Tuberculosis Diagnostics Market to Worth USD 6.42 Billion by 2034

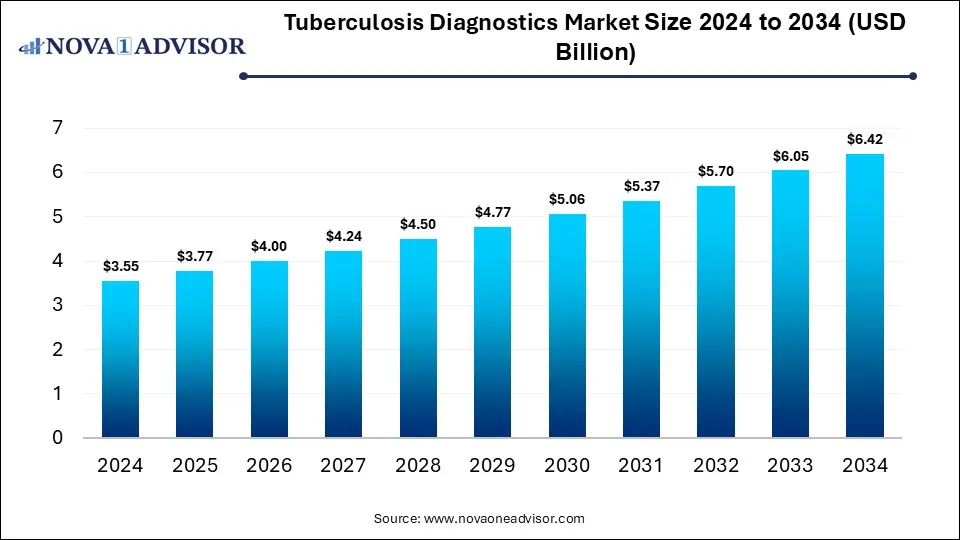

According to Nova One Advisor, the global tuberculosis diagnostics size is calculated at USD 3.77 billion in 2025 and is expected to be worth around USD 6.42 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.1% over the forecast period 2025 to 2034. A study published by Nova One Advisor a sister firm of Precedence Research.

Ottawa, Nov. 07, 2025 (GLOBE NEWSWIRE) — The global tuberculosis diagnostics market size is calculated at USD 3.55 billion in 2024, grows to USD 3.77 billion in 2025, and is projected to reach around USD 6.42 billion by 2034. The market is projected to expand at a CAGR of 6.1% between 2025 and 2034. The market is growing due to increasing TB prevalence, especially in developing countries, and the rising adoption of advanced molecular diagnostic technologies.

Tuberculosis Diagnostics Market Key Takeaways

- Asia Pacific dominated the tuberculosis diagnostics market with a revenue share in 2024.

- The Middle East & Africa is expected to grow at the fastest CAGR in the market during the forecast period.

- By test type, the nucleic acid testing segment led the market with the largest revenue share in 2024.

- By test type, the detection of drug resistance segments is expected to grow at the fastest CAGR in the market during the forecast period.

