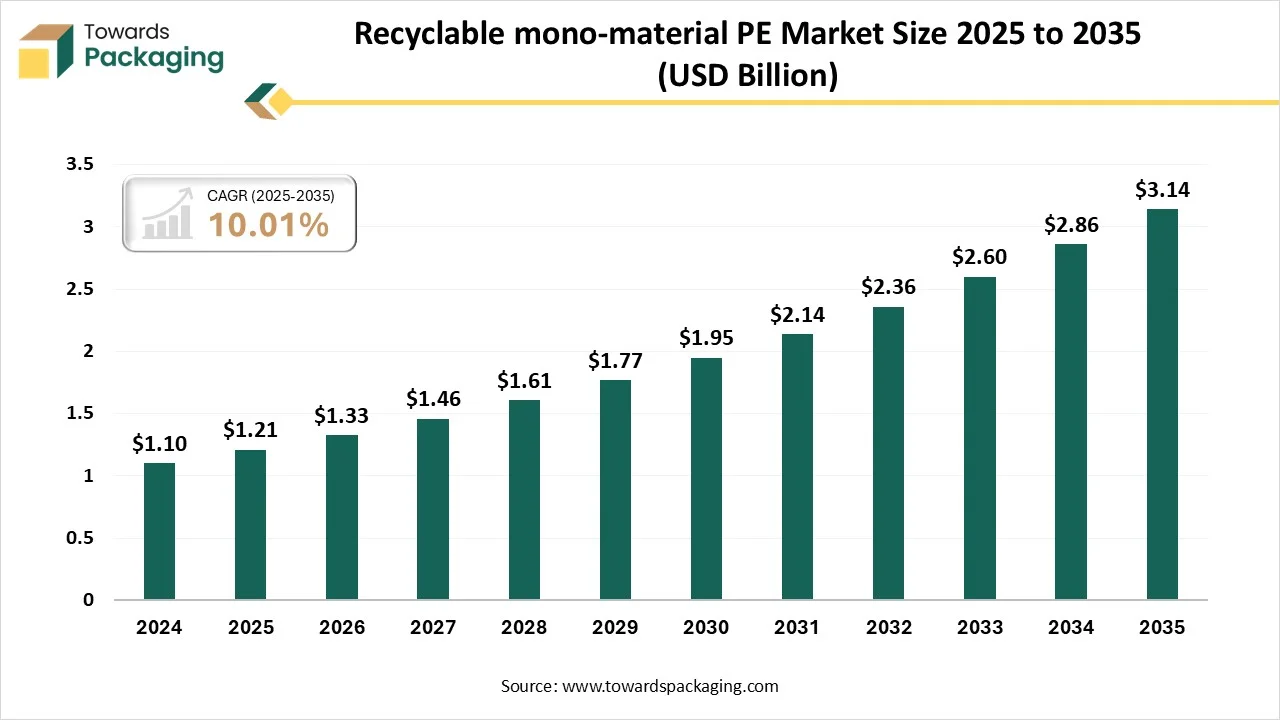

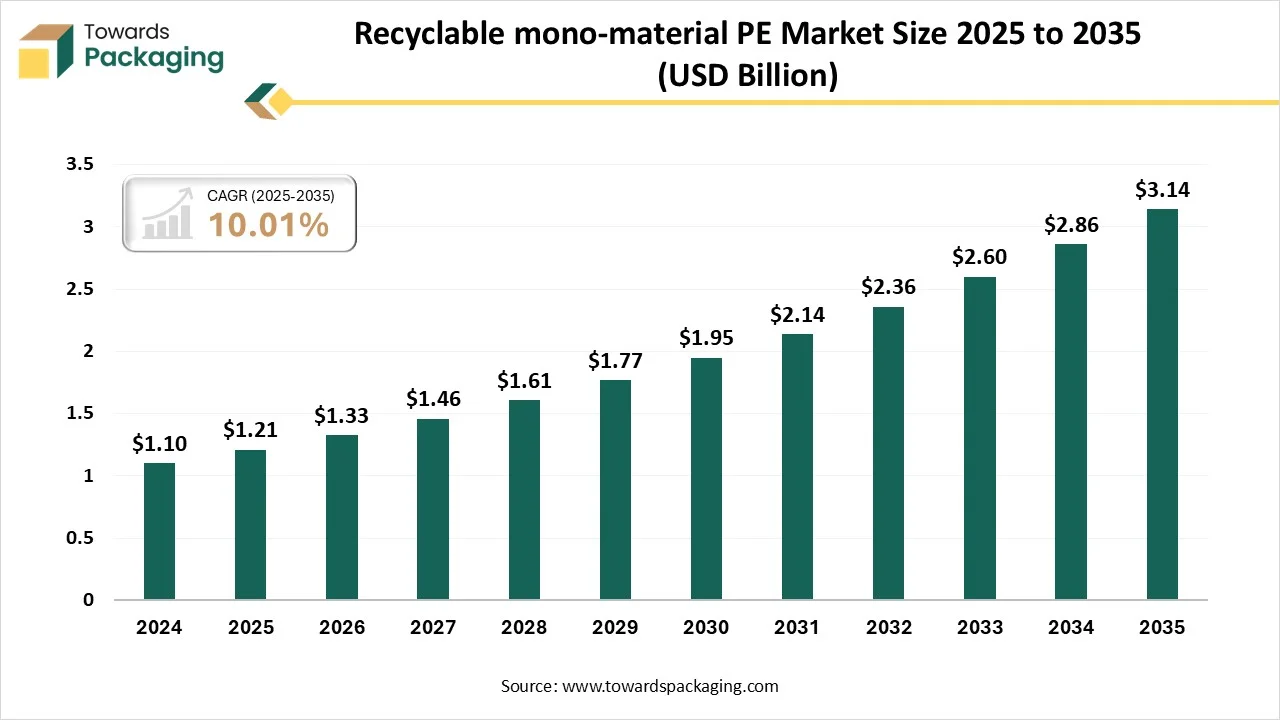

As detailed in the latest report by Towards Packaging, the global recyclable mono-material PE market is forecast to grow from USD 1.33 billion in 2026 to about USD 3.14 billion by 2035, at a CAGR of 10.01% between 2026 and 2035.

Ottawa, Jan. 22, 2026 (GLOBE NEWSWIRE) — The global recyclable mono-material PE market reported a value of USD 1.21 billion in 2025, and according to estimates, it will reach USD 3.14 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising regulatory pressure and brand commitments to replace multi-layer packaging with easily recyclable, circular economy-compatible plastic solutions.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Takeaways

- By region, the Asia Pacific dominated the global recyclable mono-material PE market by holding the highest market share in 2025.

- By region, Europe is expected to grow at a notable rate from 2026 to 2035.

- By material type, the HDPR segment dominated the market share in 2025.

- By material type, the LLDPE segment is expected to grow at the fastest rate between 2026 and 2035.

- By foam/product format, the films & sheets segment led the market share in 2025.

- By foam/product format, the spouted pouches segment is projected to grow the fastest between 2026 and 2035.

- By application/end use, the flexible packaging segment dominated the market share in 2025.

- By application/end use, the healthcare and pharmaceutical packaging segment is projected to grow at the fastest rate between 2026 and 2035.

- By end-use industry, the food & beverages industry segment led the market share in 2024.

- By end-use industry, the e-commerce and logistics segment is projected to grow at the fastest rate between 2026 and 2035.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5927

Market Overview

Recyclable Mono-Material PE Industry: Turning Simplicity into Sustainability

The recyclable mono-material PE market is gaining strong momentum as brands and packaging converters move toward more straightforward material structures that enhance recyclability without sacrificing functionality. Compared to multi-layer laminates, mono PE solutions make collection sorting and reprocessing simpler, which makes them extremely compatible with circular economy objectives. Demand is being further accelerated by growing adoption in food, personal care, and e-commerce packaging, particularly as global sustainability standards tighten.

Government Initiatives for the Recyclable Mono-Material PE Industry:

- Extended Producer Responsibility (EPR) Guidelines (India & EU): These mandates make producers, importers, and brand owners financially and operationally responsible for managing the end-of-life of their plastic packaging, including mono-material PE, thereby incentivizing its collection and recycling.

- Mandatory Recycled Content Targets (EU & India): The EU and India have implemented regulations that require plastic packaging to contain a minimum percentage of recycled plastic (e.g., 25% for PET bottles by 2025 in the EU), which directly drives demand for high-quality recycled PE materials.

