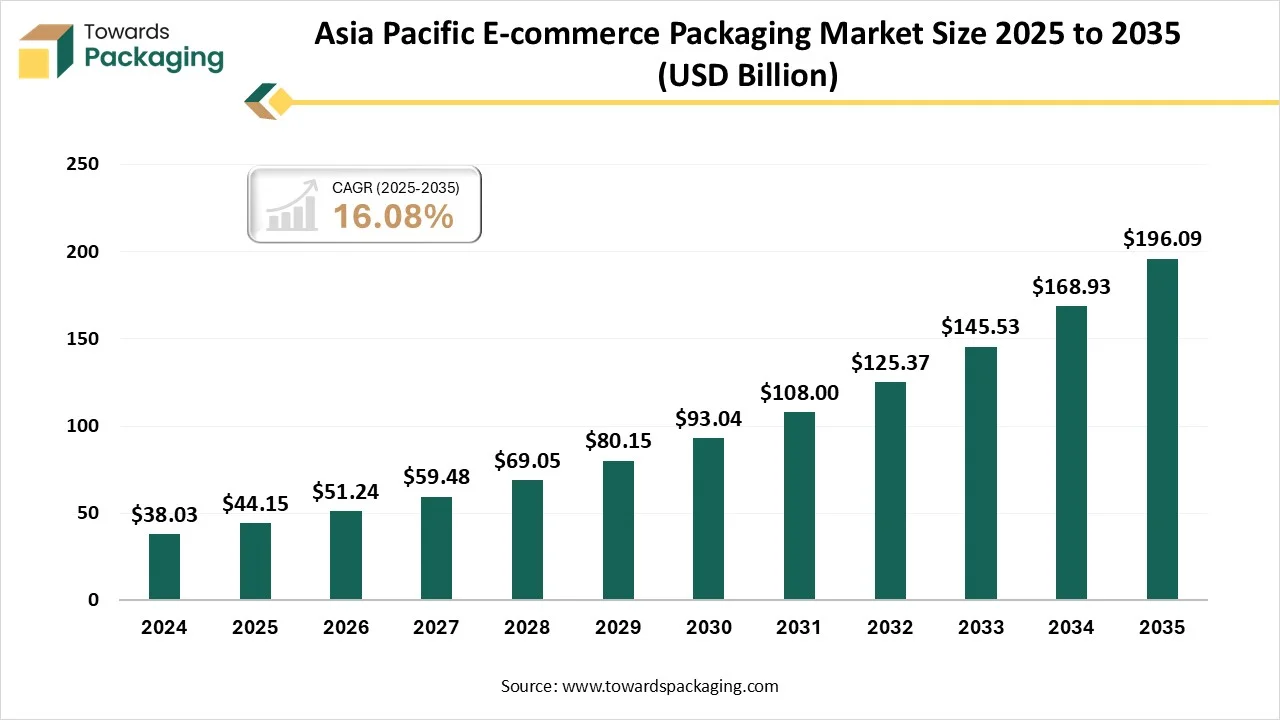

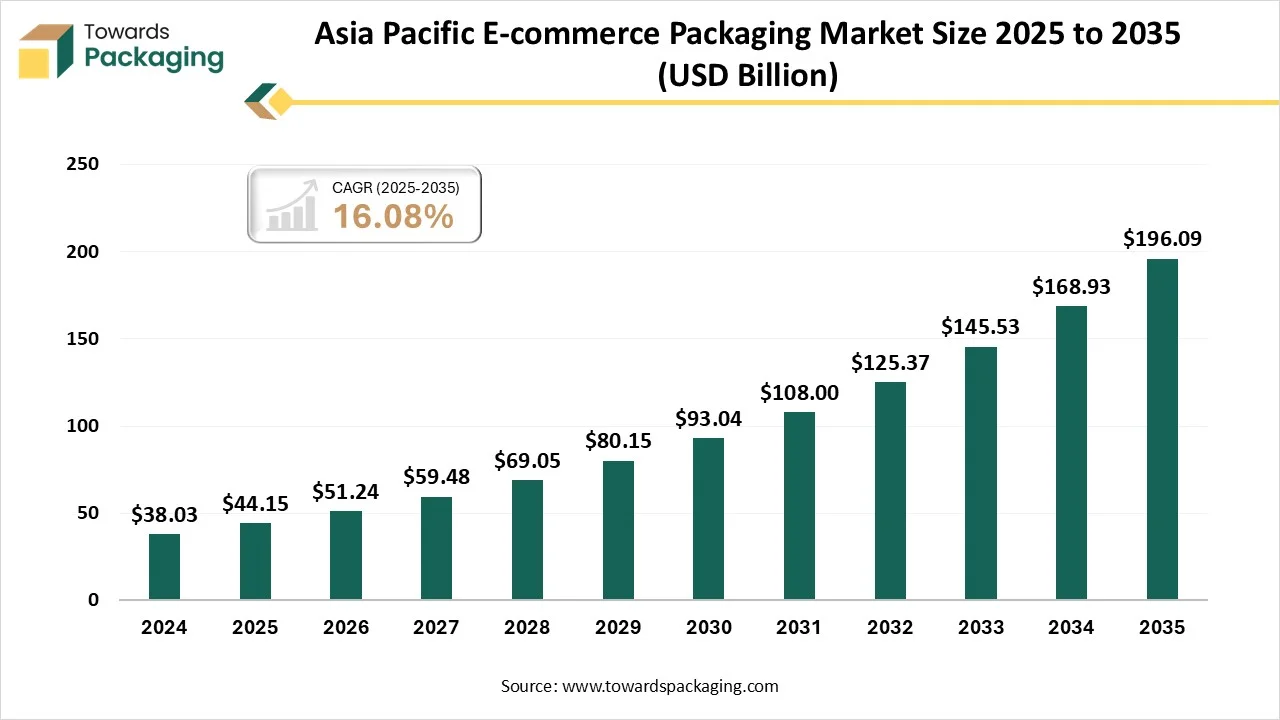

According to researchers from Towards Packaging, the Asia Pacific e-commerce packaging market, estimated at USD 44.15 billion in 2025, is forecast to expand to USD 196.09 billion by 2034, growing at a CAGR of 16.08% over the forecast period.

Ottawa, Jan. 15, 2026 (GLOBE NEWSWIRE) — The Asia Pacific e-commerce packaging market generated revenue of USD 44.15 billion in 2025, and this figure is projected to grow to USD 196.09 billion in 2034, according to research conducted by Towards Packaging, a sister firm of Precedence Research. The Asia-Pacific e-commerce packaging market is expanding rapidly, driven by rising online shopping, increasing internet and smartphone penetration, and growing consumer demand for safe, branded, and sustainable delivery solutions.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is the E-commerce Packaging Market in the Asia Pacific?

The Asia-Pacific e-commerce packaging market is driven by the rapid rise of online shopping across major economies, including China, India, and Southeast Asia, as well as increasing internet and smartphone penetration, growing disposable incomes, and shifting consumer preferences toward safe, sustainable, and branded delivery solutions that enhance the unboxing experience. Demand is also boosted by advances in packaging technology, logistics expansion, and regulatory focus on eco-friendly materials.

E-commerce packaging refers to packaging materials and solutions specifically designed to protect, contain, and present products sold through online retail channels during shipping and delivery. It encompasses boxes, mailers, pouches, protective inserts, labels, and tapes that ensure products arrive safely and undamaged while also supporting cost-efficient logistics and brand identity. Effective e-commerce packaging not only minimizes transit damage but also enhances customer satisfaction with secure fit, ease of opening, and sustainability features.