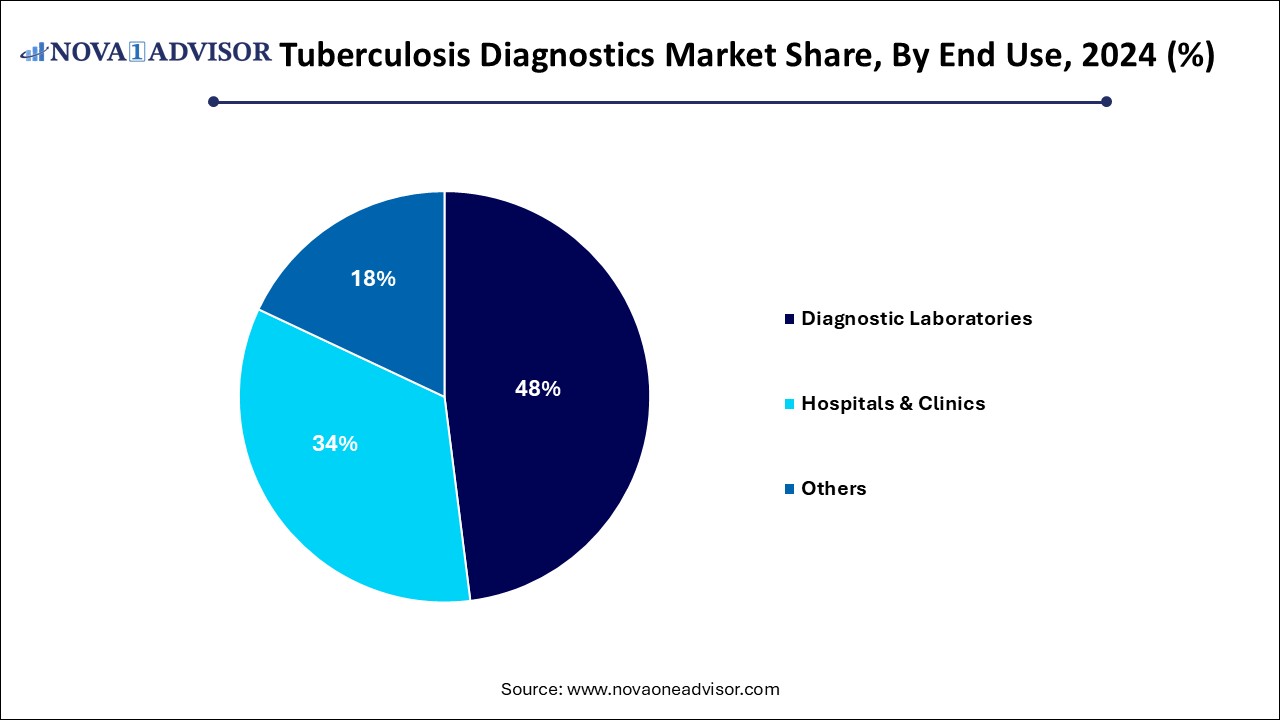

- By end use, the hospitals and clinics segment dominated the market with a major revenue share.

- By end use, the diagnostic laboratories segment is expected to grow at the fastest CAGR in the market during the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/8766

What is Tuberculosis Diagnostics?

The tuberculosis diagnostics market is growing due to rising TB cases and increasing adoption of advanced diagnostic technologies. The market is witnessing significant growth due to the rising incidence of TB globally and the growing demand for early and accurate detection. Advancements in molecular and point-of-care diagnostic technologies are enhancing test accuracy and speed. Additionally, supportive government programs, increased healthcare spending, and awareness campaigns by global health organizations are driving market expansion. These factors collectively contribute to the strong growth of the market.

- For Instance, As per the Global Tuberculosis Report 2024, around 10.8 million new TB cases were reported in 2023, which equals nearly 134 cases per 100,000 people worldwide.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/8766

Tuberculosis Diagnostics Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 3.77 billion |

| Revenue forecast in 2034 | USD 6.42 billion |

| Growth rate | CAGR of 6.1% from 2025 to 2034 |

| Historical data | 2018 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Test type, End use, Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key companies profiled | Abbott; QIAGEN; Thermo Fisher Scientific Inc.; BD, F. Hoffmann-La Roche AG; Hologic, Inc.; Cepheid; DiaSorin S.p.A.; Hain Lifescience GmbH; Oxford Immunotec |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

Why it’s important to diagnose TB

Not everyone infected with TB germs becomes sick. As a result, two TB-related conditions exist: inactive TB and active TB disease.

Treatment options are available for both inactive TB and active TB disease.

If you are diagnosed with inactive TB, there are treatments available that can help protect you from getting sick with active TB disease.

People with active TB disease may be able to spread the germs to people they spend time with every day. Without treatment, active TB disease can be fatal.

When to get tested

You may need a TB test if you have:

- Symptoms of TB disease

- Spent time with someone who has active TB disease

- Factors that put you at higher risk for developing active TB disease

- Employment, school, travel, or immigration health screening requirements

Medical Evaluation for TB Disease

A healthcare provider determines whether a person has inactive TB (latent TB infection) or active TB disease using several diagnostic steps.