- Packaging and Packaging Waste Regulation (PPWR) (EU): This regulation requires all packaging to be designed for recyclability by 2030 and sets targets for waste reduction, favoring mono-materials like PE over harder-to-recycle multi-layer options.

- Single-Use Plastics (SUP) Directive (EU): The directive bans specific single-use plastic items where affordable alternatives exist and introduces design requirements, collection targets, and labelling standards that indirectly encourage the shift to recyclable mono-PE for allowed applications.

- Solid Waste Infrastructure for Recycling Grants (US EPA): The U.S. Environmental Protection Agency (EPA) is investing millions of dollars in grants to improve domestic recycling and composting infrastructure, which is crucial for effectively processing mono-material PE packaging.

Key Trends of the Recyclable mono-material PE Market

- Move toward simple, recyclable structures: Brands are replacing complex laminates with mono-PE to improve recyclability.

- High-barrier mono-PE development: Improved barrier and sealing performance is expanding use in food and personal care packaging.

- Rising use of PCR content: Manufacturers are adding post-consumer recycled PE to meet circular economy and regulatory goals.

- Regulatory and consumer push: EPR policies and eco-conscious consumers are accelerating the adoption of mono-material PE packaging.

Market Opportunities

- Replacement of Multi-Layer Packaging: String opportunity to replace non-recyclable, complex laminates in food, personal care, and household packaging with mono PR structures that support easier recycling.

- High Barrier Film Innovation: Advancements in barrier coatings, scalability, and mechanical strength are enabling mono-material PE to enter demanding applications such as pouches, sachets, and retail packaging.

- Integration of PCR Content: Rising regulations and brand commitments are creating opportunities for mono PE packaging with post-consumer for mono PR packaging with post-consumer recycled (PCR) content, supporting circular economy targets.

More Insights of Towards Packaging:

- Industrial Foam Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Disposables Packaging Market Size, Share, Trends, and Forecast Analysis, 2025-2035

- Laminated Tubes Market Size and Segments Outlook (2026–2035)

- Collapsible Rigid Containers Market Size and Segments Outlook (2026–2035)

- Cosmetic Tubes Market Size and Segments Outlook (2026–2035)

- Plastic Bag Market Size and Segments Outlook (2026–2035)

- 3D CAD Software Market Size, Trends and Segments (2026–2035)

- Plastic Recycling Services Market Size, Trends and Regional Analysis (2026–2035)

- 3D Semiconductor Packaging Market Size and Segments Outlook (2026–2035)

- Battery Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Hot-fill Food Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Paper Packaging Market Size and Segments Outlook (2026–2035)

- Vaccine Packaging Market Size, Trends and Regional Analysis (2026–2035)

- 3D Rendering Market Size, Trends and Segments (2026–2035)

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Size, Trends and Segments (2026–2035)

- Labeling Machine Market Size, Trends and Segments (2026–2035)

- Stand-Up Pouch Market Size, Trends and Competitive Landscape (2026–2035)

- Fiber Trays for Meal Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Retail Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. 503B Compounding Pharmacy Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

Segmental Insights

By Material Type

The HDPR segment dominates the recyclable mono-material PE market, driven by its strong resistance to chemicals and moisture, superior qualities, and high strength-to-density ratio. Because HDPE is frequently used in rigid and semi-rigid packaging applications, brands looking to increase recyclability without sacrificing performance favor it. Its dominance is further reinforced by its compatibility with current recycling streams.

The LLDPE segment is growing rapidly in the market owing to its exceptional flexibility, resistance to punctures, and capacity to create packaging structures that are both thinner and more resilient. The adoption of LLDPE is being accelerated by the growing need for lightweight, downgauged packaging in flexible applications. Strong growth is also being supported by its suitability for mono-material designs that are in line with circular economy objectives.

By Foam/Product Format

Films & sheets segment dominates the recyclable mono-material PE market because it is widely used in industrial wraps, protective packaging, and flexible packaging. Films and sheets are a major source of market revenue due to their high demand from the food consumer goods and retail sectors, as well as their ease of recycling. Adoption is further fueled by their compatibility with high-speed packaging lines.

