Rising satellite deployments, private-sector participation, and national space programs accelerate growth across launch services, manufacturing, and downstream applications.

Austin, United States, Feb. 03, 2026 (GLOBE NEWSWIRE) — Space Economy Market Size & Growth Analysis:

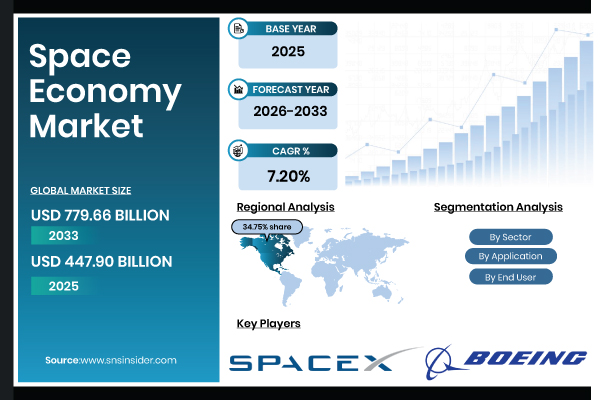

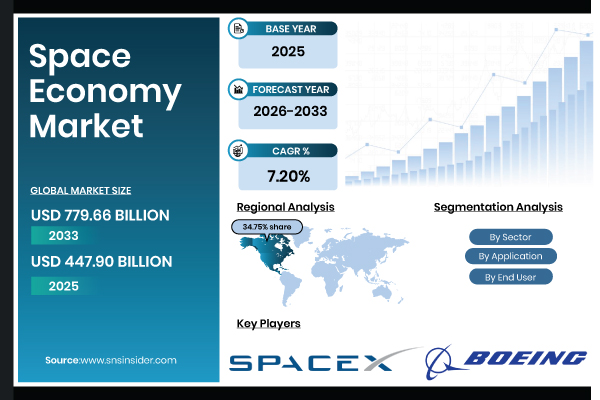

According to SNS Insider, the Space Economy Market was valued at USD 447.90 billion in 2025 and is projected to reach USD 779.66 billion by 2033, expanding at a CAGR of 7.20% during the forecast period 2026–2033.

The global space economy market growth is mainly attributed to the increasing commercialization of space, launch systems development, space exploration, investments in the preparation of space economy, increasing satellites constellations for communication and Earth observation and space-based services. Technological advancements in reusable launch vehicles, smaller satellites, and digital payloads are driving down costs and enhancing the scalability of missions, promoting sustained market expansion. Beyond satellite imagery, rising demand for navigation, broadband connectivity, climate monitoring, and defense-related applications also support the space economy. Particularly, public–private partnerships and cross-border collaborations are also hastening the innovation and commercialization across space value chain.

Get a Sample Report of Space Economy Market: https://www.snsinsider.com/sample-request/8748

Market Size and Forecast:

- Market Size in 2025: USD 447.90 Billion

- Market Size by 2033: USD 779.66 Billion

- CAGR: 7.20% from 2026 to 2033

- Base Year: 2025

- Forecast Period: 2026–2033

- Historical Data: 2022–2024

U.S. Space Economy Market Outlook:

The U.S. Space Economy was valued at USD 128.28 billion in 2025 and is expected to reach USD 208.59 billion by 2033, growing at a CAGR of 6.29% over the forecast period. Enduring U.S. federal funding, NASA initiatives, and Department of Defense programs remain the foundation for market leadership. Significant private space companies, strong venture capital flows, and a mature aerospace manufacturing ecosystem are propelling growth in launch services, satellite manufacturing, and downstream data services.

Government Support and Strategic Investments Drive Market Growth:

Around the world governments are ramping up their space budgets to bolster national security, scientific research, and the digital backbone that underpins society. Launch capabilities, in-orbit services, and space infrastructure reinforced by increasing policy support, long-term space missions and private initiatives, continue to incentivize innovations over the long term, underpinning the market expansion potential.

High Development Costs and Regulatory Complexity May Restrain Growth:

High capital-intensiveness, lengthy development lead times, and a stringent regulatory environment present hurdles even if the space economy appears to be on a strong growth trajectory. The costs for R&D, launch operations, insurance, and compliance will be prohibitive for all but the largest players, which may help temper near-term market growth.

Major Space Economy Market Companies Analysis Listed in the Report are

- SpaceX

- Blue Origin

- NASA

- Lockheed Martin

- Boeing

- Northrop Grumman

- ISRO (Indian Space Research Organisation)

- Arianespace

- OneWeb

- Rocket Lab

- Planet Labs

- Relativity Space

- Blue Origin

- Virgin Galactic

- Eutelsat

- SES S.A.

- Maxar Technologies

- Rocket Lab

Need Any Customization Research on Space Economy Market, Enquire Now: https://www.snsinsider.com/enquiry/8748

Segmentation Analysis:

By Sector

Satellite Manufacturing held the largest market share of 32.45% in 2025, driven by sustained government defense spending, expanding LEO satellite constellations, and rising demand for communication and navigation satellites. Replacement cycles and long-term institutional contracts continue to anchor this segment. In contrast, Space Tourism, while smaller in base, is projected to grow at the fastest CAGR of 9.80%, fueled by increasing private-sector launches, declining launch costs, growing high-net-worth consumer interest, and rapid progress in reusable launch and suborbital flight technologies.