1. Medical History

The provider will ask about:

- Current symptoms of TB (e.g., persistent cough, fever, night sweats, weight loss)

- Contact with anyone diagnosed with TB

- Previous positive TB tests

- Past TB treatment or diagnosis

- Risk factors (e.g., HIV infection, immunosuppression, travel or residence in high TB-burden areas)

2. Physical Examination

A thorough examination helps:

- Assess general health

- Identify symptoms related to TB

- Detect other conditions that may influence TB diagnosis or treatment

3. Tests for TB Infection

There are two main tests:

a. TB Blood Test (IGRA)

- Detects immune response to TB proteins in blood.

- Preferred for those who received the BCG vaccine, as it’s not affected by vaccination.

b. TB Skin Test (TST)

- Small amount of testing material injected under the skin.

- Requires a follow-up visit after 48–72 hours to check for a reaction.

4. Interpreting Test Results

- Positive Result: Indicates TB germs are present; additional tests (chest x-ray, sputum test) are required to determine whether the infection is active or inactive.

- Negative Result: Suggests no TB infection, but further evaluation may be needed if symptoms are present or if the person is at high risk (e.g., HIV-positive, recent exposure).

5. Chest X-ray

Used primarily to detect TB disease in the lungs — the most common site of infection.

6. Laboratory Tests

Common tests include:

- Sputum smear and culture (typically 3 samples)

- Drug susceptibility testing to determine which antibiotics are effective

- Additional samples (urine, tissue biopsy) if TB is suspected outside the lungs

Diagnosis Outcomes

Inactive TB (Latent TB Infection)

- TB germs are present but not causing illness or contagiousness.

- No symptoms.

- Treatment recommended to prevent progression to active TB.

Active TB Disease

- TB germs are multiplying and causing illness.

- Symptoms are present.

- Contagious and requires multi-drug therapy.

Treatment

Inactive TB

- Short, convenient treatment regimens available.

- Prevents progression to active TB.

- Easier to treat due to fewer bacteria.

Active TB Disease

- Requires a combination of several antibiotics.

- Duration: 4–6 months or longer.

- Full adherence to prescribed medication is critical to prevent relapse and drug resistance.

What are the Major Drivers in the Tuberculosis Diagnostics Market?

Rising global TB incidence, increasing demand for rapid and accurate diagnostic methods, and advancements in molecular and point-of-care testing technologies. Additionally, government initiatives, improved healthcare infrastructure, and growing awareness about early disease detection and prevention are boosting market growth. Support from global health organizations further accelerates the adoption of advanced TB diagnostic solutions.

What are the Key trends in the Tuberculosis Diagnostics Market in 2024?

- In November 2024, QIAGEN collaborated with McGill University’s Centre for Microbiome Research to advance microbiome research and innovation. This partnership is expected to strengthen QIAGEN’s presence in the North American microbiome research market, valued at around USD 1.8 billion.

- In April 2024, Revvity, Inc. launched the Auto-Pure 2400 liquid handler from Allsheng to enhance the T-SPOT.TB test process. Designed for ease of use and efficiency, the system streamlines lab operations while combining the Auto-Pure 2400’s productivity with the T-SPOT.TB test’s precision benefits laboratories, healthcare providers, and patients alike.

What is the Appearing Challenge in the Tuberculosis Diagnostics Market?

Limited access to advanced testing in low-income regions due to high costs and inadequate healthcare infrastructure. Additionally, the presence of drug-resistant TB strains, lack of skilled professionals, and delays in diagnosis hinder effective disease management. Inconsistent screening programs and limited awareness in remote areas further restrict market growth and early detection efforts.

Segmental Insights

By Test Type Insights

What made the Nucleic Acid Testing Segment Dominant in the Tuberculosis Diagnostics Market in 2024?

In 2024, the nucleic acid testing segment accounted for the highest revenue in the market due to its efficiency in detecting TB bacteria and drug resistance with high precision. The increasing use of automated molecular systems, along with the rising focus on early and accurate diagnosis, has strengthened its demand. Moreover, ongoing research and government-backed screening programs. Have further supported the market leadership.