The spouted pouches and tubes segment is growing rapidly in the market because there is a growing need for packaging formats that are lightweight, resealable, and convenient. PE tubes and pouches made of a single material are becoming more popular among brands in an effort to meet sustainability goals without sacrificing functionality. Growing use in home care, healthcare, and personal care applications supports growth even more.

By Application/End Use

The flexible packaging segment is dominating the recyclable mono-material PE market, driven by the growing need for affordable, lightweight, and recyclable packaging options. Multi-layer laminates are gradually being replaced by mono-material PE structures, which helps companies become more recyclable. Food, beverages, and consumer goods packaging continue to drive the market’s dominance.

The healthcare and pharmaceutical packaging segment is growing rapidly because of increasing regulatory focus on sustainable yet safe packaging materials. Mono material PE offers excellent chemical resistance, hygiene, and barrier performance, making it suitable for medical and pharmaceutical uses. Growing healthcare consumption and packaging innovation are further boosting demand.

By End Use Industry

The food & beverages industry segment is dominating the recyclable mono-material PE market due to the demand for recyclable food-grade materials, which is rising, and packaging volumes are high. Mono material PR guarantees product safety and shelf life while assisting food brands in meeting their sustainability obligations. Sustained dominance is supported by rising packaged and ready-to-eat food consumption.

The e-commerce and logistics segment is growing rapidly because of rising online retail activity and demand for lightweight, durable, and recyclable packaging materials. Mono-material PE films and mailers help reduce packaging waste and improve recyclability in logistics operations. Growth in cross-border trade and last-mile delivery further accelerates this segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

By Region

Asia Takes the Lead: Dominating Growth in the Recyclable Mono-Material PE Industry

The Asia Pacific region is dominating the recyclable mono-material PE market due to large-scale packaging manufacturing, rapid urbanization, and growing consumption of packaged goods. Strong demand from food retail and industrial sectors, combined with expanding recycling infrastructure, supports regional leadership. Other countries play a key role in driving market volume.

China Recyclable Mono-Material PE Market Trends

China’s market is growing rapidly as brands shift away from multi-layer packaging to meet recyclability, ESG, and circular-economy requirements. Flexible packaging, especially food, beverage, and e-commerce films, leads adoption because mono-PE offers a strong balance of cost, performance, and recyclability. Government waste-reduction policies and local incentives, combined with China’s large PE film manufacturing base, are accelerating commercialization and scale-up.

Europe Leads the Charge: Recyclable Mono-Material PE Becomes the Fastest-Growing Packaging Trend

Europe is growing rapidly owing to strict environmental regulations and strong government support for recyclable and mono-e material packaging solutions. Brand commitments to circular economy principles and bans on non-recyclable plastics are accelerating market adoption. Increased investment in sustainable packaging innovation is further strengthening regional growth.

Germany Recyclable Mono-Material PE Market Trends

Germany’s market is expanding moderately as stringent environmental regulations and the EU’s recyclability requirements push brands towards single-polymer packaging to improve recycling outcomes. Demand for mono-PE flexible films and pouches is supported by strong domestic recycling infrastructure and high corporate sustainability standards in the food, beverage, and personal care sectors.

Recent Developments in the Recyclable Mono-Material PE Industry:

- In January 2026, Amcor announced aggressive expansion of its mono PE and mono PP high barrier films to replace aluminum foil in food and pharma categories. These specialized coatings and structures are designed to replace traditional aluminum foil while maintaining oxygen-barrier protection, allowing brands to transition to fully recyclable materials within existing polyethylene and polypropylene streams.

- In October 2025, Amcor launched Am Secure, a proprietary PE-based material for thermoformed medical and pharmaceutical trays. This solution provides the same clarity and durability as traditional materials but is certified by the Association of Plastic Recyclers (APR) for recyclability, offering a more sustainable and cost-effective alternative for critical healthcare applications.

- In June 2024, Mondi launched the recycled spouted Pouch designed as a recyclable mono material alternative to plastic tubs for the paint industry. This innovative packaging solution significantly reduces plastic usage by up to 90% while ensuring the pouch is compatible with existing polyethylene recycling streams

Top Companies in the Recyclable Mono-Material PE Market & Their Offerings:

Tier 1:

- Amcor offers the AmPrima Plus line, a range of high-barrier, recycle-ready mono-PE pouches designed to replace non-recyclable multi-layer structures in coffee and food applications.

