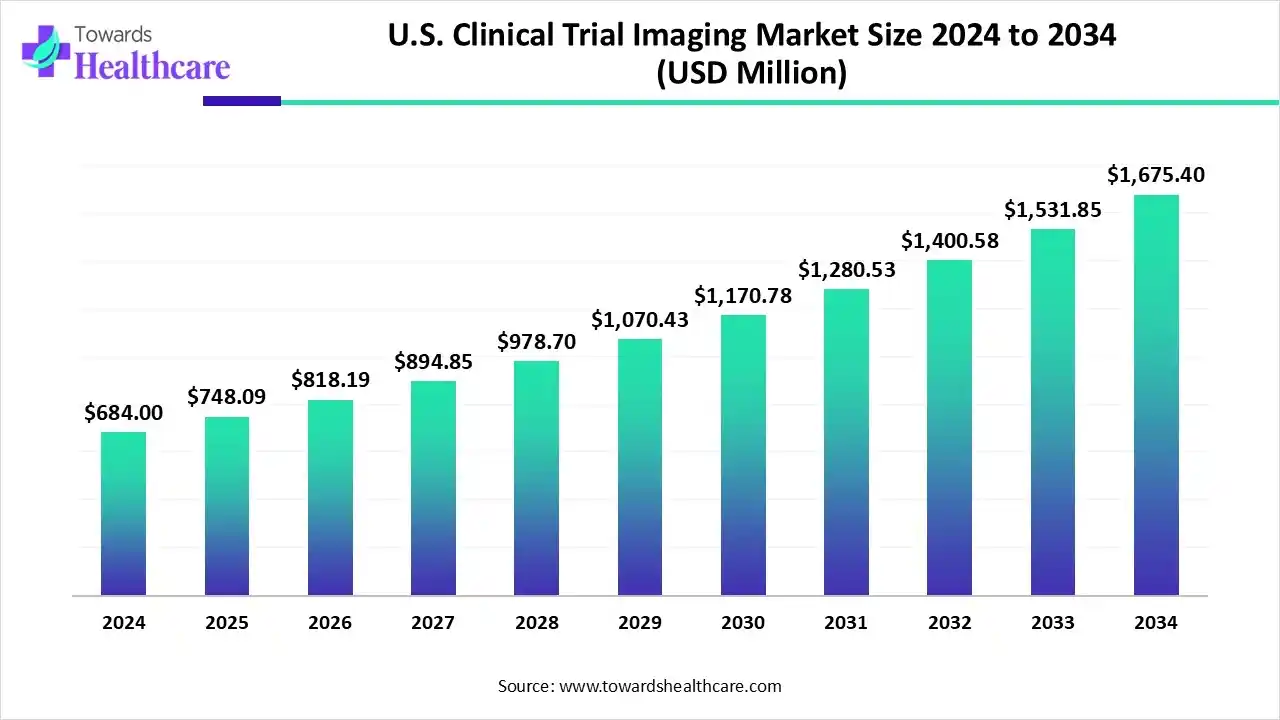

U.S. Clinical Trial Imaging Market to Worth USD 1,675.4 Million by 2034, Growing at 9.37% CAGR

The U.S. clinical trial imaging market size is calculated at USD 748.09 million in 2025 and is expected to reach around USD 1675.4 million by 2034, growing at a CAGR of 9.37% for the forecasted period.

Ottawa, Nov. 11, 2025 (GLOBE NEWSWIRE) — The U.S. clinical trial imaging market size was valued at USD 684 million in 2024 and is predicted to hit around USD 1675.4 million by 2034, rising at a 9.37% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6255

Key Takeaways

- The U.S. clinical trial imaging sector pushed the market to USD 684 million by 2024.

- Long-term projections show a USD 1675.4 million valuation by 2034.

- Growth is expected at a steady CAGR of 9.37% between 2025 to 2034.