By Application

Telecommunications dominated with a 28.67% market share in 2025, supported by growing global demand for satellite broadband, 5G backhaul, maritime and aviation connectivity, and rural coverage expansion. Continuous data traffic growth keeps this segment structurally strong. Earth Observation & Remote Sensing is expected to expand at the fastest CAGR of 9.45%, driven by rising adoption for climate monitoring, disaster management, agriculture analytics, urban planning, and defense surveillance, supported by advances in imaging resolution and AI-based data interpretation.

By End-User

Government accounted for the largest share at 40.32% in 2025, reflecting consistent investments in national security, space exploration, weather forecasting, and sovereign satellite infrastructure. Stable budget allocations and long mission cycles sustain demand. Private Companies are projected to register the fastest growth at a CAGR of 9.90%, supported by increased venture capital funding, commercialization of launch services, satellite-as-a-service models, and expanding private participation in space data and exploration markets.

By Technology Type

Reusable Rockets led the market with a 35.27% share in 2025, driven by their proven ability to reduce launch costs, improve mission cadence, and enhance operational efficiency. Their reliability has made them the preferred technology for both commercial and government launches. Space Robotics is expected to grow at the fastest CAGR of 10.25%, propelled by rising demand for in-orbit servicing, satellite life extension, debris removal, autonomous exploration, and robotic support for deep-space missions.

By Price Range

The Medium price range dominated with a 38.19% share in 2025, as it offers an optimal balance between cost, performance, and mission reliability, making it suitable for most commercial and institutional users. Standardized platforms and shared launch models reinforce adoption. The Premium segment is projected to grow at a CAGR of 9.70%, driven by increasing demand for high-end payloads, deep-space missions, defense-grade systems, and advanced propulsion and robotics technologies.

By Distribution Channel

Direct Contracts held the largest share of 42.16% in 2025, supported by long-term agreements between governments, defense agencies, and established aerospace firms, ensuring mission security and predictable revenue streams. Partnerships & Collaborations are expected to grow at the fastest CAGR of 9.85%, as complex missions increasingly require shared investment, technology co-development, public–private partnerships, and cross-border cooperation to accelerate innovation and reduce financial risk.

Regional Insights:

The North America Space Economy had the most market share in 2025, with 34.75% owing to satellite production, launch services, and space tourist initiatives. The government and commercial firms do much of the work, and a lot of money is going toward reusable rockets and satellites that watch the Earth.

The Asia Pacific Space Economy is the fastest-growing area, with a CAGR of 8.50%. By 2025, there will be more than 850 satellite projects and about 600 launch missions, mostly from China (420 satellites) and India (180 satellites). Space tourism and commercial launch services are becoming more popular, but satellite manufacturing and Earth monitoring stand out. The Asia Pacific area is a prominent player in the global market due to government spending, private sector activity, technological improvement, and cooperation between regions.

Recent Developments:

- In January 2025, SpaceX launched Starship SN25 on its first fully integrated orbital test flight, showing off its advanced reusability and heavy-lift potential for missions to other planets. The mission also sent up 60 Starlink satellites as part of the expansion of global broadband coverage.

- In July 2025, Blue Origin flew its 10th crewed New Shepard flight in a step toward upgrading passengers’ experiences aboard, and commercial opportunities for companies to take payloads to space.

Purchase Single User PDF of Space Economy Market Report (20% Discount): https://www.snsinsider.com/checkout/8748

Exclusive Sections of the Report (The USPs):

- LAUNCH SUCCESS & MISSION RELIABILITY METRICS – helps you evaluate launch success rates (%) by company and region, payload performance benchmarks, and mission frequency per operator to assess operational maturity and risk exposure.

- REUSABLE ROCKET TURNAROUND & OPERATIONAL EFFICIENCY – helps you understand average turnaround time improvements (%) for reusable launch vehicles, indicating cost efficiency, launch cadence scalability, and long-term competitiveness.

- MARKET DEMAND & SATELLITE UTILIZATION INSIGHTS – helps you analyze global satellite bandwidth utilization (%), subscription growth for satellite internet services (%), and real-world demand trends across commercial and government users.

- CONTRACTING & REVENUE MIX ANALYSIS – helps you track the share (%) of commercial versus government contracts awarded annually, revealing demand diversification, revenue stability, and dependence on public-sector funding.

- REGULATORY & COMPLIANCE IMPACT ASSESSMENT – helps you measure regulatory approvals issued (%), project delays due to compliance hurdles (%), and evolving insurance coverage trends affecting mission timelines and investment risk.

- WORKFORCE & TALENT AVAILABILITY METRICS – helps you assess employment distribution (%) across regions, growth rate of STEM-related space jobs (%), and the annual pipeline of trained astronauts and skilled professionals supporting sector expansion.

Space Economy Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 447.90 Billion |

| Market Size by 2033 | USD 779.66 Billion |

| CAGR | CAGR of 7.20% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Key Segments | • By Sector (Satellite Manufacturing, Launch Services, Space Tourism, Space Mining, Ground Infrastructure, Space-based Communications, Earth Observation & Remote Sensing, Others) • By Application (Defense & Security, Telecommunications, Navigation, Scientific Research, Commercial Exploration, Space Tourism, Earth Observation, Others) • By End User (Government, Private Companies, Research Institutes, Educational Institutions, Others) • By Technology Type (Reusable Rockets, Propulsion Systems, Space Habitats, Satellites, Space Robotics, Others) • By Price Range (Low, Medium, Premium) • By Distribution Channel (Direct Contracts, Online Services & Platforms, Partnerships & Collaborations, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Access Complete Report Details of Space Economy Market Analysis & Outlook: https://www.snsinsider.com/reports/space-economy-market-8748

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.