- Berry Global: Provides various mono-material PE flexible films and Sustane® recycled polymers, including mono-PE laminates for industrial and consumer packaging.

- Mondi Group: Features the re/cycle portfolio, which includes FlexiBag Reinforced, a mono-PE-based bag with enhanced mechanical properties and adjustable barrier protection for pet food and liquids.

- Sealed Air Corporation: Recently launched Cryovac® VPP MonoPro, a recycle-ready, high-barrier mono-PE film for vertical form-fill-seal (VFFS) applications in fluid and pumpable foods.

- Sonoco Products Company: Offers EnviroSense™ mono-material PE flexible packaging designed to be drop-in replacements for standard multi-material films while remaining compatible with current recycling streams.

- Constantia Flexibles: Specializes in the EcoLam family, a series of mono-PE laminates ranging from standard to high-barrier versions that are certified for recyclability in the PE stream.

- ProAmpac: Provides ProActive Recyclable® R-2000 series, a high-performance mono-PE film designed for high-speed filling lines and various pouch formats.

- Huhtamaki: Offers Huhtamaki blueloop™ solutions, which include mono-PE flexible packaging aimed at achieving high-barrier protection without using unrecyclable multi-material layers.

- DS Smith Plc: While primarily fiber-focused, they provide mono-material PE plastic solutions specifically through their flexible packaging and Bag-in-Box divisions to support circularity.

- Smurfit Kappa Group: Focuses on recyclable mono-material PE films through its Bag-in-Box division, ensuring that both the bag and the tap are compatible with existing PE recycling systems.

Tier 2:

- Uflex Ltd.

- Wipak Group

- Jindal Poly Films

- Bischof + Klein

- DNP (Dai Nippon Printing)

- Toray Industries Inc.

- Alpla Werke Alwin Lehner GmbH & Co KG

- AptarGroup Inc.

Segments Covered in the Report

By Material Type

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Ultra-High-Molecular-Weight PE (UHMWPE)

By Form / Product Format

- Films & Sheets

- PE Stretch Films

- PE Shrink Films

- Flat PE Films

- Bags & Sacks

- Containers & Bottles (mono-PE)

- Caps & Closures (PE)

- Tubes & Spouted Pouches (mono-PE)

- Rigid PE Packaging

By Application / End-Use

- Flexible Packaging

- Pouches

- Wraps & Overwraps

- Mailer Bags

- Rigid Packaging

- Bottles & Jars

- Containers

- Consumer Goods Packaging

- Food & Beverage Packaging

- Healthcare & Pharmaceutical Packaging

- Industrial & Chemical Packaging

- E-Commerce & Retail Packaging

By End-Use Industry

- Food & Beverages

- Personal Care & Cosmetics

- Household Goods

- Healthcare / Medical

- Industrial & Chemicals

- E-Commerce Logistics

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5927

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight – Check It Out:

- Aseptic Bag-in-Box Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- Gusseted Pouches Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Cement Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Augmented Reality in Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Halal Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Surgical Instruments Packaging Market Size, Trends and Segments (2026–2035)

- Nutraceutical Flexible Packaging Market Size, Segments, Regional Data, Competitive Landscape, and Value Chain Analysis

- Gift Packaging Market Size and Segments Outlook (2026–2035)

- Aluminum Caps and Closures Market Size and Segments Outlook (2026–2035)

- Lubricant Packaging Market Size, Trends and Segments (2026–2035)

- Rigid Box Market Size and Segments Outlook (2026–2035)

- Biofoam Packaging Market Size, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Polystyrene Packaging Market Size, Segments, Regions, Competition & Trade (2025-2035)

- Aseptic Carton Packaging Market Size, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Printed Signage Market Insights, Size, Trends and Competitive Landscape (2026–2035)

- Tertiary Packaging Market Size, Share, Trends, Segments, Regional Insights, and Competitive Landscape 2024-2034

- Electronic Packaging Market Size, Share, Trends, Regional Insights, Competitive Landscape & Trade Analysis

- Packaging 4.0 Market Size, Segments Data, and Competitive Analysis

- Packaging 5.0 Market Trends, Segments, Regional Performance, and Competitive Strategies

- Packaging in Supply Chain Management Market Size, Segments Data and Regional Insights (NA, EU, APAC, LA, MEA)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.