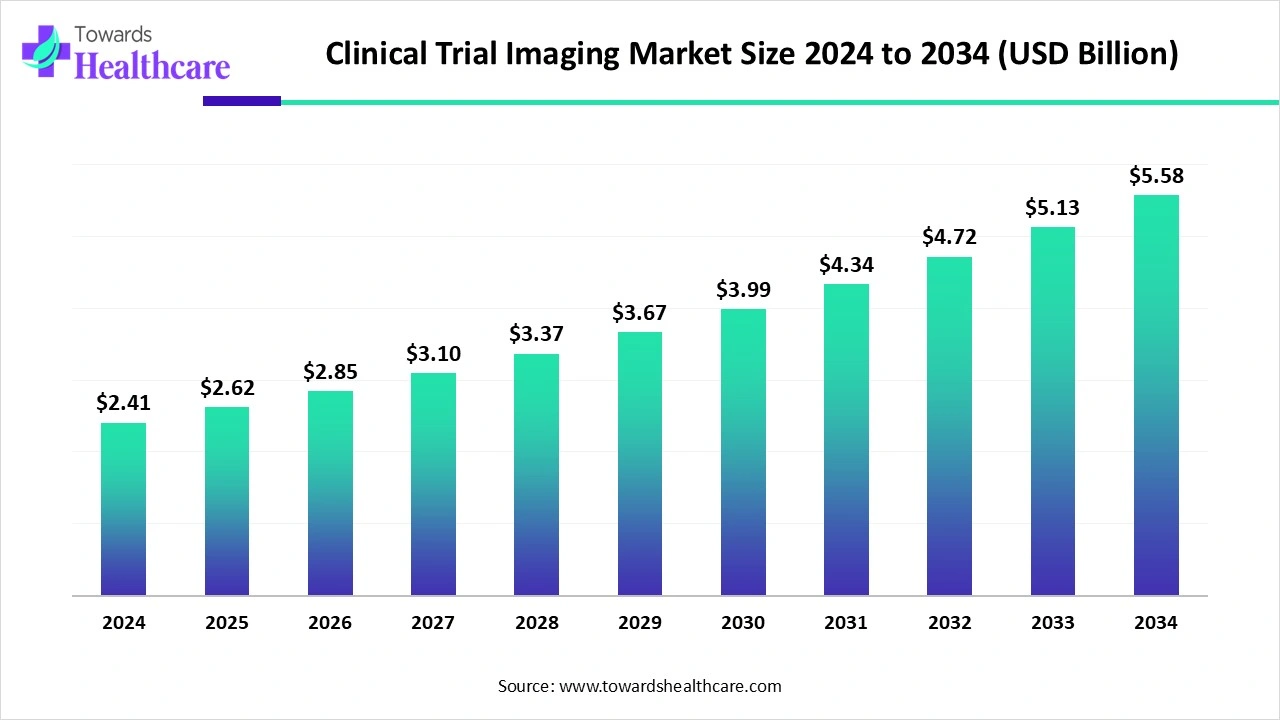

- The global clinical trial imaging market is set to grow from US$2.41 billion in 2024 to US$5.58 billion by 2034, at a CAGR of 8.8%.

- The Northeast U.S. was dominant in the market in 2024.

- The West Coast is expected to grow at the fastest CAGR during 2025-2034.

- By modality, the magnetic resonance imaging (MRI) segment held a major revenue share of the market in 2024.

- By modality, the positron emission tomography (PET) segment is expected to witness rapid expansion in the coming years.

- By therapeutic area, the oncology segment led the U.S. clinical trial imaging market in 2024.

- By therapeutic area, the neurology segment is expected to grow rapidly in the predicted timeframe.

- By technology/service type, the image analysis & interpretation segment accounted for the largest revenue share of the market in 2024.

- By technology/service type, the imaging CRO services segment is expected to register the fastest growth in the studied years.

- By end user, the pharmaceutical & biotechnology companies segment dominated the market in 2024.

- By end user, the contract research organizations (CROs) segment is expected to grow fastest during 2025-2034.

What are the Emerging Advances in the U.S. Clinical Trial Imaging?

The market prominently comprises the utilization of medical imaging solutions such as MRI, CT, and PET, with a particular acquiring of treatment’s effect. Involvement of crucial drivers is a rise in the use of imaging biomarkers, regulatory support for quantitative imaging, and the expansion of contract research organizations (CROs). Currently, the leading players are advancing optical coherence tomography (OCT), mainly in ophthalmology trials, due to its micrometer-resolution imaging of the retina. Alongside, ongoing breakthroughs in hybrid imaging technologies, especially combined PET/MRI scanners, are also fostering the overall market progression in the US.

