling the market’s growth. High demand for ready-to-eat and ready-to-consume options to save time and maintain nutritional integrity is another major factor for the market’s growth.

Technological Innovations are helpful for the Market’s Growth

Technological innovations such as AI, ML, and advanced packaging are fueling market growth. Advanced procedures such as intelligent cutting systems, precision and efficiency, and automation are further fueling the market’s growth by reducing human intervention and automating as many packaging procedures as possible. Non-thermal methods such as e-beam irradiation, ultrasound, and high-pressure processing enhance the quality and shelf life of processed meat, helping maintain flavors and nutrients intact. Enhanced production consistency through traceability systems, smart sensors, and robotics further drives the industry’s growth.

Recent Developments in the Processed Meat Market

- In July 2025, Brazilian Meat Processor (BRF) launched their first line of chilled chicken products produced in Saudi Arabia. The company’s main aim is to capture 10% of this market share in 18 months.

- In April 2025, Rolinson Group, specializing in the sale and servicing of established global brands, announced its entry into the food processing industry. The main aim of the company is to provide cutting-edge machinery and unparalleled customer support to food manufacturers.

Impact of AI in the Processed Meat Market

Artificial intelligence (AI) is transforming the processed meat market by improving efficiency, product quality, safety, and supply chain performance. In processing plants, AI-powered computer vision systems inspect meat cuts for texture, color, marbling, and surface defects with far more precision than manual inspection. These systems also detect contamination risks and foreign materials early, helping companies maintain strict hygiene standards and reduce recalls. Machine learning models optimize grinding, mixing, curing, smoking, and cooking processes to achieve consistent flavor, moisture levels, and texture across batches while reducing energy use and production waste.

AI-driven automation supports accurate portioning, seasoning, and packaging, lowering labor requirements and improving throughput. Predictive maintenance tools monitor equipment performance in real time, allowing processors to address mechanical issues before they disrupt production.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/processed-meat-market

New Trends in the Processed Meat Market

- Higher demand for convenience by consumers with a hectic lifestyle is one of the major factors for the growth of the market.

- Options with high protein content and other nutritional benefits are another major factor for the growth of the market.

- Advanced technologies helping the market to maintain the processed meat’s shelf life, taste, and texture are also helping to fuel the market’s growth.

Product Survey of the Processed Meat Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Brands |

| Cured Meats | Meat preserved through salting, nitrate curing, and seasoning for extended shelf life. | Ham, bacon, corned beef, pastrami | Retail grocery, delis, foodservice | Hormel Foods, WH Group, Maple Leaf Foods |

| Smoked Meats | Meat exposed to controlled smoking for flavor and preservation. | Smoked pork, smoked beef, smoked turkey | Deli meals, sandwiches, BBQ retail | Tyson Foods, JBS Prepared Foods |

| Cooked and Ready to Eat Processed Meats | Fully cooked products that require no additional preparation. | Cooked ham, frankfurters, luncheon meat | Snack foods, ready meals, lunch boxes | Conagra, Smithfield, Hormel |

| Frozen Processed Meats | Processed meats preserved through freezing to extend shelf life. | Frozen sausages, frozen meatballs, frozen patties | Retail freezers, foodservice, export | BRF, Minerva, Pilgrim’s |

| Sausages and Hot Dogs | Ground meat emulsions formed into links or patties and cooked or smoked. | Beef sausages, pork sausages, hot dogs, bratwurst | Retail, fast food, grilling | Johnsonville, Oscar Mayer, Hormel |

| Canned and Shelf Stable Meats | Long life processed meats packaged for ambient storage. | Canned beef, Spam style meat, canned sausages | Emergency rations, travel, developing markets | Hormel (Spam), Tulip, Libby’s |

| Marinated and Pre Seasoned Meats | Red or white meat infused with marinades or spices to enhance flavor and convenience. | Barbecue marinated pork, spiced chicken cuts | Ready to cook retail, meal kits | Tyson Foods, BRF, CP Foods |

| Deli Meats and Cold Cuts | Thinly sliced processed meats used in sandwiches and snacks. | Roast beef slices, turkey breast slices, salami | Delis, sandwiches, ready to eat retail | Boar’s Head, Maple Leaf Foods |

