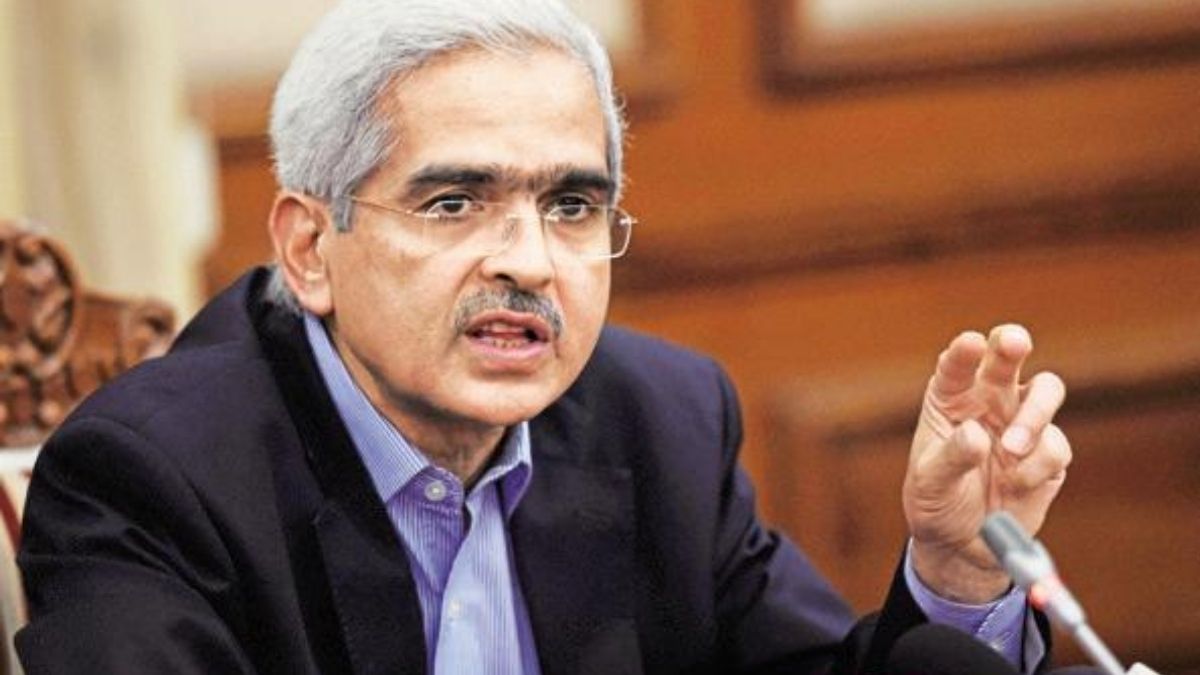

RBI Governor Shaktikanta Das announced on Friday that the Central Bank will give the retail investors direct access to primary and secondary G-sec markets, which include government bonds.

He said that India will become one of the few countries allowing this, and it will be a major structural reform. This will enable retail investors to open G-sec accounts directly with the RBI, he added. G-sec stands for government security that recognises the debt obligation of the Government. It is issued by either Central or State governments as a tradeable instrument. The securities either includes short-term instruments like treasury bills or long-term instruments like bonds.

The Monetary Policy Committee (MPC) of the RBI have agreed to not change the policy rates.