Key Indicators and Highlights

| Table | Scope | |

| Market Size in 2025 | USD 748.09 Million | |

| Projected Market Size in 2034 | USD 1675.4 Million | |

| CAGR (2025 – 2034) | 9.37 | % |

| Market Segmentation | By Modality, By Therapeutic Area, By Technology/Service Type, By End User | |

| Top Key Players | ICON plc, Parexel International, Medpace Holdings, BioTelemetry, Radiant Sage, Bioclinica, PAREXEL Informatics, Invicro LLC, WorldCare Clinical, IXICO plc, Intrinsic Imaging LLC, Clario, Siemens Healthineers Clinical Trials Imaging, GE Healthcare Clinical Research Imaging, Perceptive Informatics, BioTel Research, Prism Clinical Imaging, PAREXEL Medical Imaging, Resonance Health Ltd., Keosys Medical Imaging, ICON plc, Parexel International, Medpace Holdings, BioTelemetry, Radiant Sage, Bioclinica, PAREXEL Informatics, Invicro LLC, WorldCare Clinical, IXICO plc, Intrinsic Imaging LLC, Clario, Siemens Healthineers Clinical Trials Imaging, GE Healthcare Clinical Research Imaging, Perceptive Informatics, BioTel Research, Prism Clinical Imaging, PAREXEL Medical Imaging, Resonance Health Ltd., Keosys Medical Imaging | |

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

What are the Major Drivers in the U.S. Clinical Trial Imaging Market?

Specifically, the US is encouraging modernization of clinical trials, mainly in oncology, which highly demands accurate, quantifiable endpoints for patient stratification and result assessment. For this, advanced imaging techniques are employed, such as MRI & CT scans. Other technological advances in imaging modalities, software, and AI analytics are allowing rapid, more precise, and more reliable data collection of trials.

What are the Key Drifts in the U.S. Clinical Trial Imaging Market?

- In September 2025, Algernon Pharma secured $4M non-dilutive deal to unveil the U.S. neuroimaging clinics for Alzheimer’s.

- In April 2025, Yunu, provider of transformative clinical trials imaging workflow solutions, secured an investment empowered by Spring Mountain Capital.

- In June 2025, Brainomix, an innovator in stroke artificial intelligence (AI) imaging solutions, and 3DR Labs partnered to assist acute stroke care in the US through the clinically validated and FDA-cleared Brainomix 360 Stroke.

What is the Developing Limitation in the U.S. Clinical Trial Imaging Market?

Mainly, the increasing need for the highest investment in equipment, including PET and MRI scanners, and the requirement for professionals are creating a hindrance to the market expansion, especially for small companies. Also, the management of large datasets, ensuring data security, and maintenance of standardization at different locations present crucial logistical and technical barriers.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Country Analysis

How did the Northeast U.S. Dominate the Market in 2024?

In 2024, the Northeast U.S. held the biggest share of the market. The presence of a pharmaceutical and biotechnology companies hub, along with ongoing vital R&D investment is mainly promoting the innovations in the respective region. Nowadays, the market is leveraging the widespread developments in the integrated artificial intelligence (AI), the application of cloud-based data management, and the growth of decentralized clinical trials (DCTs), specifically in therapeutic areas like oncology and neurology.

Why did the West Coast Grow Notably in the U.S. Clinical Trial Imaging Market in 2024?

In the upcoming years, the West Coast will expand rapidly in the market. The market will be fueled by the presence of contract research organizations (CROs) in this country, like IQVIA and Icon plc, which are widely involved in the unification of advanced imaging data into the wider clinical data ecosystems, and have raised emphasis on AI & cloud approaches. Recent efforts, including the “Clinical Trials in Oncology West Coast 2024” event in San Francisco and the 2025 event in Burlingame, CA, are examples where discussion and showcasing of innovative developments have merged with the participation of Ergomed CRO.

U.S. Clinical Trial Imaging Market: Notable Efforts in 2023-2025

| “PRIMED-AI” program | In March 2025, NIH Common Fund activated this to allow precision medicine coupled with AI by integrating with clinical imaging and multimodal data. |

| FDA | In January 2025, it issued draft guidance on “Considerations for the Use of Artificial Intelligence to Support Regulatory Decision-Making for Drug and Biological Products”. |

| Clinical Trials Innovation Unit (CTIU) | In 2023, developed by NCI, which is “pressure testing” numerous innovations in trial design and conduct, such as technologies and processes. |

Global Clinical Trial Imaging Market Growth

The global clinical trial imaging market was valued at US$ 2.41 billion in 2024 and is projected to grow to US$ 2.62 billion in 2025, reaching US$ 5.58 billion by 2034, expanding at a CAGR of 8.8% during the forecast period.

To invest in our premium strategic solution and customized market report options, click here: https://www.towardshealthcare.com/checkout/6164

Segmental Insights

By modality analysis

Which Modality Led the U.S. Clinical Trial Imaging Market in 2024?

The magnetic resonance imaging (MRI) segment captured the dominating share of the market in 2024. Emerging advances and benefits of this modality, such as high-resolution, non-ionising soft-tissue imaging, are making it necessary for monitoring the growth in trials for neurological, oncological, and cardiovascular concerns. The recent developments encompass the unveiling of the use of 7 Tesla (7T) MRI scanners in clinical trials, and Siemens Healthineers introduced the Magnetom Terra 7T for brain and knee imaging.