| Reformed and Restructured Meats | Meats shaped into uniform products using binding technologies. | Reformed beef steaks, shaped patties | QSR, foodservice | Tyson Foods, OSI Group |

| Low Sodium and Clean Label Processed Meats | Products formulated with reduced sodium, natural preservatives, or simplified ingredient lists. | Clean label ham, low sodium bacon | Health conscious retail | Applegate Naturals, True Story Foods |

| Premium and Artisanal Processed Meats | Specialty meats crafted using traditional curing or gourmet techniques. | Iberico ham, dry cured salami, artisanal prosciutto | Gourmet retail, specialty stores | Fermin, Creminelli, D’Artagnan |

| Halal and Kosher Processed Meats | Processed meats certified for religious dietary compliance. | Halal deli meats, kosher franks | Middle Eastern markets, Jewish markets, global retail | Midamar, Al Islami, Empire Kosher |

| Plant Assisted or Hybrid Processed Meats | Blended products combining meat with plant proteins for healthier formulations. | Meat plant sausages, blended patties | Flexitarian consumers, wellness retail | Perdue Chicken Plus, private labels |

| Ready Meal Meat Components | Processed meats included as components in ready meals. | Meatballs, sliced sausage, cooked strips | Frozen meals, convenience meals | Conagra, Nestlé Prepared Foods |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5928

Processed Meat Market Dynamics

What Are the Growth Drivers of the Processed Meat Market?

Changing consumer preferences, hectic schedules, rising disposable income, and high demand for convenient meal options are among the major factors driving the growth of the processed meat industry. Processed meat retains its nutritional value and flavor with advanced technology, improving its packaging and shelf life. The easy availability of processed meat across various offline and online platforms at different price points also supports the market’s growth.

Challenge

Increased Health Risks May Hamper the Market’s Growth

Preservatives and chemicals used in the processed meat industry may hamper market growth. Such chemicals may raise the risk of colon cancer and other fatal issues, further creating obstructions in the growth of the market. Use of nitrates and nitrites can be reactive in the body and form N-nitroso compounds that can damage DNA and elevate the risk of cancer. Hence, such issues altogether may hamper the growth of the processed meat market.

Opportunity

Product Innovation Is Helpful for the Market’s Growth

Processed meat manufacturers are paying attention to managing sodium levels, saturated fats, and the use of preservatives at the lowest possible levels to enhance the product’s health qualities, which is helpful for market growth. The availability of different flavor options and the customization of flavors also help fuel the market’s growth and create major opportunities to expand the consumer base. The availability of premium processed meat options, such as premium meat cuts, sausages, and cold cuts, also fuels market growth.

Processed Meat Market Regional Analysis

Asia Pacific is Expected to Grow in the Forecast Period

Asia Pacific dominated the processed meat market in 2024, driven by changing consumer preferences and high demand for convenient, ready-to-cook, and ready-to-eat options. Such options allow consumers to enjoy nutritious meat more quickly, which supports market growth. Processed meat options, such as sausages and patties, are highly sought after by consumers in the household segment, as they are versatile and useful for preparing a variety of dishes. Countries such as India, China, Japan, and South Korea have made major contributions to the market’s growth due to high demand for processed meat and their easy availability across different platforms.

The Middle East and Africa are Observed to Be the Fastest-Growing Regions in the Foreseeable Period

The Middle East and Africa are expected to grow over the forecast period due to rising consumer populations demanding processed meat and high-protein options, and greater consumer awareness of conscious eating. Processed meat options that are rich in flavor and retain their nutritional value also help fuel the market’s growth. Rising disposable income, rapid urbanization, and changing consumer preferences are other major factors driving market growth. South Africa, the UAE, Saudi Arabia, and Kuwait are major contributors to the market’s growth, driven by changing consumer preferences and high demand for quality meat options.

North America is expected to have Notable Growth in the foreseeable Period

North America is expected to grow at a notable rate during the forecast period due to factors such as changing consumer lifestyles, high demand for processed and convenient meat options, hectic lifestyles, and higher demand for ready-to-eat and ready-to-prepare food options. Processed meat with intact nutritional and flavor profiles further fuels market growth. Rapid urbanization and rising disposable income also help fuel market growth. The US and Canada make a major contribution to the market’s growth in the region, driven by changing lifestyles and higher demand for protein-rich, convenient options.