Asia Pacific Government Initiatives for the E-commerce Packaging Industry:

- China’s Green Packaging Regulations (2025): These rules mandate that express logistics companies phase out non-degradable plastic mailers, tapes, and fillers by June 1, 2025, in favor of recyclable or certified biodegradable alternatives.

- Australia’s National Packaging Targets (2025): This initiative requires 100% of all packaging, including e-commerce boxes and mailers, to be reusable, recyclable, or compostable by the end of 2025.

- India’s E-Commerce Export Hubs (ECEHs): The government is launching five pilot export hubs to support small businesses by providing integrated services like quality certification and standardized sustainable packaging for cross-border trade.

- Vietnam’s Environmental Protection Law (2025 Enforcement): This law enforces specific eco-labeling and reduction targets for consumer packaging, requiring brands to manage and recycle post-consumer waste through a national framework.

- The India Plastics Pact: As Asia’s first such agreement, this public-private initiative unifies major e-commerce players and the government to eliminate unnecessary plastic packaging and ensure all plastic used is 100% recyclable or compostable.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5901

What Are the Latest Key Trends in the Asia Pacific E-commerce Packaging Market?

1. Sustainable and Eco-friendly Packaging – Brands are increasingly adopting recyclable, biodegradable, and compostable materials to meet growing consumer and regulatory demand for reducing environmental impact and plastic waste.

2. Smart Packaging Technologies – Integration of RFID, QR codes, NFC chips, and sensors helps with product tracking, authenticity checks, and enhanced customer engagement throughout the delivery process.

3. Customization and Branding – E-commerce sellers are using customized boxes, branded mailers, and unique unboxing experiences to strengthen brand identity and customer loyalty.

4. Automation and AI-Driven Solutions – Automated packing systems and AI help optimize packaging size, reduce waste, and improve fulfillment efficiency in high-volume e-commerce operations.

5. Flexible and Lightweight Formats – Pouches, bags, and other lightweight solutions are gaining traction due to lower shipping costs and better resource efficiency for diverse product categories.

What is the Potential Growth Rate of the Asia Pacific E-commerce Packaging Industry?

The e-commerce packaging market in the Asia Pacific is driven by the rapid expansion of online retail, as more consumers shop via smartphones and the internet, resulting in an increase in the volume of shipments that require protective and efficient packaging. Rising disposable incomes, urbanization, and changing lifestyles further boost demand for diverse product deliveries.

Consumer preference for sustainable, recyclable, and branded packaging encourages the adoption of eco-friendly solutions. Advances in packaging technology, automation, and smart features improve efficiency and customer experience. Additionally, competitive e-commerce dynamics and regulatory support for green materials contribute to sustained market growth.

Country-Level Analysis:

China E-commerce Packaging Market Trends

China dominates the Asia-Pacific market due to its massive e-commerce ecosystem, high online shopper base, and strong logistics infrastructure. The presence of leading e-commerce platforms, extensive manufacturing capacity, cost-efficient packaging production, and rapid adoption of automation and smart packaging solutions further strengthen China’s leadership in meeting large-scale, fast-delivery demands efficiently.

India E-commerce Packaging Market Trends

India is growing fastest in the Asia-Pacific market due to rapid digital adoption, with increasing internet and smartphone users boosting online shopping demand. Enhanced logistics and supply chain infrastructure, rising consumer expectations for safe, convenient deliveries, and strong eco-friendly packaging initiatives are also key drivers. Local language accessibility and expanding e-commerce reach into smaller cities further accelerate market growth.

South Korea E-commerce Packaging Market Trends

South Korea’s e-commerce packaging market grows notably due to rapid online shopping adoption, high internet and smartphone usage, and tech-savvy consumers demanding secure, efficient packaging solutions. Urban lifestyles and busy consumers boost demand for convenient deliveries, while sustainable, recyclable materials and customization for sectors like beauty and electronics further drive packaging innovation and market expansion.