Moreover, the positron emission tomography (PET) segment is anticipated to grow at a rapid CAGR. Currently, the market is bolstering advances in hybrid solutions, such as the combination of PET’s metabolic information with MRI’s anatomical clarity or CT’s anatomical detail, which expands diagnostic accuracy. The US leaders have developed and emphasized long axial field of view (LAFOV) or total-body PET systems (e.g., uEXPLORER, Panorama GS). Those facilitated increased image clarity, enhanced sensitivity, minimal scan times, and reduced radiation doses, also further allowing comprehensive whole-body diagnostics in a single session.

By therapeutic area analysis

What Made the Oncology Segment Dominant in the Market in 2024?

In 2024, the oncology segment led with a major share of the U.S. clinical trial imaging market. The US is facing a huge rise in cancer cases, and an expanded shift towards tailored and targeted therapies in oncology is boosting demand for sophisticated imaging.

- In August 025, the National Institutes of Health (NIH) awarded the UC Davis Department of Radiology a National Institute of Biomedical Imaging and Bioengineering R01 Research Project Grant with a budget of $2.5 million for four years, which will foster innovations in medical imaging techniques for cancer and bone and heart disease.

On the other hand, the neurology segment is estimated to register rapid expansion during 2025-2034. The key companies in the market are rigorously using AI for improving trial design, automating neuroimaging analysis (e.g., automated quantification of brain changes), and interpreting complex datasets. Besides this, the US has been stepping into imaging biomarkers are acting as a crucial factor in patient recruitment and stratification for clinical trials. Whereas the ongoing Alzheimer’s Disease Neuroimaging Initiative (ADNI 4) study presents the validation of biomarkers for prospective AD clinical trials.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By technology/service type analysis

How did the Image Analysis & Interpretation Segment Lead the Market in 2024?

The image analysis & interpretation segment dominated with a major share of the U.S. clinical trial imaging market in 2024. A prominent catalyst is a rise in emphasis on targeted therapies, coupled with imaging to offer the required deeper, non-invasive, and quantifiable endpoints. The emergence of groundbreaking alliances is supporting whole-body MRI scans for earlier cancer detection and AI-assisted tools for the reduction of false positives in mammography.

However, the imaging CRO services segment will expand rapidly in the coming era. As these services are offering higher cost-effectiveness, accelerated R&D investment by diverse pharmaceutical & biotech companies is impacting the overall expansion. In this era, CROs are leveraging “Core Lab” for imaging and safety services to facilitate an integrated and robust approach to clinical trials. IQVIA, Medpace, and Labcorp are increasingly exploring their facilities through various strategic offerings.

By end user analysis

Why did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2024?

In 2024, the pharmaceutical & biotechnology companies segment registered dominance in the U.S. clinical trial imaging market. These companies are raising their research and development budgets for developing novel drugs, mainly for chronic diseases like cancer and cardiovascular conditions. Although companies like Verve Therapeutics are extensively employing imaging in trials for high cholesterol, and other sophisticated PET, CT, and MRI solutions, to offer both qualitative and quantitative data for regulatory submission.

Whereas the contract research organizations (CROs) segment will expand at a rapid CAGR. CROs are widely reinforcing planned collaborations, including GE HealthCare’s partnership with the Mayo Clinic, to promote innovation in medical imaging and diagnostics. In the last years, CROs have made announcements regarding their adoption of its adoption of a new Clinical Trial Management System (CTMS) for boosting their abilities to conduct clinical trials, specifically for imaging data.

Browse More Insights of Towards Healthcare:

The global clinical trial software market was valued at US$ 0.9 billion in 2024 and is expected to rise to US$ 1.03 billion in 2025, reaching approximately US$ 3.23 billion by 2034. The market is projected to expand at a strong CAGR of 13.74% from 2025 to 2034, driven by increasing digital transformation in trial management and data integration.

The clinical trial design market stood at USD 567.66 million in 2024, growing to USD 613.25 million in 2025, and is forecasted to hit USD 1.23 billion by 2034. The sector is advancing at a CAGR of 8.04% during 2025–2034, fueled by the growing complexity of trial protocols and the demand for adaptive, patient-centric designs.

In 2024, the clinical trial central lab services market was valued at USD 4.13 billion and is expected to grow to USD 4.54 billion in 2025, ultimately reaching USD 10.54 billion by 2034. This reflects a CAGR of 9.84%, supported by the increasing outsourcing of laboratory operations and the growing demand for standardized testing across global sites.