Trade Analysis of the Processed Meat Market

What’s actually traded (HS proxies & product forms)

- Finished retail products — sausages, hams, cured/cooked meats and jerky cleared typically under HS chapter 16 (e.g., “Other prepared or preserved meat” HS 1602 and related codes).

- Semi-finished inputs — frozen trimmed cuts, seasoned batters, cured casings and spice premixes shipped to contract packers.

- Service/know-how flows — co-packing, private-label manufacturing, and technical/food-safety services tied to export volumes. (Source: UN/COMTRADE HS data via World Bank WITS.)

Top Exporters and Supply Hubs

- Thailand, Germany, China, United States, Spain and Brazil are among the most visible exporters of prepared/preserved meat in recent trade tabulations — country prominence varies by product niche (e.g., canned/preserved lines, cured pork, snack meats). Thailand is a leading exporter in HS 1602 by value in 2023, with major EU origins (Germany, Spain, Netherlands), important for cured and processed lines into other OECD markets.

- Brazil and Argentina are important origin suppliers of processed beef/pork products and large-volume meat inputs that feed processing/export chains globally (and feed regional processed-meat production). Brazil’s scale in slaughtering and processed exports continues to underpin global supply.

Top Importers / Demand Centres

- European Union, United States, China, Japan and Middle East markets are major importers of finished processed-meat SKUs and semi-processed inputs. The EU and U.S. are both large consumers and re-exporters (intra-EU trade is substantial for cured and specialty products). China’s rising import appetite for pork and processed pork lines has driven targeted trade flows and occasional trade remedies/investigations.

Typical Trade Flows & Commercial Patterns

- Bulk trims → local finishing: many exporters ship frozen trims or seasoned batters to lower-cost co-packers in importing regions where finishing and retail packaging reduce freight and adapt labels to local language/claims.

- Finished SKU exports from processing hubs: countries with strong curing traditions (Spain, Italy, Germany) export branded and private-label cured products into neighbouring markets and diaspora channels.

- Private-label supply chains: retailers source private-label processed meats from contract manufacturers in low-cost manufacturing regions (e.g., parts of Eastern Europe, Latin America, and Southeast Asia) and then distribute regionally. (Source: COMTRADE / trade platform summaries)

Processed Meat Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6.13% |

| Market Size in 2025 | USD 740.95 Billion |

| Market Size in 2026 | USD 786.37 Billion |

| Market Size by 2034 | USD 1,265.70 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Processed Meat Market Segmental Analysis

Product Type Analysis

The fresh processed meat segment dominated the processed meat market in 2024 due to higher demand for convenient options suitable for consumers with hectic schedules. Hence, consumers lately are demanding ready-to-eat options, convenient meals, and high-protein options that help them maintain their nutritional profile and avoid unhealthy snacking, further fueling the market’s growth. The segment also observes growth due to the availability of high-quality processed meat compared to canned and other frozen alternatives.

The cooked/ready-to-eat meat segment is expected to grow over the forecast period due to consumers’ hectic schedules, rapid urbanization, rising disposable incomes, and higher demand for convenient options. The ready-to-eat meals and convenient options help to save time and are also nutritious, allowing consumers to maintain their protein intake. It also helps prevent unhealthy snacking and is high-quality thanks to advanced processing and freezing techniques.

Meat Type Analysis

The poultry segment led the processed meat market in 2024 due to strong consumer awareness of chicken’s high protein content. The segment also observes growth as chicken is used as a staple food in many households and is also nutritious. The high, clean protein content of chicken also helps fuel the market’s growth. The ready-to-cook and eat options allow consumers to save their time from extensive meal planning, further fueling the market’s growth. It is also an affordable option that allows consumers to maintain their protein intake with ease.

The beef segment is expected to grow over the forecast period due to its high protein content, versatility, and convenience in preparing various dishes in various forms. Globalization, the rapid increase in disposable income, and higher demand for convenient, high-protein options are other major factors driving the processed meat market’s growth in the foreseeable future. Technological advancements that help improve packaging, shelf life, and product appearance are another major factor in the industry’s growth.