More Insights of Towards Packaging:

- PCR Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Baby Food Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Personal Care Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Food Service Packaging Market by Product, End-User, Region, and Key Manufacturers, Competitive Dynamics and Trends

- Luxury Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Recyclable mono-material PE Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Europe Pharmaceutical Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Europe Flexible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Sustainable Wipe Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Microplastic Recycling Market Size, Trends, Segments and Competitive Analysis, 2025-2035

- Packaging Market Size, Trends, Segments, Competitive Analysis, Regional Dynamics with Manufacturers and Suppliers Data 2035

- Pharmaceutical Plastic Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Single-use Packaging Market Size, Segments, and Regional Dynamics (North America, Europe, APAC, LA, MEA)

- Alcoholic Beverage Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Form-Fill-Seal Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Pet Care Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Refillable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Dairy Product Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Hermetic Packaging Market Size, Segmentation, and Competitive Insights (2024-2034)

- Consumer Packaged Goods (CPG) Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

Segment Analysis

Product Type Insights

What Made the Boxes & Cartons Segment Dominant in the Asia Pacific E-commerce Packaging Market in 2024?

The boxes and cartons dominate the Asia-Pacific market due to their strong protection, stackability, and suitability for a wide range of products, including electronics, apparel, and consumer goods. Their compatibility with automation, ease of branding, recyclability, and ability to withstand long-distance shipping further support widespread adoption across regional e-commerce supply chains.

The pouches and bags segment is the fastest-growing in the market due to a lightweight design that reduces shipping costs, flexibility for diverse product sizes, and rising demand for eco-friendly materials. Their convenience, lower material usage, and suitability for fashion, accessories, and small goods appeal to both sellers and consumers, accelerating adoption across online retail channels.

Material Type Insights

How the Paper & Paperboard Dominated the Asia Pacific E-commerce Packaging Market in 2024?

The paper & paperboard dominate the Asia-Pacific market due to their recyclability, biodegradability, and strong regulatory support for sustainable materials. They offer excellent printability for branding, sufficient strength for product protection, cost effectiveness, and compatibility with automated packing systems, making them widely preferred by e-commerce companies across diverse product categories.

The plastic segment is the fastest-growing in the Asia-Pacific market because plastics offer lightweight, durable, and low-cost protection that withstands transit stresses for fragile online orders. Their versatility for films, mailers, and flexible formats reduces shipping weight and cost, while ongoing material innovations improve barrier and handling performance, boosting adoption across sectors like electronics and consumer goods.

End Use Industry Insights

What made the Retail & Consumer Goods Segment Dominant in the Asia Pacific E-commerce Packaging Market in 2024?

The retail & consumer goods segment dominates the market due to high online demand for fashion, electronics, beauty, and everyday products, requiring reliable protection and presentation. Wide product variety, frequent purchases, and consumer expectations for brand experience drive extensive use of customized, secure packaging in this segment.

The food & beverages segment is the fastest-growing in the market because online grocery and meal delivery expansion boosts demand for freshness-preserving, tamper-evident, and hygienic packaging. Rising urbanization, disposable incomes, and preference for convenient, ready-to-eat foods increase the need for protective, lightweight solutions that ensure safe transit and product quality.

Distribution Channel Insights

What Made the Direct-To-Consumer E-Commerce Platforms Segment Dominant in the Asia Pacific E-commerce Packaging Market in 2024?

The direct-to-consumer e-commerce platform segment dominates the market because brands sell directly online, driving high volumes of deliveries requiring tailored packaging. Strong consumer engagement, personalized unboxing experiences, and control over branding and sustainability choices further boost demand for customized packaging solutions through these platforms.