The clinical trial biorepository and archiving solutions market generated US$ 4.4 billion in 2024, which is projected to climb to US$ 4.76 billion in 2025 and further to US$ 9.69 billion by 2034, expanding at a CAGR of 8.21%. The growth is underpinned by the surge in biomarker-based research and the need for secure long-term storage of biospecimens.

The clinical trial investigative site network market was valued at US$ 8.36 billion in 2023 and is poised to reach US$ 15.99 billion by 2034, growing at a CAGR of 6.07% from 2024 to 2034. This steady rise reflects the increasing emphasis on site quality, patient recruitment efficiency, and global collaboration in clinical research.

The clinical trial supply and logistics market was estimated at US$ 3.74 billion in 2023 and is projected to grow to US$ 8.58 billion by 2034, registering a CAGR of 7.63% over the forecast period. The expansion is driven by the rising number of complex, multicenter trials and the demand for temperature-controlled logistics solutions.

The global clinical trial supplies market reached US$ 4.9 billion in 2024, is expected to increase to US$ 5.34 billion in 2025, and is anticipated to achieve around US$ 11.4 billion by 2034, growing at a CAGR of 8.87%. The growth is attributed to increasing R&D spending and the expansion of clinical trials into emerging regions.

Meanwhile, the global clinical trial services market was valued at US$ 60.7 billion in 2024, expected to grow to US$ 66.07 billion in 2025, and projected to reach approximately US$ 141.85 billion by 2034. The market is advancing at a CAGR of 8.85% between 2025 and 2034, supported by the rising volume of drug development programs and the growing reliance on contract research organizations (CROs).

Lastly, the global oncology clinical trial market recorded a size of US$ 13.64 billion in 2024, set to rise to US$ 14.36 billion in 2025, and is projected to hit nearly US$ 22.85 billion by 2034, expanding at a CAGR of 5.30% throughout the forecast period. The growth is propelled by the continuous pipeline of novel cancer therapies and precision medicine advancements.

What are the Latest Developments in the U.S. Clinical Trial Imaging Market?

- In August 2025, the medtech company DESKi launched HeartFocus, the transforming, AI-powered cardiac imaging software in the US.

- In January 2025, XingImaging, a MITRO company, a company in advanced research imaging and radiopharmaceutical services, opened its new state-of-the-art research facility in New Haven, Connecticut.

U.S. Clinical Trial Imaging Market Key Players List

- ICON plc (Imaging CRO division)

- Parexel International

- Medpace Holdings

- BioTelemetry (Philips)

- Radiant Sage (Parexel subsidiary)

- Bioclinica (ERT)

- PAREXEL Informatics

- Invicro LLC (Konica Minolta)

- WorldCare Clinical

- IXICO plc

- Intrinsic Imaging LLC

- Clario (formerly ERT & Bioclinica Imaging)

- Siemens Healthineers Clinical Trials Imaging

- GE Healthcare Clinical Research Imaging

- Perceptive Informatics (Parexel)

- BioTel Research

- Prism Clinical Imaging

- PAREXEL Medical Imaging

- Resonance Health Ltd.

- Keosys Medical Imaging

- ICON plc (Imaging CRO division)

- Parexel International

- Medpace Holdings

- BioTelemetry (Philips)

- Radiant Sage (Parexel subsidiary)

- Bioclinica (ERT)

- PAREXEL Informatics

- Invicro LLC (Konica Minolta)

- WorldCare Clinical

- IXICO plc

- Intrinsic Imaging LLC

- Clario (formerly ERT & Bioclinica Imaging)

- Siemens Healthineers Clinical Trials Imaging

- GE Healthcare Clinical Research Imaging

- Perceptive Informatics (Parexel)

- BioTel Research

- Prism Clinical Imaging

- PAREXEL Medical Imaging

- Resonance Health Ltd.

- Keosys Medical Imaging

Segments Covered in the Report

By Modality

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Ultrasound

- X-ray & Others

By Therapeutic Area

- Oncology

- Neurology

- Cardiology

- Musculoskeletal Disorders

- Endocrinology & Metabolic Diseases

- Others (Rare & Infectious Diseases)

By Technology/Service Type

- Image Analysis & Interpretation

- Imaging Data Management

- Imaging CRO Services

- Software Solutions (AI/ML-enabled imaging platforms)

- Site Management & Training

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Medical Device Companies

- Contract Research Organizations (CROs)

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6255

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. IndiaShorts takes no editorial responsibility for the same.