Distribution Channel Analysis

The supermarkets and hypermarkets segment led the processed meat market in 2024 due to the easy availability of these stores near residential areas, enabling consumers to buy the products they desired and fueling market growth. Such stores have separate product sections for consumers’ convenience. Hence, such stores are a go-to spot for consumers to buy groceries and various processed meat options, further fueling market growth. Such markets also offer a variety of discounts to consumers, making it an economical option and further fueling the market’s growth.

The online retail segment is expected to grow over the foreseeable period due to the convenience e-commerce platforms offer, which is expected to fuel the processed meat market’s growth. Such platforms also allow consumers to choose from a wide range of products, helping them find the right option. Online delivery platforms also help to fuel the market’s growth, making it convenient for consumers to buy their desired processed meat option and save time.

End Use Analysis

The household/retail consumer segment led the processed meat market in 2024, driven by high household consumption. Such options are convenient, allow consumers to prepare various dishes more quickly, and are useful for those with a hectic schedule. Such meat options are packed with nutrition and flavor thanks to advanced technology that helps retain flavor. The easy availability of processed meat across platforms and at cost-effective prices also helps fuel the market’s growth.

The food service segment is expected to grow in the foreseen period due to factors such as convenience, the growing culture of ordering food online and dining in cafeterias and restaurants, and product innovation. The foodservice segment enables the globalization of flavors, allowing consumers to experience a range of cuisines, further fueling market growth. Processed meat with a longer shelf life, intact nutrition, and enhanced flavor options also helps fuel the market’s growth in the foreseeable future.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Processed Meat Market

- Hormel Foods Corporation – Produces a wide range of processed meats including deli meats, sausages, bacon, and canned meat products. Hormel leverages strong retail brands and diversified protein offerings to maintain category leadership.

- Conagra Brands Inc. – Offers processed meat products across multiple packaged food brands, focusing on frozen meals, ready-to-eat meats, and convenience formats. The company emphasizes scalable production and national retail presence.

- Foster Farms – A major U.S. poultry producer supplying processed chicken products such as cooked strips, nuggets, sausages, and marinated items. Foster Farms focuses on value-added, ready-to-cook and ready-to-eat poultry categories.

- JBS S.A. – One of the world’s largest meat processors, offering an extensive portfolio of processed beef, pork, and chicken products. JBS integrates large-scale operations to supply processed meats globally through multiple flagship brands.

- Tyson Foods Inc. – Produces a broad assortment of processed meats including frozen chicken products, sausages, deli meats, and prepared foods. Tyson leverages vertically integrated operations and strong U.S. distribution networks.

- Smithfield Foods, Inc. – The largest pork processor in the U.S., known for processed pork products such as bacon, hams, sausages, and packaged deli meats. Smithfield emphasizes quality upgrades and expanded ready-to-eat offerings.

- Cargill Incorporated – Supplies processed beef, turkey, and value-added protein items including patties, cooked meats, and marinated products. Cargill supports retail and foodservice channels with global-scale processing capabilities.

- Pilgrim’s Pride Corporation – A major producer of processed chicken items including breaded products, fully cooked meats, and seasoned poultry. The company focuses on efficiency, innovation, and diverse product formats across retail and foodservice.

- The Kraft Heinz Company – Produces iconic processed meat brands including cold cuts, hot dogs, and packaged luncheon meats. Kraft Heinz maintains strong brand recognition and innovation in convenience-based protein products.

- China Xiangtai Food Co., Ltd. – A Chinese meat processing company supplying pork-based processed meats and packaged protein products. The company targets domestic consumption through value-added and ready-to-cook offerings.

Segments Covered in the Report

By Product Type

- Fresh Processed Meat

- Cured Meat

- Smoked Meat

- Frozen Processed Meat

- Cooked/Ready-to-Eat Meat

- Dried Meat Products

By Meat Type

- Poultry

- Pork

- Beef

- Mutton

- Other Meats (seafood, mixed meats)

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Butcher Shops & Specialty Retail

- Online Retail & E-Commerce

- Foodservice / HoReCa Supply

By End-Use

- Household / Retail Consumers

- Foodservice (restaurants, QSRs, cafés)

- Institutions (schools, hospitals, catering)

- Industrial Food Processors

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5928

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.