The third-party e-commerce platform segment is the fastest-growing in the Asia-Pacific market due to the surge in multi-brand online marketplaces. These platforms enable smaller retailers to reach wider audiences, increasing demand for standardized, protective, and efficient packaging solutions that ensure safe delivery and enhance customer experience across diverse product categories.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Asia Pacific E-commerce Packaging Industry

- In October 2025, Packaging solutions provider NPAC, through its partner Ranpak Holdings, launched the FillPak Mini automated paper fill solutions machine in October 2025, offering Asia-Pacific customers a compact, sustainable void fill system designed for space-constrained e-commerce packing stations. The FillPak Mini delivers versatile operating modes with intuitive controls, supporting efficient, eco-friendly packaging operations and enhanced productivity across regional e-commerce fulfillment centers.

- In July 2025, Tetra Pak expanded its Asia-Pacific footprint with the inauguration of an upgraded aseptic carton packaging line at its Binh Duong facility in Vietnam. The expansion, unveiled in July 2025, introduces a second production line that more than doubles capacity and adds 15 new packaging formats, boosting sustainable support for regional food and beverage producers and meeting rising market demand.

Top Companies in the Asia Pacific E-commerce Packaging Market & Their Offerings:

Tier 1:

- Berry Global provides plastic containers, closures, and dispensing solutions, including Amazon APASS-certified e-commerce packaging.

- Sealed Air Corporation offers a variety of rigid packaging solutions and is a major participant in the APAC market, focusing on innovation and sustainability initiatives.

- Mondi Group provides a full portfolio of paper-based e-commerce solutions, including corrugated boxes, paper mailers, and specialty barrier papers.

- Huhtamaki Oyj offers sustainable molded fiber and flexible packaging solutions (blueloop™) across food service, consumer goods, and healthcare markets in India and beyond.

- Sonoco Products Company specializes in rigid paper containers, tubes and cores, and protective packaging, using 100% recycled fiber materials for sustainable solutions.

- Silgan Holdings manufactures sustainable rigid packaging, including dispensing and specialty closures, metal containers, and custom plastic containers, with plants in Asia.

- ALPLA offers a wide range of high-quality plastic packaging solutions through its ten manufacturing plants in India for various markets like personal care and food.

- Plastipak Packaging specializes in a wide range of proprietary PET packaging technologies and sustainable solutions, including aerosol, barrier, and hotfill containers.

Tier 2:

- Constantia Flexibles

- CCL Industries

- Winpak Ltd

- Coveris

- SCG Packaging Plc

- RENGO Co. Ltd

- NIPPON PAPER INDUSTRIES

- Kerry Logistics

- SF Express

Segment Covered in the Report

By Product Type

- Boxes & Cartons

- Rigid Boxes

- Folding Cartons

- Pouches & Bags

- Stand-up Pouches

- Flat Pouches

- Tubes & Cylindrical Packaging

- Tube Packaging

- Capsule Tubes

- Mailer Envelopes

- Bubble Mailers

- Padded Envelopes

- Other Packaging Solutions

- Labels & Tags

- Protective Wraps

By Material Type

- Paper & Paperboard

- Plastics

- Biodegradable / Compostable Materials

- Metal & Aluminum Packaging

- Others

By End-Use Industry

- Retail & Consumer Goods

- Food & Beverages

- Healthcare & Pharmaceuticals

- Electronics & Appliances

- Others

By Distribution Channel

- Direct-to-Consumer E-commerce Platforms

- Third-Party E-commerce Platforms

- Offline / Retail Channel Support

- Others

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5901

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight – Check It Out:

- Thin Wall Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Dunnage Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Retail Ready Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Blister Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Cold Chain Packaging Refrigerants Market Size, Segments, Regional Data, and Competitive Landscape Analysis

- Packaging Adhesive Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Stick Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Metalized Flexible Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Thermoform Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Vacuum Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Food Packaging Technology and Equipment Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Automated Bagging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- U.S. Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Packaging Materials Market Size, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Packaging Waste Management Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

- Sustainable Plastic Packaging Market Size, Trends, and Growth Forecast 2025-2035

- Recyclable Plastic Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Plastic Recycling Services Market Size, Regional Insights (NA, EU, APAC, LA, MEA), Trade & Manufacturer Data 2035

- Digital Printing Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Feed Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.