The detection of drug-resistant tuberculosis segment is anticipated to witness the fastest growth during the forecast period, owing to the increasing burden of resistant TB strains and the need for timely diagnosis to guide effective treatment. The growing use of advanced molecular assays, rising investments in TB control programs, and expanding access to rapid diagnostic tools are further driving the demand for drug-resistance detection tests globally.

By End User Insights

How did Hospitals and Clinics Segment Dominate the Tuberculosis Diagnostics Market in 2024?

The hospitals and clinics segment dominated the market with the largest revenue share due to high patient inflow and availability of advanced diagnostic infrastructure. These facilities are often the primary centers for TB screening, diagnosis, and treatment, supported by skilled healthcare professionals and government-funded programs. Additionally, the growing integration of rapid molecular testing and improved laboratory setups within hospitals and clinics further enhanced their role in accurate and timely TB diagnosis.

The diagnostic laboratories segment is projected to grow at the fastest CAGR during the forecast period due to rising demand for accurate, large-scale TB testing and the availability of advanced molecular diagnostic equipment. Increasing collaborations between public health agencies and private labs, along with expanding the laboratory network in developing regions, are enhancing accessibility. Additionally, the shift towards automated, high-throughput testing and cost-effective diagnostic services further drives the segment’s rapid growth.

By Regional Insights

How is Asia Pacific contributing to the Expansion of the Tuberculosis Diagnostics Market?

Asia-Pacific dominated the market in 2024 due to the region’s high TB prevalence, particularly in countries like India, China, and Indonesia. Strong government initiatives, improved healthcare infrastructure, and increased funding for TB control programs have supported widespread diagnostic adoption. Additionally, growing awareness about early detection, rising investments in molecular testing technologies, and the presence of key diagnostic players have further strengthened the region’s market dominance.

How is the Middle East & Africa Accelerating the Tuberculosis Diagnostics Market?

The Middle East and Africa region is expected to grow at the fastest CAGR in the tuberculosis diagnostics market during the forecast period due to the rising incidence of

TB, especially in low- and middle-income countries. Increasing government efforts to improve disease surveillance, expand access to advanced diagnostic technologies, and strengthen healthcare infrastructure are key growth drivers. Additionally, global health organizations support and growing awareness about early TB detection further boost market expansion in the region.

Tuberculosis Diagnostics Market Top Key Companies:

- Abbott

- QIAGEN

- Thermo Fisher Scientific Inc.

- BD

- F. Hoffmann-La Roche AG

- Hologic, Inc.

- Cepheid

- DiaSorin S.p.A.

- Hain Lifescience GmbH

- Oxford Immunotec

Recent Developments in the Tuberculosis Diagnostics Market

- In April 2025, the World Health Organization (WHO) released the “WHO Consolidated Guidelines on Tuberculosis: Module 3 – Diagnosis” to help nations and health agencies enhance TB detection and improve diagnostic practices worldwide.

- In May 2024, BD introduced the “TB Guardianship Program” to educate healthcare professionals on advanced TB diagnostic and drug susceptibility testing methods. Conducted in collaboration with key organizations such as the Indian Chest Society, Central TB Division, The Union, Corporate TB Pledge, and USAID, the initiative aims to strengthen awareness and improve diagnostic capabilities through a structured, multi-part training series.

More Insights in Nova One Advisor:

- Veterinary Clinical Chemistry Diagnostics Market – The global veterinary clinical chemistry diagnostics market size is calculated at USD 2.85 billion in 2024, grows to USD 3.10 billion in 2025, and is projected to reach around USD 6.57 billion by 2034, growing at a CAGR of 8.71% from 2025 to 2034.

- U.S. Veterinary Clinical Chemistry Diagnostics Market – The U.S. veterinary clinical chemistry diagnostics market size is calculated at USD 764.75 million in 2024, grows to USD 819.89 million in 2025, and is projected to reach around USD 1,534.17 million by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

- Neurodiagnostics Market – The global neurodiagnostics market size was valued at USD 19.35 billion in 2024 and is anticipated to reach around USD 26.28 billion by 2034, growing at a CAGR of 3.11% from 2025 to 2034.

- Heart Attack Diagnostics Market – The global heart attack diagnostics market size was valued at USD 13.76 billion in 2024 and is anticipated to reach around USD 31.40 billion by 2034, growing at a CAGR of 8.6% from 2025 to 2034.

- Primary Care POC Diagnostics Market – The global primary care POC diagnostics market size was valued at USD 27.25 billion in 2024 and is anticipated to reach around USD 213.16 billion by 2034, growing at a CAGR of 22.84% from 2025 to 2034.

- U.S. Gastric Cancer Diagnostics Market – The U.S. gastric cancer diagnostics market size is calculated at USD 489.45 million in 2024, grows to USD 524.15 million in 2025, and is projected to reach around USD 970.95 million by 2034, and growing at a CAGR of 7.09% from 2025 to 2034.

- In Vitro Diagnostics Contract Manufacturing Market – The global in vitro diagnostics contract manufacturing market size was valued at USD 23.25 billion in 2024 and is anticipated to reach around USD 63.68 billion by 2034, growing at a CAGR of 10.6% from 2025 to 2034.

- Alzheimer’s Disease Diagnostics Market – The global Alzheimer’s disease diagnostics market size is calculated at USD 8.95 billion in 2024, grows to USD 9.94 billion in 2025, and is projected to reach around USD 25.53 billion by 2034, growing at a CAGR of 11.05% from 2025 to 2034.

- Home Diagnostics Market – The global home diagnostics market size is calculated at USD 6.95 billion in 2024, grows to USD 7.33 billion in 2025, and is projected to reach around USD 11.87 billion by 2034, expanding at a CAGR of 5.5% from 2025 to 2034.

- Smart Diagnostics And Monitoring Devices Market – The Smart Diagnostics And Monitoring Devices Market size was exhibited at USD 13.84 billion in 2024 and is projected to hit around USD 141.37 billion by 2034, growing at a CAGR of 26.16% during the forecast period 2025 to 2034.

- In Vitro Diagnostics Market – The in vitro diagnostics market size was exhibited at USD 80.85 billion in 2024 and is projected to hit around USD 157.56 billion by 2034, growing at a CAGR of 6.9% during the forecast period 2024 to 2034.

- Allergy Diagnostics Market – The Allergy Diagnostics Market size was exhibited at USD 6.75 billion in 2024 and is projected to hit around USD 18.17 billion by 2034, growing at a CAGR of 10.41% during the forecast period 2025 to 2034.

- Saliva Collection And Diagnostics Market – The saliva collection and diagnostics market size was exhibited at USD 818.15 million in 2024 and is projected to hit around USD 1,307.51 million by 2034, growing at a CAGR of 4.8% during the forecast period 2024 to 2034.

- CRISPR-Based Diagnostics Market – The CRISPR-based diagnostics market size was exhibited at USD 3.65 billion in 2024 and is projected to hit around USD 16.94 billion by 2034, growing at a CAGR of 16.59% during the forecast period 2025 to 2034.

- Europe In Vitro Diagnostics Market – The Europe in vitro diagnostics market size was exhibited at USD 26.98 billion in 2024 and is projected to hit around USD 29.22 billion by 2034, growing at a CAGR of 0.8% during the forecast period 2025 to 2034.

- Canada In Vitro Diagnostics Market – The Canada in vitro diagnostics market size was exhibited at USD 3.74 billion in 2024 and is projected to hit around USD 4.88 billion by 2034, growing at a CAGR of 2.7% during the forecast period 2025 to 2034.

- Autoimmune Disease Diagnostics Market – The autoimmune disease diagnostics market size was exhibited at USD 5.85 billion in 2023 and is projected to hit around USD 10.68 billion by 2033, growing at a CAGR of 6.2% during the forecast period 2024 to 2033

Tuberculosis Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Tuberculosis Diagnostics market.

By Type

- Nucleic Acid Testing

- Detection of Latent Infection (Skin Test & IGRA)

- Detection of Drug Resistance (DST)

- Other Methods

- Phage Assay

- Cytokine Detection Assay

- Diagnostic Laboratory Methods

- Radiographic Method

- Other Methods

By End Use

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/8766

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.